3 Bar Reversal3 Bar Reversal

This pattern is described in John Carter's "Mastering the Trade"

The 3 Bar Reversal indicator is a simple but effective price action tool designed to highlight potential short-term reversals in market direction. It monitors consecutive bar behavior and identifies turning points based on a three-bar pattern. This tool can assist traders in spotting trend exhaustion or early signs of a reversal, particularly in scalping or short-term trading strategies.

How It Works

This indicator analyzes the relationship between consecutive bar closes:

It counts how many bars have passed since the price closed higher than the previous close (barssince(close >= close )) — referred to as an "up streak".

It also counts how many bars have passed since the price closed lower than the previous close (barssince(close <= close )) — known as a "down streak".

A reversal condition is met when:

There have been exactly 3 bars in a row moving in one direction (up or down), and

The 4th bar closes in the opposite direction.

When this condition is detected, the script performs two actions:

Plots a triangle on the chart to signal the potential reversal:

A green triangle below the bar for a possible long (buy) opportunity.

A red triangle above the bar for a possible short (sell) opportunity.

Triggers an alert condition so users can set notifications for when a reversal is detected.

Interpretation

Long Signal: The market has printed 3 consecutive lower closes, followed by a higher close — suggesting bullish momentum may be emerging.

Short Signal: The market has printed 3 consecutive higher closes, followed by a lower close — indicating possible bearish momentum.

These patterns are common in market retracements and can act as confirmation signals when used with other indicators such as RSI, MACD, support/resistance, or volume analysis.

Usage Examples

Scalping: Use the reversal signal to quickly enter short-term trades after a short-term exhaustion move.

Swing Trading: Combine this with trend indicators (e.g., moving averages) to time pullbacks within larger trends.

Confirmation Tool: Use this indicator alongside candlestick patterns or support/resistance zones to validate entry or exit points.

Alert Setup: Enable alerts based on the built-in alertcondition to receive instant notifications for potential trade setups.

Limitations

The 3-bar reversal logic does not guarantee a trend change; it signals potential reversals, which may need confirmation.

Best used in conjunction with broader context such as trend direction, market structure, or other technical indicators.

Reversalpattern

reversalchartpatternsLibrary "reversalchartpatterns"

User Defined Types and Methods for reversal chart patterns - Double Top, Double Bottom, Triple Top, Triple Bottom, Cup and Handle, Inverted Cup and Handle, Head and Shoulders, Inverse Head and Shoulders

method delete(this)

Deletes the drawing components of ReversalChartPatternDrawing object

Namespace types: ReversalChartPatternDrawing

Parameters:

this (ReversalChartPatternDrawing) : ReversalChartPatternDrawing object

Returns: current ReversalChartPatternDrawing object

method delete(this)

Deletes the drawing components of ReversalChartPattern object. In turn calls the delete of ReversalChartPatternDrawing

Namespace types: ReversalChartPattern

Parameters:

this (ReversalChartPattern) : ReversalChartPattern object

Returns: current ReversalChartPattern object

method lpush(this, obj, limit, deleteOld)

Array push with limited number of items in the array. Old items are deleted when new one comes and exceeds the limit

Namespace types: array

Parameters:

this (array) : array object

obj (ReversalChartPattern) : ReversalChartPattern object which need to be pushed to the array

limit (int) : max items on the array. Default is 10

deleteOld (bool) : If set to true, also deletes the drawing objects. If not, the drawing objects are kept but the pattern object is removed from array. Default is false.

Returns: current ReversalChartPattern object

method draw(this)

Draws the components of ReversalChartPatternDrawing

Namespace types: ReversalChartPatternDrawing

Parameters:

this (ReversalChartPatternDrawing) : ReversalChartPatternDrawing object

Returns: current ReversalChartPatternDrawing object

method draw(this)

Draws the components of ReversalChartPatternDrawing within the ReversalChartPattern object.

Namespace types: ReversalChartPattern

Parameters:

this (ReversalChartPattern) : ReversalChartPattern object

Returns: current ReversalChartPattern object

method scan(zigzag, patterns, errorPercent, shoulderStart, shoulderEnd, allowedPatterns, offset)

Scans zigzag for ReversalChartPattern occurences

Namespace types: zg.Zigzag

Parameters:

zigzag (Zigzag type from Trendoscope/Zigzag/11) : ZigzagTypes.Zigzag object having array of zigzag pivots and other information on each pivots

patterns (array) : Existing patterns array. Used for validating duplicates

errorPercent (float) : Error threshold for considering ratios. Default is 13

shoulderStart (float) : Starting range of shoulder ratio. Used for identifying shoulders, handles and necklines

shoulderEnd (float) : Ending range of shoulder ratio. Used for identifying shoulders, handles and necklines

allowedPatterns (array) : array of int containing allowed pattern types

offset (int) : Offset of zigzag to consider only confirmed pivots

Returns: int pattern type

method createPattern(zigzag, patternType, patternColor, properties, offset)

Create Pattern from ZigzagTypes.Zigzag object

Namespace types: zg.Zigzag

Parameters:

zigzag (Zigzag type from Trendoscope/Zigzag/11) : ZigzagTypes.Zigzag object having array of zigzag pivots and other information on each pivots

patternType (int) : Type of pattern being created. 1 - Double Tap, 2 - Triple Tap, 3 - Cup and Handle, 4 - Head and Shoulders

patternColor (color) : Color in which the patterns are drawn

properties (ReversalChartTradeProperties)

offset (int)

Returns: ReversalChartPattern object created

method getName(this)

get pattern name of ReversalChartPattern object

Namespace types: ReversalChartPattern

Parameters:

this (ReversalChartPattern) : ReversalChartPattern object

Returns: string name of the pattern

method getDescription(this)

get consolidated description of ReversalChartPattern object

Namespace types: ReversalChartPattern

Parameters:

this (ReversalChartPattern) : ReversalChartPattern object

Returns: string consolidated description

method init(this)

initializes the ReversalChartPattern object and creates sub object types

Namespace types: ReversalChartPattern

Parameters:

this (ReversalChartPattern) : ReversalChartPattern object

Returns: ReversalChartPattern current object

ReversalChartPatternDrawing

Type which holds the drawing objects for Reversal Chart Pattern Types

Fields:

patternLines (array type from Trendoscope/Drawing/2) : array of Line objects representing pattern

entry (Line type from Trendoscope/Drawing/2) : Entry price Line

targets (array type from Trendoscope/Drawing/2)

stop (Line type from Trendoscope/Drawing/2) : Stop price Line

patternLabel (Label type from Trendoscope/Drawing/2)

ReversalChartTradeProperties

Trade properties of ReversalChartPattern

Fields:

riskAdjustment (series float) : Risk Adjustment for calculation of stop

useFixedTarget (series bool) : Boolean flag saying use fixed target type wherever possible. If fixed target type is not possible, then risk reward/fib ratios are used for calculation of targets

variableTargetType (series int) : Integer value which defines whether to use fib based targets or risk reward based targets. 1 - Risk Reward, 2 - Fib Ratios

variableTargetRatios (array) : Risk reward or Fib Ratios to be used for calculation of targets when fixed target is not possible or not enabled

entryPivotForWm (series int) : which Pivot should be considered as entry point for WM patterns. 0 refers to the latest breakout pivot where as 5 refers to initial pivot of the pattern

ReversalChartPattern

Reversal Chart Pattern master type which holds the pattern components, drawings and trade details

Fields:

pivots (array type from Trendoscope/Zigzag/11) : Array of Zigzag Pivots forming the pattern

patternType (series int) : Defines the main type of pattern 1 - Double Tap, 1 - Triple Tap, 3 - Cup and Handle, 4 - Head and Shoulders, 5- W/M Patterns, 6 - Full Trend, 7 - Half Trend

patternColor (series color) : Color in which the pattern will be drawn on chart

properties (ReversalChartTradeProperties)

drawing (ReversalChartPatternDrawing) : ReversalChartPatternDrawing object which holds the drawing components

trade (Trade type from Trendoscope/TradeTracker/1) : TradeTracker.Trade object holding trade components

Heikin-Ashi Reversals with Region & DotsIf you want to use Heiken Ashi candles as a way to screen for bullish and bearish reversal.

Green background is stay long and strong. Red background = potential top or bearish continuation.

