PROTECTED SOURCE SCRIPT

Güncellendi ETH long bot - 8hr

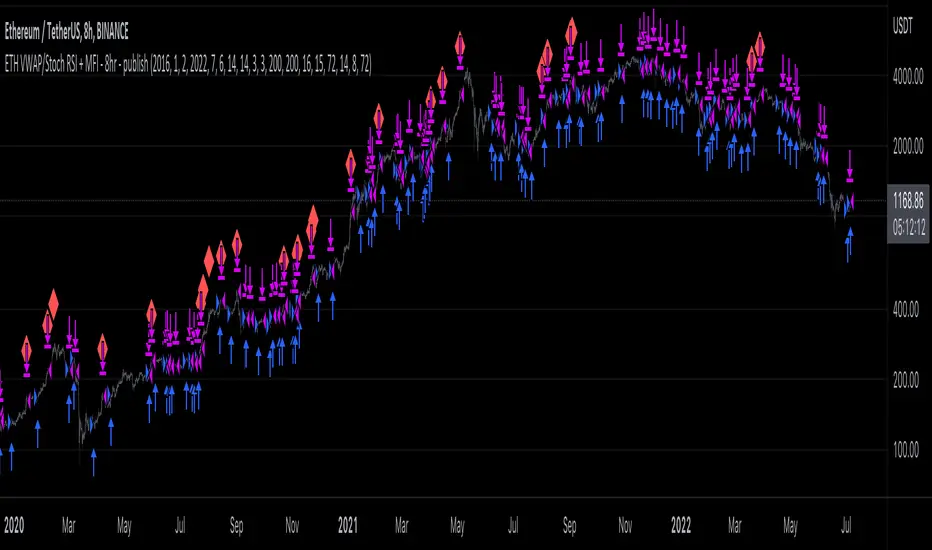

This is a high-latency algorithm, safely running on the Ethereum 8hr chart where it can execute trades on a multi-day timeframe, making it easy to enter and exit large positions and without incurring excessive commission fees.

As a long bot, this script should be ran in markets that are trending upwards. Nonetheless, the operator can be at ease knowing that the script can safely run autonomously during these extended periods. It is shown here performing full-time over a 46 month period, from January 2019 through October 2021, steadily increasing the available capital despite the asset's fluctuations. While the buy and hold return over this time was 714%, the algorithm produced a net profit 4,060%, outperforming the market by over 5.5x. This equates to a 40x return on investment in 4 years.

The strategy behind this algorithm is to always capitalize on significant jumps in the market. This is accomplished by using a simple combination of RSIs:

- One RSI uses VWAP as a source, which is primarily responsible for entering growth trends whenever they begin

- The other is a Stochastic RSI , which is primarily responsible for identifying exhausted periods of growth

These calculations are calibrated so that the bot can jump in and out of trades to improve its position when there isn't significant price action one way or the other, but is then able to remain in positions during uptrends that are backed by volume to achieve maximum gains. This strategy is reflected by the fact that while profitable trades are almost 3 times larger than losing trades, on average, they also last for an average of 6 days, whereas losing trades usually last about 2.

As a long bot, this script should be ran in markets that are trending upwards. Nonetheless, the operator can be at ease knowing that the script can safely run autonomously during these extended periods. It is shown here performing full-time over a 46 month period, from January 2019 through October 2021, steadily increasing the available capital despite the asset's fluctuations. While the buy and hold return over this time was 714%, the algorithm produced a net profit 4,060%, outperforming the market by over 5.5x. This equates to a 40x return on investment in 4 years.

The strategy behind this algorithm is to always capitalize on significant jumps in the market. This is accomplished by using a simple combination of RSIs:

- One RSI uses VWAP as a source, which is primarily responsible for entering growth trends whenever they begin

- The other is a Stochastic RSI , which is primarily responsible for identifying exhausted periods of growth

These calculations are calibrated so that the bot can jump in and out of trades to improve its position when there isn't significant price action one way or the other, but is then able to remain in positions during uptrends that are backed by volume to achieve maximum gains. This strategy is reflected by the fact that while profitable trades are almost 3 times larger than losing trades, on average, they also last for an average of 6 days, whereas losing trades usually last about 2.

Sürüm Notları

This is a high-latency algorithm, safely running on the Ethereum 8hr chart.Executing trades on a multi-day timeframe makes it easy to enter and exit large positions, and without incurring excessive commission fees.

Being a Long Bot, this script performs best in general uptrends, but nonetheless proves efficient enough to run autonomously across many cycles. It is shown here operating full-time over a 5 year period, from the ETH/USDT launch on Binance in August of 2017, through June of 2022, the time of publishing this script.

While Buying and Holding Ethereum over this time would've netted you 267%, the algorithm produced a net profit of 6,067% over the same time frame.

This outperforms the market by nearly 23x, and equates to a 60x return on investment over 5 years.

The strategy behind this algorithm is to always capitalize on significant jumps in the market. This is accomplished by using a simple combination of RSIs:

- One RSI uses VWAP as a source, which is primarily responsible for entering growth trends whenever the begin on a micro level

- And the other is a Stochastic RSI , which is primarily responsible for identifying exhausted periods of growth on a macro level

To sustain the algorithm when not in bullish macro trends, a standard MFI is used to enter and exit trades off of this calculation's basic principles.

These indicators are calibrated so that, when price action is resetting, the bot can jump in and out of trades to improve its position, but is then able to remain in positions during uptrends that are backed by volume, in order to achieve maximum gains.

Statistics in the Performance Summary show how this strategy plays out in the trade metrics. Specifically, winning trades are almost 2 times larger than losing trades, on average, and they also last for an average of 5 days, whereas losing trades usually last about 2.

In summary, the boom and bust cycles, both small and large, that Ethereum has produced since 2017 prove to have been enough to sustain this single algorithm. Over the 5 year period, the script could've comfortably traded in bad markets while always being poised to capitalize on the asset's sporadic, but significant, gains.

Except in the belly of bear markets, I let this Long Bot run with a portion of the portfolio full-time.

Sürüm Notları

[Please refer to newest version of this script]Korumalı komut dosyası

Bu komut dosyası kapalı kaynak olarak yayınlanmaktadır. Ancak, ücretsiz ve herhangi bir sınırlama olmaksızın kullanabilirsiniz – daha fazla bilgiyi buradan edinebilirsiniz.

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, alım satım veya diğer türden tavsiye veya öneriler anlamına gelmez ve teşkil etmez. Kullanım Koşulları bölümünde daha fazlasını okuyun.

Korumalı komut dosyası

Bu komut dosyası kapalı kaynak olarak yayınlanmaktadır. Ancak, ücretsiz ve herhangi bir sınırlama olmaksızın kullanabilirsiniz – daha fazla bilgiyi buradan edinebilirsiniz.

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, alım satım veya diğer türden tavsiye veya öneriler anlamına gelmez ve teşkil etmez. Kullanım Koşulları bölümünde daha fazlasını okuyun.