PROTECTED SOURCE SCRIPT

kriptoeth SP

KriptoETH SP Indicator - Smart Money Analysis Tool

Main Function

This indicator identifies potential market reversal points based on Smart Money concepts. It analyzes liquidity sweeps and significant support/resistance breaks to generate trading signals.

Key Features

1. Swing Analysis

Identifies high and low levels based on specified swing length (default 15 bars)

These levels are considered potential liquidity zones

2. Liquidity Sweep Detection

Detects short-term violations of support and resistance levels as "sweeps"

Sweep tolerance (%) parameter allows sensitivity adjustment

3. Volume Confirmation

Requires volume spike for signal formation

Volume multiplier sets minimum volume threshold

4. Trend Filter

Analyzes overall trend direction using 50-period MA

Filters signals against the trend to improve success rate

5. Retest Capability

Tracks price return to main signal levels (B/S lines) after initial signals

Shows small confirmation signals when retests occur

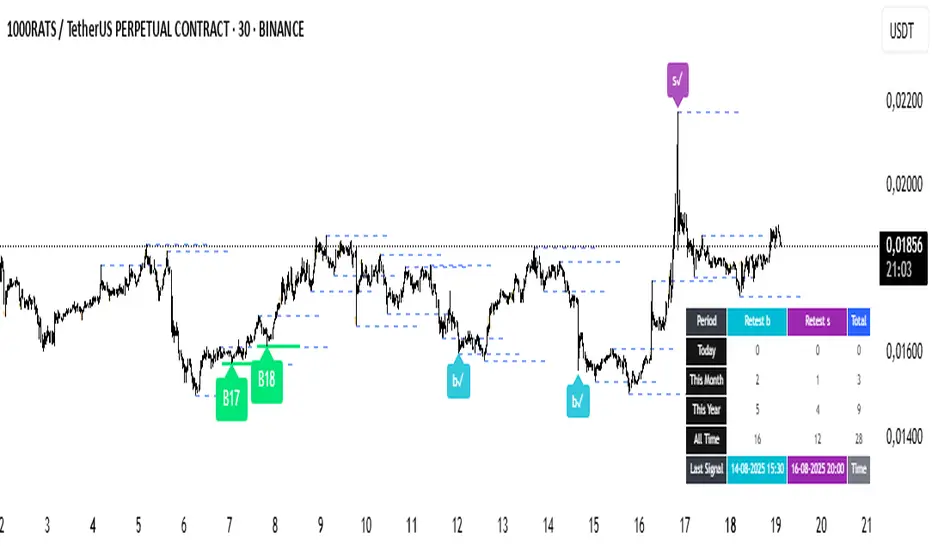

Signal Types

B Signal: Potential buy opportunity (green label)

S Signal: Potential sell opportunity (red label)

b✓ / s✓: Retest confirmation signals (small labels)

Filtering System

Filters out too-rapid breaks

Controls for insufficient bar distance

Next bar confirmation option

Eliminates signals inconsistent with trend direction

Statistics Table

Daily, monthly, yearly retest counts

Last signal timestamps

Total signal statistics

Usage Guidelines

Combine signals with other technical analysis tools

Determine your risk-reward ratio in advance

Limit position size to 1-2% of your capital

Consider overall market conditions

Use proper stop-loss levels

Wait for confluence with other indicators

Parameters Explanation

Swing Length: Period for identifying swing highs/lows

Sweep Tolerance: Sensitivity for liquidity sweep detection

Volume Multiplier: Minimum volume increase requirement

Trend Filter: Enable/disable trend-based signal filtering

Retest Filters: Additional confirmation requirements for retest signals

How It Works

Algorithm identifies swing highs and lows as potential liquidity levels

Monitors for price sweeps beyond these levels with volume confirmation

Generates main signals (B/S) when criteria are met

Tracks subsequent retests of these signal levels

Applies multiple filters to reduce false signals

Best Practices

Use higher timeframes for trend confirmation

Combine with support/resistance analysis

Consider market structure context

Apply proper risk management rules

Backtest on historical data before live trading

IMPORTANT DISCLAIMER: This indicator is for educational and analysis purposes only. It does not constitute financial advice. Trading involves substantial risk of loss. Always conduct your own research and consider consulting with a qualified financial advisor before making investment decisions. Past performance does not guarantee future results.

