PROTECTED SOURCE SCRIPT

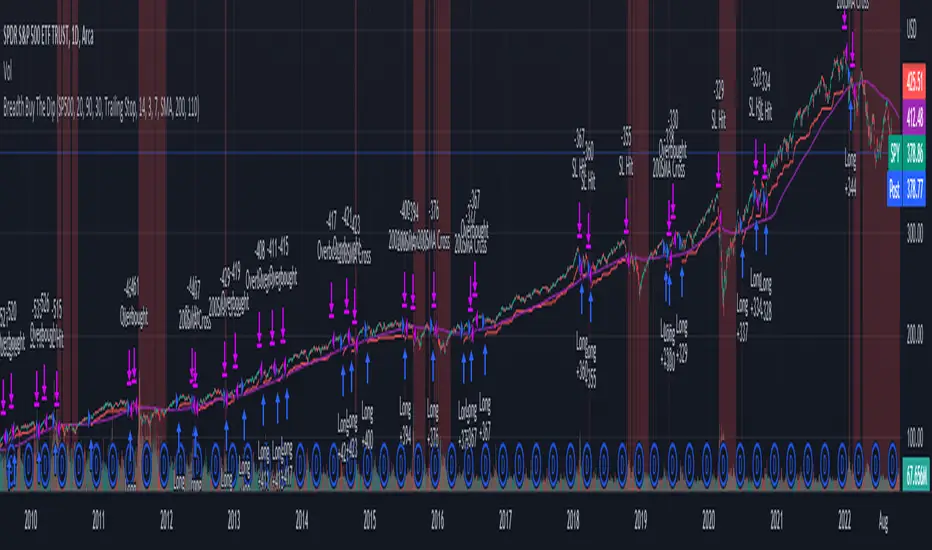

Strategy Based on Percent of Stocks Above/Below Key Moving

This Strategy looks to buy the market after the percentage of stocks below the 20 SMA moving average drops below 30% and crosses back above it. The strategy outperforms buy and hold on the S&P and more importantly only has a max draw down of 11% which gives it a much better risk adjusted performance then buy and hold alone.

It has three sell rules, 1. When the same indicator crosses into overbought territory. 2. Index Closes below the 200 SMA. 3. Stop Loss is triggered (default is Trailing stop loss).

The indicator used can be found here :

The Strategy has been coded so that all the variables can be adjusted so you can tweak it to get the best performance to whatever market you like. I have hard coded the best variables I could find to trade the SPY.

SPY.

You can track market breadth on the following markets:

Market Tickers Available = SP500 , DJI, NQ, NQ100, R2000, R3000, SP500 Financials, SP500 Materials, SP500 Energy, SP500 Staples, SP500 Discretionary, SP500 Industrials , SP500 Real Estates, Overall Market

The strategy can be used on any of these moving averages : 20, 50, 100, 150, 200

You can adjust the greed and fear levels to change when the strategy takes trades at Overbought and Oversold Levels

Stop Loss

Two Stop losses are available a fixed stop loss based on an ATR value or a trailing % Stop Loss

Regime Filters

Two Regime filters are available:

1. a simple moving average (Strategy wont take trades under the 200 SMA)

2. Advance/Decline Filter Details can be found here:![[KY]Cumulative Advance Decline Line](https://s3.tradingview.com/s/S1GcKule_mid.png)

Date Filter

It has three sell rules, 1. When the same indicator crosses into overbought territory. 2. Index Closes below the 200 SMA. 3. Stop Loss is triggered (default is Trailing stop loss).

The indicator used can be found here :

The Strategy has been coded so that all the variables can be adjusted so you can tweak it to get the best performance to whatever market you like. I have hard coded the best variables I could find to trade the

You can track market breadth on the following markets:

Market Tickers Available = SP500 , DJI, NQ, NQ100, R2000, R3000, SP500 Financials, SP500 Materials, SP500 Energy, SP500 Staples, SP500 Discretionary, SP500 Industrials , SP500 Real Estates, Overall Market

The strategy can be used on any of these moving averages : 20, 50, 100, 150, 200

You can adjust the greed and fear levels to change when the strategy takes trades at Overbought and Oversold Levels

Stop Loss

Two Stop losses are available a fixed stop loss based on an ATR value or a trailing % Stop Loss

Regime Filters

Two Regime filters are available:

1. a simple moving average (Strategy wont take trades under the 200 SMA)

2. Advance/Decline Filter Details can be found here:

![[KY]Cumulative Advance Decline Line](https://s3.tradingview.com/s/S1GcKule_mid.png)

Date Filter

Korumalı komut dosyası

Bu komut dosyası kapalı kaynak olarak yayınlanmaktadır. Ancak, ücretsiz ve herhangi bir sınırlama olmaksızın kullanabilirsiniz – daha fazla bilgiyi buradan edinebilirsiniz.

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, alım satım veya diğer türden tavsiye veya öneriler anlamına gelmez ve teşkil etmez. Kullanım Koşulları bölümünde daha fazlasını okuyun.

Korumalı komut dosyası

Bu komut dosyası kapalı kaynak olarak yayınlanmaktadır. Ancak, ücretsiz ve herhangi bir sınırlama olmaksızın kullanabilirsiniz – daha fazla bilgiyi buradan edinebilirsiniz.

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, alım satım veya diğer türden tavsiye veya öneriler anlamına gelmez ve teşkil etmez. Kullanım Koşulları bölümünde daha fazlasını okuyun.