PROTECTED SOURCE SCRIPT

MARKET SCANNER

Core Components:

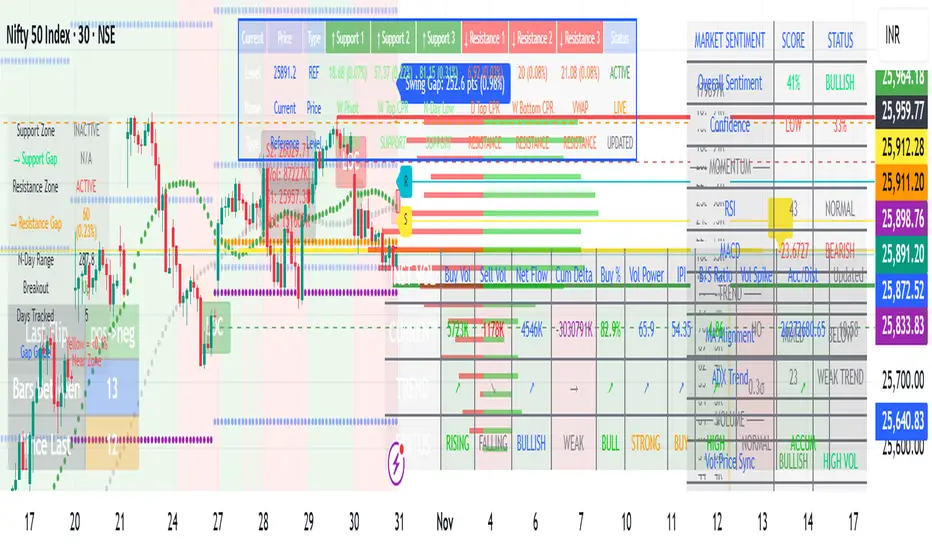

1. Market Structure & Pivot Points

Multi-timeframe Pivots: Daily, Weekly, Monthly pivot points

Central Pivot Range (CPR): For all timeframes

N-Day High/Low Tracking: Dynamic support/resistance based on recent price action

2. Volume Analysis

Institutional Volume Metrics: Buy/Sell pressure, Net flow, Volume Power

Cumulative Delta: Tracks order flow imbalance

Volume Profile: Right-side profile with POC (Point of Control) and Value Area

Volume Strikes: Identifies significant volume absorption/breakout levels

3. Price Action & Patterns

Fibonacci-based Candlestick Recognition: Green/Red candles with specific Fibonacci conditions

Support/Resistance Zones: Dynamic boxes based on Fibonacci retracements

Breakout Detection: Tracks breakouts above N-day high/low with retracement levels

4. Moving Averages & VWAP

VWAP with multiple moving averages (20, 50, 250 periods)

MVWAP Sign Detection: Tracks flips in VWAP momentum

5. Market Sentiment Analysis

Composite Sentiment Score: Combines RSI, MACD, Stochastic, Moving Averages, ADX

Confidence Scoring: Measures signal reliability

Conflict Detection: Identifies when volume and price signals disagree

6. Advanced Features

Dynamic Gap Calculations: Measures distance to support/resistance zones

Swing Analysis: Identifies swing highs/lows with gap measurements

Volume-Price Confirmation: Validates moves with volume

Professional Tables: Multiple tables displaying pivot levels, differences, sentiment, and volume metrics

Key Trading Concepts Implemented:

Institutional Order Flow: Tracks smart money activity

Volume-Weighted Price Levels: Identifies significant price zones

Multi-timeframe Analysis: Correlates daily, weekly, monthly levels

Fibonacci Retracement Strategies: For entries and exits

Market Microstructure: Through volume profile and delta analysis

Visual Outputs:

Dynamic support/resistance boxes

Volume profile histogram

Multiple information tables

Real-time sentiment scoring

Retracement lines and zones

This is essentially a professional-grade trading suite that combines price action, volume analysis, market structure, and sentiment into one comprehensive tool suitable for both discretionary and systematic trading approaches.

1. Market Structure & Pivot Points

Multi-timeframe Pivots: Daily, Weekly, Monthly pivot points

Central Pivot Range (CPR): For all timeframes

N-Day High/Low Tracking: Dynamic support/resistance based on recent price action

2. Volume Analysis

Institutional Volume Metrics: Buy/Sell pressure, Net flow, Volume Power

Cumulative Delta: Tracks order flow imbalance

Volume Profile: Right-side profile with POC (Point of Control) and Value Area

Volume Strikes: Identifies significant volume absorption/breakout levels

3. Price Action & Patterns

Fibonacci-based Candlestick Recognition: Green/Red candles with specific Fibonacci conditions

Support/Resistance Zones: Dynamic boxes based on Fibonacci retracements

Breakout Detection: Tracks breakouts above N-day high/low with retracement levels

4. Moving Averages & VWAP

VWAP with multiple moving averages (20, 50, 250 periods)

MVWAP Sign Detection: Tracks flips in VWAP momentum

5. Market Sentiment Analysis

Composite Sentiment Score: Combines RSI, MACD, Stochastic, Moving Averages, ADX

Confidence Scoring: Measures signal reliability

Conflict Detection: Identifies when volume and price signals disagree

6. Advanced Features

Dynamic Gap Calculations: Measures distance to support/resistance zones

Swing Analysis: Identifies swing highs/lows with gap measurements

Volume-Price Confirmation: Validates moves with volume

Professional Tables: Multiple tables displaying pivot levels, differences, sentiment, and volume metrics

Key Trading Concepts Implemented:

Institutional Order Flow: Tracks smart money activity

Volume-Weighted Price Levels: Identifies significant price zones

Multi-timeframe Analysis: Correlates daily, weekly, monthly levels

Fibonacci Retracement Strategies: For entries and exits

Market Microstructure: Through volume profile and delta analysis

Visual Outputs:

Dynamic support/resistance boxes

Volume profile histogram

Multiple information tables

Real-time sentiment scoring

Retracement lines and zones

This is essentially a professional-grade trading suite that combines price action, volume analysis, market structure, and sentiment into one comprehensive tool suitable for both discretionary and systematic trading approaches.

Korumalı komut dosyası

Bu komut dosyası kapalı kaynak olarak yayınlanmaktadır. Ancak, ücretsiz ve herhangi bir sınırlama olmaksızın kullanabilirsiniz – daha fazla bilgiyi buradan edinebilirsiniz.

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, alım satım veya diğer türden tavsiye veya öneriler anlamına gelmez ve teşkil etmez. Kullanım Koşulları bölümünde daha fazlasını okuyun.

Korumalı komut dosyası

Bu komut dosyası kapalı kaynak olarak yayınlanmaktadır. Ancak, ücretsiz ve herhangi bir sınırlama olmaksızın kullanabilirsiniz – daha fazla bilgiyi buradan edinebilirsiniz.

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, alım satım veya diğer türden tavsiye veya öneriler anlamına gelmez ve teşkil etmez. Kullanım Koşulları bölümünde daha fazlasını okuyun.