OPEN-SOURCE SCRIPT

Güncellendi Aroon, Velocity & RMS Volume Strategy

📈 Strategy Name:

Aroon, Velocity & RMS Volume Strategy

By GabrielAmadeusLau

🧠 Strategy Overview

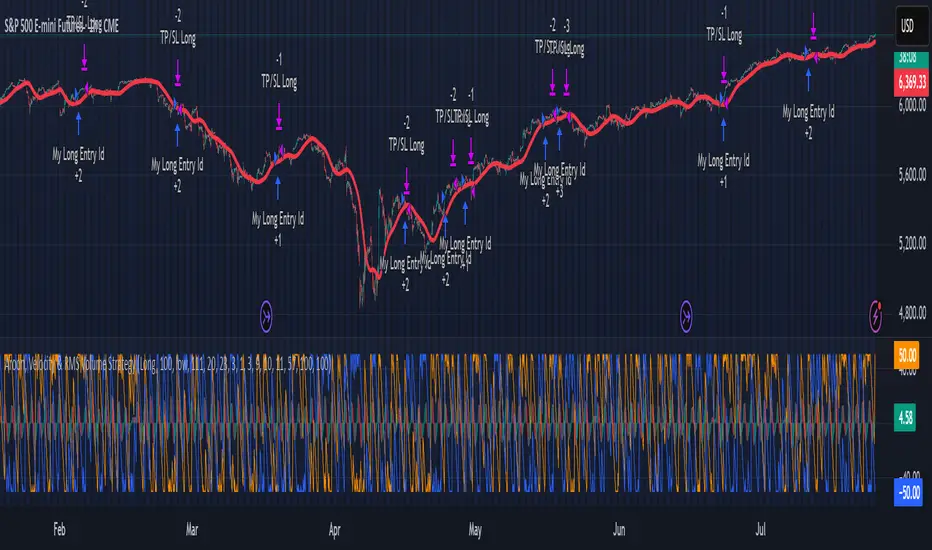

This strategy is a hybrid momentum-trend model designed to trade directional breakouts using Aroon Oscillator crossovers, volume acceleration (velocity), and trend confirmation via a Super Smoother filter. Trade entries are filtered by custom time windows, and position sizing is dynamically calculated using ATR-based risk parameters.

🧩 Core Components

🔶 1. Aroon Oscillator

Detects breakout points using the relative position of recent highs/lows.

Aroon Up > Aroon Down triggers long setups; the opposite for short.

A baseline shift (-50) centers the Aroon plots for symmetry.

📉 2. Super Smoother Trend Filter

A zero-lag digital filter (2-pole smoother) applied to price.

Acts as a directional bias confirmation:

Price must be above the smoother for longs.

Price must be below for shorts.

📊 3. Velocity of RMS Volume

Measures the rate of change of volume, enhanced with RMS normalization and bandpass filtering.

Entries are only taken when volume velocity is rising, indicating increasing market activity in the trade direction.

⚙️ Entry Conditions

✅ Long Entry

Aroon Up crosses above Aroon Down

Price is above the Super Smoother

Volume velocity is rising

Current hour is not excluded

✅ Short Entry

Aroon Down crosses above Aroon Up

Price is below the Super Smoother

Volume velocity is rising

Current hour is not excluded

🔒 Risk Management & Position Sizing

ATR-Based Stop Loss & Take Profit:

SL = entry price ± ATR × sl_mult

TP = entry price ± ATR × tp_mult

Fixed Dollar Risk per Trade ($):

Position size is auto-calculated using:

units

=

⌊

User Risk

Stop Distance

⌋

units=⌊

Stop Distance

User Risk

⌋

🕐 Time Filtering

User-defined option to exclude up to three hours from trading (e.g., during low-liquidity or poor-performance times).

Controlled via:

excludeHour toggle

excludeHour1, excludeHour2, excludeHour3

📺 Visuals and Plots

Aroon Up / Down: shifted to oscillate around 0 for visual clarity.

Super Smoother: thick red trend line over price.

Velocity: dynamically shaded area chart (teal = increasing, red = decreasing).

🧠 Advanced Features (Behind-the-Scenes)

Includes modular filters and custom smoothing techniques for expansion:

Jurik MA, Butterworth HP, Laguerre Filter, Tillson T3, Hann FIR, RMS Scaling

Modular ma() and velocity() functions enable future extension and dynamic experimentation.

✅ Strengths

Combines trend, momentum, and volume in a single signal framework.

Employs robust digital signal processing filters for noise reduction.

Custom position sizing + time filtering add risk control and flexibility.

