RSI MSB | QuantMAC

🎯 Overview

The RSI MSB (Momentum Shifting Bands) represents a groundbreaking fusion of traditional RSI analysis with advanced momentum dynamics and adaptive volatility bands. This sophisticated indicator combines RSI smoothing, relative momentum calculations, and dynamic standard deviation bands to create a powerful oscillator that automatically adapts to changing market conditions, providing superior signal accuracy across different trading environments.

🔧 Key Features

- Hybrid RSI-Momentum Engine: Proprietary combination of smoothed RSI with relative momentum analysis

- Dynamic Adaptive Bands: Self-adjusting volatility bands that respond to indicator strength

- Dual Trading Modes: Flexible Long/Short or Long/Cash strategies for different risk preferences

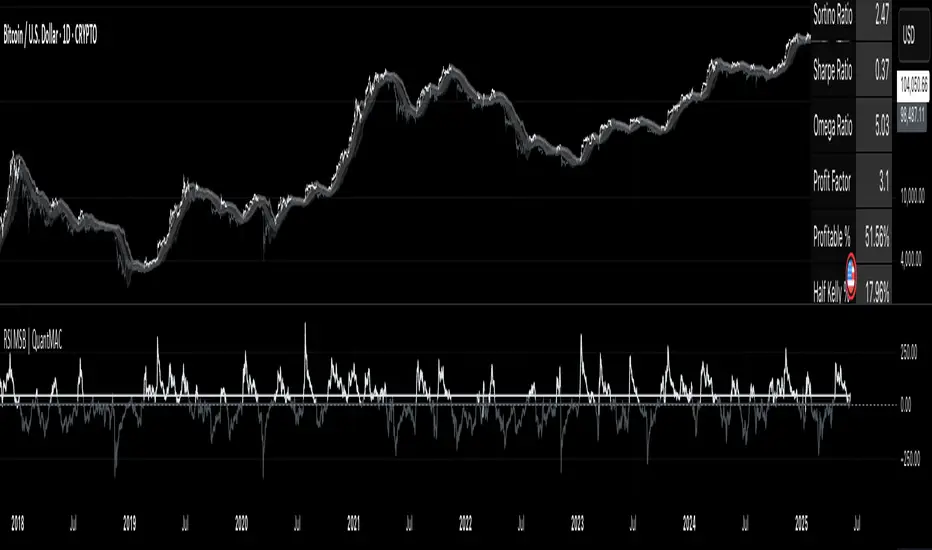

- Advanced Performance Analytics: Comprehensive metrics including Sharpe, Sortino, and Omega ratios

- Smart Visual System: Dynamic color coding with 9 professional color schemes

- Precision Backtesting: Date range filtering with detailed historical performance analysis

- Real-time Signal Generation: Clear entry/exit signals with customizable threshold sensitivity

- Position Sizing Intelligence: Half Kelly criterion for optimal risk management

📈 How The MSB Technology Work

The Momentum Shifting Bands technology is built on a revolutionary approach that combines multiple signal sources into one cohesive system:

RSI Foundation: 💪

- Calculate traditional RSI using customizable length and source

- Apply exponential smoothing to reduce noise and false signals

- Normalize values for consistent performance across different timeframes

Momentum Analysis Engine: ⚡

- Compute fast and slow momentum using rate of change calculations

- Calculate relative momentum by comparing fast vs slow momentum

- Normalize momentum values to 0-100 scale for consistency

- Apply smoothing to create stable momentum readings

Dynamic Combination: 🔄

The genius of MSB lies in its weighted combination of RSI and momentum signals. The momentum weight parameter allows traders to adjust the balance between RSI stability and momentum responsiveness, creating a hybrid indicator that captures both trend continuation and reversal signals.

Adaptive Band System: 🎯

- Calculate dynamic standard deviation multiplier based on indicator strength

- Generate upper and lower bands that expand during high volatility periods

- Create normalized oscillator that scales between band boundaries

- Provide visual reference for overbought/oversold conditions

⚙️ Comprehensive Parameter Control

RSI Settings: 📊

- RSI Length: Controls the period for RSI calculation (default: 21)

- Source: Price input selection (close, open, high, low, etc.)