Yellow dots show strong red heiken ashi candles with small upside wicks. The next candle determines whether it should be green or red. If next heiken ashi candle closes above the current candle = green, bull trend still in line. If next heiken ashi candle closes below, then time to sell

Half-Trend Channel [BigBeluga]Half Trend Channel is a powerful trend-following indicator designed to identify trend direction, fakeouts, and potential reversal points. The combination of upper/lower bands, midline coloring, and specific signals makes it ideal for spotting trend continuation and market reversals.

The base of the channel is calculated using smoothed half-trend logic.

// Initialize half trend on the first bar

if barstate.isfirst

hl_t := close

// Update half trend value based on conditions

switch

closeMA < hl_t and highestHigh < hl_t => hl_t := highestHigh

closeMA > hl_t and lowestLow > hl_t => hl_t := lowestLow

=> hl_t := hl_t

// Smooth

float s_hlt = ta.hma(hl_t, len)

🔵 Key Features:

Upper and Lower Bands:

The bands adapt dynamically to market volatility.

Price movements toward the bands help identify areas of overextension and potential reversal points.

Midline Trend Signal:

The midline changes color to reflect the current trend:

Green Midline: Indicates an uptrend.

Purple Midline: Signals a downtrend.

Fakeout Signals ("X"):

"X" markers appear when price briefly breaches the outer bands but fails to sustain the move.

Fakeouts help traders identify areas where price momentum weakens.

Reversal Signals (Triangles):

Triangles (▲ and ▼) mark potential tops and bottoms:

▲ Up Triangles: Suggest a potential bottom and a reversal to the upside.

▼ Down Triangles: Indicate a potential top and a reversal to the downside.

Dynamic Trend Labels:

At the last bar, the indicator displays labels like "Trend Up" or "Trend Dn" , reflecting the current trend direction.

🔵 Usage:

Use the colored midline to determine the overall trend direction.

Monitor "X" fakeout signals to spot failed breakouts or momentum exhaustion near the bands.

Watch for reversal triangles (▲ and ▼) to identify potential trend reversals at tops or bottoms.

Combine the bands and midline signals to confirm trade entries and exits:

Enter long trades when price bounces off the lower band with a green midline.

Consider short trades when price reverses from the upper band with a purple midline.

Use the trend label (e.g., "Trend Up" or "Trend Dn") for quick confirmation of the current market state.

The Half Trend Channel is an essential tool for traders who want to follow trends, avoid fakeouts, and identify reliable tops and bottoms to optimize their trading decisions.

Dragon Harmonic Pattern [TradingFinder] Dragon Detector🔵 Introduction

The Dragon Harmonic Pattern is one of the technical analysis tools that assists traders in identifying Potential Reversal Zones (PRZ). Resembling an "M" or "W" shape, this pattern is recognized in financial markets as a method for predicting bullish and bearish trends. By leveraging precise Fibonacci ratios and measuring price movements, traders can use this pattern to forecast market trends with high accuracy.

The Dragon Harmonic Pattern is built on the XABCD structure, where each point plays a significant role in shaping and forecasting price movements. Point X marks the beginning of the trend, representing the initial price movement. Point A indicates the first retracement, usually falling within the 0.380 to 0.620 range of the XA wave.

Next, point B signals the second retracement, which lies within 0.200 to 0.400 of the AB wave. Point C, acting as the hump of the pattern, is generally located within 0.800 to 1.100 of the XA wave. Finally, point D represents the endpoint of the pattern and the Potential Reversal Zone (PRZ), where the primary price reversal occurs.

In bullish scenarios, the Dragon Pattern indicates a reversal from a downtrend to an uptrend, where prices move upward from point D. Conversely, in bearish scenarios, prices decline after reaching point D. Accurate identification of this pattern through Fibonacci ratio analysis and PRZ examination can significantly increase the success rate of trades, enabling traders to adjust their strategies based on key market levels such as 0.618 or 1.100.

Due to its high accuracy in identifying Potential Reversal Zones (PRZ) and its alignment with Fibonacci ratios, the Dragon Harmonic Pattern is considered one of the most popular tools in technical analysis. Traders can use this pattern to pinpoint entry and exit points with greater confidence while minimizing trading risks.

Bullish :

Bearish :

🔵 How to Use

The Dragon Harmonic Pattern indicator helps traders identify bullish and bearish patterns in the market, allowing them to capitalize on available trading opportunities. By analyzing Fibonacci ratios and the XABCD structure, the indicator highlights Potential Reversal Zones (PRZ).

🟣 Bullish Dragon Pattern

In the Bullish Dragon Pattern, the price transitions from a downtrend to an uptrend after reaching point D. At this stage, points X, A, B, C, and D must be carefully identified.

Fibonacci ratios for these points are as follows: Point A should fall within 0.380 to 0.620 of the XA wave, point B within 0.200 to 0.400 of the AB wave, and point C within 0.800 to 1.100 of the XA wave.

When the price reaches point D, traders should look for bullish signals such as reversal candlesticks or increased trading volume to enter a buy position. The take-profit level can be set near the previous price high or based on the 1.272 Fibonacci ratio of the XA wave, while the stop-loss should be placed slightly below point D.

🟣 Bearish Dragon Pattern

In the Bearish Dragon Pattern, the price shifts from an uptrend to a downtrend after reaching point D. In this pattern, points X, A, B, C, and D must also be identified. Fibonacci ratios for these points are as follows: Point A should fall within 0.380 to 0.620 of the XA wave, point B within 0.200 to 0.400 of the AB wave, and point C within 0.800 to 1.100 of the XA wave.

Upon reaching point D, bearish signals such as reversal candlesticks or decreasing trading volume indicate the opportunity to enter a sell position. The take-profit level can be set near the previous price low or based on the 1.272 Fibonacci ratio of the XA wave, while the stop-loss should be placed slightly above point D.

By combining the Dragon Harmonic Pattern indicator with precise Fibonacci ratio analysis, traders can identify key opportunities while minimizing risks and improving their decision-making in both bullish and bearish market conditions.

🔵 Setting

🟣 Logical Setting

ZigZag Pivot Period : You can adjust the period so that the harmonic patterns are adjusted according to the pivot period you want. This factor is the most important parameter in pattern recognition.

Show Valid Forma t: If this parameter is on "On" mode, only patterns will be displayed that they have exact format and no noise can be seen in them. If "Off" is, the patterns displayed that maybe are noisy and do not exactly correspond to the original pattern.

Show Formation Last Pivot Confirm : if Turned on, you can see this ability of patterns when their last pivot is formed. If this feature is off, it will see the patterns as soon as they are formed. The advantage of this option being clear is less formation of fielded patterns, and it is accompanied by the latest pattern seeing and a sharp reduction in reward to risk.

Period of Formation Last Pivot : Using this parameter you can determine that the last pivot is based on Pivot period.

🟣 Genaral Setting

Show : Enter "On" to display the template and "Off" to not display the template.

Color : Enter the desired color to draw the pattern in this parameter.

LineWidth : You can enter the number 1 or numbers higher than one to adjust the thickness of the drawing lines. This number must be an integer and increases with increasing thickness.

LabelSize : You can adjust the size of the labels by using the "size.auto", "size.tiny", "size.smal", "size.normal", "size.large" or "size.huge" entries.

🟣 Alert Setting

Alert : On / Off

Message Frequency : This string parameter defines the announcement frequency. Choices include: "All" (activates the alert every time the function is called), "Once Per Bar" (activates the alert only on the first call within the bar), and "Once Per Bar Close" (the alert is activated only by a call at the last script execution of the real-time bar upon closing). The default setting is "Once per Bar".

Show Alert Time by Time Zone : The date, hour, and minute you receive in alert messages can be based on any time zone you choose. For example, if you want New York time, you should enter "UTC-4". This input is set to the time zone "UTC" by default.

🔵 Conclusion

The Dragon Harmonic Pattern is an advanced and practical technical analysis tool that aids traders in accurately predicting bullish and bearish trends by identifying Potential Reversal Zones (PRZ) and utilizing Fibonacci ratios. Built on the XABCD structure, this pattern stands out for its flexibility and precision in identifying price movements, making it a valuable resource among technical analysts. One of its key advantages is its compatibility with other technical tools such as trendlines, support and resistance levels, and Fibonacci retracements.

