OPEN-SOURCE SCRIPT

Anchored VWAP

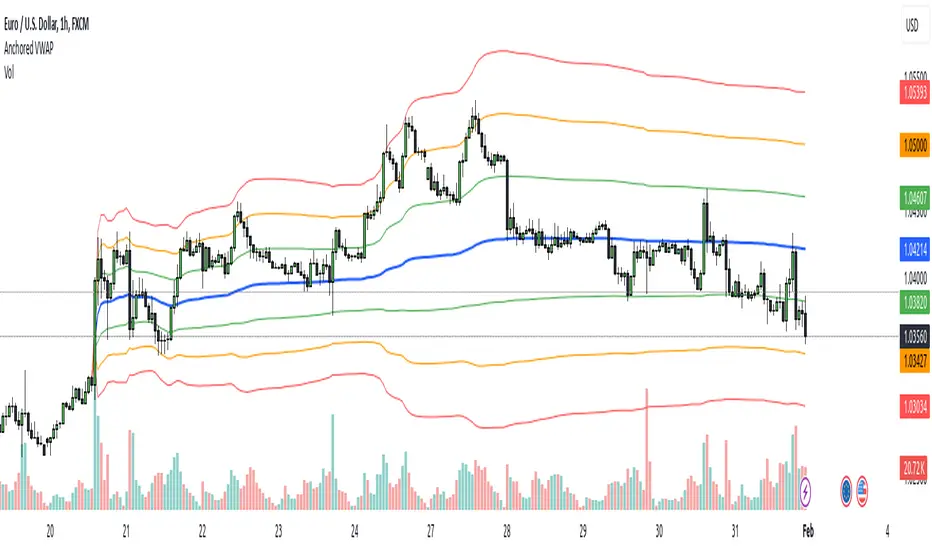

Anchored VWAP with 3 Standard Deviation Bands

📈 Version: Pine Script v5

📌 Author: Aymen Haddaji

🔍 Overview

This indicator calculates an Anchored Volume-Weighted Average Price (AVWAP), allowing traders to anchor the VWAP calculation from a user-defined date and time. It also plots three standard deviation bands above and below the AVWAP to help identify potential areas of overbought and oversold conditions.

📊 Features & Functionality

✔ Custom Anchor Point: Select a specific date and time to start the AVWAP calculation.

✔ OHLC/4 Calculation: Uses the average of Open, High, Low, and Close to smooth the price input.

✔ Three Standard Deviation Bands:

1st Deviation (Green): Moderate volatility zone.

2nd Deviation (Orange): High volatility zone.

3rd Deviation (Red): Extreme overbought/oversold areas.

✔ Real-Time Calculation: Updates dynamically with each price movement.

✔ Clear Visuals:

AVWAP (Blue Line) represents the fair market price from the anchor.

Deviation Bands (Dashed Lines) show potential support and resistance levels.

🛠 How It Works

VWAP Calculation

Uses a cumulative sum of price × volume divided by cumulative volume.

Calculation starts from the user-defined anchor time.

Standard Deviation Bands

Measures the price dispersion around the AVWAP.

The wider the bands, the higher the volatility.

When price touches or exceeds the 3rd deviation, a potential reversal zone is indicated.

Trading Strategies with AVWAP & Deviation Bands

Trend Confirmation:

Price above AVWAP = Uptrend (bullish).

Price below AVWAP = Downtrend (bearish).

Support & Resistance:

AVWAP acts as dynamic support or resistance.

1st & 2nd deviations often act as secondary levels.

Mean Reversion Trading:

When price reaches the 3rd standard deviation, a pullback is likely.

Breakout Confirmation:

A strong close above/below the 3rd deviation may indicate trend continuation.

⚙️ Input Settings

📍 Anchor Time: Allows you to set the exact date and time to start the AVWAP calculation.

🎯 Ideal For

✅ Intraday traders looking for short-term mean reversion plays.

✅ Swing traders identifying key support/resistance zones.

✅ Trend traders confirming long-term market direction.

✅ Volatility traders using standard deviation for trade entries.

📈 Version: Pine Script v5

📌 Author: Aymen Haddaji

🔍 Overview

This indicator calculates an Anchored Volume-Weighted Average Price (AVWAP), allowing traders to anchor the VWAP calculation from a user-defined date and time. It also plots three standard deviation bands above and below the AVWAP to help identify potential areas of overbought and oversold conditions.

📊 Features & Functionality

✔ Custom Anchor Point: Select a specific date and time to start the AVWAP calculation.

✔ OHLC/4 Calculation: Uses the average of Open, High, Low, and Close to smooth the price input.

✔ Three Standard Deviation Bands:

1st Deviation (Green): Moderate volatility zone.

2nd Deviation (Orange): High volatility zone.

3rd Deviation (Red): Extreme overbought/oversold areas.

✔ Real-Time Calculation: Updates dynamically with each price movement.

✔ Clear Visuals:

AVWAP (Blue Line) represents the fair market price from the anchor.

Deviation Bands (Dashed Lines) show potential support and resistance levels.

🛠 How It Works

VWAP Calculation

Uses a cumulative sum of price × volume divided by cumulative volume.

Calculation starts from the user-defined anchor time.

Standard Deviation Bands

Measures the price dispersion around the AVWAP.

The wider the bands, the higher the volatility.

When price touches or exceeds the 3rd deviation, a potential reversal zone is indicated.

Trading Strategies with AVWAP & Deviation Bands

Trend Confirmation:

Price above AVWAP = Uptrend (bullish).

Price below AVWAP = Downtrend (bearish).

Support & Resistance:

AVWAP acts as dynamic support or resistance.

1st & 2nd deviations often act as secondary levels.

Mean Reversion Trading:

When price reaches the 3rd standard deviation, a pullback is likely.

Breakout Confirmation:

A strong close above/below the 3rd deviation may indicate trend continuation.

⚙️ Input Settings

📍 Anchor Time: Allows you to set the exact date and time to start the AVWAP calculation.

🎯 Ideal For

✅ Intraday traders looking for short-term mean reversion plays.

✅ Swing traders identifying key support/resistance zones.

✅ Trend traders confirming long-term market direction.

✅ Volatility traders using standard deviation for trade entries.

Açık kaynak kodlu komut dosyası

Gerçek TradingView ruhuyla, bu komut dosyasının mimarı, yatırımcıların işlevselliğini inceleyip doğrulayabilmesi için onu açık kaynaklı hale getirdi. Yazarı tebrik ederiz! Ücretsiz olarak kullanabilseniz de, kodu yeniden yayınlamanın Topluluk Kurallarımıza tabi olduğunu unutmayın.

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, alım satım veya diğer türden tavsiye veya öneriler anlamına gelmez ve teşkil etmez. Kullanım Koşulları bölümünde daha fazlasını okuyun.

Açık kaynak kodlu komut dosyası

Gerçek TradingView ruhuyla, bu komut dosyasının mimarı, yatırımcıların işlevselliğini inceleyip doğrulayabilmesi için onu açık kaynaklı hale getirdi. Yazarı tebrik ederiz! Ücretsiz olarak kullanabilseniz de, kodu yeniden yayınlamanın Topluluk Kurallarımıza tabi olduğunu unutmayın.

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, alım satım veya diğer türden tavsiye veya öneriler anlamına gelmez ve teşkil etmez. Kullanım Koşulları bölümünde daha fazlasını okuyun.