PROTECTED SOURCE SCRIPT

Güncellendi [TT] Option Chain

✅Option Geeks for NSE India

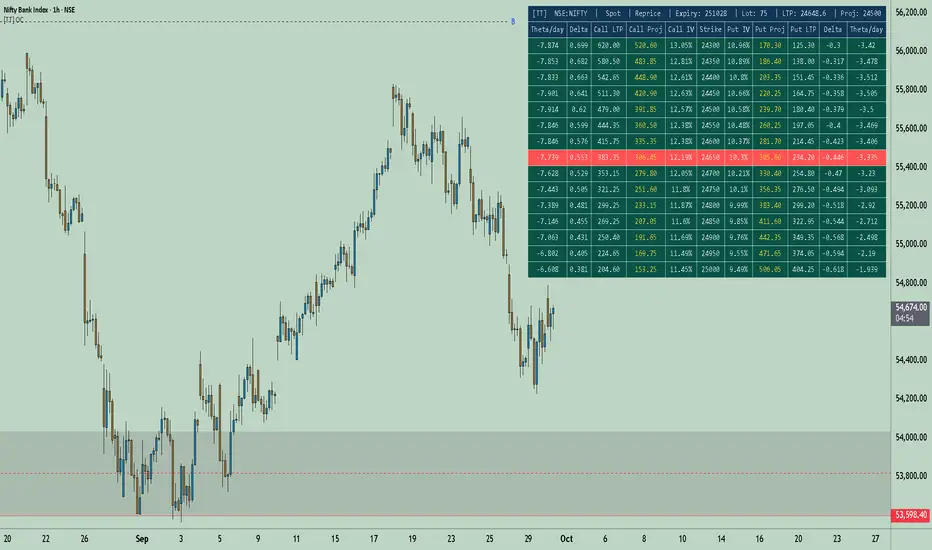

Option Geeks is a powerful tool designed for options traders on the NSE (National Stock Exchange of India). It provides real-time visualization and insights based on key option greeks such as Delta, Gamma, Theta, and Implied Volatility (IV) — enabling traders to make more informed decisions when analyzing option chains and positions.

✅What This Script Does:

Calculates and displays the main option greeks for both Call and Put options.

Highlights sensitivity of option prices to changes in:

Underlying price (Delta, Gamma)

Time decay (Theta)

Implied Volatility Calculation.

Tracks live changes in IV and allows comparison across strikes and expiries.

Helps identify favorable option setups and hedging opportunities.

Designed for Bank Nifty, Nifty 50, and top NSE FnO stocks.

✅ How It Works (Conceptually):

Uses a simplified Black-Scholes model adapted for Indian markets.

Takes into account underlying price, strike, days to expiry, interest rate, and volatility to compute the Greeks. Plots real-time values on chart

Manually You need to input the ATM Strike and nearest expiry to update Greeks accordingly.

✅ Who Should Use It:

Options traders seeking deeper insight beyond price charts.

Scalpers and positional traders looking to understand how their trades react to time, price, and volatility.

Anyone trading on NSE’s F&O segment who wants to make smarter trades based on calculated risk metrics

Option Geeks is a powerful tool designed for options traders on the NSE (National Stock Exchange of India). It provides real-time visualization and insights based on key option greeks such as Delta, Gamma, Theta, and Implied Volatility (IV) — enabling traders to make more informed decisions when analyzing option chains and positions.

✅What This Script Does:

Calculates and displays the main option greeks for both Call and Put options.

Highlights sensitivity of option prices to changes in:

Underlying price (Delta, Gamma)

Time decay (Theta)

Implied Volatility Calculation.

Tracks live changes in IV and allows comparison across strikes and expiries.

Helps identify favorable option setups and hedging opportunities.

Designed for Bank Nifty, Nifty 50, and top NSE FnO stocks.

✅ How It Works (Conceptually):

Uses a simplified Black-Scholes model adapted for Indian markets.

Takes into account underlying price, strike, days to expiry, interest rate, and volatility to compute the Greeks. Plots real-time values on chart

Manually You need to input the ATM Strike and nearest expiry to update Greeks accordingly.

✅ Who Should Use It:

Options traders seeking deeper insight beyond price charts.

Scalpers and positional traders looking to understand how their trades react to time, price, and volatility.

Anyone trading on NSE’s F&O segment who wants to make smarter trades based on calculated risk metrics

Sürüm Notları

Now you can Project the Option price Every input is given a tooltip read it to understand how to use the indicator

Korumalı komut dosyası

Bu komut dosyası kapalı kaynak olarak yayınlanmaktadır. Ancak, ücretsiz ve herhangi bir sınırlama olmaksızın kullanabilirsiniz – daha fazla bilgiyi buradan edinebilirsiniz.

TeamTaurus

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, alım satım veya diğer türden tavsiye veya öneriler anlamına gelmez ve teşkil etmez. Kullanım Koşulları bölümünde daha fazlasını okuyun.

Korumalı komut dosyası

Bu komut dosyası kapalı kaynak olarak yayınlanmaktadır. Ancak, ücretsiz ve herhangi bir sınırlama olmaksızın kullanabilirsiniz – daha fazla bilgiyi buradan edinebilirsiniz.

TeamTaurus

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, alım satım veya diğer türden tavsiye veya öneriler anlamına gelmez ve teşkil etmez. Kullanım Koşulları bölümünde daha fazlasını okuyun.