By using the Dragon Harmonic Pattern indicator, traders can accurately determine entry and exit points for their trades. The indicator analyzes key Fibonacci ratios—0.380 to 0.620, 0.200 to 0.400, and 0.800 to 1.100—to identify critical levels such as price highs and lows, offering precise trading strategies. In bullish scenarios, traders can profit from rising prices, while in bearish scenarios, they can capitalize on price declines.

In conclusion, the Dragon Harmonic Pattern is a highly reliable tool for identifying trading opportunities with exceptional accuracy. However, for optimal results, it is recommended to combine this pattern with other analytical tools and thoroughly assess market conditions. By utilizing this indicator, traders can reduce their trading risks while achieving higher profitability and confidence in their trading strategies.

Turtle Soup ICT Strategy [TradingFinder] FVG + CHoCH/CSD🔵 Introduction

The ICT Turtle Soup trading setup, designed in the ICT style, operates by hunting or sweeping liquidity zones to exploit false breakouts and failed breakouts in key liquidity Zones, such as recent highs, lows, or major support and resistance levels.

This setup identifies moments when the price breaches these liquidity zones, triggering stop orders placed (Stop Hunt) by other traders, and then quickly reverses direction. These movements are often associated with liquidity sweeps that create temporary market imbalances.

The reversal is typically confirmed by one of three structural shifts : a Market Structure Shift (MSS), a Change of Character (CHoCH), or a break of the Change in State of Delivery (CISD). Each of these structural shifts provides a reliable signal to interpret market intent and align trading decisions with the expected price movement. After the structural shift, the price frequently pullback to a Fair Value Gap (FVG), offering a precise entry point for trades.

By integrating key concepts such as liquidity, liquidity sweeps, stop order activation, structural shifts (MSS, CHoCH, CISD), and price imbalances, the ICT Turtle Soup setup enables traders to identify reversal points and key entry zones with high accuracy.

This strategy is highly versatile, making it applicable across markets such as forex, stocks, cryptocurrencies, and futures. It offers traders a robust and systematic approach to understanding price movements and optimizing their trading strategies

🟣 Bullish and Bearish Setups

Bullish Setup : The price first sweeps below a Sell-Side Liquidity (SSL) zone, then reverses upward after forming an MSS or CHoCH, and finally pulls back to an FVG, creating a buying opportunity.

Bearish Setup : The price first sweeps above a Buy-Side Liquidity (BSL) zone, then reverses downward after forming an MSS or CHoCH, and finally pulls back to an FVG, creating a selling opportunity.

🔵 How to Use

To effectively utilize the ICT Turtle Soup trading setup, begin by identifying key liquidity zones, such as recent highs, lows, or support and resistance levels, in higher timeframes.

Then, monitor lower timeframes for a Liquidity Sweep and confirmation of a Market Structure Shift (MSS) or Change of Character (CHoCH).

After the structural shift, the price typically pulls back to an FVG, offering an optimal trade entry point. Below, the bullish and bearish setups are explained in detail.

🟣 Bullish Turtle Soup Setup

Identify Sell-Side Liquidity (SSL) : In a higher timeframe (e.g., 1-hour or 4-hour), identify recent price lows or support levels that serve as SSL zones, typically the location of stop-loss orders for traders.

Observe a Liquidity Sweep : On a lower timeframe (e.g., 15-minute or 30-minute), the price must move below one of these liquidity zones and then reverse. This movement indicates a liquidity sweep.

Confirm Market Structure Shift : After the price reversal, look for a structural shift (MSS or CHoCH) indicated by the formation of a Higher Low (HL) and Higher High (HH).

Enter the Trade : Once the structural shift is confirmed, the price typically pulls back to an FVG. Enter a buy trade in this zone, set a stop-loss slightly below the recent low, and target Buy-Side Liquidity (BSL) in the higher timeframe for profit.

🟣 Bearish Turtle Soup Setup

Identify Buy-Side Liquidity (BSL) : In a higher timeframe, identify recent price highs or resistance levels that serve as BSL zones, typically the location of stop-loss orders for traders.

Observe a Liquidity Sweep : On a lower timeframe, the price must move above one of these liquidity zones and then reverse. This movement indicates a liquidity sweep.

Confirm Market Structure Shift : After the price reversal, look for a structural shift (MSS or CHoCH) indicated by the formation of a Lower High (LH) and Lower Low (LL).

Enter the Trade : Once the structural shift is confirmed, the price typically pulls back to an FVG. Enter a sell trade in this zone, set a stop-loss slightly above the recent high, and target Sell-Side Liquidity (SSL) in the higher timeframe for profit.

🔵 Settings

Higher TimeFrame Levels : This setting allows you to specify the higher timeframe (e.g., 1-hour, 4-hour, or daily) for identifying key liquidity zones.

Swing period : You can set the swing detection period.

Max Swing Back Method : It is in two modes "All" and "Custom". If it is in "All" mode, it will check all swings, and if it is in "Custom" mode, it will check the swings to the extent you determine.

Max Swing Back : You can set the number of swings that will go back for checking.

FVG Length : Default is 120 Bar.

MSS Length : Default is 80 Bar.

FVG Filter : This refines the number of identified FVG areas based on a specified algorithm to focus on higher quality signals and reduce noise.

Types of FVG filter s:

Very Aggressive Filter: Adds a condition where, for an upward FVG, the last candle's highest price must exceed the middle candle's highest price, and for a downward FVG, the last candle's lowest price must be lower than the middle candle's lowest price. This minimally filters out FVGs.

Aggressive Filter: Builds on the Very Aggressive mode by ensuring the middle candle is not too small, filtering out more FVGs.

Defensive Filter: Adds criteria regarding the size and structure of the middle candle, requiring it to have a substantial body and specific polarity conditions, filtering out a significant number of FVGs.

Very Defensive Filter: Further refines filtering by ensuring the first and third candles are not small-bodied doji candles, retaining only the highest quality signals.

In the indicator settings, you can customize the visibility of various elements, including MSS, FVG, and HTF Levels. Additionally, the color of each element can be adjusted to match your preferences. This feature allows traders to tailor the chart display to their specific needs, enhancing focus on the key data relevant to their strategy.

🔵 Conclusion

The ICT Turtle Soup trading setup is a powerful tool in the ICT style, enabling traders to exploit false breakouts in key liquidity zones. By combining concepts of liquidity, liquidity sweeps, market structure shifts (MSS and CHoCH), and pullbacks to FVG, this setup helps traders identify precise reversal points and execute trades with reduced risk and increased accuracy.

With applications across various markets, including forex, stocks, crypto, and futures, and its customizable indicator settings, the ICT Turtle Soup setup is ideal for both beginner and advanced traders. By accurately identifying liquidity zones in higher timeframes and confirming structure shifts in lower timeframes, this setup provides a reliable strategy for navigating volatile market conditions.

Ultimately, success with this setup requires consistent practice, precise market analysis, and proper risk management, empowering traders to make smarter decisions and achieve their trading goals.

Double Top/Bottom [AlgoAlpha]Introducing the Double Top/Bottom Indicator by AlgoAlpha, a powerful tool designed to identify key reversal patterns in the market with precision. This indicator meticulously detects double tops and double bottoms, helping traders recognize potential trend reversals and make informed trading decisions.

Key Features:

🔍 Pattern Detection : Accurately identifies double top and double bottom formations based on customizable time horizons.

🎨 Customizable Appearance : Choose your preferred colors for bullish and bearish trends to match your trading style.

📊 Signal Labels : Option to display only the second pivot of the double top/bottom for a cleaner chart view.

🔧 Flexible Settings : Adjust the time horizon to control the look-back period, allowing for detection of both short-term and long-term patterns.

📈 Visual Enhancements : Draws trend lines and fills between pivotal points to visually highlight potential reversal zones.

🔔 Alerts : Set up alerts for potential double top and double bottom formations to stay informed of key market movements.

How to Use the Double Top/Bottom Indicator :

🛠 Add the Indicator : Simply add the Double Top/Bottom Indicator to your TradingView chart from your favorites. Customize the time horizon and appearance settings to fit your trading preferences.

📊 Analyze Patterns : Watch for the identified double top and double bottom patterns along with the corresponding trend lines and filled areas to anticipate potential market reversals.

🔔 Set Alerts : Enable alerts to receive notifications when double top or double bottom patterns are detected, ensuring you never miss a critical trading opportunity.