- RSI Smoothing: Reduces noise in RSI calculations (default: 20)

Momentum Settings: 🔥

- Fast Momentum Length: Short-term momentum period (default: 19)

- Slow Momentum Length: Long-term momentum period (default: 21)

- Momentum Weight: Balance between RSI and momentum (default: 0.6)

Oscillator Settings: ⚙️

- Base Length: Foundation moving average for band calculations (default: 40)

- Standard Deviation Length: Period for volatility measurement (default: 53)

- SD Multiplier: Base band width adjustment (default: 0.7)

- Oscillator Multiplier: Scaling factor for oscillator values (default: 100)

Signal Thresholds: 🎯

- Long Threshold: Bullish signal trigger level (default: 93)

- Short Threshold: Bearish signal trigger level (default: 53)

🎨 Advanced Visual System

Main Chart Elements: 📈

- Dynamic Shifting Bands: Upper and lower bands with intelligent transparency

- Adaptive Fill Zone: Color-coded area between bands showing current market state

- Basis Line: Moving average foundation displayed as subtle reference points

- Smart Bar Coloring: Candles change color based on oscillator state for instant visual feedback

Oscillator Pane: 📊

- Normalized MSB Oscillator: Main signal line with dynamic coloring based on market state

- Threshold Lines: Horizontal reference lines for entry/exit levels

- Zero Line: Central reference for oscillator neutrality

- Color State Indication: Line colors change based on bullish/bearish conditions

📊 Professional Performance Metrics

The built-in analytics suite provides institutional-grade performance measurement:

- Net Profit %: Total strategy return percentage

- Maximum Drawdown %: Worst peak-to-trough decline

- Win Rate %: Percentage of profitable trades

- Profit Factor: Ratio of gross profits to gross losses

- Sharpe Ratio: Risk-adjusted return measurement

- Sortino Ratio: Downside-focused risk adjustment

- Omega Ratio: Probability-weighted performance ratio

- Half Kelly %: Optimal position sizing recommendation

- Total Trades: Complete transaction count

🎯 Strategic Trading Applications

Long/Short Mode: ⚡

Maximizes profit potential by capturing both upward and downward price movements. The MSB technology helps identify when momentum is building in either direction, allowing for optimal position switches between long and short positions.

Long/Cash Mode: 🛡️

Conservative approach ideal for retirement accounts or risk-averse traders. The indicator's adaptive nature helps identify the best times to be invested versus sitting in cash, protecting capital during adverse market conditions.

🚀 Unique Advantages

Traditional Indicators vs RSI MSB:

- Static vs Dynamic: While most indicators use fixed parameters, MSB bands adapt based on indicator strength

- Single Signal vs Multi-Signal: Combines RSI reliability with momentum responsiveness

- Lagging vs Balanced: Optimized balance between signal speed and accuracy

- Simple vs Intelligent: Advanced momentum analysis provides superior market insight

💡 Professional Setup Guide

For Day Trading (Short-term): 📱

- RSI Length: 14-18

- RSI Smoothing: 12-15

- Momentum Weight: 0.7-0.8

- Thresholds: Long 90, Short 55

For Swing Trading (Medium-term): 📊

- RSI Length: 21-25 (default range)

- RSI Smoothing: 18-22

- Momentum Weight: 0.5-0.7

- Thresholds: Long 93, Short 53 (defaults)

For Position Trading (Long-term): 📈

- RSI Length: 25-30

- RSI Smoothing: 25-30

- Momentum Weight: 0.4-0.6

- Thresholds: Long 95, Short 50

🧠 Advanced Trading Techniques

MSB Divergence Analysis: 🔍

Watch for divergences between price action and MSB readings. When price makes new highs/lows but the oscillator doesn't confirm, it often signals upcoming reversals or momentum shifts.

