Stella Edge|SuperFunded

What it is

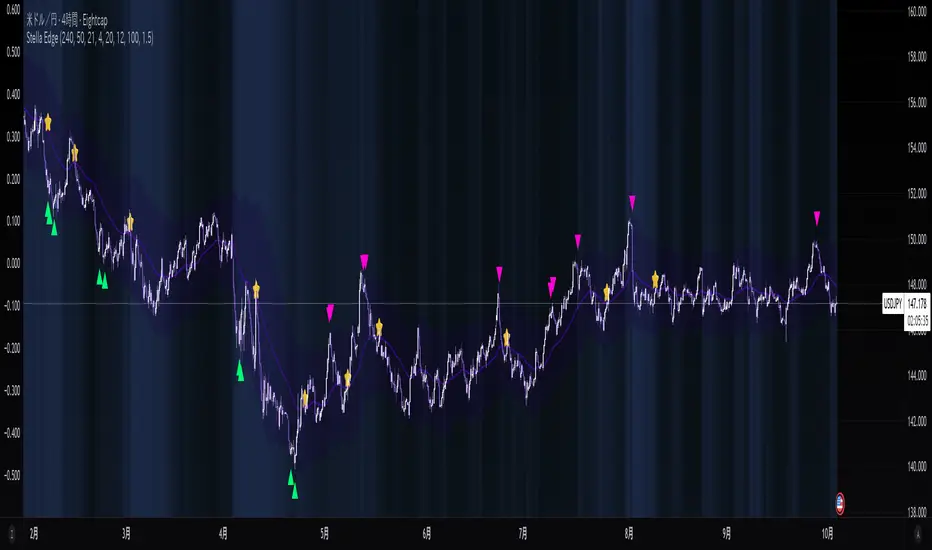

Stella Edge is a higher-timeframe (HTF) EMA + ATR channel with adaptive zones, a volatility hazard filter, and clean entry/exit cues. It projects an HTF EMA with ATR bands, paints a calm-to-active “aurora” background using normalized ATR, and marks:

・Long cue when price crosses up into/through the lower band (potential buy zone).

・Short cue when price crosses down into/through the upper band (potential sell zone).

・Take-profit star when price crosses back through the HTF EMA against your active direction.

・Skull marker on extreme volatility bars (ATR & Volume spikes) to warn of unstable conditions.

Why this is not a simple mashup

・HTF regime first: Instead of reacting to local noise, entries are contextualized by an HTF EMA±ATR envelope (request.security) that frames price with structural zones (upper = supply bias, lower = demand bias).

・Risk-aware gating: A dual-threshold volatility filter flags bars where true range and volume spike far above their baselines—conditions that often degrade signal quality.

・Signal hygiene: Cross checks use band values from the prior bar [1] to reduce duplicate/ambiguous triggers when HTF data updates, yielding cleaner, fewer, higher-quality icons.

・Visual cognition: The aurora background blends two night tones by the percent-rank of HTF ATR, so your eye immediately senses regime intensity without reading numbers.

How it works (concise)

1. Pull HTF EMA(len) and HTF ATR(len) via request.security.

2. Compute upper/lower bands = EMA ± ATR×multiplier (projected continuously).

3. Aurora mode: Normalize HTF ATR by 200-bar percent-rank and map it to a calm→active gradient for background.

4. Signals

・Long when close crosses up the lowerBand[1].

・Short when close crosses down the upperBand[1].

・Track tradeDirection and print a ⭐️ when price crosses the HTF EMA against the current direction (TP cue).

5. Volatility hazard (optional): Flag bars where

・TR ≥ ATR(avg, N) × multiplier and

・Volume ≥ SMA(volume, M) × multiplier.

These get a 💀 label so you can avoid forced entries/exits during disorderly bursts.

Parameters (UI mapping)

Higher-Timeframe & Core

・Higher TF for EMA/ATR: HTF used by request.security (e.g., 60).

・EMA Length (HTF): HTF EMA period.

・ATR Length (HTF): HTF ATR period.

・ATR Multiplier: Band width.

・Aurora mode: Toggle dynamic background (ATR-based gradient).

Volatility Filter (Volatility Filter group)

・Enable Extreme Volatility Filter?: On/off.

・ATR Period / ATR Spike Multiplier: Bar is “extreme” if TR ≥ ATR×multiplier.

・Volume MA Period / Volume Spike Multiplier: “Extreme” also requires Volume ≥ SMA×multiplier.

Signal Settings

・Long Arrow Color / Short Arrow Color: Icon colors for long/short cues.

Practical usage

・Plan around the HTF envelope:

・Below lower band → price may be stretched into demand zone (look for long cue & reaction).

・Above upper band → stretched into supply zone (look for short cue & reaction).

・Confirmation: Treat arrows as triggers, not commands. Favor entry when you also see reaction candles (rejection wicks, engulfings) or micro-structure alignment.

