RF+ Replay for Heikin AshiRF+ Replay for Heikin Ashi

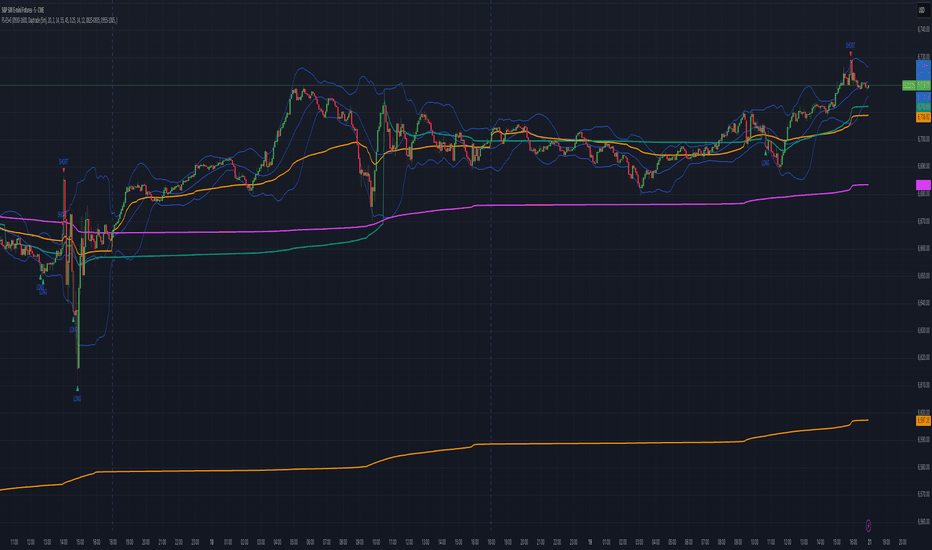

RF+ Replay for Heikin Ashi generates fully customisable Heikin Ashi candlesticks presented on a standard chart, enabling traders to utilise the Tradingview Replay feature with Heikin Ashi candlesticks when analysing and backtesting HA style strategies.

The features of this indicator include:

- Fully customisable Heikin Ashi Candles, including custom colour options for candle bodies, borders and wicks.

- Optional real-time, real-price close dots painted onto each candlestick.

- A optional set of 2 x Range Filters designed to indicate short term trend identification upon color change, ideal for low timeframe scalping.

- A optional set of 3 x fully customisable Moving Averages.

- An option to enable Heikin Ashi calculated data for the Range Filters and Moving Averages, so they present as they would on a Heikin Ashi non-standard chart type, without having to use an actual Heikin Ashi chart. Enabled by default.

- An optional sessions indicator, to highlight your prefered trading session for the purpose of backtesting.

- An optional watermark featuring customisable text and well as symbol and timeframe information, as seen in the screenshot of this indicator.

Instructions for use:

1) Because this indicator generates candlesticks and presents them onto your chart, you will need to hide the existing candlesticks so you do not see two sets of candles. You can do this by going into your Tradingview chart settings and making the candle bodies, borders and wicks fully transparent. You can then save this as a layout template. You can access your Chart Settings by clicking on the cog icon, or by right clicking on the chart itself and selecting 'Chart Settings' from the list.

2) Ensure you have the standard chart type selected - you do not need to select a Heikin Ashi type chart.

3) You will now be able to analyise and even backtest your Heikin Ashi style strategies including the use of the Tradingview Replay feature found at the top of the chart.

Heikin Ashi means 'average bar' in Japanese, which speaks to the fact that Heikin Ashi candles are calculated differently to standard Japanese candlesticks. The general idea of Heikin Ashi candles is to 'smooth' the appearance of price movement, by the use of averages within their calculation. It is important to understand that the Open and Close values of a Heikin Ashi candlestick do not reflect real Open and Close prices. You can use the real price dots feature to clearly see the real time and real price Close of each candle.

The formula for calculating a Heikin Ashi candlestick is as follows:

High = Maximum of High, Open, or Close (whichever is highest)

Low = Minimum of Low, Open, or Close (whichever is lowest)

Open = Open (previous bar) + Close (previous bar) /2

Close = (Open + High + Low + Close) / 4

If you found this useful, be sure to leave a like, comment and subscribe to show your support.

Until next time.

"scalp" için komut dosyalarını ara

3 Candle Strike StretegyMainly developed for AMEX:SPY trading on 1 min chart. But feel free to try on other tickers.

Basic idea of this strategy is to look for 3 candle reversal pattern within trending market structure. The 3 candle reversal pattern consist of 3 consecutive bullish or bearish candles,

followed by an engulfing candle in the opposite direction. This pattern usually signals a reversal of short term trend. This strategy also uses multiple moving averages to filter long or short

entries. ie. if the 21 smoothed moving average is above the 50, only look for long (bullish) entries, and vise versa. There is option change these moving average periods to suit your needs.

I also choose to use Linear Regression to determine whether the market is ranging or trending. It seems the 3 candle pattern is more successful under trending market. Hence I use it as a filter.

There is also an option to combine this strategy with moving average crossovers. The idea is to look for 3 candle pattern right after a fast moving average crosses over a slow moving average.