Band Width Interpretation: 📏

- Expanding Bands: Increasing volatility, expect larger price moves

- Contracting Bands: Decreasing volatility, prepare for potential breakouts

- Band Touches: Price touching outer bands often signals reversal opportunities

Multi-Timeframe Analysis: ⏰

Use MSB on higher timeframes for trend direction and lower timeframes for precise entry timing. The momentum component makes it particularly effective for timing entries within established trends.

⚠️ Important Risk Disclaimers

Critical Risk Factors:

- Market Conditions: No indicator performs equally well in all market environments

- Backtesting Limitations: Historical performance may not reflect future market behavior

- Parameter Sensitivity: Different settings may produce significantly different results

- Volatility Risk: Momentum-based indicators can be sensitive to extreme market conditions

- Capital Risk: Always use appropriate position sizing and stop-loss protection

📚 Educational Benefits

This indicator provides exceptional learning opportunities for understanding:

- Advanced RSI analysis and momentum integration techniques

- Adaptive indicator design and dynamic band calculations

- The relationship between momentum shifts and price movements

- Professional risk management using Kelly Criterion principles

- Modern oscillator interpretation and multi-signal analysis

🔍 Market Applications

The RSI MSB works effectively across various markets:

- Forex: Excellent for currency pair momentum analysis

- Stocks: Individual equity and index trading with momentum confirmation

- Commodities: Adaptive to commodity market momentum cycles

- Cryptocurrencies: Handles extreme volatility with momentum filtering

- Futures: Professional derivatives trading applications

🔧 Technical Innovation

The RSI MSB represents advanced research into multi-signal technical analysis. The proprietary momentum-RSI combination has been optimized for:

- Computational Efficiency: Fast calculation even on high-frequency data

- Signal Clarity: Clear, actionable trading signals with reduced noise

- Market Adaptability: Automatic adjustment to changing momentum conditions

- Parameter Flexibility: Wide range of customization options for different trading styles

🔔 Updates and Evolution

The RSI MSB | QuantMAC continues to evolve with regular updates incorporating the latest research in momentum-based technical analysis. The comprehensive parameter set allows for extensive customization and optimization across different market conditions.

Past Performance Disclaimer: Past performance results shown by this indicator are hypothetical and not indicative of future results. Market conditions change continuously, and no trading system or methodology can guarantee profits or prevent losses. Historical backtesting may not reflect actual trading conditions including market liquidity, slippage, and fees that would affect real trading results.

Master The Markets With Multi-Signal Intelligence! 🎯📈

Yalnızca davetli komut dosyası

Bu komut dosyasına yalnızca yazar tarafından onaylanan kullanıcılar erişebilir. Kullanmak için izin istemeniz ve almanız gerekir. Bu genellikle ödeme yapıldıktan sonra verilir. Daha fazla ayrıntı için aşağıdaki yazarın talimatlarını izleyin veya doğrudan Quant_MAC ile iletişime geçin.

TradingView, yazarına tamamen güvenmediğiniz ve nasıl çalıştığını anlamadığınız sürece bir komut dosyası için ödeme yapmanızı veya kullanmanızı TAVSİYE ETMEZ. Ayrıca topluluk komut dosyalarımızda ücretsiz, açık kaynaklı alternatifler bulabilirsiniz.

Yazarın talimatları

Feragatname

Yalnızca davetli komut dosyası

Bu komut dosyasına yalnızca yazar tarafından onaylanan kullanıcılar erişebilir. Kullanmak için izin istemeniz ve almanız gerekir. Bu genellikle ödeme yapıldıktan sonra verilir. Daha fazla ayrıntı için aşağıdaki yazarın talimatlarını izleyin veya doğrudan Quant_MAC ile iletişime geçin.

TradingView, yazarına tamamen güvenmediğiniz ve nasıl çalıştığını anlamadığınız sürece bir komut dosyası için ödeme yapmanızı veya kullanmanızı TAVSİYE ETMEZ. Ayrıca topluluk komut dosyalarımızda ücretsiz, açık kaynaklı alternatifler bulabilirsiniz.