PROTECTED SOURCE SCRIPT

Slark Signal Xtreme

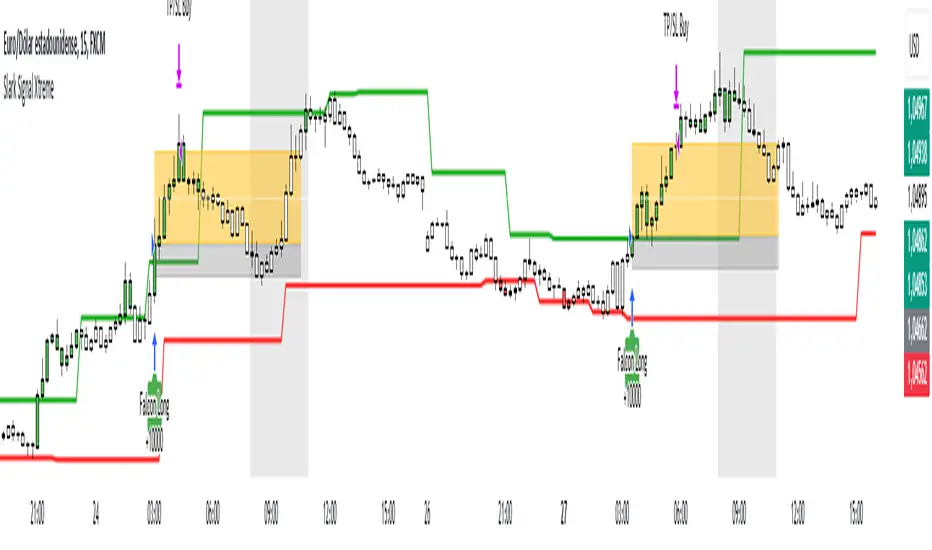

Strategy Description: Slark Signal Xtreme

The Slark Signal Xtreme is an innovative trading strategy designed to identify and capitalize on market opportunities by leveraging pivots, trend breakouts, and dynamic risk management. This strategy combines day-of-week and time filters with a ticks-based Stop Loss (SL) and Take Profit (TP) system, delivering customized signals and real-time alerts. Ideal for traders seeking a structured and highly customizable approach, Slark Signal Xtreme also incorporates advanced visual tools for efficient trade management.

Key Features:

- Pivot- and Breakout-Based Signals: Utilizes pivot detection (highs/lows) combined with an ATR-based slope calculation to pinpoint trend changes and potential entry or exit points.

- Dynamic Stop-Loss (SL) and Take-Profit (TP) Levels: Automatically calculates SL and TP based on the entry price and user-defined tick settings, adapting to volatility and optimizing risk management.

- Time and Day Filters: Allows you to select specific days of the week and trading sessions during which signals are generated, avoiding low-liquidity periods or unwanted high volatility.

- Customizable Risk Management: Lets you define the number of ticks for SL and TP, trading hours, initial capital, pyramiding, and commissions, tailoring the strategy to various risk profiles and assets.

- Enhanced Visualization:

- SL and TP Boxes: Displays rectangular boxes on the chart indicating SL and TP levels, streamlining trade management.

- Candle Color Changes: Candles can be colored according to price position relative to pivot lines (bullish, bearish, or neutral).

- Session Highlight: Shades the chart background during the selected trading hours, providing immediate context on when the strategy is active.- Automated Alerts: Generates customizable alerts in TradingView whenever a buy or sell signal is triggered, detailing the timing, instrument, and SL/TP levels.

How the Strategy Works:

- Technical Indicator Calculations:

- Pivot High/Low and Slope: Identifies price pivot points and calculates slope (based on ATR) to measure trend strength.

- Time and Day Filters: Signals only trigger within the specified days and hours, helping avoid undesirable market conditions.- Generating Buy and Sell Signals:

- Buy Signal (Long): Activated when price breaks above a downward pivot-based trendline or meets the condition for higher pivots.

- Sell Signal (Short): Activated when price breaks below an upward pivot-based trendline or meets the condition for lower pivots.

- Operation Conditions: Signals are only generated on selected days and during chosen trading hours, avoiding periods of low liquidity or excessive volatility.- Dynamic SL and TP Calculation:

- Stop-Loss (SL) and Take-Profit (TP): Determined by the entry price ± a user-defined number of ticks.

- SL and TP Visualization: Boxes are drawn on the chart from the entry price to SL/TP levels, enabling clear visual reference for trade management.- Order Execution and Alerts:

- Order Execution: When a signal is generated, Slark Signal Xtreme automatically opens a long or short position in TradingView’s backtesting environment.

- Alerts: Customizable alerts can be set up to provide real-time notifications (via TradingView or third-party integrations), offering essential details like instrument, time, SL/TP, etc.- Trade Management and Monitoring:

- Automatic Closure: Each trade is automatically closed upon reaching its SL or TP, ensuring disciplined risk control.

- Trade Summary: TradingView’s built-in reporting tools list all trades with cumulative results, simplifying performance evaluation.- Additional Visualization:

- Candle Coloring by Trend: Candles can be colored bullish, bearish, or neutral based on the pivot-driven trend detection.

- Operational Range Highlighting: The chart background is shaded during the permitted trading hours, clarifying when the strategy is active and enhancing visibility.

