OPEN-SOURCE SCRIPT

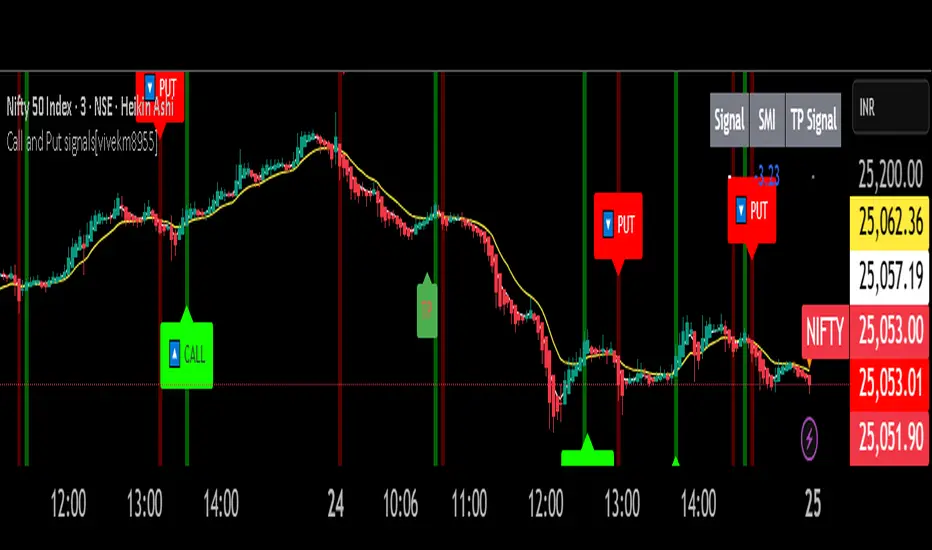

Call and Put signals[vivekm8955]

🔍 Strategy Overview

This adaptive strategy generates clear CALL (Buy) and PUT (Sell) signals by combining:

✅ Dual EMA structure

✅ Heikin Ashi trend confirmation

✅ Smoothed Stochastic Momentum Index (SMI)

✅ Take Profit (TP) signals via momentum reversal

✅ Dynamic support from average price action

The goal: Give retail traders institutional-grade signals with clarity, without lag.

📊 Trade Entry Logic

🔼 CALL Signal (Buy):

Fast EMA < Avg Price

Slow EMA < Avg Price

Slow EMA < Fast EMA

Confirmed by crossover

➡️ This implies price has dipped below value zones and is showing strength.

🔽 PUT Signal (Sell):

Fast EMA > Avg Price

Slow EMA > Avg Price

Slow EMA > Fast EMA

Confirmed by crossover

➡️ Indicates price is elevated and showing weakness.

🏁 Exit Logic (Take Profit)

✅ TP Buy Signal: SMI crosses below 0 → Weakening upside

✅ TP Sell Signal: SMI crosses above 0 → Weakening downside

These act as exit cues or partial booking areas.

📌 Visualization & Alerts

🔼 CALL Signal → Green label below candle

🔽 PUT Signal → Red label above candle

✅ TP Signal → Small label (TP) showing ideal exit points

🔔 Real-time alerts enabled (CALL, PUT, TP alerts)

Background color changes based on EMA crossovers for added confirmation.

🕯️ Additional Filters Used

Heikin Ashi Candles: For smoothing out noise and validating trends.

SMI (Double EMA): A momentum indicator better suited for trending markets.

📈 Dashboard Included

Displays current signal, SMI value, and TP status in real-time

Color-coded for easy interpretation

Auto-adaptive table (fixes out-of-bound issues)

📎 Ideal Timeframes

Timeframe Use Case

5m – 15m Intraday Scalping

1h – 4h Swing Trading

1D Positional Plays

🚦 Suggested Usage

Step Action

1️⃣ Confirm signal (CALL or PUT) on 1TF and 1 higher TF

2️⃣ Enter near signal candle close

3️⃣ Exit on TP label OR SMI reversal

4️⃣ Avoid entry during high volatility news events

⚠️ Disclaimer – Use with Caution!