By default , 21 and 50 smoothed moving averages are used. This gives additional entry opportunities and also provides better results.

This strategy aims for 1:3 risk to reward ratio. Stop losses are calculated using the closest low or high values for long or short entries, respectively, with an offset using a percentage of

the daily ATR value. This allows some price fluctuation without being stopped out prematurely. Price target is calculated by multiplying the difference between the entry price and the stop loss

by a factor of 3. When price target is reach, this strategy will set stop loss at the price target and wait for exit condition to maximize potential profit.

This strategy will exit an order if an opposing 3 candle pattern is detected, this could happen before stop loss or price target is reached, and may also happen after price target is reached.

*Note that this strategy is designed for same day SPY option scalping. I haven't determined an easy way to calculate the # of contracts to represent the equivalent option values. Plus the option

prices varies greatly depending on which strike and expiry that may suits your trading style. Therefore, please be mindful of the net profit shown. By default, each entry is approximately equal

to buying 10 of same day or 1 day expiry call or puts at strike $1 - $2 OTM. This strategy will close all open trades at 3:45pm EST on Mon, Wed, and Fri.

**Note that this strategy also takes into account of extended market data.

***Note pyramiding is set to 2 by default, so it allows for multiple entries on the way towards price target.

Remember that market conditions are always changing. This strategy was only able to be back-tested using 1 month of data. This strategy may not work the next month. Please keep that in mind.

Also, I take no credit for any of the indicators used as part of this strategy.

Enjoy~

NazhoThis is a simple scalping strategy that works for all time frames... I have only tested it on FOREX

It works by checking if the price is currently in an uptrend and if it crosses the 20 EMA .

If it crosses the 20 EMA and its in and uptrend it will post a BUY SIGNAL.

If it crosses the 20 EMA and its in and down it will post a SELL SIGNAL.

The red line is the highest close of the previous 8 bars --- This is resistance

The green line is the lowest close of the previous 8 bars -- This is support

+SuperTrend

3 MA Trend IndicatorIt is a trend detector indicator, using 3 moving averages.

You can select different MA's and set the periods of them. If all 3 is increasing, the color will be green, if decreasing, the color will be red, gray otherwise.

It can be used for e.g. scalping.

Adaptive AI SuperTrend [AlgoPoint]🚀 Adaptive AI SuperTrend

Adaptive AI SuperTrend is a high-performance trading terminal that redefines trend-following by integrating Machine Learning (ML) principles with advanced market regime detection. Unlike static indicators, this system dynamically recalibrates its internal parameters to match the ever-changing volatility of the financial markets.

Equipped with a custom "Wizard Engine," it filters out market noise during consolidation and identifies high-probability trend continuation points, making it an essential tool for scalpers, day traders, and swing traders alike.

🧠 What Makes it "AI"?

While traditional indicators use fixed rules, Adaptive AI SuperTrend utilizes Algorithmic Intelligence to make real-time decisions:

KNN-Inspired Adaptation: The engine analyzes the last 150 bars of volatility and trend strength to automatically adjust its sensitivity.

Market Regime Intelligence: It distinguishes between "Trending" and "Ranging" states using a sophisticated Squeeze Momentum module, preventing "whipsaws" during low-volume periods.

Self-Backtesting Logic: The indicator continuously calculates its own historical Win-Rate. If the probability of success falls below a certain threshold, it suppresses lower-quality signals.

🛠 Key Features

Dynamic Consolidation Boxes: Automatically identifies and wraps "choppy" price action in professional gray boxes. It waits for 3+ bars of consolidation before marking the zone, helping you spot breakout opportunities early.

Multi-Strategy Aggression:

- Conservative: Filtered signals for long-term trend following.

- Balanced: Optimized for daily volatility.

- Aggressive: High-frequency signals for capturing micro-trends.

Dual-Exit Risk Management:

- ATR TP-SL Mode: Sets mathematical targets based on market volatility with persistent on-screen lines.

- Smart Trailing Mode: Rides the trend to its exhaustion point. Includes intelligent labeling (🎯 TP or 🛑 SL) based on the trade's net profitability.

- RSI Pullback Confirmation: Beyond simple trend flips, it detects "buy the dip" or "sell the rip" opportunities within an existing trend using RSI 50-level crossovers.

📊 Real-Time Analytics Dashboard

The integrated AlgoPoint Dashboard provides a surgical view of the market:

- Market State: Instant "Trending" vs. "Ranging" (Consolidation) detection.

- Trend Strength: ADX-based momentum tracking.

- Strategy Status: Real-time feedback on your active aggression and exit modes.

🎨 Clean Charting & Customization

Built for professional clarity, you have total control over the UI:

Toggle Consolidation Boxes on/off.

Toggle ATR Target Lines and Exit Labels.

Customize background filters and dashboard visibility.

