OPEN-SOURCE SCRIPT

Buy/Sell Volume Balance

DESCRIPTION

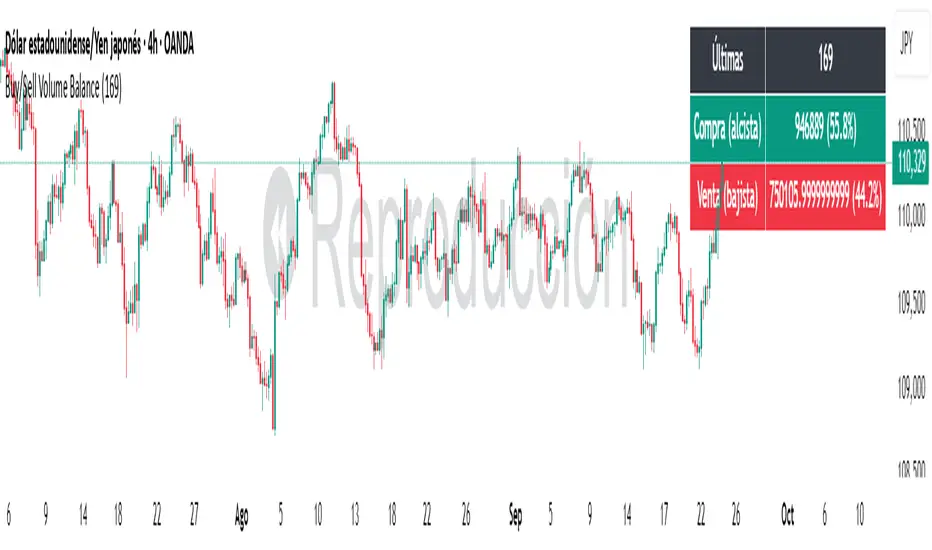

Buy/Sell Volume Balance is a simple yet powerful indicator designed to measure and visualize the balance between buying and selling volume over a customizable number of recent candles. It helps traders quickly assess market pressure during consolidation phases or ranges, in order to anticipate the most likely breakout direction.

How it works

The indicator analyzes the last N candles (default = 100, user-editable).

Each candle’s total volume is classified as:

Bullish volume (Buy volume): if the candle closes above or equal to its open.

Bearish volume (Sell volume): if the candle closes below its open.

The volumes are summed separately to calculate:

Total Buy Volume

Total Sell Volume

The percentage of each side relative to the total is also displayed.

All results are shown in a fixed table at the top of the chart for quick interpretation.

Purpose

This tool is specifically designed to help traders evaluate the internal battle between buyers and sellers during a range or sideways market. By understanding which side is accumulating more volume within the range, traders can anticipate which direction is more likely when the price breaks out.

If Buy volume dominates → potential bullish breakout.

If Sell volume dominates → potential bearish breakout.

If both sides are nearly balanced, it signals indecision and a higher chance of false breakouts.

Imbalance Threshold

In practice, traders often consider a clear imbalance when one side reaches at least 55–60% of the total volume.

Above this threshold, the dominant side is more likely to dictate the breakout direction.

Below this threshold, the market is usually in indecision and further confirmation is needed before acting.

How to use it

Add the indicator to your chart and choose the lookback period (number of candles).

Focus on ranges or consolidation zones where price is moving sideways.

Observe the balance of Buy vs Sell volume in the top-right box:

A clear imbalance (>55–60%) suggests the stronger side is more likely to push the breakout.

A balanced ratio (<55–60%) indicates indecision and possible false breakouts.

Use it in combination with support/resistance zones, breakout patterns, or volume spikes for best results.

✅ In summary: This indicator does not give direct buy/sell signals, but it provides valuable context about market pressure, helping you to align your trades with the most probable breakout direction.

Buy/Sell Volume Balance is a simple yet powerful indicator designed to measure and visualize the balance between buying and selling volume over a customizable number of recent candles. It helps traders quickly assess market pressure during consolidation phases or ranges, in order to anticipate the most likely breakout direction.

How it works

The indicator analyzes the last N candles (default = 100, user-editable).

Each candle’s total volume is classified as:

Bullish volume (Buy volume): if the candle closes above or equal to its open.

Bearish volume (Sell volume): if the candle closes below its open.

The volumes are summed separately to calculate:

Total Buy Volume

Total Sell Volume

The percentage of each side relative to the total is also displayed.

All results are shown in a fixed table at the top of the chart for quick interpretation.

Purpose

This tool is specifically designed to help traders evaluate the internal battle between buyers and sellers during a range or sideways market. By understanding which side is accumulating more volume within the range, traders can anticipate which direction is more likely when the price breaks out.

If Buy volume dominates → potential bullish breakout.

If Sell volume dominates → potential bearish breakout.

If both sides are nearly balanced, it signals indecision and a higher chance of false breakouts.

Imbalance Threshold

In practice, traders often consider a clear imbalance when one side reaches at least 55–60% of the total volume.

Above this threshold, the dominant side is more likely to dictate the breakout direction.

Below this threshold, the market is usually in indecision and further confirmation is needed before acting.

How to use it

Add the indicator to your chart and choose the lookback period (number of candles).

Focus on ranges or consolidation zones where price is moving sideways.

Observe the balance of Buy vs Sell volume in the top-right box:

A clear imbalance (>55–60%) suggests the stronger side is more likely to push the breakout.

A balanced ratio (<55–60%) indicates indecision and possible false breakouts.

Use it in combination with support/resistance zones, breakout patterns, or volume spikes for best results.

✅ In summary: This indicator does not give direct buy/sell signals, but it provides valuable context about market pressure, helping you to align your trades with the most probable breakout direction.

Açık kaynak kodlu komut dosyası

Gerçek TradingView ruhuyla, bu komut dosyasının mimarı, yatırımcıların işlevselliğini inceleyip doğrulayabilmesi için onu açık kaynaklı hale getirdi. Yazarı tebrik ederiz! Ücretsiz olarak kullanabilseniz de, kodu yeniden yayınlamanın Topluluk Kurallarımıza tabi olduğunu unutmayın.

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, alım satım veya diğer türden tavsiye veya öneriler anlamına gelmez ve teşkil etmez. Kullanım Koşulları bölümünde daha fazlasını okuyun.

Açık kaynak kodlu komut dosyası

Gerçek TradingView ruhuyla, bu komut dosyasının mimarı, yatırımcıların işlevselliğini inceleyip doğrulayabilmesi için onu açık kaynaklı hale getirdi. Yazarı tebrik ederiz! Ücretsiz olarak kullanabilseniz de, kodu yeniden yayınlamanın Topluluk Kurallarımıza tabi olduğunu unutmayın.

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, alım satım veya diğer türden tavsiye veya öneriler anlamına gelmez ve teşkil etmez. Kullanım Koşulları bölümünde daha fazlasını okuyun.