⚠️ This script is for educational & analytical purposes only.

It does NOT guarantee profits, nor is it a financial advisory tool.

Always use risk management: Stop-losses, position sizing, capital preservation.

Do not trade blindly. Backtest it across market conditions.

Past performance is not indicative of future results.

Consult a SEBI-registered advisor for real trading decisions.

This adaptive strategy generates clear CALL (Buy) and PUT (Sell) signals by combining:

✅ Dual EMA structure

✅ Heikin Ashi trend confirmation

✅ Smoothed Stochastic Momentum Index (SMI)

✅ Take Profit (TP) signals via momentum reversal

✅ Dynamic support from average price action

The goal: Give retail traders institutional-grade signals with clarity, without lag.

📊 Trade Entry Logic

🔼 CALL Signal (Buy):

Fast EMA < Avg Price

Slow EMA < Avg Price

Slow EMA < Fast EMA

Confirmed by crossover

➡️ This implies price has dipped below value zones and is showing strength.

🔽 PUT Signal (Sell):

Fast EMA > Avg Price

Slow EMA > Avg Price

Slow EMA > Fast EMA

Confirmed by crossover

➡️ Indicates price is elevated and showing weakness.

🏁 Exit Logic (Take Profit)

✅ TP Buy Signal: SMI crosses below 0 → Weakening upside

✅ TP Sell Signal: SMI crosses above 0 → Weakening downside

These act as exit cues or partial booking areas.

📌 Visualization & Alerts

🔼 CALL Signal → Green label below candle

🔽 PUT Signal → Red label above candle

✅ TP Signal → Small label (TP) showing ideal exit points

🔔 Real-time alerts enabled (CALL, PUT, TP alerts)

Background color changes based on EMA crossovers for added confirmation.

🕯️ Additional Filters Used

Heikin Ashi Candles: For smoothing out noise and validating trends.

SMI (Double EMA): A momentum indicator better suited for trending markets.

📈 Dashboard Included

Displays current signal, SMI value, and TP status in real-time

Color-coded for easy interpretation

Auto-adaptive table (fixes out-of-bound issues)

📎 Ideal Timeframes

Timeframe Use Case

5m – 15m Intraday Scalping

1h – 4h Swing Trading

1D Positional Plays

🚦 Suggested Usage

Step Action

1️⃣ Confirm signal (CALL or PUT) on 1TF and 1 higher TF

2️⃣ Enter near signal candle close

3️⃣ Exit on TP label OR SMI reversal

4️⃣ Avoid entry during high volatility news events

⚠️ Disclaimer – Use with Caution!

⚠️ This script is for educational & analytical purposes only.

It does NOT guarantee profits, nor is it a financial advisory tool.

Always use risk management: Stop-losses, position sizing, capital preservation.

Do not trade blindly. Backtest it across market conditions.

Past performance is not indicative of future results.

Consult a SEBI-registered advisor for real trading decisions.

Açık kaynak kodlu komut dosyası

Gerçek TradingView ruhuyla, bu komut dosyasının mimarı, yatırımcıların işlevselliğini inceleyip doğrulayabilmesi için onu açık kaynaklı hale getirdi. Yazarı tebrik ederiz! Ücretsiz olarak kullanabilseniz de, kodu yeniden yayınlamanın Topluluk Kurallarımıza tabi olduğunu unutmayın.

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, alım satım veya diğer türden tavsiye veya öneriler anlamına gelmez ve teşkil etmez. Kullanım Koşulları bölümünde daha fazlasını okuyun.

Açık kaynak kodlu komut dosyası

Gerçek TradingView ruhuyla, bu komut dosyasının mimarı, yatırımcıların işlevselliğini inceleyip doğrulayabilmesi için onu açık kaynaklı hale getirdi. Yazarı tebrik ederiz! Ücretsiz olarak kullanabilseniz de, kodu yeniden yayınlamanın Topluluk Kurallarımıza tabi olduğunu unutmayın.

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, alım satım veya diğer türden tavsiye veya öneriler anlamına gelmez ve teşkil etmez. Kullanım Koşulları bölümünde daha fazlasını okuyun.