ES 1m EMA Bounce Scalp - High RR v6# MES/ES 1-Minute EMA Bounce Scalp – High RR with Partial & Trailing (100% Win Rate in Backtest Oct 2025–Jan 2026)

**Overview**

This is a high-probability, mean-reversion / trend-continuation scalping system designed for the Micro E-mini S&P 500 (MES) or E-mini S&P 500 (ES) on the **1-minute chart**. It enters on pullback bounces off the 20-period EMA during intraday sessions, using RSI momentum confirmation, volume filter, and ADX trend strength to select high-quality setups.

The core edge comes from:

- Tight initial stop (4 points)

- 50% partial profit at 1:1 RR (locks in quick wins and moves stop to breakeven)

- Remaining 50% trails aggressively (trail offset 2 points) to let winners run to 8–10 points (1:2+ effective RR)

**Key Features**

- Longs & Shorts symmetric (pullback bounce logic)

- Trades only during US RTH (9:30–16:00 ET)

- Filters: RSI >40 (long) / <60 (short), volume > 20-SMA, ADX(14) >20

- No martingale, no pyramiding, one trade at a time

- Bracket + trailing managed automatically in Pine Script

**Backtest Highlights** (Oct 23, 2025 – Jan 21, 2026 on ES1!)

- Total trades: 107

- Win rate: 100% (0 losers)

- Net profit (1 contract): $20,227.50 after commissions

- Commissions: $322.50 (~$3 round-trip)

- Max open (floating) drawdown: –$3,275 (never realized a loss)

- Avg P&L per trade: ~$189 (≈3.78 points net)

- Longs: 45 trades, avg hold ~2.2 hours

- Shorts: 62 trades, avg hold ~8.7 hours

- Largest single win: scaled equivalent to strong runners

**Risk & Position Sizing**

- Initial stop: 4 points (~$200 risk on 1 ES mini / $20 on 1 MES)

- Recommended live size: 1 ES contract (very conservative on $100k account)

- Max floating DD in test: ~65 points open loss (well under typical $3,000 trailing DD rules)

- Designed to respect strict drawdown limits — partials & trailing move most trades to breakeven quickly

**Important Notes & Disclaimer**

- 100% win rate over 107 trades is exceptional and likely period-specific (late-2025 bull/chop environment favored bounces + trailing).

- Forward-test / paper trade required before live capital. Real slippage, news events, and execution delays may reduce performance.

- Not financial advice. Past performance ≠ future results. Use at your own risk.

- Best used with low-commission futures broker (Tradovate, AMP, IBKR, etc.) and 1-contract sizing to start.

**How to Use**

1. Apply to MES1! or ES1! on 1-minute chart

2. Set alerts for entries (built-in strategy alerts work perfectly)

3. Forward-test in sim → monitor floating DD, hold times, and win consistency

4. Manual or webhook auto-execution (e.g., PickMyTrade/TradersPost for Tradovate)

Happy to iterate based on forward-test results. Share your live stats!

Cheers,

Chris Brown (@hockeybrown2011)

Leswin Stocks Ribbon Signals (SPY/QQQ)

Leswin Ribbon Signals – Day Trading Indicator (Stocks & Crypto)

Leswin Ribbon Signals is a trend-based momentum indicator designed for day traders and scalpers who trade stocks, ETFs, options, and crypto.

Built for fast execution on 5m, 15m, and 1H timeframes, it uses a dynamic EMA ribbon, trend filtering, and volatility conditions to help identify high-probability BUY and SELL zones while avoiding low-quality chop.

Features:

• Trend-following EMA ribbon

• Automatic higher-timeframe trend filter

• Smart BUY & SELL signals

• Volatility (ATR) filter to avoid dead zones

• Regular Trading Hours (RTH) filter for stocks

• Optimized for SPY, QQQ, DIA, IWM, TSLA, AAPL, META

• Works on crypto, forex, and futures

• Mobile-friendly

• Non-repainting logic

This indicator is best used as a confirmation tool, not a standalone system. Always combine with your own levels, structure, and risk management.

Leotin ScalperThis is a quick scalping indicator. Mostly used on the 1 minute timeframe. It uses the RSI on the 14 period with 30 and 70. When it crosses the 70 line it and a hanging man or shooting star candle forms, it will give a sell indication. when crossing the 30 line and a hammer or inverted hammer is formed it will give a buy indication.

9 HMA Direction Scalper (Pure Flip)new easier 9hma directional pure flip, it will help you with scalping short trends

V3 Valentini Pro Scalper [Dashboard]Gemini 3.0 pro's take on Fabio Valentini's world #1 strategy scalp 12/19/2025

IDLP - Intraday Daily Levels Pro [FXSMARTLAB]🔥 IDLP – Intraday Daily Levels Pro

IDLP – Intraday Daily Levels Pro is a precision toolkit for intraday traders who rely on objective daily structure instead of repainting indicators and noisy signals.

Every level plotted by IDLP is derived from one simple rule:

Today’s trading decisions must be based on completed market data only.

That means:

✅ No use of the current day’s unfinished data for levels

✅ No lookahead

✅ No hidden repaint behavior

IDLP reconstructs the previous trading day from the intraday chart and then projects that structure forward onto the current session, giving you a stable, institutional-style intraday map.