How It Works : The indicator scans the price action for pivot highs and lows within a specified time horizon, identifying potential double top and double bottom patterns. It maintains a sequence of these pivots and verifies the formation of these patterns based on the relationship between consecutive pivots and the proximity to a defined limit. When a double top or double bottom is confirmed, the indicator marks the second pivot point with a label and draws trend lines to visualize the reversal pattern. Additionally, it provides alert conditions to notify traders of potential confirmations, enhancing decision-making without cluttering the chart.

⚠️ Important Reminder : The labels indicating double tops and bottoms appear with a delay and are intended to mark the formations after they have already formed. They are not meant to be used as real-time trading signals. While they align perfectly with pivot points in hindsight, please use them as markers for analysis rather than immediate trading triggers.

70% rule strength/trend/reversalThis indicator tells you which candle closed strong for the day by identifying if the price closed above 70% of the candle's total height. this can help you identify reversals/new trends/ renewed strength in the current trend.

The indicator colors such candle green and if the candle closes with increase in price by 5% or higher then marks an asterisk under the candle.

HOPE THIS HELPS

Engulfing Reversal Market PhaseStay at the right side of the market.

This indicator detects bullish and bearish phase in the market based on recent reversal.

It is designed to help filter your trades.

Open only long trades if indicator shows green and open only short trades when indicator shows red.

This indicator will detect bullish and bearish engulfing reversal pattern on the chart.

Bullish engulfing occurs when current candle closes below the bars that created the high.

Bearish engulfing occurs when current candle closes below the bars that created the high.

The reversal pattern occurs not only on a trend change, but can be also be present as a trend continuation pattern or a breakout pattern.

The indicator is able to detect 3 candle patterns and multi candle patterns if detects inside bars in the pattern.

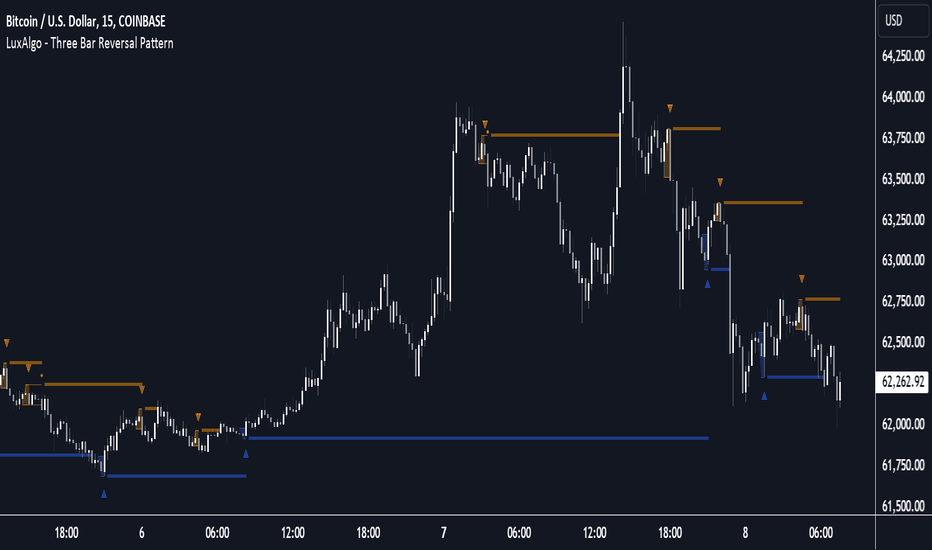

Three Bar Reversal Pattern [LuxAlgo]The Three Bar Reversal Pattern indicator identifies and highlights three bar reversal patterns on the user price chart.

The script also provides an option for incorporating various trend indicators used to filter out detected signals, allowing them to enhance their accuracy and help obtain a more comprehensive analysis.

🔶 USAGE

The script automates the detection of three-bar reversal patterns and provides a clear, visually identifiable signal for potential trend reversals.

When a reversal chart pattern is confirmed and price action aligns with the pattern, the pattern's boundaries are extended, forming levels, with the upper boundary often acting as a resistance and the lower boundary as a support.

The script allows users to filter patterns based on a specific trend direction detected by multiple trend indicators. Users can choose to view patterns that are either aligned with the detected trend or opposite to it.

Included trend indicators are: Moving Average Cloud, Supertrend, and Donchian Channels.

🔶 DETAILS

The three-bar reversal pattern is a technical analysis pattern that signals a potential reversal in the prevailing trend. The pattern consists of three consecutive bar formations:

First Bar and Second Bar: 2 consecutive of the same sentiment, representing the prevailing trend in the market.

Third Bar: Confirms the reversal by closing beyond the high or low of the first bar, signaling a potential change in market sentiment.

Various types of three-bar reversal patterns are documented. The script supports two main types:

Normal Pattern: Detects three-bar reversal patterns without requiring the third bar closing price to surpass the high (bullish pattern) or low (bearish pattern) of the first bar. It identifies basic formations signaling potential trend reversals.

Enhanced Pattern: Specifically identifies three-bar reversal patterns where the third bar closing price surpasses the high (bullish pattern) or low (bearish pattern) of the first bar. This type provides a more selective signal for stronger trend reversals.

🔶 SETTINGS

Pattern Type: Users can choose the type of 3-bar reversal patterns to detect: Normal, Enhanced, or All. "Normal" detects patterns that do not necessarily surpass the high/low of the first bar. "Enhanced" detects patterns where the third bar surpasses the high/low of the first bar. "All" detects both Normal and Enhanced patterns.

Derived Support and Resistance: Toggles the visibility of the support and resistance levels/zones.

🔹 Trend Filtering

Filtering: Allows users to filter patterns based on the trend indicators: Moving Average Cloud, Supertrend, and Donchian Channels. The "Aligned" option only detects patterns that align with the trend and conversely, the "Opposite" option detects patterns that go against the trend.

🔹 Trend Indicator Settings

Moving Average Cloud: Allows traders to choose the type of moving averages (SMA, EMA, HMA, etc.) and set the lengths for fast and slow-moving averages.

Supertrend: Options to set the ATR length and factor for Supertrend.

Donchian Channels: Option to set the length for the channel calculation.

🔶 RELATED SCRIPTS

Reversal-Candlestick-Structure .

Reversal-Signals .

The Bar Counter Trend Reversal Strategy [TradeDots]Overview

The Bar Counter Trend Reversal Strategy is designed to identify potential counter-trend reversal points in the market after a series of consecutive rising or falling bars.

By analyzing price movements in conjunction with optional volume confirmation and channel bands (Bollinger Bands or Keltner Channels), this strategy aims to detect overbought or oversold conditions where a trend reversal may occur.

🔹How it Works

Consecutive Price Movements

Rising Bars: The strategy detects when there are a specified number of consecutive rising bars (No. of Rises).

Falling Bars: Similarly, it identifies a specified number of consecutive falling bars (No. of Falls).

Volume Confirmation (Optional)

When enabled, the strategy checks for increasing volume during the consecutive price movements, adding an extra layer of confirmation to the potential reversal signal.

Channel Confirmation (Optional)

Channel Type: Choose between Bollinger Bands ("BB") or Keltner Channels ("KC").

Channel Interaction: The strategy checks if the price interacts with the upper or lower channel lines: For short signals, it looks for price moving above the upper channel line. For long signals, it looks for price moving below the lower channel line.

Customization:

No. of Rises/Falls: Set the number of consecutive bars required to trigger a signal.

Volume Confirmation: Enable or disable volume as a confirmation factor.

Channel Confirmation: Enable or disable channel bands as a confirmation factor.

Channel Settings: Adjust the length and multiplier for the Bollinger Bands or Keltner Channels.

Visual Indicators:

Entry Signals: Triangles plotted on the chart indicate potential entry points:

Green upward triangle for long entries.

Red downward triangle for short entries.

Channel Bands: The upper and lower bands are plotted for visual reference.

Strategy Parameters:

Initial Capital: $10,000.

Position Sizing: 80% of equity per trade.

Commission: 0.01% per trade to simulate realistic trading costs.

🔹Usage

Set up the number of Rises/Falls and choose whether if you want to use channel indicators and volume as the confirmation.

Monitor the chart for triangles indicating potential entry points.

Consider the context of the overall market trend and other technical factors.

Backtesting and Optimization:

Use TradingView's Strategy Tester to evaluate performance.

Adjust parameters to optimize results for different market conditions.

🔹 Considerations and Recommendations

Risk Management:

The strategy does not include built-in stop-loss or take-profit levels. It's recommended to implement your own risk management techniques.

