PROTECTED SOURCE SCRIPT

volume.riiin

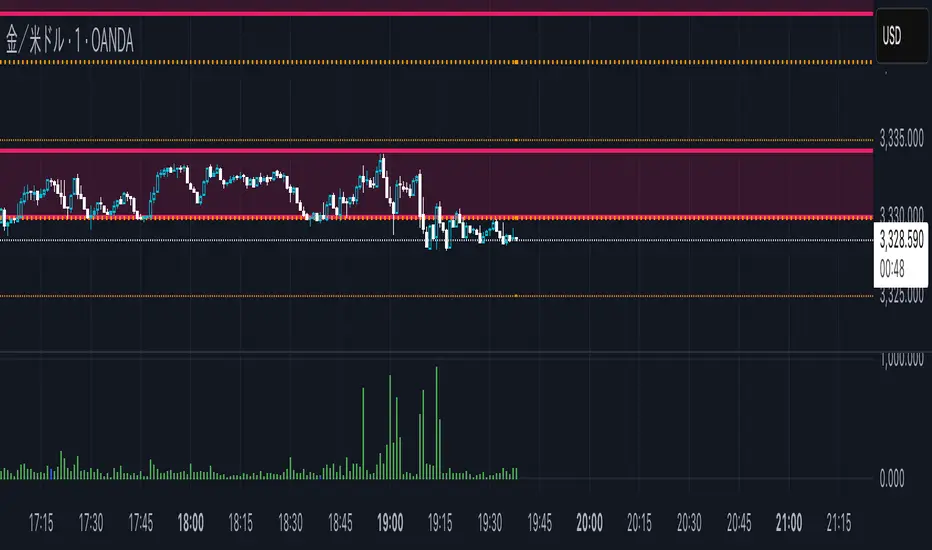

Futures Volume – Real Institutional Activity Insight

This indicator visualizes futures market volume, which reflects the actual number of contracts traded on centralized exchanges like CME. Unlike spot volume (often broker-specific or tick-based), futures volume shows true institutional participation and market conviction.

Key Features:

📈 Reliable Volume Data from real futures markets (e.g., CME Gold, Crude Oil, S&P 500)

🔍 Anticipate Trend Reversals by spotting sudden volume spikes

💥 Confirm Breakouts: Price moves with volume = higher reliability

🧠 Identify Key Battle Zones: High volume price levels often become strong support/resistance

🔗 Can be combined with spot chart for better decision-making

Why Use Futures Volume?

Futures volume often acts as a leading indicator, revealing shifts in market sentiment before price follows. For assets like XAUUSD (Gold), tracking the futures market can give you a real edge, especially when spotting fakeouts or validating big moves.

Let volume tell the real story behind the chart.

Use this indicator to trade with the institutions, not against them.

This indicator visualizes futures market volume, which reflects the actual number of contracts traded on centralized exchanges like CME. Unlike spot volume (often broker-specific or tick-based), futures volume shows true institutional participation and market conviction.

Key Features:

📈 Reliable Volume Data from real futures markets (e.g., CME Gold, Crude Oil, S&P 500)

🔍 Anticipate Trend Reversals by spotting sudden volume spikes

💥 Confirm Breakouts: Price moves with volume = higher reliability

🧠 Identify Key Battle Zones: High volume price levels often become strong support/resistance

🔗 Can be combined with spot chart for better decision-making

Why Use Futures Volume?

Futures volume often acts as a leading indicator, revealing shifts in market sentiment before price follows. For assets like XAUUSD (Gold), tracking the futures market can give you a real edge, especially when spotting fakeouts or validating big moves.

Let volume tell the real story behind the chart.

Use this indicator to trade with the institutions, not against them.

Korumalı komut dosyası

Bu komut dosyası kapalı kaynak olarak yayınlanmaktadır. Ancak, ücretsiz ve herhangi bir sınırlama olmaksızın kullanabilirsiniz – daha fazla bilgiyi buradan edinebilirsiniz.

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, alım satım veya diğer türden tavsiye veya öneriler anlamına gelmez ve teşkil etmez. Kullanım Koşulları bölümünde daha fazlasını okuyun.

Korumalı komut dosyası

Bu komut dosyası kapalı kaynak olarak yayınlanmaktadır. Ancak, ücretsiz ve herhangi bir sınırlama olmaksızın kullanabilirsiniz – daha fazla bilgiyi buradan edinebilirsiniz.

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, alım satım veya diğer türden tavsiye veya öneriler anlamına gelmez ve teşkil etmez. Kullanım Koşulları bölümünde daha fazlasını okuyun.