OPEN-SOURCE SCRIPT

Güncellendi SOT & SA Detector Pro

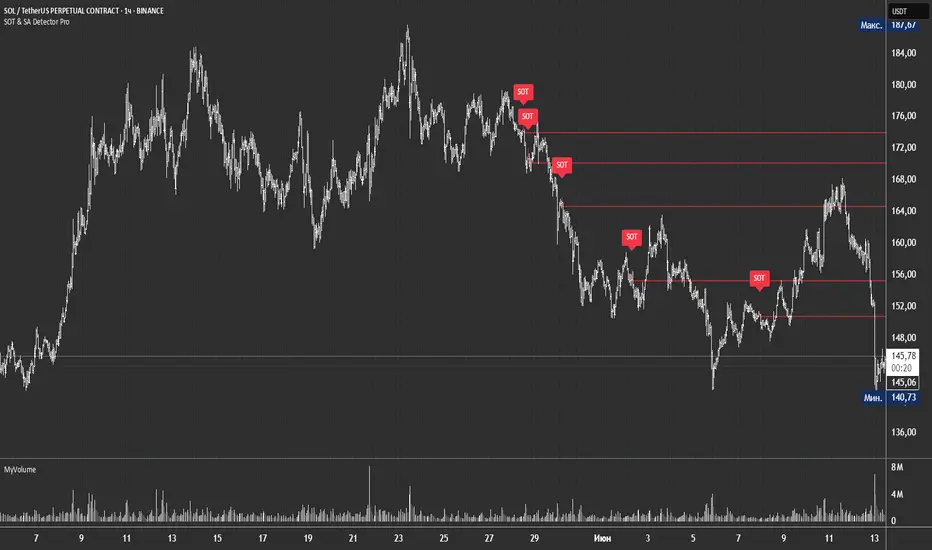

SOT & SA Detector Pro- Advanced Reversal Pattern Recognition

OVERVIEW

The SOT & SA Detector is an educational indicator designed to identify potential market reversal points through systematic analysis of candlestick patterns, volume confirmation, and price wave structures. SOT (Shorting of Thrust) signals suggest potential bearish reversals after upward price movements, while SA (Selling Accumulation) signals indicate possible bullish reversals following downward trends. This tool helps traders recognize key market transition points by combining multiple technical criteria for enhanced signal reliability.

═══════════════════════════════════════════════════════════════

HOW IT WORKS

Technical Methodology

The indicator employs a multi-factor analysis approach that evaluates:

Wave Structure Analysis: Identifies minimum 2-bar directional waves (upward for SOT, downward for SA)

Price Delta Validation: Ensures closing price changes remain within specified percentage thresholds (default 0.3%) best 0.1.

Candlestick Tail Analysis: Measures rejection wicks using configurable tail multipliers

Volume Confirmation: Requires increased volume compared to previous periods

Pattern Confirmation: Validates signals through subsequent price action

Signal Generation Process

Pattern Recognition: Scans for qualifying candlestick formations with appropriate tail characteristics

Volume Verification: Confirms patterns with volume expansion using adjustable multiplier

Price Confirmation: Validates signals when price breaks and closes beyond pattern extremes

Signal Display: Places labeled markers and draws horizontal reference levels

Mathematical Foundation

Delta calculation: math.abs(close[1] - close[2]) / close[2] <= deltaPercent / 100

Tail analysis: (high[1] - close[1]) >= tailMultiplier * (close[1] - low[1]) for SOT

Volume filter: volume[1] >= volume[2] * volumeFactor

═══════════════════════════════════════════════════════════════

KEY FEATURES

Dual Pattern Recognition: Identifies both bullish (SA) and bearish (SOT) reversal candidates

Volume Integration: Incorporates volume analysis for enhanced signal validation

Customizable Parameters: Adjustable wave length, delta percentage, tail multiplier, and volume factor

Visual Clarity: Color-coded bar highlighting, labeled signals, and horizontal reference levels

Time-Based Filtering: Configurable analysis period to focus on recent market activity

Non-Repainting Signals: Confirmed signals remain stable and do not change with new price data

Alert System: Built-in notifications for both initial signals and subsequent confirmations

═══════════════════════════════════════════════════════════════

HOW TO USE

Signal Interpretation

Red SOT Labels: Appear above potential bearish reversal candles with downward-pointing markers

Green SA Labels: Display below potential bullish reversal candles with upward-pointing markers

Horizontal Lines: Extend from signal levels to provide ongoing reference points

Bar Coloring: Highlights qualifying pattern candles for visual emphasis

Trading Application

This indicator serves as an educational tool for pattern recognition and should be used in conjunction with additional analysis methods. Consider SOT signals as potential areas of selling pressure following upward moves, while SA signals may indicate buying interest after downward price action.