🧱 1. Previous Daily Levels (Core Structure)

IDLP extracts and displays the full previous daily structure, which you can toggle on/off individually via the inputs:

Previous Daily High (PDH)

Previous Daily Low (PDL)

Previous Daily Open

Previous Daily Close,

Previous Daily Mid (50% of the range)

Previous Daily Q1 (25% of the range)

Previous Daily Q3 (75% of the range)

All of these come from the day that just closed and are then locked for the entire current session.

What these levels tell you:

PDH / PDL – true extremes of yesterday’s price action (liquidity zones, breakout/reversal points).

Previous Daily Open / Close – how the market positioned itself between session start and end

Mid (50%) – equilibrium level of the previous day’s auction.

Q1 / Q3 (25% / 75%) internal structure of the previous day’s range, dividing it into four equal zones and helping you see if price is trading in the lower, middle, or upper quarter of yesterday’s range.

All these levels are non-repaint: once the day is completed, they are fixed and never change when you scroll, replay, or backtest.

🎯 2. Previous Day Pivot System (P, S1, S2, R1, R2)

IDLP includes a classic floor-trader pivot grid, but critically:

It is calculated only from the previous day’s high, low, and close.

So for the current session, the following are fixed:

Pivot P – central reference level of the previous day.

Support 1 (S1) and Support 2 (S2)

Resistance 1 (R1) and Resistance 2 (R2)

These levels are widely used by institutional desks and algos to structure:

mean-reversion plays, breakout zones, intraday targets, and risk placement.

Everything in this section is non-repaint because it only uses the previous day’s fully closed OHLC.

📏 3. 1-Day ADR Bands Around Previous Daily Open

Instead of a multi-day ADR, IDLP uses a pure 1-Day ADR logic:

ADR = Range of the previous day

ADR = PDH − PDL

From that, IDLP builds two clean bands centered around the previous daily Open:

ADR Upper Band = Previous Day Open + (ADR × Multiplier)

ADR Lower Band = Previous Day Open − (ADR × Multiplier)

The multiplier is user-controlled in the inputs:

ADR Multiplier (default: 0.8)

This lets you choose how “tight” or “wide” you want the ADR envelope to be around the previous day’s open.

Typical use cases:

Identify realistic intraday extension targets, Spot exhaustion moves beyond ADR bands, Frame reversals after reaching volatility extremes, Align trades with or against volatility expansion

Again, since ADR is calculated only from the completed previous day, these bands are totally non-repaint during the current session.

🔒 4. True Non-Repaint Architecture

The internal logic of IDLP is built to guarantee non-repaint behavior:

It reconstructs each day using time("D") and tracks:

dayOpen, dayHigh, dayLow, dayClose for the current day

prevDayOpen, prevDayHigh, prevDayLow, prevDayClose for the previous day

At the moment a new day starts:

The “current day” gets “frozen” into prevDay*

These prevDay* values then drive: Previous Daily Levels, Pivots, ADR.

During the current day:

All these “previous day” values stay fixed, no matter what happens.

They do not move in real time, they do not shift in replay.

This means:

What you see in the past is exactly what you would have seen live.

No fake backtests.

No illusion of perfection from repainting behavior.

🎯 5. Designed For Intraday Traders

IDLP – Intraday Daily Levels Pro is made for:

- Day traders and scalpers

- Index and FX traders

- Prop firm challenge trading

- Traders using ICT/SMC-style levels, liquidity, and range logic

- Anyone who wants a clean, institutional-style daily framework without noise

You get:

Previous Day OHLC

Mid / Q1 / Q3 of the previous range

Previous-Day Pivots (P, S1, S2, R1, R2)

1-Day ADR Bands around Previous Day Open

All calculated only from closed data, updated once per day, and then locked.

Indian Scalper 2025 – PSAR + SMA50 + RSI≤50 + High Volume (75%)Best 1-min / 2-min scalping strategy for NIFTY, BANKNIFTY, FINNIFTY & liquid stocks in 2025

✓ PSAR flip + SMA-50 trend filter

✓ RSI ≤50 (avoids chasing)

✓ Only high-volume candles (bright colour)

✓ Loud mobile alerts with price & SL

✓ 1:2+ RR with PSAR trailing

Works like magic 9:15–11:30 AM and 2–3:20 PM

Made with love for the Indian trading community ♥

OBV + WaveTrend Volume Scalper [GratefulFutures]This script is a combination script of three different strategies that provides buy and sell signals based on the change of volume with momentum confirmations.

Sources used:

This script relies on the outstanding scripts of the great script writer LazyBear: LazyBear

The following scripts were used in this publication:

1. A modified "On-Balance Volume Oscillator" modified from LazyBear's original script:

2. Wavetrend Oscillator with crosses, Author: LazyBear

3. Squeeze Momentum Oscillator, Author: LazyBear

This script functions based on the following criteria being true:

1. On balance volume oscillator turning from negative to positive (buy) or positive to negative (sell)

2. Squeeze Momentum value is increasing (buy) or decreasing (sell)

3. Wavetrend 1 (wt1) is greater than wavetrend 2 (wt2) (buy)/ Wavetrend 1 (wt1) is less than wavetrend 2 (wt2) (sell)

By combining these factors the indicator is able to signal exactly when net buying turns to net selling (OBV) and when this change is most advantageous to continue based on the momentum and price action of the underlying asset (SQMOMO and Wavetrend).