Market Conditions:

Performance may vary in different market environments. Testing and adjustments are advised when applying the strategy to new instruments or timeframes.

No Guarantee of Future Results:

Past performance is not indicative of future results. Always perform due diligence and consider the risks involved in trading.

E9 Shark-32 PatternUnderstanding the Shark-32 Pattern and its Trading Applications

The Shark-32 Pattern is a bearish technical trading formation used to predict market reversals or trend continuations. It highlights a downward move followed by a corrective rally, signaling a potential resumption of the downtrend. Here’s a breakdown of how it works:

What is the Shark-32 Pattern?

The Shark-32 pattern is a five-wave structure typically observed in bearish markets:

Wave 0 to X: A significant price decline starts the pattern.

Wave X to A: A correction pushes the price slightly upward.

Wave A to B: The price drops again but doesn’t reach the initial low.

Wave B to C: A final sharp decline concludes the pattern.

Once Wave C is formed, it suggests that the market will continue to move downward, presenting a potential selling or shorting opportunity.

Using the Pattern in Trading

This pattern is valuable for traders seeking high-probability bearish setups. The goal is to capitalize on the continuation of a downtrend following the corrective rally (X to A). Identifying the Shark-32 pattern helps anticipate the next wave of selling pressure.

Trading Setup

Identify a Shark-32 pattern.

If the price closes above the pattern's high, buy at the open the next day.

If the price closes below the pattern's low, short at the open the next day.

Sell/cover when the price moves 7% in the direction of the breakout.

Close the trade for a loss if the price moves 7% in the opposite direction.

For example, in a bull market after an upward breakout from a Shark-32, the net gain was $69.55. The method won 56% of the time with 5,218 winning trades and an average gain of $714.07. Conversely, 44% of trades were losers, with an average loss of $747.33. The average holding period was 26 calendar days.

The gains and losses were closely aligned with the 7% threshold set for this test.

Key Target Levels

To enhance the strategy, use dotted projection lines as target levels:

Upper Target: Drawn above the high of the corrective rally (Wave A). If the price breaks above this line, it may signal further upward movement, indicating a potentially weaker downtrend.

Lower Target: Positioned below the low of Wave C, providing a target for bearish trades.

These lines help determine future price targets and assist in setting take-profit or stop-loss levels.

Trading the Breakout

Look for breakouts once the Shark-32 pattern is identified:

Upward Breakout: If the price closes above the green line (high from two bars ago), it indicates a potential reversal to the upside.

Downward Breakout: If the price breaks below the red line (low from two bars ago), it confirms the bearish continuation.

Breakouts allow traders to adjust their positions based on market shifts.

Trading Tips

Continuation: The Shark-32 pattern acts as a continuation 60% of the time, confirming the ongoing trend.

Breakout Confirmation: Wait for the price to close above or below the pattern’s key levels before entering a trade.

Trade with the Trend: Since the Shark-32 is a continuation pattern, expect the breakout to align with the inbound price trend.

Symmetry: Patterns with symmetry often perform better. For more insights, refer to detailed trading literature.

Half-Staff: The Shark-32 can form midway in a trend, similar to flags and pennants.

Shark-32: Trading Performance

Based on an analysis of 23,369 trades, the following performance metrics were observed:

Bull Market with Upward Breakout: The average net profit was $69.55. This method won 56% of the time, with winning trades averaging $714.07. Losing trades, which constituted 44% of the total, had an average loss of $747.33. The average holding period was 26 calendar days.

Bull Market with Downward Breakout: The average net loss was $(76.36). This method won 43% of the time, with winning trades averaging $753.56. Losing trades, which constituted 57% of the total, had an average loss of $706.32. The average holding period was 23 calendar days.

Bear Market with Upward Breakout: The average net loss was $(89.13). This method won 46% of the time, with winning trades averaging $710.77. Losing trades, which constituted 54% of the total, had an average loss of $756.97. The average holding period was 16 calendar days.

Bear Market with Downward Breakout: The average net profit was $65.17. This method won 52% of the time, with winning trades averaging $781.62. Losing trades, which constituted 48% of the total, had an average loss of $722.41. The average holding period was 13 calendar days.

Swing Failure Pattern SFP [TradingFinder] SFP ICT Strategy🔵 Introduction

The Swing Failure Pattern (SFP), also referred to as a "Fake Breakout" or "False Breakout," is a vital concept in technical analysis. This pattern is derived from classic technical analysis, price action strategies, ICT concepts, and Smart Money Concepts.

It’s frequently utilized by traders to identify potential trend reversals in financial markets, especially in volatile markets like cryptocurrencies and forex. SFP helps traders recognize failed attempts to breach key support or resistance levels, providing strategic opportunities for trades.

The Swing Failure Pattern (SFP) is a popular strategy among traders used to identify false breakouts and potential trend reversals in the market. This strategy involves spotting moments where the price attempts to break above or below a previous high or low (breakout) but fails to sustain the move, leading to a sharp reversal.

Traders use this strategy to identify liquidity zones where stop orders (stop hunt) are typically placed and targeted by larger market participants or whales.

When the price penetrates these areas but fails to hold the levels, a liquidity sweep occurs, signaling exhaustion in the trend and a potential reversal. This strategy allows traders to enter the market at the right time and capitalize on opportunities created by false breakouts.

🟣 Types of SFP

When analyzing SFPs, two main variations are essential :

Real SFP : This occurs when the price breaks a critical level but fails to close above it, then quickly reverses. Due to its clarity and strong signal, this SFP type is highly reliable for traders.

Considerable SFP : In this scenario, the price closes slightly above a key level but quickly declines. Although significant, it is not as definitive or trustworthy as a Real SFP.

🟣 Understanding SFP

The Swing Failure Pattern, or False Breakout, is identified when the price momentarily breaks a crucial support or resistance level but cannot maintain the movement, leading to a rapid reversal.

The pattern can be categorized as follows :

Bullish SFP : This type occurs when the price dips below a support level but rebounds above it, signaling that sellers failed to push the price lower, indicating a potential upward trend.

Bearish SFP : This pattern forms when the price surpasses a resistance level but fails to hold, suggesting that buyers couldn’t maintain the higher price, leading to a potential decline.

🔵 How to Use

To effectively identify an SFP or Fake Breakout on a price chart, traders should follow these steps :

Identify Key Levels: Locate significant support or resistance levels on the chart.

Observe the Fake Breakout: The price should break the identified level but fail to close beyond it.

Monitor Price Reversal: After the breakout, the price should quickly reverse direction.

Execute the Trade: Traders typically enter the market after confirming the SFP.

🟣 Examples

Bullish Example : Bitcoin breaks below a $30,000 support level, drops to $29,000, but closes above $30,000 by the end of the day, signaling a Real Bullish SFP.

Bearish Example : Ethereum surpasses a $2,000 resistance level, rises to $2,100, but then falls back below $2,000, forming a Bearish SFP.

🟣 Pros and Cons of SFP

Pros :

Effective in identifying strong reversal points.

Offers a favorable risk-to-reward ratio.

Applicable across different timeframes.

Cons :

Requires experience and deep market understanding.

Risk of encountering false breakouts.

Should be combined with other technical tools for optimal effectiveness.

🔵 Settings

🟣 Logical settings

Swing period : You can set the swing detection period.

SFP Type : Choose between "All", "Real" and "Considerable" modes to identify the swing failure pattern.

Max Swing Back Method : It is in two modes "All" and "Custom". If it is in "All" mode, it will check all swings, and if it is in "Custom" mode, it will check the swings to the extent you determine.

Max Swing Back : You can set the number of swings that will go back for checking.

🟣 Display settings

Displaying or not displaying swings and setting the color of labels and lines.

🟣 Alert Settings

Alert SFP : Enables alerts for Swing Failure Pattern.

Message Frequency : Determines the frequency of alerts. Options include 'All' (every function call), 'Once Per Bar' (first call within the bar), and 'Once Per Bar Close' (final script execution of the real-time bar). Default is 'Once per Bar'.

Show Alert Time by Time Zone : Configures the time zone for alert messages. Default is 'UTC'.

🔵 Conclusion

The Swing Failure Pattern (SFP), or False Breakout, is an essential analytical tool that assists traders in identifying key market reversal points for successful trading.

By understanding the nuances between Real SFP and Considerable SFP, and integrating this pattern with other technical analysis tools, traders can make more informed decisions and better manage their trading risks.

