PROTECTED SOURCE SCRIPT

candle stats v1

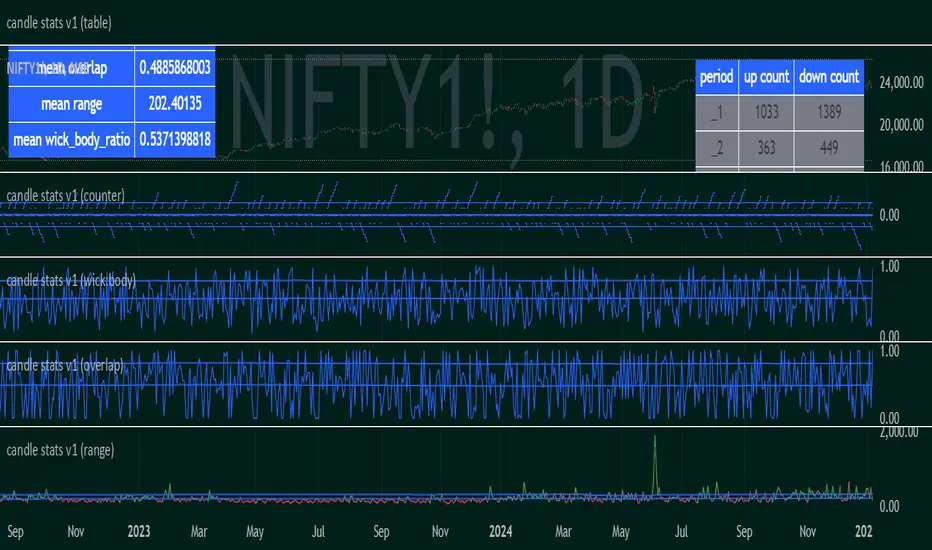

Objective:

Capture sequential/subsequent candle's relative properties

Average observations to represent the landscape of the marketplace

Parameters:

"range" : high-low

"overlap" : range - range[1]

"wick_body_ratio" : (range - abs(open-close))/range

"up_count" for "period" : number of occurrences where <period> consecutive candles have low>low[i+1]. (note: the values are not cumulative over period)

*"down_count" for "period" : number of occurrences where <period> consecutive candles have high<high[i+1]. (note: the values are not cumulative over period)

** the last counter includes the value for "period" and all above

Basic inferences:

mean_range could be used to derive at an appropriate hard-stoploss

high wick to body ratio indicates healthy buzzing market, ie, each candle has a high frequency standing wave within it. a lower value indicates that the timeframe is ordered and highly directional

low overlap indicates trend definition/resolution

the counters show how likely or unlikely a run up or run down of a particular length is

a combination of counter and mean_range could be used to derive at an appropriate take profit

Use case:

to determine the appropriate timeframe to develop or apply a strategy

Future enhancements:

more complex relationships such as higher highs and lower lows

frequency of oscillations

Capture sequential/subsequent candle's relative properties

Average observations to represent the landscape of the marketplace

Parameters:

"range" : high-low

"overlap" : range - range[1]

"wick_body_ratio" : (range - abs(open-close))/range

"up_count" for "period" : number of occurrences where <period> consecutive candles have low>low[i+1]. (note: the values are not cumulative over period)

*"down_count" for "period" : number of occurrences where <period> consecutive candles have high<high[i+1]. (note: the values are not cumulative over period)

** the last counter includes the value for "period" and all above

Basic inferences:

mean_range could be used to derive at an appropriate hard-stoploss

high wick to body ratio indicates healthy buzzing market, ie, each candle has a high frequency standing wave within it. a lower value indicates that the timeframe is ordered and highly directional

low overlap indicates trend definition/resolution

the counters show how likely or unlikely a run up or run down of a particular length is

a combination of counter and mean_range could be used to derive at an appropriate take profit

Use case:

to determine the appropriate timeframe to develop or apply a strategy

Future enhancements:

more complex relationships such as higher highs and lower lows

frequency of oscillations

Korumalı komut dosyası

Bu komut dosyası kapalı kaynak olarak yayınlanmaktadır. Ancak, ücretsiz ve herhangi bir sınırlama olmaksızın kullanabilirsiniz – daha fazla bilgiyi buradan edinebilirsiniz.

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, alım satım veya diğer türden tavsiye veya öneriler anlamına gelmez ve teşkil etmez. Kullanım Koşulları bölümünde daha fazlasını okuyun.

Korumalı komut dosyası

Bu komut dosyası kapalı kaynak olarak yayınlanmaktadır. Ancak, ücretsiz ve herhangi bir sınırlama olmaksızın kullanabilirsiniz – daha fazla bilgiyi buradan edinebilirsiniz.

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, alım satım veya diğer türden tavsiye veya öneriler anlamına gelmez ve teşkil etmez. Kullanım Koşulları bölümünde daha fazlasını okuyun.