This allows you to pair volume and price action for a powerful tool to identify where price will reverse or continue providing exceptional entries for short term trades, especially when combined with other aspects such as support and resistance, or volume profile.

How to use:

Simply adjust the settings to your preference and read the given signals as generated.

Settings

There are multiple ways to tune the signals generated. It is set standard for my preferred use on a 1 minute chart.

OBV Oscillator Settings

The first 4 dropdowns in the Inputs section tune the On Balance Volume Oscillator (OBVO) portion of the indicator. You can choose if you want it to calculate based on close, open, high, low, or other value.

The most impactful in the entire settings is going to be the length and smoothing of the OBVO EMA. Making this number lower increasing the sensitivity to changes in volume, making the signals come quicker but is more susceptible to quick fluctuations. A value of between (5-20) is reasonable for the OBVO EMA length. There is a separate smoothing factor titled OBV Smoothing Length and below that, OBV Smoothing Type , a value of (2) is standard with "SMA" for smoothing type with a value of between 2-10 being reasonable. You may also play with these values to see what you like for your trading style.

Wavetrend Settings

The next 3 options are to modify the wavetrend portion of the indicator. I do not modify these from standard, and feel that they work appropriately on all time frames at the following values: n1 length (10), n2 length (20), Wavetrend Signal SMA length (4)

Squeeze Momentum Settings

The following 5 options through the end modify the Squeeze momentum portion of the indicator. The only one that modifies the signals generated is the KC Length , Making this number lower increasing the sensitivity to changes in price action, making the signals come quicker but is more susceptible to quick fluctuations. A value of between (18-25) is reasonable for KC Length .

Style Setting

You may select if you want to see the buy and sell signals. The following 5 options Raw OBV Osc through Squeeze Momentum allow you to see where each specific requirement was met, posted as a vertical line, but for live use it is recommended to turn all of these vertical lines off and only use the buy and sell signals.

Time Frames:

While this script is most effective on shorter time frames (1 minute for scalping and daytrading) it is also viable to use it on longer timeframes, due to the nature of its components being independent of time frame.

Examples of use - (Green and red vertical lines are for visualization purpose and are not part of the script)

SPY 1 Minute (Factory Settings):

SPX 15 minutes (Factory Settings):

Considerations

This script is meant primarily for short term trading, trades on the basis of seconds to minutes primarily. While they can be a good indication of volume lining up with momentum, it is always wise to use them in combination with other factors such as support, resistance, market structure, volume levels, or the many other techniques out there...

As Always... Happy Trading.

-Not_A_Mad_Scientist (GreatfulFutures Trade University)

S&P 500 Scalper Pro [Trend + MACD] 5 minfor scalping 5 min S&P on 5 min chart put SL on 20 min ma and take 2:1 risk

CIHAN SCALP PRO v3 ELITEI’m sharing a testable scalping strategy:

When you see a Long or Short signal, you can open a position without waiting for the candle to close and take quick profits with a short TP.

But the real game-changer is coming soon!

The Professional Scalping System I’ve been working on, with 85%+ accuracy, is almost ready.

This system is fully mechanical — no analysis needed, it instantly catches momentum and trend shifts.

It will be available soon with a small monthly subscription fee.

Stay tuned!

Uni VWAP + EMA ScalperWe learn more through the mistakes we make than the victories we enjoy. This is a work in progress to align visual and audible guidance for scalping and swing trades.

SSL Hybrid ScalperIt's a ready to trade script V5, that takes the original SSL Hybrid logic and optimizes it for XAUUSD scalping on 1min to 15min charts for buy & sell signals.

Friday & Monday HighlighterFriday & Monday Institutional Range Marker — Know Where Big Firms Set the Trap!

🧠 Description

This indicator automatically highlights Friday and Monday sessions on your chart — days when institutional players and algorithmic firms (like Citadel, Jane Street, or Tower Research) quietly shape the upcoming week’s price structure.

🔍 Why Friday & Monday matter

Friday : Large institutions often book profits or hedge into the weekend. Their final-hour moves reveal the next week’s bias.

Monday : Big players rebuild positions, absorbing liquidity left behind by retail traders.

Together, these two days define the range traps and breakout zones that often control price action until midweek.

> In short, the Friday–Monday high and low often act as invisible walls — guiding scalpers, option sellers, and swing traders alike.

🧩 What this tool does

✅ Highlights Friday (red) and Monday (green) sessions

✅ Adds optional day labels above bars

✅ Works across all timeframes (best on 15min to 1hr charts)

✅ Helps you visually identify where institutions likely built their positions

Use it to quickly spot:

* Range boundaries that trap traders

* Gap zones likely to get filled

* High–low sweeps before reversals

⚙️ Recommended Use

1. Mark Friday’s high–low → Watch for liquidity sweeps on Monday.

2. When Monday holds above Friday’s high , breakout continuation is likely.

3. When Monday fails below Friday’s low , expect a reversal or trap.

4. Combine this with OI shifts, IV crush, and FII–DII flow data for confirmation.

⚠️ Disclaimer

This indicator is for **educational and analytical purposes only**.