---

Strategy Properties (Important)

This backtest was conducted in TradingView under the following configuration:

- Initial Capital: 1000 USD

- Order Size: 10,000 contracts (adjust according to the traded asset)

- Commission: 0.05 USD per order

- Slippage: 1 tick

- Pyramiding: 1 order

- Price Verification for Limit Orders: 0 ticks

- Recalculate on Every Tick & On Bar Close: Enabled

- Bar Magnifier for Backtesting Precision: Enabled

These properties provide a realistic view of the strategy’s performance. However, default parameters may vary depending on each user or market:

- Order Size: Should be calculated according to the asset traded and your desired risk level.

- Commission and Slippage: Costs can vary by market and instrument; there is no universal default that guarantees realistic results.

All users are strongly recommended to adjust these properties within the script settings to match their own trading accounts and platforms, ensuring the most accurate backtest results.

---

Backtesting Results:

- Net Profit: +28.70

- Total Trades: 397

- Winning Trades: 138

- Win Rate: 34.76%

- Profit Factor: 1.07

- Sharpe Ratio: 1.25

- Sortino Ratio: 1.45

- Average Bars per Trade: 24

- Average Profit per Trade: 1.45

These numbers provide an overview of the strategy’s historical performance, demonstrating its potential for profitability given appropriate risk management.

---

Interpretation of Results:

- The strategy can be profitable despite a relatively modest win rate, thanks to a suitable risk-reward ratio.

- A profit factor of 1.07 indicates that total profits slightly exceed total losses.

- It is essential to monitor drawdown and ensure it aligns with your personal risk tolerance.

---

Risk Warning:

Trading leveraged financial instruments carries a high level of risk and may not be suitable for all investors. Before trading, carefully consider your investment objectives, experience level, and risk tolerance. Past performance does not guarantee future results. Always perform additional testing and adjust the strategy to your specific needs.

---

What Makes This Strategy Original?

- Focus on Pivots and Time/Day Filters: Rather than purely relying on momentum indicators, Slark Signal Xtreme uses pivot-based signals and scheduling filters to capture higher-liquidity, directional market moves.

- Dynamic Risk Management: Ticks-based SL/TP and customizable trading sessions enable precise adaptation to various markets and trading styles.

- Advanced Visualization Tools: SL/TP boxes, candle coloring, and session highlights streamline market interpretation and facilitate real-time decision-making.

- Seamless Alert Integration: Although native TradingView alerts are provided, it can be integrated with third-party messaging services (Telegram, Discord, etc.) for enhanced automation.

---

Additional Considerations

- Continuous Testing and Optimization: Regularly backtest and fine-tune parameters (SL, TP, time filters, etc.) to accommodate changing market conditions.

- Complementary Analysis: Combine this strategy with other technical or fundamental tools to confirm signals.

- Rigorous Risk Management: Ensure SL/TP levels and position sizes conform to your overall risk management plan.

- Updates and Support: Future updates and improvements may be released based on community feedback. For questions or suggestions, feel free to reach out.

---

Example Configuration

Assume you want to run Slark Signal Xtreme with these settings:

- Trading Days: Monday to Friday

- Trading Hours: 8:00 to 11:00 (exchange or broker time)

- Stop Loss (SL) in Ticks: 100

- Take Profit (TP) in Ticks: 300

- SL/TP Box Extension: 20 bars

- Initial Capital: 1000 USD

- Risk per Trade: 1% of capital

- Commissions & Slippage: 0.05 USD commission, 1 tick slippage

---

Conclusion

The Slark Signal Xtreme strategy delivers a robust and adaptable solution by merging pivots, time/day filters, flexible risk parameters, and advanced visualization. Its distinctive and customizable design makes it a powerful resource for traders aiming to diversify their methods and exploit trend breakouts under specific conditions. Fully compatible with TradingView, Slark Signal Xtreme can enhance your trading toolkit and foster a more systematic approach to your operations.

---

Final Disclaimer:

Financial markets are inherently volatile and pose significant risks. This strategy should be employed as part of a comprehensive trading plan and does not guarantee positive outcomes. Always consult a qualified financial advisor before making investment decisions. The use of Slark Signal Xtreme is solely at the user’s discretion, who must evaluate personal risk tolerance and financial objectives.

Korumalı komut dosyası

Bu komut dosyası kapalı kaynak olarak yayınlanmaktadır. Ancak, ücretsiz ve herhangi bir sınırlama olmaksızın kullanabilirsiniz – daha fazla bilgiyi buradan edinebilirsiniz.

Get access to our exclusive tools: popeyacademy.com

Join our 4k+ community: t.me/popeyacademy

All content provided by PoPey Group is for informational & educational purposes only. Past performance does not guarantee future results.

Join our 4k+ community: t.me/popeyacademy

All content provided by PoPey Group is for informational & educational purposes only. Past performance does not guarantee future results.

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, alım satım veya diğer türden tavsiye veya öneriler anlamına gelmez ve teşkil etmez. Kullanım Koşulları bölümünde daha fazlasını okuyun.

Korumalı komut dosyası

Bu komut dosyası kapalı kaynak olarak yayınlanmaktadır. Ancak, ücretsiz ve herhangi bir sınırlama olmaksızın kullanabilirsiniz – daha fazla bilgiyi buradan edinebilirsiniz.

Get access to our exclusive tools: popeyacademy.com

Join our 4k+ community: t.me/popeyacademy

All content provided by PoPey Group is for informational & educational purposes only. Past performance does not guarantee future results.

Join our 4k+ community: t.me/popeyacademy

All content provided by PoPey Group is for informational & educational purposes only. Past performance does not guarantee future results.

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, alım satım veya diğer türden tavsiye veya öneriler anlamına gelmez ve teşkil etmez. Kullanım Koşulları bölümünde daha fazlasını okuyun.