PROTECTED SOURCE SCRIPT

Assets Correlation by GDM

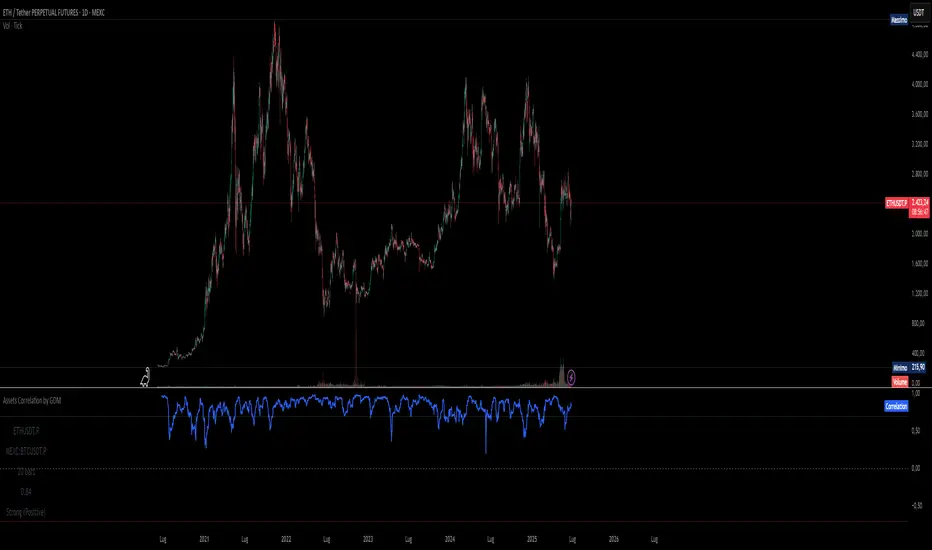

📊 Correlation Matrix Table between Two Assets

This indicator calculates and displays the rolling correlation between the asset on your chart and a second asset of your choice. The correlation is computed based on log returns over a user-defined lookback period. A live summary table appears in the bottom left corner, providing a real-time snapshot of the current correlation and its context.

How it works:

Comparison Asset:

Select any symbol to compare with the chart asset (e.g., compare BTCUSD to ETHUSD).

Lookback Period:

Choose the rolling window (in bars) used to calculate the Pearson correlation coefficient.

Dynamic Table:

A table in the lower left corner summarizes:

Main asset symbol

Comparison symbol

Analysis period (bars)

Current correlation value (rounded to 2 decimals)

Correlation strength & direction (Strong, Moderate, Weak | Positive/Negative)

Visual Plot:

The indicator plots the correlation value over time so you can observe changes and trends.

Table Positioning:

Table location can be adjusted from settings (bottom left/right, top left/right).

How to use:

Risk Management & Diversification:

Quickly assess if two assets move together (positive correlation), in opposite directions (negative correlation), or independently.

Pairs Trading:

Identify opportunities when correlation diverges from historical norms.

Portfolio Construction:

Avoid overexposure to highly correlated assets, or use negative correlation for hedging.

Limitations & Tips:

Correlation values are based on historical returns and may change during periods of market stress or volatility.

Use multiple lookback periods (short, medium, long) for a more robust view.

Correlation does not imply causation—always complement with additional analysis.

Script Features:

User-selectable comparison asset and lookback window.

Real-time correlation calculation.

Clean summary table with correlation stats.

Optional alert logic and correlation plot for more advanced usage.

If you find this indicator useful, please leave a like and let me know your suggestions for improvements!

This indicator calculates and displays the rolling correlation between the asset on your chart and a second asset of your choice. The correlation is computed based on log returns over a user-defined lookback period. A live summary table appears in the bottom left corner, providing a real-time snapshot of the current correlation and its context.

How it works:

Comparison Asset:

Select any symbol to compare with the chart asset (e.g., compare BTCUSD to ETHUSD).

Lookback Period:

Choose the rolling window (in bars) used to calculate the Pearson correlation coefficient.

Dynamic Table:

A table in the lower left corner summarizes:

Main asset symbol

Comparison symbol

Analysis period (bars)

Current correlation value (rounded to 2 decimals)

Correlation strength & direction (Strong, Moderate, Weak | Positive/Negative)

Visual Plot:

The indicator plots the correlation value over time so you can observe changes and trends.

Table Positioning:

Table location can be adjusted from settings (bottom left/right, top left/right).

How to use:

Risk Management & Diversification:

Quickly assess if two assets move together (positive correlation), in opposite directions (negative correlation), or independently.

Pairs Trading:

Identify opportunities when correlation diverges from historical norms.

Portfolio Construction:

Avoid overexposure to highly correlated assets, or use negative correlation for hedging.

Limitations & Tips:

Correlation values are based on historical returns and may change during periods of market stress or volatility.

Use multiple lookback periods (short, medium, long) for a more robust view.

Correlation does not imply causation—always complement with additional analysis.

Script Features:

User-selectable comparison asset and lookback window.

Real-time correlation calculation.

Clean summary table with correlation stats.

Optional alert logic and correlation plot for more advanced usage.

If you find this indicator useful, please leave a like and let me know your suggestions for improvements!

Korumalı komut dosyası

Bu komut dosyası kapalı kaynak olarak yayınlanmaktadır. Ancak, ücretsiz ve herhangi bir sınırlama olmaksızın kullanabilirsiniz – daha fazla bilgiyi buradan edinebilirsiniz.

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, alım satım veya diğer türden tavsiye veya öneriler anlamına gelmez ve teşkil etmez. Kullanım Koşulları bölümünde daha fazlasını okuyun.

Korumalı komut dosyası

Bu komut dosyası kapalı kaynak olarak yayınlanmaktadır. Ancak, ücretsiz ve herhangi bir sınırlama olmaksızın kullanabilirsiniz – daha fazla bilgiyi buradan edinebilirsiniz.

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, alım satım veya diğer türden tavsiye veya öneriler anlamına gelmez ve teşkil etmez. Kullanım Koşulları bölümünde daha fazlasını okuyun.