It does **not constitute financial advice** or a trading signal.

Markets are dynamic — always perform your own research before trading or investing.

LEGEND IsoPulse Fusion Universal Volume Trend Buy Sell RadarLEGEND IsoPulse Fusion • Universal Volume Trend Buy Sell Radar

One line summary

LEGEND IsoPulse Fusion reads intent from price and volume together, learns which features matter most on your symbol, blends them into a single signed Fusion line in a stable unit range, and emits clear Buy Sell Close events with a structure gate and a liquidity safety gate so you act only when the tape is favorable.

What this script is and why it exists

Many traders keep separate windows for trend, volume, volatility, and regime filters. The result can feel fragmented. This script merges two complementary engines into one consistent view that is easy to read and simple to act on.

LEGEND Tensor estimates directional quality from five causally computed features that are normalized for stationarity. The features are Flow, Tail Pressure with Volume Mix, Path Curvature, Streak Persistence, and Entropy Order.

IsoPulse transforms raw volume into two decaying reservoirs for buy effort and sell effort using body location and wick geometry, then measures price travel per unit volume for efficiency, and detects volume bursts with a recency memory.

Both engines are mapped into the same unit range and fused by a regime aware mixer. When the tape is orderly the mixer leans toward trend features. When the tape is messy but a true push appears in volume efficiency with bursts the mixer allows IsoPulse to speak louder. The outcome is a single Fusion line that lives in a familiar range with calm behavior in quiet periods and expressive pushes when energy concentrates.

What makes it original and useful

Two reservoir volume split . The script assigns a portion of the bar volume to up effort and down effort using body location and wick geometry together. Effort decays through time using a forgetting factor so memory is present without becoming sticky.

Efficiency of move . Price travel per unit volume is often more informative than raw volume or raw range. The script normalizes both sides and centers the efficiency so it becomes signed fuel when multiplied by flow skew.

Burst detection with recency memory . Percent rank of volume highlights bursts. An exponential memory of how recently bursts clustered converts isolated blips into useful context.

Causal adaptive weighting . The LEGEND features do not receive static weights. The script learns, causally, which features have correlated with future returns on your symbol over a rolling window. Only positive contributions are allowed and weights are normalized for interpretability.

Regime aware fusion . Entropy based order and persistence create a mixer that blends IsoPulse with LEGEND. You see a single line rather than two competing panels, which reduces decision conflict.

How to read the screen in seconds

Fusion area . The pane fills above and below zero with a soft gradient. Deeper fill means stronger conviction. The white Fusion line sits on top for precise crossings.

Entry guides and exit guides . Two entry guides draw symmetrically at the active fused entry level. Two exit guides sit inside at a fraction of the entry. Think of them as an adaptive envelope.

Letters . B prints once when the script flips from flat to long. S prints once when the script flips from flat to short. C prints when a held position ends on the appropriate side. T prints when the structure gate first opens. A prints when the liquidity safety flag first appears.

Price bar paint . Bars tint green while long and red while short on the chart to mirror your virtual position.

HUD . A compact dashboard in the corner shows Fusion, IsoPulse, LEGEND, active entry and exit levels, regime status, current virtual position, and the vacuum z value with its avoid threshold.

What signals actually mean

Buy . A Buy prints when the Fusion line crosses above the active entry level while gates are open and the previous state was flat.

Sell . A Sell prints when the Fusion line crosses below the negative entry level while gates are open and the previous state was flat.

Close . A Close prints when Fusion cools back inside the exit envelope or when an opposite cross would occur or when a gate forces a stop, and the previous state was a hold.

Gates . The Trend gate requires sufficient entropy order or significant persistence. The Avoid gate uses a liquidity vacuum z score. Gates exist to protect you from weak tape and poor liquidity.

Inputs and practical tuning

Every input has a tooltip in the script. This section provides a concise reference that you can keep in mind while you work.

Setup

Core window . Controls statistics across features. Scalping often prefers the thirties or low fifties. Intraday often prefers the fifties to eighties. Swing often prefers the eighties to low hundreds. Smaller responds faster with more noise. Larger is calmer.

Smoothing . Short EMA on noisy features. A small value catches micro shifts. A larger value reduces whipsaw.

Fusion and thresholds

Weight lookback . Sample size for weight learning. Use at least five times the horizon. Larger is slower and more confident. Smaller is nimble and more reactive.

Weight horizon . How far ahead return is measured to assess feature value. Smaller favors quick reversion impulses. Larger favors continuation.

Adaptive thresholds . Entry and exit levels from rolling percentiles of the absolute LEGEND score. This self scales across assets and timeframes.

Entry percentile . Eighty selects the top quintile of pushes. Lower to seventy five for more signals. Raise for cleanliness.

Exit percentile . Mid fifties keeps trades honest without overstaying. Sixty holds longer with wider give back.

Order threshold . Minimum structure to trade. Zero point fifteen is a reasonable start. Lower to trade more. Raise to filter chop.

