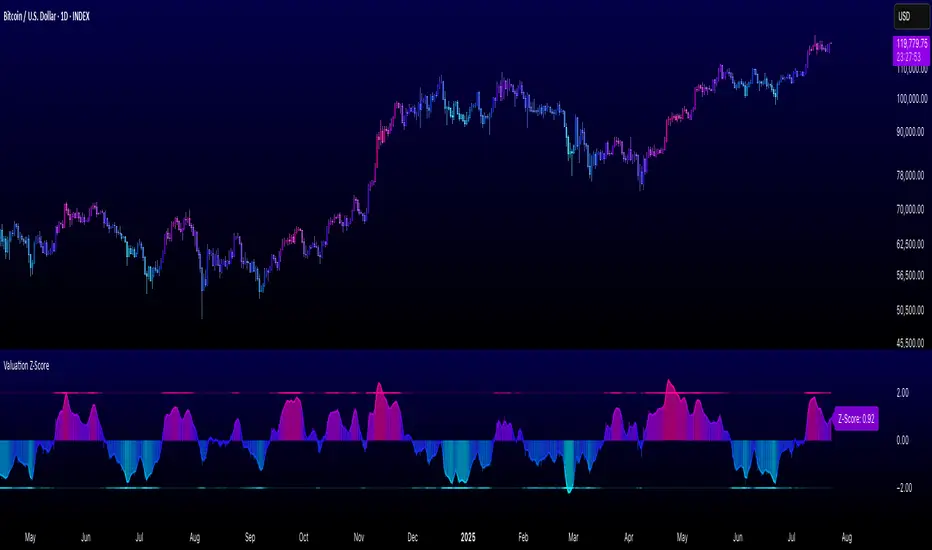

Valuation Z-Score

The "Valuation Z-Score" indicator is a custom Pine Script designed to assess the valuation of an asset, such as Bitcoin, by calculating a composite Z-Score based on multiple technical indicators and risk-adjusted performance metrics. It provides a visual representation of overbought and oversold conditions using a color-graded histogram and a short length smoothed moving average (SMA).

Key Features:

Z-Score Calculation:

- Combines Z-Scores from indicators like RSI, MACD, Bollinger Bands, TSI, ROC, Momentum, CCI, Chande Momentum Oscillator, and additional metrics (Sharpe Ratio, Sortino Ratio, Omega Ratio) over customizable lookback periods.

Customizable Inputs:

- Z-Score Lookback and Technical Valuation Lookback for Z-Score calculations.

- Metrics Calc Lookback periods for risk-adjusted performance ratios.

- Adjustable Upper and Lower Z-Score Thresholds (default ±2.0).

- SMA Length and color bar toggle for plot customization.

Visualization:

- A histogram displays the total Z-Score with a 5-color gradient (cyan for oversold, magenta for overbought) and dynamic transparency based on proximity to thresholds.

- An SMA line/area overlays the histogram for trend smoothing.

- Threshold lines (upper and lower) with adaptive transparency.

- A label shows the current Z-Score value.

- Optional background bar coloring based on SMA.

Usage:

- The indicator helps identify potential overbought (above upper threshold) or oversold (below lower threshold) conditions.

- The color gradient and SMA provide visual cues for trend strength and reversals.

- Ideal for traders analyzing asset valuation over any timeframe.

Yalnızca davetli komut dosyası

Bu komut dosyasına yalnızca yazar tarafından onaylanan kullanıcılar erişebilir. Kullanmak için izin istemeniz ve almanız gerekir. Bu izin genellikle ödeme yapıldıktan sonra verilir. Daha fazla ayrıntı için aşağıdaki yazarın talimatlarını izleyin veya doğrudan QuantPablo ile iletişime geçin.

TradingView, yazarına tam olarak güvenmediğiniz ve nasıl çalıştığını anlamadığınız sürece bir komut dosyası için ödeme yapmanızı veya kullanmanızı ÖNERMEZ. Ayrıca topluluk komut dosyaları bölümümüzde ücretsiz, açık kaynaklı alternatifler bulabilirsiniz.

Yazarın talimatları

Uyarı: Erişim talebinde bulunmadan önce lütfen yalnızca davetli komut dosyaları kılavuzumuzu okuyun.

Feragatname

Yalnızca davetli komut dosyası

Bu komut dosyasına yalnızca yazar tarafından onaylanan kullanıcılar erişebilir. Kullanmak için izin istemeniz ve almanız gerekir. Bu izin genellikle ödeme yapıldıktan sonra verilir. Daha fazla ayrıntı için aşağıdaki yazarın talimatlarını izleyin veya doğrudan QuantPablo ile iletişime geçin.

TradingView, yazarına tam olarak güvenmediğiniz ve nasıl çalıştığını anlamadığınız sürece bir komut dosyası için ödeme yapmanızı veya kullanmanızı ÖNERMEZ. Ayrıca topluluk komut dosyaları bölümümüzde ücretsiz, açık kaynaklı alternatifler bulabilirsiniz.

Yazarın talimatları

Uyarı: Erişim talebinde bulunmadan önce lütfen yalnızca davetli komut dosyaları kılavuzumuzu okuyun.