PROTECTED SOURCE SCRIPT

Falcon - Volume & Level reaction

Falcon - Volume & Level Reaction

Our indicator, Falcon - Volume & Level Reaction, is designed to provide traders with comprehensive insights into price behavior through the calculation of horizontal volume profiles. By analyzing these profiles, the indicator identifies key levels and assesses price reactions, offering valuable trading signals.

---

# Concept

The Falcon - Volume & Level Reaction indicator is built to help traders identify and capitalize on key market levels by analyzing volume profiles and price behavior. This indicator enhances trading strategies by providing clear signals based on robust analysis, allowing traders to make informed decisions and improve their trading outcomes.

---

# Functions

1. Volume Profile Calculation

- Profile Period: Calculates horizontal volume profiles over a specified number of bars.

- Peak Volumes: Identifies peak volume levels based on the sensitivity parameter.

2. Price Behavior Analysis

- Primary Check: Determines if bars close above or below the peak level.

- Secondary Checks:

- Volume Decrease: Confirms a decrease in volume after the price touches the level.

- Volatility Check: Ensures bars do not exceed the average ATR range.

3. Signal Generation

- Combined Signals: The primary check generates initial long/short signals, while secondary checks strengthen these signals.

- Real-time Alerts: Provides "Potential" short or long signals based on the current candle's closure relative to the level.

4. Comprehensive Analysis: Helps identify multiple factors that validate level protection and potential price reversals.

---

# Description of Checks

1. Primary Check: Price Closure

- This check assesses whether the bars close above or below the identified peak volume levels. If the price closes above the level, it generates a long signal; if it closes below, it generates a short signal. This check is fundamental as it directly indicates the price's interaction with significant volume levels.

2. Secondary Check 1: Volume Decrease

- After the price touches a peak volume level, this check verifies if there is a subsequent decrease in trading volume. A decrease in volume after touching the level suggests reduced market interest at that price, which can indicate potential reversals or continuations based on the overall market context.

3. Secondary Check 2: Volatility Check

- This check ensures that the price bars do not exceed the average ATR range after touching the peak volume level. Lower volatility near key levels indicates stability and strengthens the signal generated by the primary check, confirming the market's reaction to these levels.

---

# How to Use the Indicator

1. Set Parameters: Define volume profile parameters such as profile period, number of peaks, and level sensitivity.

2. Analyze the Chart: Observe the peak volume levels displayed on the chart.

3. Receive Signals: Follow the buy or sell signals that appear when the price touches the level and the primary and secondary checks are met.

4. Respond to Alerts: When a "Potential" long or short signal appears, evaluate the closure of the current candle relative to the level to make a trading decision.

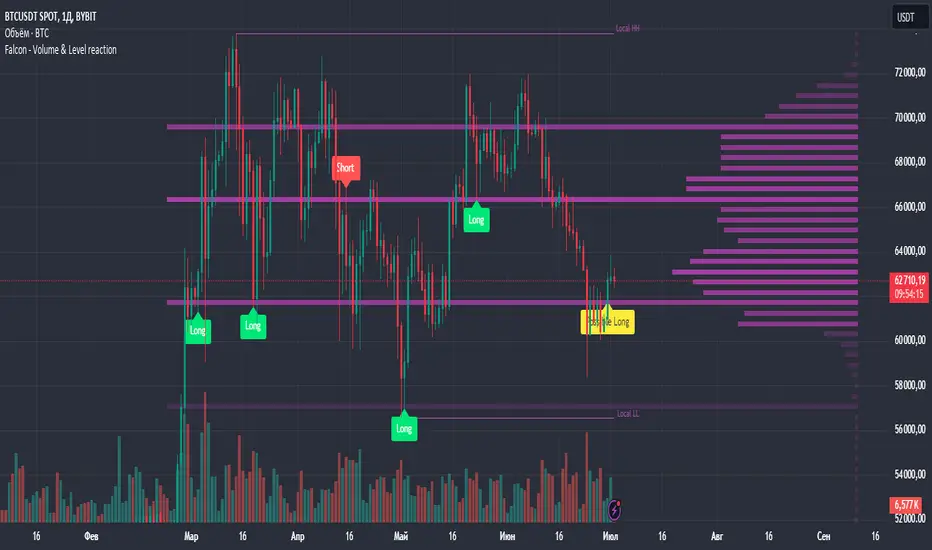

Example of Work

- Setup:

- Result:

---

# Input Parameters

- Profile back: Defines the lookback period for volume profiles (10–500, step 1).

- Max Profile: Sets the maximum number of profiles (10–300, step 5).

- Profiles Length: Specifies the length of profiles (10–100, step 1).

- Profiles Offset: Determines the offset for profiles (0–100, step 1).

- Profiles Width: Sets the width of profiles (1–10).

- Profiles Color: Chooses the color for profiles.

- Lvls Color: Chooses the color for levels.

- Lvl's sensitivity: Adjusts the sensitivity of levels (1–10).

- tolerance: Sets the tolerance level (0.000–0.003, step 0.001).

- tolerance ATR: Defines the ATR tolerance (1.0–4.0).

---

Falcon - Volume & Level Reaction

Индикатор на основе горизонтальных объемов помогает трейдерам выявлять ключевые уровни объемной проторговки, предоставляя четкие сигналы для принятия торговых решений.

Функции

– Определение и отображение пиковых уровней объемной проторговки.

– Сигналы на покупку (Long) и продажу (Short) на основе поведения цены.

– Анализ объема торгов до и после касания уровня.

– Оценка волатильности цены в период консолидации.

– Автоматическая подстройка под выбранный таймфрейм.

– Отображение локальных максимумов и минимумов.

Настройки

– Количество баров назад VRVP: определяет период для расчета горизонтальных объемов.