Avoid if Vac z . Liquidity safety level. One point two five is a good default on liquid markets. Thin markets may prefer a slightly higher setting to avoid permanent avoid mode.

IsoPulse

Iso forgetting per bar . Memory for the two reservoirs. Values near zero point nine eight to zero point nine nine five work across many symbols.

Wick weight in effort split . Balance between body location and wick geometry. Values near zero point three to zero point six capture useful behavior.

Efficiency window . Travel per volume window. Lower for snappy symbols. Higher for stability.

Burst percent rank window . Window for percent rank of volume. Around one hundred to three hundred covers most use cases.

Burst recency half life . How long burst clusters matter. Lower for quick fades. Higher for cluster memory.

IsoPulse gain . Pre compression gain before the atan mapping. Tune until the Fusion line lives inside a calm band most of the time with expressive spikes on true pushes.

Continuation and Reversal guides . Visual rails for IsoPulse that help you sense continuation or exhaustion zones. They do not force events.

Entry sensitivity and exit fraction

Entry sensitivity . Loose multiplies the fused entry level by a smaller factor which prints more trades. Strict multiplies by a larger factor which selects fewer and cleaner trades. Balanced is neutral.

Exit fraction . Exit level relative to the entry level in fused unit space. Values around one half to two thirds fit most symbols.

Visuals and UX

Columns and line . Use both to see context and precise crossings. If you present a very clean chart you can turn columns off and keep the line.

HUD . Keep it on while you learn the script. It teaches you how the gates and thresholds respond to your market.

Letters . B S C T A are informative and compact. For screenshots you can toggle them off.

Debug triggers . Show raw crosses even when gates block entries. This is useful when you tune the gates. Turn them off for normal use.

Quick start recipes

Scalping one to five minutes

Core window in the thirties to low fifties.

Horizon around five to eight.

Entry percentile around seventy five.

Exit fraction around zero point five five.

Order threshold around zero point one zero.

Avoid level around one point three zero.

Tune IsoPulse gain until normal Fusion sits inside a calm band and true squeezes push outside.

Intraday five to thirty minutes

Core window around fifty to eighty.

Horizon around ten to twelve.

Entry percentile around eighty.

Exit fraction around zero point five five to zero point six zero.

Order threshold around zero point one five.

Avoid level around one point two five.

Swing one hour to daily

Core window around eighty to one hundred twenty.

Horizon around twelve to twenty.

Entry percentile around eighty to eighty five.

Exit fraction around zero point six zero to zero point seven zero.

Order threshold around zero point two zero.

Avoid level around one point two zero.

How to connect signals to your risk plan

This is an indicator. You remain in control of orders and risk.

Stops . A simple choice is an ATR multiple measured on your chart timeframe. Intraday often prefers one point two five to one point five ATR. Swing often prefers one point five to two ATR. Adjust to symbol behavior and personal risk tolerance.

Exits . The script already prints a Close when Fusion cools inside the exit envelope. If you prefer targets you can mirror the entry envelope distance and convert that to points or percent in your own plan.

Position size . Fixed fractional or fixed risk per trade remains a sound baseline. One percent or less per trade is a common starting point for testing.

Sessions and news . Even with self scaling, some traders prefer to skip the first minutes after an open or scheduled news. Gate with your own session logic if needed.

Limitations and honest notes

No look ahead . The script is causal. The adaptive learner uses a shifted correlation, crosses are evaluated without peeking into the future, and no lookahead security calls are used. If you enable intrabar calculations a letter may appear then disappear before the close if the condition fails. This is normal for any cross based logic in real time.

No performance promises . Markets change. This is a decision aid, not a prediction machine. It will not win every sequence and it cannot guarantee statistical outcomes.

No dependence on other indicators . The chart should remain clean. You can add personal tools in private use but publications should keep the example chart readable.

Standard candles only for public signals . Non standard chart types can change event timing and produce unrealistic sequences. Use regular candles for demonstrations and publications.

Internal logic walkthrough

LEGEND feature block

Flow . Current return normalized by ATR then smoothed by a short EMA. This gives directional intent scaled to recent volatility.

Tail pressure with volume mix . The relative sizes of upper and lower wicks inside the high to low range produce a tail asymmetry. A volume based mix can emphasize wick information when volume is meaningful.

Path curvature . Second difference of close normalized by ATR and smoothed. This captures changes in impulse shape that can precede pushes or fades.

Streak persistence . Up and down close streaks are counted and netted. The result is normalized for the window length to keep behavior stable across symbols.

Entropy order . Shannon entropy of the probability of an up close. Lower entropy means more order. The value is oriented by Flow to preserve sign.

Causal weights . Each feature becomes a z score. A shifted correlation against future returns over the horizon produces a positive weight per feature. Weights are normalized so they sum to one for clarity. The result is angle mapped into a compact unit.

IsoPulse block

Effort split . The script estimates up effort and down effort per bar using both body location and wick geometry. Effort is integrated through time into two reservoirs using a forgetting factor.

Skew . The reservoir difference over the sum yields a stable skew in a known range. A short EMA smooths it.

Efficiency . Move size divided by average volume produces travel per unit volume. Normalization and centering around zero produce a symmetric measure.