Best Practices

Combine with trend analysis and support/resistance levels

Consider overall market context and timeframe alignment

Use proper risk management techniques

Validate signals with additional technical indicators

═══════════════════════════════════════════════════════════════

SETTINGS

Analysis Days (Default: 20)

Controls the lookback period for signal detection. Higher values extend historical analysis while lower values focus on recent activity.

Minimum Bars in Wave (Default: 2)

Sets the minimum consecutive bars required to establish directional wave patterns. Increase for stronger trend confirmation.

Max Close Change % (Default: 0.3) best 0.1.

Defines acceptable closing price variation between consecutive bars. Lower values require tighter price consolidation.

Tail Multiplier (Default: 1.0) best 1.5 or more.

Adjusts sensitivity for candlestick tail analysis. Higher values require more pronounced rejection wicks.

Volume Factor (Default: 1.0)

Sets volume expansion threshold compared to previous period. Values above 1.0 require volume increases.

═══════════════════════════════════════════════════════════════

LIMITATIONS

Market Conditions

May produce false signals in highly volatile or low-volume conditions

Effectiveness varies across different market environments and timeframes

Requires sufficient volume data for optimal performance

Signal Timing

Signals appear after pattern completion, not in real-time during formation

Confirmation signals depend on subsequent price action

Historical signals do not guarantee future market behavior

Technical Constraints

Limited to analyzing price and volume data only

Does not incorporate fundamental analysis or external market factors

Performance may vary significantly across different trading instruments

═══════════════════════════════════════════════════════════════

IMPORTANT DISCLAIMERS

This indicator is designed for educational purposes and technical analysis learning. It does not constitute financial advice, investment recommendations, or trading signals. Past performance does not guarantee future results. Trading involves substantial risk of loss, and this tool should be used alongside proper risk management techniques and additional analysis methods.

Always conduct thorough analysis using multiple indicators and consider market context before making trading decisions. The SOT & SA patterns represent potential reversal points but do not guarantee price direction changes.

═══════════════════════════════════════════════════════════════

Credits: Original concept and Pine Script implementation by Everyday_Trader_X

Version: Pine Script v6 compatible

Category: Technical Analysis / Reversal Detection

Overlay: Yes (displays on price chart)

OVERVIEW

The SOT & SA Detector is an educational indicator designed to identify potential market reversal points through systematic analysis of candlestick patterns, volume confirmation, and price wave structures. SOT (Shorting of Thrust) signals suggest potential bearish reversals after upward price movements, while SA (Selling Accumulation) signals indicate possible bullish reversals following downward trends. This tool helps traders recognize key market transition points by combining multiple technical criteria for enhanced signal reliability.

═══════════════════════════════════════════════════════════════

HOW IT WORKS

Technical Methodology

The indicator employs a multi-factor analysis approach that evaluates:

Wave Structure Analysis: Identifies minimum 2-bar directional waves (upward for SOT, downward for SA)

Price Delta Validation: Ensures closing price changes remain within specified percentage thresholds (default 0.3%) best 0.1.

Candlestick Tail Analysis: Measures rejection wicks using configurable tail multipliers

Volume Confirmation: Requires increased volume compared to previous periods

Pattern Confirmation: Validates signals through subsequent price action

Signal Generation Process

Pattern Recognition: Scans for qualifying candlestick formations with appropriate tail characteristics

Volume Verification: Confirms patterns with volume expansion using adjustable multiplier

Price Confirmation: Validates signals when price breaks and closes beyond pattern extremes

Signal Display: Places labeled markers and draws horizontal reference levels

Mathematical Foundation

Delta calculation: math.abs(close[1] - close[2]) / close[2] <= deltaPercent / 100

Tail analysis: (high[1] - close[1]) >= tailMultiplier * (close[1] - low[1]) for SOT

Volume filter: volume[1] >= volume[2] * volumeFactor

═══════════════════════════════════════════════════════════════

KEY FEATURES

Dual Pattern Recognition: Identifies both bullish (SA) and bearish (SOT) reversal candidates

Volume Integration: Incorporates volume analysis for enhanced signal validation

Customizable Parameters: Adjustable wave length, delta percentage, tail multiplier, and volume factor

