Güncellendi

Elliott Wave Scanner - HAP [PRO]

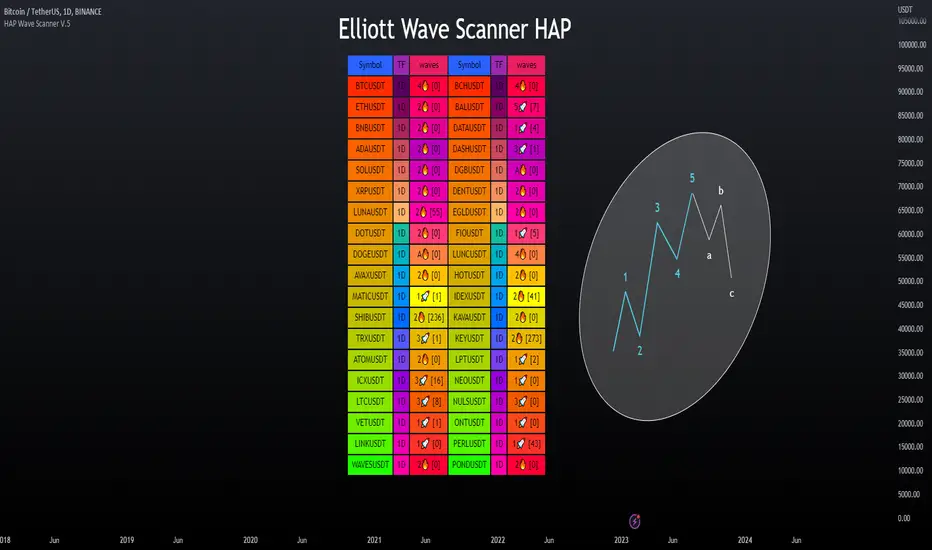

▶Elliott Wave Scanner

This is an added feature of the wave drawing version, but this version is used for scanning multiple currency pairs simultaneously, based on the custom list you have specified as your preferred ones, making it more convenient for you.

This :![Elliott Wave - HAP [PRO]](https://s3.tradingview.com/p/PLh61sBj_mid.png)

════════════════════════

This will be an adjustment of the number bars to be similar to the version in the drawing wave, with the only difference being that this version will be a scan of multiple waveforms simultaneously, including the input data format. It is recommended to only change the numbers, maintaining the original structure to avoid any errors, as demonstrated in the example below.

Pine Script®

**Kindly note to specify the numerical sequence of each wave. Parentheses should always be preceded by a comma and conclude on the final line without one.

════════════════════════

▶Let's take a look at the different parts of the scanned version.

════════════════════════

🎯 Bringing in the RSI to help make decisions, as referenced in the book by "Jason Perl".

if the market is advancing as part of a bullish HAP WAVE up sequence, then the RSI should remain above `40` during corrective setbacks for HAP WAVEs 2 and 4. Similarly, if the market is declining as part of a bearish HAP WAVE down sequence, then the RSI should remain beneath 60 during corrective for HAP WAVEs 2 and 4

For example, an uptrend in Wave tends to cause an RSI divergence between Wave 5 and Wave 3. When Wave 5 exceeds Wave 3, the RSI is often seen at Wave 5, which is lower than Wave 3.

This is an added feature of the wave drawing version, but this version is used for scanning multiple currency pairs simultaneously, based on the custom list you have specified as your preferred ones, making it more convenient for you.

This :

![Elliott Wave - HAP [PRO]](https://s3.tradingview.com/p/PLh61sBj_mid.png)

════════════════════════

This will be an adjustment of the number bars to be similar to the version in the drawing wave, with the only difference being that this version will be a scan of multiple waveforms simultaneously, including the input data format. It is recommended to only change the numbers, maintaining the original structure to avoid any errors, as demonstrated in the example below.

This is a valid example.👇

Wave0= (21),

Wave1= (13),

Wave2= (8),

Wave3= (21),

Wave4= (13),

Wave5= (34),

WaveA= (13),

WaveB= (8),

WaveC= (21)

**Kindly note to specify the numerical sequence of each wave. Parentheses should always be preceded by a comma and conclude on the final line without one.

════════════════════════

▶Let's take a look at the different parts of the scanned version.

════════════════════════

🎯 Bringing in the RSI to help make decisions, as referenced in the book by "Jason Perl".

if the market is advancing as part of a bullish HAP WAVE up sequence, then the RSI should remain above `40` during corrective setbacks for HAP WAVEs 2 and 4. Similarly, if the market is declining as part of a bearish HAP WAVE down sequence, then the RSI should remain beneath 60 during corrective for HAP WAVEs 2 and 4

For example, an uptrend in Wave tends to cause an RSI divergence between Wave 5 and Wave 3. When Wave 5 exceeds Wave 3, the RSI is often seen at Wave 5, which is lower than Wave 3.

Sürüm Notları

V5.2 Improve work efficiency.Sürüm Notları

V5.3The wave drawing version has been updated, making it compatible with the wave drawing version. You can find details about the update in the wave drawing version.

Ücretli Alanda Mevcut

Bu gösterge yalnızca Hapharmonic Elite Technical Suite aboneleri tarafından kullanılabilir. hapharmonic tarafından hazırlanan bu ve diğer komut dosyalarına erişmek için katılın.

✨ Access premium indicators at: hapharmonic.com

📧 Email: hapharmonic@gmail.com

🤖 To request access, please send me a message with your details.

Thank you!

📧 Email: hapharmonic@gmail.com

🤖 To request access, please send me a message with your details.

Thank you!

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, alım satım veya diğer türden tavsiye veya öneriler anlamına gelmez ve teşkil etmez. Kullanım Koşulları bölümünde daha fazlasını okuyun.

Ücretli Alanda Mevcut

Bu gösterge yalnızca Hapharmonic Elite Technical Suite aboneleri tarafından kullanılabilir. hapharmonic tarafından hazırlanan bu ve diğer komut dosyalarına erişmek için katılın.

✨ Access premium indicators at: hapharmonic.com

📧 Email: hapharmonic@gmail.com

🤖 To request access, please send me a message with your details.

Thank you!

📧 Email: hapharmonic@gmail.com

🤖 To request access, please send me a message with your details.

Thank you!

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, alım satım veya diğer türden tavsiye veya öneriler anlamına gelmez ve teşkil etmez. Kullanım Koşulları bölümünde daha fazlasını okuyun.