Butterfly Harmonic Pattern [TradingFinder] Harmonic Detector🔵 Introduction

The Butterfly Harmonic Pattern is a sophisticated and highly regarded tool in technical analysis, utilized by traders to identify potential reversal points in the financial markets. This pattern is distinguished by its reliance on Fibonacci ratios and geometric configurations, which aid in predicting price movements with remarkable precision.

The origin of the Butterfly Harmonic Pattern can be traced back to the pioneering work of Bryce Gilmore, who is credited with discovering this pattern. Gilmore's extensive research and expertise in Fibonacci ratios laid the groundwork for the identification and application of this pattern in technical analysis.

The Butterfly pattern, like other harmonic patterns, is based on the principle that market movements are not random but follow specific structures and ratios.

The pattern is characterized by a distinct "M" shape in bullish scenarios and a "W" shape in bearish scenarios, each indicating a potential reversal point. These formations are identified by specific Fibonacci retracement and extension levels, making the Butterfly pattern a powerful tool for traders seeking to capitalize on market turning points.

The precise nature of the Butterfly pattern allows for the accurate prediction of target prices and the establishment of strategic entry and exit points, making it an indispensable component of a trader's analytical arsenal.

Bullish :

Bearish :

🔵 How to Use

Like other harmonic patterns, the Butterfly pattern is categorized based on how it forms at the end of an uptrend or downtrend. Unlike the Gartley and Bat patterns, the Butterfly pattern, similar to the Crab pattern, forms outside the wave 3 range at the end of a rally.

🟣 Types of Butterfly Harmonic Patterns

🟣 Bullish Butterfly Pattern

This pattern forms at the end of a downtrend and leads to a trend reversal from a downtrend to an uptrend.

🟣 Bearish Butterfly Pattern

In contrast to the Bullish Butterfly pattern, this pattern forms at the end of an uptrend and warns analysts of a trend reversal to a downtrend. In this case, traders are encouraged to shift their trading stance from buy trades to sell trades.

Advantages and Limitations of the Butterfly Pattern in Technical Analysis :

The Butterfly pattern is considered one of the precise and stable tools in financial market analysis. However, it is always important to pay special attention to the advantages and limitations of each pattern.

Here, we review the advantages and disadvantages of using the Butterfly harmonic pattern :

The main advantage of the Butterfly pattern is providing very accurate signals.

Using Fibonacci golden ratios and geometric rules, the Butterfly pattern identifies patterns accurately and systematically. (This high accuracy significantly helps investors in making trading decisions.)

Identifying this pattern requires expertise and experience in technical analysis.

Recognizing the Butterfly pattern might be complex for beginner traders. (Correct identification of the pattern necessitates mastery over geometric principles and Fibonacci ratios.)

The Butterfly harmonic pattern might issue false trading signals. (Traders usually combine the Butterfly pattern with other technical tools to confirm buy and sell signals.)

🔵 Setting

🟣 Logical Setting

ZigZag Pivot Period : You can adjust the period so that the harmonic patterns are adjusted according to the pivot period you want. This factor is the most important parameter in pattern recognition.

Show Valid Forma t: If this parameter is on "On" mode, only patterns will be displayed that they have exact format and no noise can be seen in them. If "Off" is, the patterns displayed that maybe are noisy and do not exactly correspond to the original pattern.

Show Formation Last Pivot Confirm : if Turned on, you can see this ability of patterns when their last pivot is formed. If this feature is off, it will see the patterns as soon as they are formed. The advantage of this option being clear is less formation of fielded patterns, and it is accompanied by the latest pattern seeing and a sharp reduction in reward to risk.

Period of Formation Last Pivot : Using this parameter you can determine that the last pivot is based on Pivot period.

🟣 Genaral Setting

Show : Enter "On" to display the template and "Off" to not display the template.

Color : Enter the desired color to draw the pattern in this parameter.

LineWidth : You can enter the number 1 or numbers higher than one to adjust the thickness of the drawing lines. This number must be an integer and increases with increasing thickness.

LabelSize : You can adjust the size of the labels by using the "size.auto", "size.tiny", "size.smal", "size.normal", "size.large" or "size.huge" entries.

🟣 Alert Setting

Alert : On / Off

Message Frequency : This string parameter defines the announcement frequency. Choices include: "All" (activates the alert every time the function is called), "Once Per Bar" (activates the alert only on the first call within the bar), and "Once Per Bar Close" (the alert is activated only by a call at the last script execution of the real-time bar upon closing). The default setting is "Once per Bar".

Show Alert Time by Time Zone : The date, hour, and minute you receive in alert messages can be based on any time zone you choose. For example, if you want New York time, you should enter "UTC-4". This input is set to the time zone "UTC" by default.

Advanced Fully Reversed Candles with Reversed IchimokuThe "Advanced Fully Reversed Candles with Reversed Ichimoku" indicator is a sophisticated tool designed for traders who seek a unique perspective on market dynamics. This innovative indicator not only reverses the traditional candlestick chart but also inverts the Ichimoku Cloud components, providing a comprehensive view of the market's inverted behavior.

Key Features:

Reversed Candlestick Chart:

The indicator recalculates the OHLC (Open, High, Low, Close) prices by reversing them along the price axis. This means that what typically would be an upward movement is displayed as a downward movement, and vice versa. This reversal provides an alternative view that can help traders identify hidden patterns and potential reversal points that might not be obvious on a standard chart.

Reversed Ichimoku Cloud:

All components of the Ichimoku Cloud indicator are recalculated based on the reversed price data. This includes:

Tenkan-sen (Conversion Line): Reversed based on the highest and lowest prices over the specified period.

Kijun-sen (Base Line): Reversed in a similar manner to the Tenkan-sen, providing a medium-term perspective on price trends.

Senkou Span A (Leading Span A): Reversed to form one boundary of the Kumo (cloud), offering insight into future support and resistance levels.

Senkou Span B (Leading Span B): Reversed to form the other boundary of the Kumo, complementing Senkou Span A.

Chikou Span (Lagging Span): Reversed and plotted backward for additional confirmation of trend direction and strength.

Dynamic Price Range Calculation:

The indicator dynamically calculates the maximum and minimum prices over the last 500 bars (or the available range if fewer bars are present). This ensures that the reversal is always based on the most relevant data, providing accurate and up-to-date visualizations.

Visual Enhancements:

The reversed candlesticks are color-coded for easy interpretation: green for upward movements and red for downward movements, based on the reversed data.

The Ichimoku Cloud is filled with semi-transparent colors to clearly distinguish between bullish and bearish conditions even in its reversed state.

Debugging Aids:

For transparency and accuracy, the indicator plots the maximum and minimum price lines used for the reversal calculations. This allows users to verify the internal workings of the indicator and ensure the reversal logic is correctly applied.

Usage:

This indicator is ideal for advanced traders and analysts who want to explore market behavior from an unconventional angle. By reversing both the candlestick chart and the Ichimoku Cloud, it provides a unique perspective that can uncover new trading opportunities and enhance market analysis.

Customization:

Users can customize the periods for the Tenkan-sen, Kijun-sen, and Senkou Span B, as well as the displacement for the Ichimoku Cloud. This flexibility allows traders to adapt the indicator to their specific trading strategies and timeframes.

Conclusion:

The "Advanced Fully Reversed Candles with Reversed Ichimoku" indicator is a powerful tool that transforms traditional market analysis. By inverting both price movements and key technical indicators, it opens up a new dimension of trading insights, helping traders to see the market in a completely different light.

Parameters:

Tenkan-sen period (default: 9)

Kijun-sen period (default: 26)

Senkou Span B period (default: 52)

Displacement (default: 26)

How to Apply:

Add the script to your TradingView account via the Pine Editor.

Customize the parameters according to your trading strategy.

Analyze the reversed candlestick chart and Ichimoku Cloud to gain unique insights into market trends and potential reversal points.

Expectation Breakers [QuantVue]In technical analysis, an "Expectation Breaker" refers to a market event where price action defies typical patterns and anticipated movements, signaling potential shifts in market sentiment and direction.

This indicator looks to take advantage of these opportunities by identifying 2 types of Expectation Breakers: Downside Reversal Buybacks and Upside Reversal Sellbacks.

