PROTECTED SOURCE SCRIPT

Güncellendi RSI Risk | AlgoFy Trader

RSI Risk | AlgoFy Trader

Overview

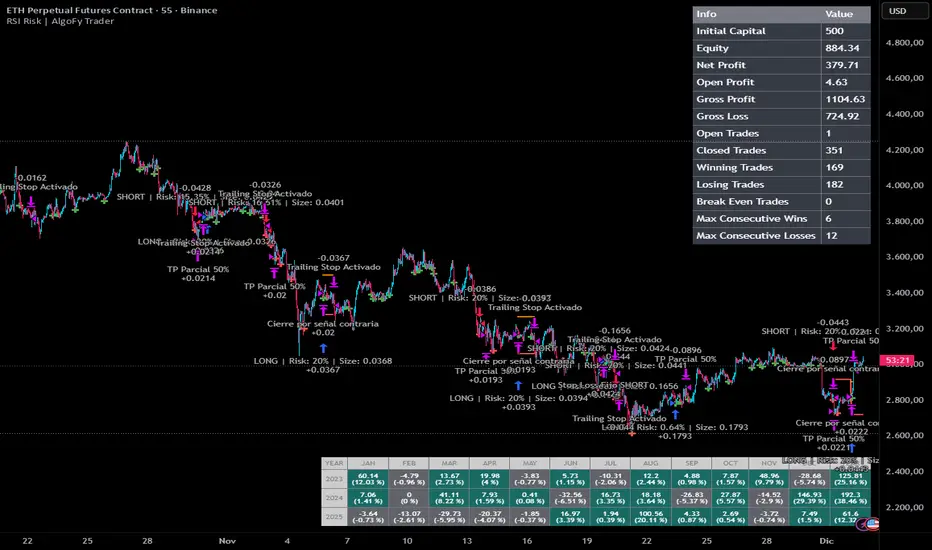

The RSI Risk | AlgoFy Trader is a trading system that combines RSI-based entry signals with automated capital management. This strategy identifies potential momentum shifts while controlling risk through calculated position sizing.

Key Features

Dynamic Risk Management:

Fixed Risk Per Trade: Users set maximum risk percentage per trade.

Automatic Position Sizing: Calculates position size based on stop-loss distance.

Capital Protection: Limits each trade's risk to user-defined percentage.

RSI Entry System:

Momentum Detection: Uses RSI crossovers above/below defined thresholds.

Clear Signals: Provides long/short entries on momentum transitions.

Multiple Exit Layers:

Dynamic Stop Loss: Stop based on recent price structure.

Fixed Safety Stop: Optional percentage-based stop loss.

Partial Take Profit: Optional early profit-taking.

Trailing Stop: Optional dynamic profit protection.

Performance Tracking:

Trade Statistics: Tracks win/loss streaks and performance metrics.

Monthly Dashboard: Shows monthly/yearly P&L with equity views.

Trade Details: Displays risk percentage and position size.

How It Works

Signal Detection: Monitors RSI for crossover events.

Risk Calculation: Determines stop-loss based on recent volatility.

Position Sizing: Calculates exact position to match risk percentage.

Example:

Account: $10,000 | Risk: 2% ($200 max)

Stop loss at 4% distance

Position size: $5,000

Result: 4% loss on $5,000 = $200 (2% of account)

Recommended Settings

Risk: 1-2% per trade

Enable fixed stop at 3-4%

Consider trailing stop activation

This script provides disciplined RSI trading with automated risk control, adjusting exposure while maintaining strict risk limits.

Overview

The RSI Risk | AlgoFy Trader is a trading system that combines RSI-based entry signals with automated capital management. This strategy identifies potential momentum shifts while controlling risk through calculated position sizing.

Key Features

Dynamic Risk Management:

Fixed Risk Per Trade: Users set maximum risk percentage per trade.

Automatic Position Sizing: Calculates position size based on stop-loss distance.

Capital Protection: Limits each trade's risk to user-defined percentage.

RSI Entry System:

Momentum Detection: Uses RSI crossovers above/below defined thresholds.

Clear Signals: Provides long/short entries on momentum transitions.

Multiple Exit Layers:

Dynamic Stop Loss: Stop based on recent price structure.

Fixed Safety Stop: Optional percentage-based stop loss.

Partial Take Profit: Optional early profit-taking.

Trailing Stop: Optional dynamic profit protection.

Performance Tracking:

Trade Statistics: Tracks win/loss streaks and performance metrics.

Monthly Dashboard: Shows monthly/yearly P&L with equity views.

Trade Details: Displays risk percentage and position size.

How It Works

Signal Detection: Monitors RSI for crossover events.

Risk Calculation: Determines stop-loss based on recent volatility.

Position Sizing: Calculates exact position to match risk percentage.

Example:

Account: $10,000 | Risk: 2% ($200 max)

Stop loss at 4% distance

Position size: $5,000

Result: 4% loss on $5,000 = $200 (2% of account)

Recommended Settings

Risk: 1-2% per trade

Enable fixed stop at 3-4%

Consider trailing stop activation

This script provides disciplined RSI trading with automated risk control, adjusting exposure while maintaining strict risk limits.

Sürüm Notları

Update Note: Enhanced the risk management system to prevent position overexposure. The script now incorporates additional safeguards that more conservatively calculate maximum position size, particularly during high volatility or when stop-loss distances are exceptionally tight. This refinement ensures each trade strictly adheres to the user-defined risk percentage, providing stronger capital protection across varying market conditions.Sürüm Notları

Update Note: Refined the chart visualization for clearer, faster interpretation of script activity. Enhanced markers and level plotting now provide immediate visual feedback on strategic entry and exit points, making it easier to understand trade execution logic and position management at a glance.Korumalı komut dosyası

Bu komut dosyası kapalı kaynak olarak yayınlanmaktadır. Ancak, ücretsiz ve herhangi bir sınırlama olmaksızın kullanabilirsiniz – daha fazla bilgiyi buradan edinebilirsiniz.

ALGOFY TRADER

Capital & risk management specialists. Medium/long-term strategies with controlled risk per trade and automatic position sizing.

"The biggest risk is NOT trading"

linktr.ee/algofytarder

Capital & risk management specialists. Medium/long-term strategies with controlled risk per trade and automatic position sizing.

"The biggest risk is NOT trading"

linktr.ee/algofytarder

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, alım satım veya diğer türden tavsiye veya öneriler anlamına gelmez ve teşkil etmez. Kullanım Koşulları bölümünde daha fazlasını okuyun.

Korumalı komut dosyası

Bu komut dosyası kapalı kaynak olarak yayınlanmaktadır. Ancak, ücretsiz ve herhangi bir sınırlama olmaksızın kullanabilirsiniz – daha fazla bilgiyi buradan edinebilirsiniz.

ALGOFY TRADER

Capital & risk management specialists. Medium/long-term strategies with controlled risk per trade and automatic position sizing.

"The biggest risk is NOT trading"

linktr.ee/algofytarder

Capital & risk management specialists. Medium/long-term strategies with controlled risk per trade and automatic position sizing.

"The biggest risk is NOT trading"

linktr.ee/algofytarder

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, alım satım veya diğer türden tavsiye veya öneriler anlamına gelmez ve teşkil etmez. Kullanım Koşulları bölümünde daha fazlasını okuyun.