OPEN-SOURCE SCRIPT

Intraday Perpetual Premium & Z-Score

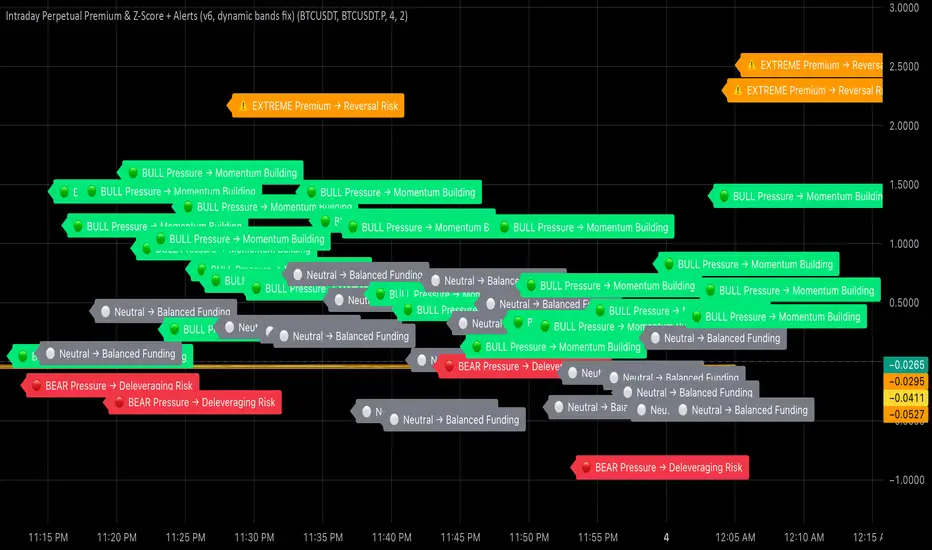

This indicator measures the real-time premium of a perpetual futures contract relative to its spot market and interprets it through a statistical lens.

It helps traders detect when funding pressure is building, when leverage is being unwound, and when crowding in the futures market may precede volatility.

How it works

• Premium (%) = (Perp – Spot) ÷ Spot × 100

The script fetches both spot and perpetual prices and calculates their percentage difference each minute.

• Rolling Mean & Z-Score

Over a 4-hour look-back, it computes the average premium and standard deviation to derive a Z-Score, showing how stretched current sentiment is.

• Dynamic ±2σ Bands highlight statistically extreme premiums or discounts.

• Rate of Change (ROC) over one hour gauges the short-term directional acceleration of funding flows.

Colour & Label Interpretation

Visual cue Meaning Trading Implication

🟢 Green bars + “BULL Pressure” Premium rising faster than mean Leverage inflows → momentum strengthening

🔴 Red bars + “BEAR Pressure” Premium shrinking Leverage unwind → pull-back or consolidation

⚠️ Orange “EXTREME Premium/Discount” Crowded trade → heightened reversal risk

⚪ Grey bars Neutral Balanced conditions

Alerts

• Bull Pressure Alert → funding & premium rising (momentum building)

• Bear Pressure Alert → premium falling (deleveraging)

• Extreme Premium Alert → crowded longs; potential top

• Extreme Discount Alert → capitulation; possible bottom

Use case

Combine this indicator with your Heikin-Ashi, RSI, and MACD confluence rules:

• Enter only when your oscillators are low → curling up and Bull Pressure triggers.

• Trim or exit when Bear Pressure or Extreme Premium appears.

• Watch for Extreme Discount during flushes as an early bottoming clue.

It helps traders detect when funding pressure is building, when leverage is being unwound, and when crowding in the futures market may precede volatility.

How it works

• Premium (%) = (Perp – Spot) ÷ Spot × 100

The script fetches both spot and perpetual prices and calculates their percentage difference each minute.

• Rolling Mean & Z-Score

Over a 4-hour look-back, it computes the average premium and standard deviation to derive a Z-Score, showing how stretched current sentiment is.

• Dynamic ±2σ Bands highlight statistically extreme premiums or discounts.

• Rate of Change (ROC) over one hour gauges the short-term directional acceleration of funding flows.

Colour & Label Interpretation

Visual cue Meaning Trading Implication

🟢 Green bars + “BULL Pressure” Premium rising faster than mean Leverage inflows → momentum strengthening

🔴 Red bars + “BEAR Pressure” Premium shrinking Leverage unwind → pull-back or consolidation

⚠️ Orange “EXTREME Premium/Discount” Crowded trade → heightened reversal risk

⚪ Grey bars Neutral Balanced conditions

Alerts

• Bull Pressure Alert → funding & premium rising (momentum building)

• Bear Pressure Alert → premium falling (deleveraging)

• Extreme Premium Alert → crowded longs; potential top

• Extreme Discount Alert → capitulation; possible bottom

Use case

Combine this indicator with your Heikin-Ashi, RSI, and MACD confluence rules:

• Enter only when your oscillators are low → curling up and Bull Pressure triggers.

• Trim or exit when Bear Pressure or Extreme Premium appears.

• Watch for Extreme Discount during flushes as an early bottoming clue.

Açık kaynak kodlu komut dosyası

Gerçek TradingView ruhuyla, bu komut dosyasının mimarı, yatırımcıların işlevselliğini inceleyip doğrulayabilmesi için onu açık kaynaklı hale getirdi. Yazarı tebrik ederiz! Ücretsiz olarak kullanabilseniz de, kodu yeniden yayınlamanın Topluluk Kurallarımıza tabi olduğunu unutmayın.

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, alım satım veya diğer türden tavsiye veya öneriler anlamına gelmez ve teşkil etmez. Kullanım Koşulları bölümünde daha fazlasını okuyun.

Açık kaynak kodlu komut dosyası

Gerçek TradingView ruhuyla, bu komut dosyasının mimarı, yatırımcıların işlevselliğini inceleyip doğrulayabilmesi için onu açık kaynaklı hale getirdi. Yazarı tebrik ederiz! Ücretsiz olarak kullanabilseniz de, kodu yeniden yayınlamanın Topluluk Kurallarımıza tabi olduğunu unutmayın.

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, alım satım veya diğer türden tavsiye veya öneriler anlamına gelmez ve teşkil etmez. Kullanım Koşulları bölümünde daha fazlasını okuyun.