Version Updates

Enhanced filtering system

Improved retest detection

Statistics tracking table

Trend-based signal validation

Multiple confirmation methods

Main Function

This indicator identifies potential market reversal points based on Smart Money concepts. It analyzes liquidity sweeps and significant support/resistance breaks to generate trading signals.

Key Features

1. Swing Analysis

Identifies high and low levels based on specified swing length (default 15 bars)

These levels are considered potential liquidity zones

2. Liquidity Sweep Detection

Detects short-term violations of support and resistance levels as "sweeps"

Sweep tolerance (%) parameter allows sensitivity adjustment

3. Volume Confirmation

Requires volume spike for signal formation

Volume multiplier sets minimum volume threshold

4. Trend Filter

Analyzes overall trend direction using 50-period MA

Filters signals against the trend to improve success rate

5. Retest Capability

Tracks price return to main signal levels (B/S lines) after initial signals

Shows small confirmation signals when retests occur

Signal Types

B Signal: Potential buy opportunity (green label)

S Signal: Potential sell opportunity (red label)

b✓ / s✓: Retest confirmation signals (small labels)

Filtering System

Filters out too-rapid breaks

Controls for insufficient bar distance

Next bar confirmation option

Eliminates signals inconsistent with trend direction

Statistics Table

Daily, monthly, yearly retest counts

Last signal timestamps

Total signal statistics

Usage Guidelines

Combine signals with other technical analysis tools

Determine your risk-reward ratio in advance

Limit position size to 1-2% of your capital

Consider overall market conditions

Use proper stop-loss levels

Wait for confluence with other indicators

Parameters Explanation

Swing Length: Period for identifying swing highs/lows

Sweep Tolerance: Sensitivity for liquidity sweep detection

Volume Multiplier: Minimum volume increase requirement

Trend Filter: Enable/disable trend-based signal filtering

Retest Filters: Additional confirmation requirements for retest signals

How It Works

Algorithm identifies swing highs and lows as potential liquidity levels

Monitors for price sweeps beyond these levels with volume confirmation

Generates main signals (B/S) when criteria are met

Tracks subsequent retests of these signal levels

Applies multiple filters to reduce false signals

Best Practices

Use higher timeframes for trend confirmation

Combine with support/resistance analysis

Consider market structure context

Apply proper risk management rules

Backtest on historical data before live trading

IMPORTANT DISCLAIMER: This indicator is for educational and analysis purposes only. It does not constitute financial advice. Trading involves substantial risk of loss. Always conduct your own research and consider consulting with a qualified financial advisor before making investment decisions. Past performance does not guarantee future results.

Version Updates

Enhanced filtering system

Improved retest detection

Statistics tracking table

Trend-based signal validation

Multiple confirmation methods

Korumalı komut dosyası

Bu komut dosyası kapalı kaynak olarak yayınlanmaktadır. Ancak, ücretsiz ve herhangi bir sınırlama olmaksızın kullanabilirsiniz – daha fazla bilgiyi buradan edinebilirsiniz.

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, alım satım veya diğer türden tavsiye veya öneriler anlamına gelmez ve teşkil etmez. Kullanım Koşulları bölümünde daha fazlasını okuyun.

Korumalı komut dosyası

Bu komut dosyası kapalı kaynak olarak yayınlanmaktadır. Ancak, ücretsiz ve herhangi bir sınırlama olmaksızın kullanabilirsiniz – daha fazla bilgiyi buradan edinebilirsiniz.

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, alım satım veya diğer türden tavsiye veya öneriler anlamına gelmez ve teşkil etmez. Kullanım Koşulları bölümünde daha fazlasını okuyun.