PROTECTED SOURCE SCRIPT

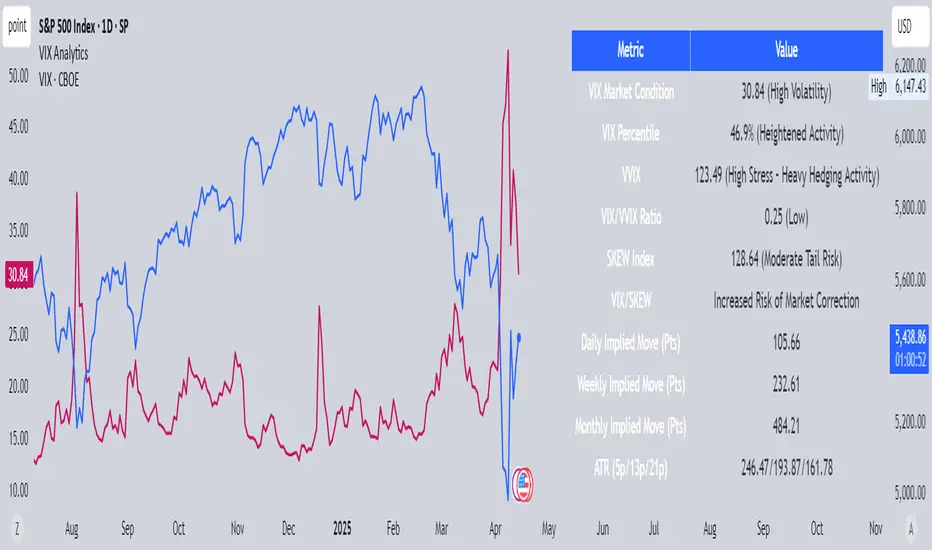

VIX Analytics

This script is designed to serve traders, analysts, and investors who want a real-time, comprehensive view of market volatility, risk sentiment, and implied movements. It combines multiple institutional-grade volatility indices into one clear dashboard and interprets them with actionable insights — directly on your chart.

🔍 Features Included

🟦VIX (CBOE Volatility Index)

Measures market expectation of 30-day S&P 500 volatility.

Color-coded interpretation ranges:

Under 13: Extreme Complacency

15–20: Stable Market

20–30: Moderate Risk

30–40: High Volatility

Over 40: Panic

🟪 VVIX (Volatility of Volatility Index)

Tracks the volatility of VIX itself.

Interpreted as a risk gauge of how aggressively traders are hedging volatility exposure.

Under 80: Market Complacency

80–100: Normal Environment

100–120: Caution — Rising Volatility of Volatility

Over 120: High Stress — Elevated Hedging Activity

🟨 SKEW Index

Measures the perceived tail risk of the S&P 500 — i.e., the probability of a black swan event.

Below 110: Potential Complacency

120–140: Moderate Tail Risk

Above 140: High Tail Risk

🧮 VIX/VVIX Ratio

Gauges relative fear levels between expected volatility and the volatility of volatility.

Under 0.5: Low Ratio — VVIX Overextended

Over 0.9: High Ratio — VIX Leading

📈 VIX Percentile (1-Year Range)

Shows where the current VIX sits relative to its 1-year high/low.

Under 20%: Volatility is Cheap

Over 70%: Fear is Elevated — Reversal Possible

📉 SPX Implied Point Moves

Projects expected moves in SPX using VIX-derived volatility:

Daily

Weekly

Monthly

Helps size positions or define expected price ranges based on volatility regime.

📊 ATR Values (5, 13, 21 periods)

Traditional volatility using historical prices.

Provided alongside implied data for comparison.

🧠 Unique Logic & Interpretation Layer

This script doesn’t just show raw data — it interprets it. It reads the relationship between VIX, VVIX, and SKEW to highlight:

When market volatility may be underpriced

When hidden tail risks are forming

When to be cautious of volatility expansions

How current implied movement compares to past realized volatility

✅ Use Cases

Day traders: Know when volatility is low or expanding before scalping or swinging.

Options traders: Identify whether implied volatility is cheap or expensive.

Portfolio managers: Gauge when hedging is in demand and adjust exposure.

Risk managers: Crosscheck if current volatility aligns with macro risk events.

⚙️ Settings

Customizable table placement: Move the dashboard to any corner of your chart.

No repainting or lag: Data updates in real-time using official CBOE and SPX feeds.

🔍 Features Included

🟦VIX (CBOE Volatility Index)

Measures market expectation of 30-day S&P 500 volatility.

Color-coded interpretation ranges:

Under 13: Extreme Complacency

15–20: Stable Market

20–30: Moderate Risk

30–40: High Volatility

Over 40: Panic

🟪 VVIX (Volatility of Volatility Index)

Tracks the volatility of VIX itself.

Interpreted as a risk gauge of how aggressively traders are hedging volatility exposure.

Under 80: Market Complacency

80–100: Normal Environment

100–120: Caution — Rising Volatility of Volatility

Over 120: High Stress — Elevated Hedging Activity

🟨 SKEW Index

Measures the perceived tail risk of the S&P 500 — i.e., the probability of a black swan event.

Below 110: Potential Complacency

120–140: Moderate Tail Risk

Above 140: High Tail Risk

🧮 VIX/VVIX Ratio

Gauges relative fear levels between expected volatility and the volatility of volatility.

Under 0.5: Low Ratio — VVIX Overextended

Over 0.9: High Ratio — VIX Leading

📈 VIX Percentile (1-Year Range)

Shows where the current VIX sits relative to its 1-year high/low.

Under 20%: Volatility is Cheap

Over 70%: Fear is Elevated — Reversal Possible

📉 SPX Implied Point Moves

Projects expected moves in SPX using VIX-derived volatility:

Daily

Weekly

Monthly

Helps size positions or define expected price ranges based on volatility regime.

📊 ATR Values (5, 13, 21 periods)

Traditional volatility using historical prices.

Provided alongside implied data for comparison.

🧠 Unique Logic & Interpretation Layer

This script doesn’t just show raw data — it interprets it. It reads the relationship between VIX, VVIX, and SKEW to highlight:

When market volatility may be underpriced

When hidden tail risks are forming

When to be cautious of volatility expansions

How current implied movement compares to past realized volatility

✅ Use Cases

Day traders: Know when volatility is low or expanding before scalping or swinging.

Options traders: Identify whether implied volatility is cheap or expensive.

Portfolio managers: Gauge when hedging is in demand and adjust exposure.

Risk managers: Crosscheck if current volatility aligns with macro risk events.

⚙️ Settings

Customizable table placement: Move the dashboard to any corner of your chart.

No repainting or lag: Data updates in real-time using official CBOE and SPX feeds.

Korumalı komut dosyası

Bu komut dosyası kapalı kaynak olarak yayınlanmaktadır. Ancak, ücretsiz ve herhangi bir sınırlama olmaksızın kullanabilirsiniz – daha fazla bilgiyi buradan edinebilirsiniz.

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, alım satım veya diğer türden tavsiye veya öneriler anlamına gelmez ve teşkil etmez. Kullanım Koşulları bölümünde daha fazlasını okuyun.

Korumalı komut dosyası

Bu komut dosyası kapalı kaynak olarak yayınlanmaktadır. Ancak, ücretsiz ve herhangi bir sınırlama olmaksızın kullanabilirsiniz – daha fazla bilgiyi buradan edinebilirsiniz.

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, alım satım veya diğer türden tavsiye veya öneriler anlamına gelmez ve teşkil etmez. Kullanım Koşulları bölümünde daha fazlasını okuyun.