Aroon, Velocity & RMS Volume Strategy

By GabrielAmadeusLau

🧠 Strategy Overview

This strategy is a hybrid momentum-trend model designed to trade directional breakouts using Aroon Oscillator crossovers, volume acceleration (velocity), and trend confirmation via a Super Smoother filter. Trade entries are filtered by custom time windows, and position sizing is dynamically calculated using ATR-based risk parameters.

🧩 Core Components

🔶 1. Aroon Oscillator

Detects breakout points using the relative position of recent highs/lows.

Aroon Up > Aroon Down triggers long setups; the opposite for short.

A baseline shift (-50) centers the Aroon plots for symmetry.

📉 2. Super Smoother Trend Filter

A zero-lag digital filter (2-pole smoother) applied to price.

Acts as a directional bias confirmation:

Price must be above the smoother for longs.

Price must be below for shorts.

📊 3. Velocity of RMS Volume

Measures the rate of change of volume, enhanced with RMS normalization and bandpass filtering.

Entries are only taken when volume velocity is rising, indicating increasing market activity in the trade direction.

⚙️ Entry Conditions

✅ Long Entry

Aroon Up crosses above Aroon Down

Price is above the Super Smoother

Volume velocity is rising

Current hour is not excluded

✅ Short Entry

Aroon Down crosses above Aroon Up

Price is below the Super Smoother

Volume velocity is rising

Current hour is not excluded

🔒 Risk Management & Position Sizing

ATR-Based Stop Loss & Take Profit:

SL = entry price ± ATR × sl_mult

TP = entry price ± ATR × tp_mult

Fixed Dollar Risk per Trade ($):

Position size is auto-calculated using:

units

=

⌊

User Risk

Stop Distance

⌋

units=⌊

Stop Distance

User Risk

⌋

🕐 Time Filtering

User-defined option to exclude up to three hours from trading (e.g., during low-liquidity or poor-performance times).

Controlled via:

excludeHour toggle

excludeHour1, excludeHour2, excludeHour3

📺 Visuals and Plots

Aroon Up / Down: shifted to oscillate around 0 for visual clarity.

Super Smoother: thick red trend line over price.

Velocity: dynamically shaded area chart (teal = increasing, red = decreasing).

🧠 Advanced Features (Behind-the-Scenes)

Includes modular filters and custom smoothing techniques for expansion:

Jurik MA, Butterworth HP, Laguerre Filter, Tillson T3, Hann FIR, RMS Scaling

Modular ma() and velocity() functions enable future extension and dynamic experimentation.

✅ Strengths

Combines trend, momentum, and volume in a single signal framework.

Employs robust digital signal processing filters for noise reduction.

Custom position sizing + time filtering add risk control and flexibility.

Sürüm Notları

...Sürüm Notları

I added a feature.Açık kaynak kodlu komut dosyası

Gerçek TradingView ruhuna uygun olarak, bu komut dosyasının oluşturucusu bunu açık kaynaklı hale getirmiştir, böylece yatırımcılar betiğin işlevselliğini inceleyip doğrulayabilir. Yazara saygı! Ücretsiz olarak kullanabilirsiniz, ancak kodu yeniden yayınlamanın Site Kurallarımıza tabi olduğunu unutmayın.

Gabriel Amadeus

The Real World - Stocks Campus:

Stocks, Options, Futures, Forex, Crypto, this is what we trade.

Learn profitable trading systems or build your own, just like I did.

jointherealworld.com/?a=f7jkjpg8kh

The Real World - Stocks Campus:

Stocks, Options, Futures, Forex, Crypto, this is what we trade.

Learn profitable trading systems or build your own, just like I did.

jointherealworld.com/?a=f7jkjpg8kh

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, işlem veya diğer türden tavsiye veya tavsiyeler anlamına gelmez ve teşkil etmez. Kullanım Şartları'nda daha fazlasını okuyun.

Açık kaynak kodlu komut dosyası

Gerçek TradingView ruhuna uygun olarak, bu komut dosyasının oluşturucusu bunu açık kaynaklı hale getirmiştir, böylece yatırımcılar betiğin işlevselliğini inceleyip doğrulayabilir. Yazara saygı! Ücretsiz olarak kullanabilirsiniz, ancak kodu yeniden yayınlamanın Site Kurallarımıza tabi olduğunu unutmayın.

Gabriel Amadeus

The Real World - Stocks Campus:

Stocks, Options, Futures, Forex, Crypto, this is what we trade.

Learn profitable trading systems or build your own, just like I did.

jointherealworld.com/?a=f7jkjpg8kh

The Real World - Stocks Campus:

Stocks, Options, Futures, Forex, Crypto, this is what we trade.

Learn profitable trading systems or build your own, just like I did.

jointherealworld.com/?a=f7jkjpg8kh

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, işlem veya diğer türden tavsiye veya tavsiyeler anlamına gelmez ve teşkil etmez. Kullanım Şartları'nda daha fazlasını okuyun.