– Множитель ATR: коэффициент для вычисления волатильности.

– Множитель погрешности: допустимая погрешность касания уровня.

– Период расчета ATR: количество баров для расчета среднего ATR.

– Отображение Local HH/LL: включение/выключение отображения локальных максимумов и минимумов.

Версии

Данный скрипт – упрощенная версия нашего индикатора с закрытым доступом. Открытая версия доступна для BTC и ETH, только на дневном таймфрейме, без возможности изменения параметров

Our indicator, Falcon - Volume & Level Reaction, is designed to provide traders with comprehensive insights into price behavior through the calculation of horizontal volume profiles. By analyzing these profiles, the indicator identifies key levels and assesses price reactions, offering valuable trading signals.

---

# Concept

The Falcon - Volume & Level Reaction indicator is built to help traders identify and capitalize on key market levels by analyzing volume profiles and price behavior. This indicator enhances trading strategies by providing clear signals based on robust analysis, allowing traders to make informed decisions and improve their trading outcomes.

---

# Functions

1. Volume Profile Calculation

- Profile Period: Calculates horizontal volume profiles over a specified number of bars.

- Peak Volumes: Identifies peak volume levels based on the sensitivity parameter.

2. Price Behavior Analysis

- Primary Check: Determines if bars close above or below the peak level.

- Secondary Checks:

- Volume Decrease: Confirms a decrease in volume after the price touches the level.

- Volatility Check: Ensures bars do not exceed the average ATR range.

3. Signal Generation

- Combined Signals: The primary check generates initial long/short signals, while secondary checks strengthen these signals.

- Real-time Alerts: Provides "Potential" short or long signals based on the current candle's closure relative to the level.

4. Comprehensive Analysis: Helps identify multiple factors that validate level protection and potential price reversals.

---

# Description of Checks

1. Primary Check: Price Closure

- This check assesses whether the bars close above or below the identified peak volume levels. If the price closes above the level, it generates a long signal; if it closes below, it generates a short signal. This check is fundamental as it directly indicates the price's interaction with significant volume levels.

2. Secondary Check 1: Volume Decrease

- After the price touches a peak volume level, this check verifies if there is a subsequent decrease in trading volume. A decrease in volume after touching the level suggests reduced market interest at that price, which can indicate potential reversals or continuations based on the overall market context.

3. Secondary Check 2: Volatility Check

- This check ensures that the price bars do not exceed the average ATR range after touching the peak volume level. Lower volatility near key levels indicates stability and strengthens the signal generated by the primary check, confirming the market's reaction to these levels.

---

# How to Use the Indicator

1. Set Parameters: Define volume profile parameters such as profile period, number of peaks, and level sensitivity.

2. Analyze the Chart: Observe the peak volume levels displayed on the chart.

3. Receive Signals: Follow the buy or sell signals that appear when the price touches the level and the primary and secondary checks are met.

4. Respond to Alerts: When a "Potential" long or short signal appears, evaluate the closure of the current candle relative to the level to make a trading decision.

Example of Work

- Setup:

- Result:

---

# Input Parameters

- Profile back: Defines the lookback period for volume profiles (10–500, step 1).

- Max Profile: Sets the maximum number of profiles (10–300, step 5).

- Profiles Length: Specifies the length of profiles (10–100, step 1).

- Profiles Offset: Determines the offset for profiles (0–100, step 1).

- Profiles Width: Sets the width of profiles (1–10).

- Profiles Color: Chooses the color for profiles.

- Lvls Color: Chooses the color for levels.

- Lvl's sensitivity: Adjusts the sensitivity of levels (1–10).

- tolerance: Sets the tolerance level (0.000–0.003, step 0.001).

- tolerance ATR: Defines the ATR tolerance (1.0–4.0).

---

Falcon - Volume & Level Reaction

Индикатор на основе горизонтальных объемов помогает трейдерам выявлять ключевые уровни объемной проторговки, предоставляя четкие сигналы для принятия торговых решений.

Функции

– Определение и отображение пиковых уровней объемной проторговки.

– Сигналы на покупку (Long) и продажу (Short) на основе поведения цены.

– Анализ объема торгов до и после касания уровня.

– Оценка волатильности цены в период консолидации.

– Автоматическая подстройка под выбранный таймфрейм.

– Отображение локальных максимумов и минимумов.

Настройки

– Количество баров назад VRVP: определяет период для расчета горизонтальных объемов.

– Множитель ATR: коэффициент для вычисления волатильности.

– Множитель погрешности: допустимая погрешность касания уровня.

– Период расчета ATR: количество баров для расчета среднего ATR.

– Отображение Local HH/LL: включение/выключение отображения локальных максимумов и минимумов.

Версии

Данный скрипт – упрощенная версия нашего индикатора с закрытым доступом. Открытая версия доступна для BTC и ETH, только на дневном таймфрейме, без возможности изменения параметров

Korumalı komut dosyası

Bu komut dosyası kapalı kaynak olarak yayınlanmaktadır. Ancak, ücretsiz ve herhangi bir sınırlama olmaksızın kullanabilirsiniz – daha fazla bilgiyi buradan edinebilirsiniz.

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, alım satım veya diğer türden tavsiye veya öneriler anlamına gelmez ve teşkil etmez. Kullanım Koşulları bölümünde daha fazlasını okuyun.

Korumalı komut dosyası

Bu komut dosyası kapalı kaynak olarak yayınlanmaktadır. Ancak, ücretsiz ve herhangi bir sınırlama olmaksızın kullanabilirsiniz – daha fazla bilgiyi buradan edinebilirsiniz.

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, alım satım veya diğer türden tavsiye veya öneriler anlamına gelmez ve teşkil etmez. Kullanım Koşulları bölümünde daha fazlasını okuyun.