Downside Reversal

A downside reversals occur when a stock reaches a new high for the user defined lookback period (65 bars by default), and then experiences a larger-than-average drop and closes near its lows. This usually indicates that the market has overextended itself. The expectation is that there will be 2-3 bars of significant selling, following the downside reversal.

However, a notable sign of strength is if the stock rebounds and closes above the downside reversal bar's high within 1-3 bars. This is known as a Downside Reversal Buyback. A rapid recovery following a downside reversal is a powerful bullish indicator, breaking the expectation of lower prices. The quicker price recovers from a downside reversal, the more meaningful it is. Such a swift rebound suggests that the market's strength was underestimated, as downside reversals typically signal a short-term decline.

Upside Reversal

An upside reversal occurs when a stock reaches a new low for the user-defined lookback period (65 bars by default), and then experiences a larger-than-average rise and closes near its highs. This usually indicates that the market has overextended itself to the downside. The expectation is that there will be 2-3 bars of significant buying, following the upside reversal.

However, a notable sign of weakness is if the stock falls back and closes below the upside reversal bar's low within 1-3 bars. This is known as a Upside Reversal Sellback. A rapid fallback following an upside reversal is a powerful bearish indicator, breaking the expectation of higher prices. The quicker price falls back from an upside reversal, the more meaningful it is. Such a swift fallback suggests that the market's weakness was underestimated, as upside reversals typically signal a short-term rally.

The Expectation Breakers indicator identifies these opportunities by first identifying new highs and lows within a defined lookback period. It then compares the true range (TR), average true range (ATR), and closing range to confirm the significance of these reversals. The use of TR and ATR ensures that the reversals are substantial enough to indicate a genuine shift in market sentiment, helping to identify when price action breaks expectations.

Give this indicator a BOOST and COMMENT your thoughts below!

We hope you enjoy.

Cheers!

Reversal Candlestick Structure [LuxAlgo]The Reversal Candlestick Structure indicator detects multiple candlestick patterns occurring when trends are most likely to experience a reversal in real-time. The reversal detection method includes various settings allowing users to adjust the reversal detection algorithm more precisely.

A dashboard showing the percentage of patterns detected as reversals is also included.

🔶 USAGE

Candlestick patterns are ubiquitous to technical analysts, allowing them to detect trend continuations, reversals, and indecision.

The proposed tool effectively detects reversals by using the confluence between candlestick patterns and a reversal detection method based on the stochastic oscillator, acting as a filter for the patterns. If a candlestick pattern occurs while conditions suggest a potential reversal then the pattern is highlighted.

The displayed candle coloring allows users to observe the reversal detection method, with colored candles indicating potential reversals.

Users wanting to detect longer-term reversals can use a higher "Trend Length" setting, this can however lead to an increased amount of displayed candlestick patterns.

To prevent false positives users also have control over a "Threshold" setting in a range between (0, 100), with values closer to 100 preventing candlesticks from being detected at the start of trends.

The "Warmup Length" serves a similar purpose, and aims to prevent sudden moves to be classified as reversals. Higher values of this setting will require trends to be established for a longer period of time for reversal conditions to be detected.

🔹 Dashboard

To evaluate the role of individual candlestick patterns as potential reversal signals relative to the proposed reversal detection method, a dashboard displaying the percentage of candlestick patterns displayed (that occur when a potential reversal is detected) over the total amount detected.

Hovering on the dashboard cells of the "Reversal %" column allows displaying the total amount of patterns detected.

🔶 CANDLESTICKS PATTERNS

This tool detects 16 popular candlestick patterns, each listed in the sub-sections below.

🔹 Bullish Patterns

Hammer - A bullish reversal pattern that forms after a decline, characterized by a small body at the upper end of the trading range and a long lower shadow.

Inverted Hammer - A bullish reversal pattern that forms after a downtrend, featuring a small body at the lower end of the trading range and a long upper shadow.

Bullish Engulfing - A bullish reversal pattern where a small bearish candlestick is followed by a larger bullish candlestick that completely engulfs the previous candle.

Rising 3 - A bullish continuation pattern that consists of a long bullish candlestick followed by three smaller bearish candlesticks and then another long bullish candlestick.

3 White Soldiers - A bullish reversal pattern consisting of three consecutive long bullish candlesticks, each opening within the previous candle's body and closing higher.

Morning Star - A bullish reversal pattern made up of three candlesticks: a long bearish candlestick, followed by a short candlestick, and then a long bullish candlestick.

Bullish Harami - A bullish reversal pattern where a small bullish candlestick is completely within a previous larger bearish candlestick.

Tweezer Bottom - A bullish reversal pattern identified by an initial bullish candle, followed by a bearish candle, both having equal lows.

🔹 Bearish Patterns

Hanging Man - A bearish reversal pattern that forms after an uptrend, characterized by a small body at the upper end of the trading range and a long lower shadow.

Shooting Star - A bearish reversal pattern that forms after an uptrend, featuring a small body at the lower end of the trading range and a long upper shadow.

Bearish Engulfing - A bearish reversal pattern where a small bullish candlestick is followed by a larger bearish candlestick that completely engulfs the previous candle.

Falling 3 - A bearish continuation pattern that consists of a long bearish candlestick followed by three smaller bullish candlesticks and then another long bearish candlestick.

3 Black Crows - A bearish reversal pattern consisting of three consecutive long bearish candlesticks, each opening within the previous candle's body and closing lower.

Evening Star - A bearish reversal pattern made up of three candlesticks: a long bullish candlestick, followed by a short candlestick, and then a long bearish candlestick.

Bearish Harami - A bearish reversal pattern where a small bearish candlestick is completely within a previous larger bullish candlestick.

Tweezer Top - A bearish reversal pattern is identified by an initial bullish candle, followed by a bearish candle, both having equal highs."

🔶 SETTINGS

🔹 Patterns

Group including toggles for each of the supported candlestick patterns. Enabled toggles will allow detection of the associated candlestick pattern.

🔹 Reversal Detection

Trend Length: Determines the sensitivity of the reversal detection method to shorter-term variation, with higher values returning a detection method more sensitive to longer-term trends.

Threshold: Determines how easy it is for the reversal detection method to consider a trend at an extreme point.

Warmup Length: Warmup period in the reversal detection method, longer values will require a longer-term trend to detect potential reversals.

🔹 Style

Color Candles: Enable candle coloring on the user chart based on the reversal detection method.

Use Gradient: Use a gradient as candle coloring.

Label Size: Size of the labels displaying the detected candlesticks patterns.

🔹 Dashboard

Show Dashboard: Display the dashboard on the user chart when enabled.

Location: Dashboard location on the user chart.

Size: Size of the displayed dashboard.

Swing Failure Pattern (SFP) [LuxAlgo]The Swing Failure Pattern indicator highlights Swing Failure Patterns (SFP) on the user chart, a pattern occurring during liquidity generation from significant market participants.

A Confirmation level used to confirm a trend reversal is also included. Users can additionally filter out SFP based on a set Volume % Threshold .

🔶 USAGE

Swing failure patterns occur when candle wicks exceed (above/below) a recent swing level but close back below/above it, and occur from more significant market participants engineering liquidity. This pattern can be indicative of a potential trend reversal.

A label and an accentuated wick line highlight the SFP (both can be disabled).

Using a higher "Swings" period will not return different SFP but will however potentially reduce their detection rate.

🔹 Confirmation Level

The confirmation level is the highest point between the previous swing and SFP for a bullish SFP, and the lowest point for a bearish SFP. This level allows confirming a trend reversal after an SFP once the price breaks it.

A small triangle will be displayed when the price closes beyond the confirmation level.

A more reactive and contrarian approach could use the SFP as an entry point, and the confirmation level for taking (partial) profit, or stop loss. The example below shows a possible scenario:

🔹 Volume % Threshold

During the occurrence of an SFP, the Volume % Threshold option allows comparing the cumulative volume outside the Swing level to the total volume of the candle. The following options are included:

Volume outside swing < Threshold: Volume outside the Swing level needs to be lower than x % of total candle volume. Prevent excessive liquidity generation.

Volume outside swing > Threshold: Volume outside the Swing level needs to be higher than x % of total candle volume. Requires more significant liquidity to be generated.

None: No extra filter is applied

Note that in the above case, the left SFP is no longer highlighted because the volume above the swing level was higher than the 25% threshold of the total volume.

When we change the setting to "Volume outside swing > Threshold", we get the reversed situation.

The "Volume outside Swing level" is obtained using intrabar - Lower TimeFrame (LTF) data.