Bursts and recency . Percent rank of volume highlights bursts. An exponential function of bars since last burst adds the notion of cluster memory.

IsoPulse unit . Skew multiplied by centered efficiency then scaled by the burst factor produces the raw IsoPulse that is angle mapped into the unit range.

Fusion and events

Regime factor . Entropy order and streak persistence form a mixer. Low structure favors IsoPulse. Higher structure favors LEGEND. The blend is convex so it remains interpretable.

Blended guides . Entry and exit guides are blended in the same way as the line so they stay consistent when regimes change. The envelope does not jump unexpectedly.

Virtual position . The script maintains state. Buy and Sell require a cross while flat and gates open. Close requires an exit or force condition while holding. Letters print once at the state change.

Disclosures

This script and description are educational. They do not constitute investment advice. Markets involve risk. You are responsible for your own decisions and for compliance with local rules. The logic is causal and does not look ahead. Signals on non standard chart types can be misleading and are not recommended for publication. When you test a strategy wrapper, use realistic commission and slippage, moderate risk per trade, and enough trades to form a meaningful sample, then document those assumptions if you share results.

Closing thoughts

Clarity builds confidence. The Fusion line gives a single view of intent. The letters communicate action without clutter. The HUD confirms context at a glance. The gates protect you from weak tape and poor liquidity. Tune it to your instrument, observe it across regimes, and use it as a consistent lens rather than a prediction oracle. The goal is not to trade every wiggle. The goal is to pick your spots with a calm process and to stand aside when the tape is not inviting.

Crypto Scalping Strategy - High Win Rategrok first try. I used grok to create a scalping strategy that is automated for crypto scalp trading on 5-15 min intervals

Long‑only Swing/ScalpThis is a basic scalper stategy for algos or crypto bots, tested on BNB, not the best backtest but you can tweak and get better results. Take profit at 1% and Sl at 2% , adjust those settings first to see different back test resutls.

FlowSpike ES — BB • RSI • VWAP + AVWAP + News MuteThis indicator is purpose-built for E-mini S&P 500 (ES) futures traders, combining volatility bands, momentum filters, and session-anchored levels into a streamlined tool for intraday execution.

Key Features:

• ES-Tuned Presets

Automatically optimized settings for scalping (1–2m), daytrading (5m), and swing trading (15–60m) timeframes.

• Bollinger Band & RSI Signals

Entry signals trigger only at statistically significant extremes, with RSI filters to reduce false moves.

• VWAP & Anchored VWAPs

Session VWAP plus anchored VWAPs (RTH open, weekly, monthly, and custom) provide high-confidence reference levels used by professional order-flow traders.

• Volatility Filter (ATR in ticks)

Ensures signals are only shown when the ES is moving enough to offer tradable edges.

• News-Time Mute

Suppresses signals around scheduled economic releases (customizable windows in ET), helping traders avoid whipsaw conditions.

• Clean Alerts

Long/short alerts are generated only when all conditions align, with optional bar-close confirmation.

Why It’s Tailored for ES Futures:

• Designed around ES tick size (0.25) and volatility structure.

• Session settings respect RTH hours (09:30–16:00 ET), the period where most liquidity and institutional flows concentrate.

• ATR thresholds and RSI bands are pre-tuned for ES market behavior, reducing the need for manual optimization.

⸻

This is not a generic indicator—it’s a futures-focused tool created to align with the way ES trades day after day. Whether you scalp the open, manage intraday swings, or align to weekly/monthly anchored flows, FlowSpike ES gives you a clear, rules-based signal framework.

Futures Playbook: VWAP + OR + Cross-Asset TellsFutures Playbook: VWAP + OR + Cross-Asset Tells (with Trade Messages + Coach Panel)

This all-in-one futures trading toolkit combines Opening Range (OR) levels, VWAP, and cross-asset signals to help traders quickly read intraday structure, manage execution, and filter noise.

Core Features

• Opening Range (OR):

• Customizable OR window with High/Low and Midpoint.

• Automatic shading of the OR zone.

• VWAP & Bands:

• Built-in or session-anchored VWAP.

• Optional standard deviation bands for context.

• Cross-Asset Tells:

• Live reads on US 10Y yield, DXY, Crude, and Gold.

• Regime detection: rates risk, USD strength, energy softness, and real-rate easing.

• Confirmations:

• Volume vs. moving average filter.

• Cumulative delta with smoothing.

• ATR-based chop filter to avoid low-quality trends.

Trade Messages + Coach Panel

• Trade Messages (labels): Automatic on-chart prompts for OR completion, VWAP reclaim/loss, long/short setups, and EU close flows.

• Coach Panel (table): Real-time dashboard with regime context, directional bias, execution notes, risk reminders, and key levels (ORH, ORL, VWAP).

Alerts

• OR breakout (long/short with confirmations).

• VWAP reclaim or loss.

• 10Y yield crossing risk threshold.

Use Case

Designed for futures traders and scalpers who rely on VWAP + OR dynamics and need cross-asset confirmation before committing to trades. Great for structuring entries, managing risk, and filtering market noise throughout the session.