Visual Clarity: Color-coded bar highlighting, labeled signals, and horizontal reference levels

Time-Based Filtering: Configurable analysis period to focus on recent market activity

Non-Repainting Signals: Confirmed signals remain stable and do not change with new price data

Alert System: Built-in notifications for both initial signals and subsequent confirmations

═══════════════════════════════════════════════════════════════

HOW TO USE

Signal Interpretation

Red SOT Labels: Appear above potential bearish reversal candles with downward-pointing markers

Green SA Labels: Display below potential bullish reversal candles with upward-pointing markers

Horizontal Lines: Extend from signal levels to provide ongoing reference points

Bar Coloring: Highlights qualifying pattern candles for visual emphasis

Trading Application

This indicator serves as an educational tool for pattern recognition and should be used in conjunction with additional analysis methods. Consider SOT signals as potential areas of selling pressure following upward moves, while SA signals may indicate buying interest after downward price action.

Best Practices

Combine with trend analysis and support/resistance levels

Consider overall market context and timeframe alignment

Use proper risk management techniques

Validate signals with additional technical indicators

═══════════════════════════════════════════════════════════════

SETTINGS

Analysis Days (Default: 20)

Controls the lookback period for signal detection. Higher values extend historical analysis while lower values focus on recent activity.

Minimum Bars in Wave (Default: 2)

Sets the minimum consecutive bars required to establish directional wave patterns. Increase for stronger trend confirmation.

Max Close Change % (Default: 0.3) best 0.1.

Defines acceptable closing price variation between consecutive bars. Lower values require tighter price consolidation.

Tail Multiplier (Default: 1.0) best 1.5 or more.

Adjusts sensitivity for candlestick tail analysis. Higher values require more pronounced rejection wicks.

Volume Factor (Default: 1.0)

Sets volume expansion threshold compared to previous period. Values above 1.0 require volume increases.

═══════════════════════════════════════════════════════════════

LIMITATIONS

Market Conditions

May produce false signals in highly volatile or low-volume conditions

Effectiveness varies across different market environments and timeframes

Requires sufficient volume data for optimal performance

Signal Timing

Signals appear after pattern completion, not in real-time during formation

Confirmation signals depend on subsequent price action

Historical signals do not guarantee future market behavior

Technical Constraints

Limited to analyzing price and volume data only

Does not incorporate fundamental analysis or external market factors

Performance may vary significantly across different trading instruments

═══════════════════════════════════════════════════════════════

IMPORTANT DISCLAIMERS

This indicator is designed for educational purposes and technical analysis learning. It does not constitute financial advice, investment recommendations, or trading signals. Past performance does not guarantee future results. Trading involves substantial risk of loss, and this tool should be used alongside proper risk management techniques and additional analysis methods.

Always conduct thorough analysis using multiple indicators and consider market context before making trading decisions. The SOT & SA patterns represent potential reversal points but do not guarantee price direction changes.

═══════════════════════════════════════════════════════════════

Credits: Original concept and Pine Script implementation by Everyday_Trader_X

Version: Pine Script v6 compatible

Category: Technical Analysis / Reversal Detection

Overlay: Yes (displays on price chart)

Sürüm Notları

Minimal update.Açık kaynak kodlu komut dosyası

Gerçek TradingView ruhuyla, bu komut dosyasının yaratıcısı, yatırımcıların işlevselliğini inceleyip doğrulayabilmesi için onu açık kaynaklı hale getirdi. Yazarı tebrik ederiz! Ücretsiz olarak kullanabilseniz de, kodu yeniden yayınlamanın Topluluk Kurallarımıza tabi olduğunu unutmayın.

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, alım satım veya diğer türden tavsiye veya öneriler anlamına gelmez ve teşkil etmez. Kullanım Koşulları bölümünde daha fazlasını okuyun.

Açık kaynak kodlu komut dosyası

Gerçek TradingView ruhuyla, bu komut dosyasının yaratıcısı, yatırımcıların işlevselliğini inceleyip doğrulayabilmesi için onu açık kaynaklı hale getirdi. Yazarı tebrik ederiz! Ücretsiz olarak kullanabilseniz de, kodu yeniden yayınlamanın Topluluk Kurallarımıza tabi olduğunu unutmayın.

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, alım satım veya diğer türden tavsiye veya öneriler anlamına gelmez ve teşkil etmez. Kullanım Koşulları bölümünde daha fazlasını okuyun.