At the intrabar (LTF) level, there are a maximum of 100K bars available. When using the Volume % Threshold filter, a vertical line will highlight the maximum period during which intrabars are available.

🔶 DETAILS

🔹 LTF Settings

When 'Auto' is enabled (Settings, LTF), the LTF will be the nearest possible x times smaller TF than the current TF. When 'Premium' is disabled, the minimum TF will always be 1 minute to ensure TradingView plans lower than Premium don't get an error.

Examples with current Daily TF (when Premium is enabled):

500 : 3-minute LTF

1500 (default): 1-minute LTF

5000: 30 seconds LTF (1 minute if Premium is disabled)

The concerning LTF can be seen at the right-top (default) corner.

🔶 SETTINGS

Swings: Period used for the swing detection, with higher values returning longer-term Swing Levels.

Bullish SFP: enable/disable bullish Swing Failure Patterns.

Bearish SFP: enable/disable bearish Swing Failure Patterns.

🔹 Volume Validation

Validation:

Volume outside swing < Threshold: The volume outside the swing level needs to be lower than x % of the total volume.

Volume outside swing > Threshold: The volume outside the swing level needs to be higher than x % of the total volume.

None: No extra validation is applied.

Volume % Threshold: % of total volume as threshold.

Auto + multiple: Adjusts the initial set LTF

LTF: LTF setting

Premium: Enable when your TradingView plan is Premium or higher

🔹 Dashboard

Show Dashboard: Display applied Lower Timeframe (LTF)

Location: Location of the dashboard

Size: Size of the dashboard

🔹 Style

Swing Lines

Confirmation Lines

Swing Failure Wick

Swing Failure Label

Lines / Labels: Color for lines and labels

SFP Wicks: Color for SFP wick line

QM Signal [TradingFinder] Quasimodo Pattern - Head and Shoulders🔵 Introduction

One of the patterns in "RTM" is the "QM" pattern, also known as "Quasimodo". Its name is derived from the appearance of "Hunchback of Notre-Dame" from Victor Hugo's novel. It is a type of "Head and Shoulders" pattern.

🔵 Formation Method

🟣 Upward Trend

In an upward trend, the left shoulder is formed, and the price creates a new peak higher than the left shoulder peak . After a decline, it manages to break the previous low and move upward again. We expect the price to return approximately between and to form the "QM" pattern.

🟣 Downward Trend

In a downward trend, with a price decline, a new valley is created, forming the left shoulder, and the price forms a new valley lower than the left shoulder valley . After a price increase, it manages to break the previous high and move downward again. We expect the price to return approximately between and to form the "Quasimodo" pattern.

Note: The "QM" pattern is a specific type of head and shoulders pattern in which in the first move, the previous support is broken and it's the best condition for price reversal.

🔵 Entry Conditions for "Buy" and "Sell"

🟢 Buy

Buy Position : When a complete "QM" pattern is formed in a downtrend; we expect the price to reach the left shoulder area (with confirmation) during the retracement to enter the "BUY" position.

Profit Target in Buy Scenario : Expecting a move to the peak that broke it and the highest point in the current "Swing".

Stop Loss : Below the "Head," which is the lowest point.

🔴 Sell

Sell Position : When a "QM" pattern is formed in an uptrend, we look for entry into the "Sell" position as the price retraces to the left shoulder area.

Profit Target in Sell Scenario : Expecting a move to the price floor that has been broken and the entire "Swing" or .

Take Profit : Above the highest point or above the area will be the "SL" region.

Note : Certainly, no method alone guarantees trading capability and requires different confirmations. This indicator only detects the "QM" pattern, and the rest of the analysis will be the responsibility of the user.

Note : These profit and loss limits are based on market movements and will be provided as approximate and supportive.

Golden Swap (Zeiierman)█ Overview

The Golden Swap indicator, as designed by Zeiierman, focuses on identifying reversal points around the key levels indicated by the indicator. This pattern works by analyzing the relationship between current and past price movements, considering factors like price symmetry, baseline boundaries, and precision pin bar formations. It can offer insights into potential market reversals, allowing for more precise entries and exits.

█ How It Works

Golden Swap Long

In a market with bullish momentum, we expect the price to dip a bit before it continues to rise again. This dip is like a small retreat in an overall march upwards. So, the pattern aims to assess whether the current period's dip is relatively shallow, indicating that the overall bullish momentum remains robust despite temporary price fluctuations.

Golden Swap Short

In a market with bearish momentum (indicating selling pressure or bearish sentiment), we may still see the price rise a bit before continuing its drop. This temporary rise is like a slight bounce in an overall downward movement. In simpler terms, even when the price bounces up a bit, it's not strong enough to overcome the recent pressure of selling. The sellers are still dominating, and the price will likely continue to drop.

█ The signal is reinforced by symmetry, BaselineBound criteria, and a bearish Precision PinBar.

⚪ Symmetry in Price Movements: The pattern uses the Symmetry Precision filter to analyze the symmetry of recent price movements. This helps in determining the likelihood of a reversal. A high degree of symmetry suggests a more reliable reversal signal.

⚪ BaselineBound Criteria: This component involves the BaselineBound Threshold, which acts as a filter to validate the strength of the potential reversal. Bullish and bearish conditions are assessed based on how the current close price compares to a calculated range around the high and low of the previous period.

⚪ Precision PinBar Analysis: The pattern also incorporates the Precision PinBar filter, which evaluates the characteristics of the recent price bars. A Precision PinBar is a candlestick with a small body and a long tail, indicating a potential reversal.

⚪ Display of Key Levels: The indicator can show Open, High, and Low levels for selected timeframes, helping traders identify key price points.

█ How to Use

The Golden Swap pattern is a valuable confirmation tool, particularly around key levels or session highs and lows. It highlights instances where a previous high or low has been respected, followed by a price reversal—flipping back up in an upward trend (Golden Swap Long) or flipping back down in a downward trend (Golden Swap Short). When this pattern emerges near a key level, it strongly suggests that the price will continue moving in the direction indicated by the current trend.

Consider it akin to a minor liquidity hunt above the previous high or below the previous low. The presence of the Golden Swap pattern, especially when aligned with other indicators and filters, enhances its reliability as a signal for the continuation of the prevailing market trend.

█ Settings

Timeframe Selection: Choose from various timeframes for signal calculation.

Filter Adjustments: Fine-tune the Symmetry Precision, BaselineBound Threshold, and Precision PinBar settings to filter signals according to specific criteria.

Display Options for Key Levels: Enable or disable the display of key price levels and select timeframes for these levels.

█ Related script using the same pattern filtering techniques

-----------------

Disclaimer

The information contained in my Scripts/Indicators/Ideas/Algos/Systems does not constitute financial advice or a solicitation to buy or sell any securities of any type. I will not accept liability for any loss or damage, including without limitation any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, backtest, or individual's trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs.

My Scripts/Indicators/Ideas/Algos/Systems are only for educational purposes!

Fibonacci Timing Pattern IIThe Fibonacci Timing Pattern II is a price-based counter that seeks to determine medium-term reversals in price action. It is based on the following set of conditions:

* For a bullish Fibonacci timing signal II: The current close must be lower than the close prices from one and two periods ago. Simultaneously, the close price from two periods ago must be lower than the close price from three periods ago, and the close price from three periods ago must be lower than the close price from five periods ago. The Fibonacci sequence continues until the close price from thirty four periods ago which must be above the close price from fifty five periods ago.

* For a bearish Fibonacci timing signal II: The current close must be higher than the close prices from one and two periods ago. Simultaneously, the close price from two periods ago must be higher than the close price from three periods ago, and the close price from three periods ago must be higher than the close price from five periods ago. The Fibonacci sequence continues until the close price from thirty four periods ago which must be lower the close price from fifty five periods ago.

The signals of the pattern are ideally used in a sideways market or used in tandem with the trend (bullish signals are taken in a bullish market and bearish signals are taken in a bearish market).

SpiceIn the chart photo is a description for each shape and letter, saying what each one is.

BB, Reversals are off by default.

BB + Reversals + Next bar confirmation - The way this should be used is by waiting for a 1 or 2 bar confirmation closed above/below the high/low of the Reversal candle. So if its a Top R, a yellow box will print as a confirmed 1 bar if it closed below the top R's low, then you can wait for the second bar to close also below the Top R's low. Vice versa with the Bot R.