・Exit discipline: The ⭐️ on EMA cross-back is a simple, mechanical TP. You can scale out earlier using fixed R-multiples or prior swing levels.

・Hazard bars: Avoid initiating on 💀 bars; widen stops or step aside until volatility normalizes.

・Clutter control: If zones feel too reactive, raise HTF (e.g., 120/240) or increase ATR Length/Multiplier for broader, slower bands.

Repainting & HTF notes

・HTF series from request.security are final only when the HTF bar closes. Using upperBand[1]/lowerBand[1] for crosses helps reduce duplicate/early prints, but intrabar behavior on the current HTF bar can still evolve. Evaluate on closed bars for strict confirmation.

Best markets & timeframes

・Pairs/indices/crypto where trend–pullback cycles are common.

・Start with entry TF = your usual trading TF (e.g., 5m–1h) and HTF = 3–12× that TF (e.g., 60/120/240).

・For BTC/Gold or newsy assets, prefer higher HTF and the volatility filter ON.

Disclaimer

This tool identifies zones and timing cues; it does not guarantee outcomes. News shocks and liquidity gaps can invalidate any setup. Always size positions prudently and trade at your own risk.

SuperFunded invite-only

To obtain access, please DM me on TradingView or use the link in my profile.

Stella Edge — クイックガイド(日本語)

概要

Stella Edgeは、上位足EMA±ATRバンドで相場をフレーミングし、アダプティブな買い/売りゾーン、極端なボラティリティ警告、そしてシンプルなエントリー/利確キューを提供するインジです。

・ロング:価格が Lower Bandを上抜けたタイミングで矢印。

・ショート:価格が Upper Bandを下抜けたタイミングで矢印。

・利確⭐️:建玉方向に対して価格が HTF EMA を逆行クロスしたら表示。

・💀警告:ATRと出来高が同時スパイクした「危険」バーを明示。

・背景はHTF ATRのパーセントランクで静→動にグラデーションする「オーロラ」表現。

独自性・新規性

・上位足の構造を先に定義(EMA±ATR)→そこへ戻る/抜ける動きだけを狙うため、ノイズを減らした文脈型の判断が可能。

・二重スパイク条件(TR×ATR基準+出来高×SMA基準)で、荒れ相場のエントリー回避を支援。

・シグナルの重複・不安定を抑制、見やすい最小限のアイコンに整理。

・視覚設計としてATRの相対的な強度を背景で可視化し、一目で局面認識。

使い方のヒント

・ゾーンは押し目/戻り目の候補。矢印はトリガーとして扱い、ローソクの反応(ピンバー/包み足など)で確認してから入る。

・⭐️は機械的TPの目安。スケールアウトやR倍数での利確も併用可。

・💀が出た足での新規は原則回避。HTFを上げるとゾーンはより鈍感=落ち着いた絵に。

・HTF更新の注意:上位足バー確定までは値が変化し得ます。確定足ベースで検証するのが安全。

免責

本ツールは反発や到達を保証しません。イベントや流動性によって機能しないことがあります。資金管理のもと自己責任でご利用ください。

SuperFunded 招待専用スクリプト

このスクリプトはSuperFundedの参加者専用です。アクセスをご希望の方は、SuperFundedにご登録のメールアドレスから partner@superfunded.com 宛に、TradingViewの登録名をご送信ください。

Yalnızca davetli komut dosyası

Bu komut dosyasına yalnızca yazar tarafından onaylanan kullanıcılar erişebilir. Kullanmak için izin istemeniz ve almanız gerekir. Bu genellikle ödeme yapıldıktan sonra verilir. Daha fazla ayrıntı için aşağıdaki yazarın talimatlarını izleyin veya doğrudan SuperFunded ile iletişime geçin.

TradingView, yazarına tamamen güvenmediğiniz ve nasıl çalıştığını anlamadığınız sürece bir komut dosyası için ödeme yapmanızı veya kullanmanızı TAVSİYE ETMEZ. Ayrıca topluluk komut dosyalarımızda ücretsiz, açık kaynaklı alternatifler bulabilirsiniz.

Yazarın talimatları

Feragatname

Yalnızca davetli komut dosyası

Bu komut dosyasına yalnızca yazar tarafından onaylanan kullanıcılar erişebilir. Kullanmak için izin istemeniz ve almanız gerekir. Bu genellikle ödeme yapıldıktan sonra verilir. Daha fazla ayrıntı için aşağıdaki yazarın talimatlarını izleyin veya doğrudan SuperFunded ile iletişime geçin.

TradingView, yazarına tamamen güvenmediğiniz ve nasıl çalıştığını anlamadığınız sürece bir komut dosyası için ödeme yapmanızı veya kullanmanızı TAVSİYE ETMEZ. Ayrıca topluluk komut dosyalarımızda ücretsiz, açık kaynaklı alternatifler bulabilirsiniz.