PROTECTED SOURCE SCRIPT

Price Action [SignalCave]

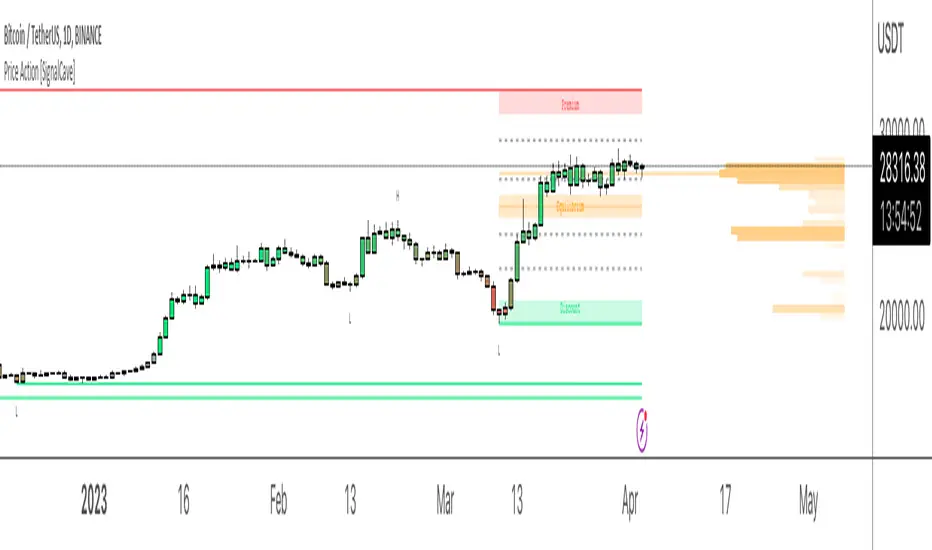

Liquidation prices are calculated with Higher Timeframe usage of "Williams Fractals" indicator.

Sell side liquidity levels are shown with "L" text and a green solid lines.

Buy side liquidity levels are shown with "H" text and a red solid lines.

Premium and Discount zones are determined with latest untested buy/sell liquidity levels.

"Premium" means the asset price is overvalued, "Discount" means the asset is undervalued.

Once price hits any active liquidity level, "Premium and Discount" zone will be recalculated.

Premium and Discount have "Equilibrium" area which is center area of the whole zone.

Extra Support & Resistance levels calculation are based on Fibonacci. Levels are 23.6%, 38.2%, 61.8% and 78.6%.

Bars are painted based on asset's momentum. The asset momentum is calculated by the RSI and ADX indicators.

Volume profile shows trade activity during the "Premium and Discount" zone.

Sell side liquidity levels are shown with "L" text and a green solid lines.

Buy side liquidity levels are shown with "H" text and a red solid lines.

Premium and Discount zones are determined with latest untested buy/sell liquidity levels.

"Premium" means the asset price is overvalued, "Discount" means the asset is undervalued.

Once price hits any active liquidity level, "Premium and Discount" zone will be recalculated.

Premium and Discount have "Equilibrium" area which is center area of the whole zone.

Extra Support & Resistance levels calculation are based on Fibonacci. Levels are 23.6%, 38.2%, 61.8% and 78.6%.

Bars are painted based on asset's momentum. The asset momentum is calculated by the RSI and ADX indicators.

Volume profile shows trade activity during the "Premium and Discount" zone.

Korumalı komut dosyası

Bu komut dosyası kapalı kaynak olarak yayınlanmaktadır. Ancak, ücretsiz ve herhangi bir sınırlama olmaksızın kullanabilirsiniz – daha fazla bilgiyi buradan edinebilirsiniz.

Pine Script Code Generator:

getpinescript.com/

Optimize Your TradingView Strategies:

pinetune.app

Trading Simulation Game:

Dare2Trade.com

Pine Script Job Proposals:

t.me/kriswaters

getpinescript.com/

Optimize Your TradingView Strategies:

pinetune.app

Trading Simulation Game:

Dare2Trade.com

Pine Script Job Proposals:

t.me/kriswaters

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, alım satım veya diğer türden tavsiye veya öneriler anlamına gelmez ve teşkil etmez. Kullanım Koşulları bölümünde daha fazlasını okuyun.

Korumalı komut dosyası

Bu komut dosyası kapalı kaynak olarak yayınlanmaktadır. Ancak, ücretsiz ve herhangi bir sınırlama olmaksızın kullanabilirsiniz – daha fazla bilgiyi buradan edinebilirsiniz.

Pine Script Code Generator:

getpinescript.com/

Optimize Your TradingView Strategies:

pinetune.app

Trading Simulation Game:

Dare2Trade.com

Pine Script Job Proposals:

t.me/kriswaters

getpinescript.com/

Optimize Your TradingView Strategies:

pinetune.app

Trading Simulation Game:

Dare2Trade.com

Pine Script Job Proposals:

t.me/kriswaters

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, alım satım veya diğer türden tavsiye veya öneriler anlamına gelmez ve teşkil etmez. Kullanım Koşulları bölümünde daha fazlasını okuyun.