OPEN-SOURCE SCRIPT

TwistedHWAY Oracle - Intelligent Level Detection System

═════════════════════════════════════════════════════════════════════════

🎯 TwistedHWAY Oracle™ - Intelligent Level Detection System

═════════════════════════════════════════════════════════════════════════

OVERVIEW

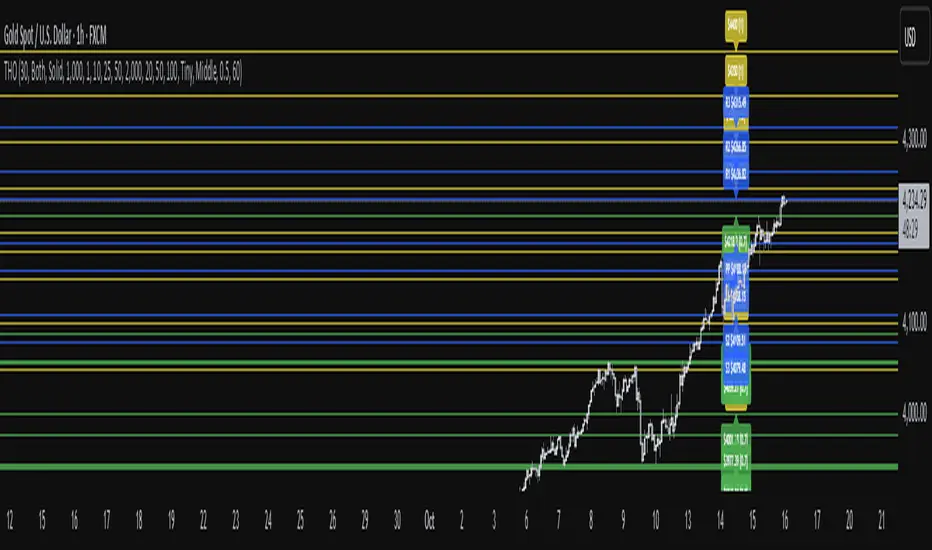

TwistedHWAY Oracle™ combines six independent calculation engines to identify high-probability support and resistance levels. The indicator uses adaptive market regime detection and confluence analysis to automatically rank levels by confidence score, helping traders identify key reaction zones where price is likely to find support or resistance.

KEY FEATURES

The indicator provides comprehensive level detection through:

DETECTION ENGINES

1 — Pivot Points Engine

Calculates daily pivot levels including PP, R1-R3, and S1-S3 using previous day's high, low, and close.

2 — Swing Detector

Identifies significant swing highs and lows using prominence filtering to eliminate noise.

3 — Psychological Matrix

Detects round number levels at three configurable increments (default: 10, 25, 50).

4 — Fibonacci Engine

Calculates retracement levels (23.6%, 38.2%, 50%, 61.8%, 78.6%) from major swings.

5 — VWAP System

Generates volume-weighted average price levels at three different periods.

6 — Confluence Analyzer

Awards bonus confidence points when multiple engines identify the same level.

HOW TO USE

Reading the Levels

Trading Strategies

SETTINGS GUIDE

Oracle Settings

Individual Engine Controls

Each engine can be toggled on/off with separate alert controls:

Visual Settings

Alert Configuration

ADAPTIVE PARAMETERS

The indicator automatically adjusts to market conditions:

Market regime is detected using 100-period volatility measurement with automatic threshold adjustment.

ALERTS

Five alert types plus special confluence alerts:

Alerts include price level, confidence score, and source information.

BEST PRACTICES

Timeframe Selection

Optimization by Instrument

Forex:

Psychological increments: 0.0010, 0.0050, 0.0100

Stocks (Low-priced):

Psychological increments: 1, 5, 10

Stocks (High-priced):

Psychological increments: 10, 25, 50

Crypto:

Adjust based on price range and volatility

LIMITATIONS

NOTES

═════════════════════════════════════════════════════════════════════════

Version: 3.0 | Build 2025.10

License: GNU GPL v3.0

© 2025 TwistedHWAY

═════════════════════════════════════════════════════════════════════════

🎯 TwistedHWAY Oracle™ - Intelligent Level Detection System

═════════════════════════════════════════════════════════════════════════

OVERVIEW

TwistedHWAY Oracle™ combines six independent calculation engines to identify high-probability support and resistance levels. The indicator uses adaptive market regime detection and confluence analysis to automatically rank levels by confidence score, helping traders identify key reaction zones where price is likely to find support or resistance.

KEY FEATURES

The indicator provides comprehensive level detection through:

- Six Detection Engines — Each engine operates independently with its own alert system

- Confluence Analysis — Automatically awards bonus confidence when multiple engines identify the same level

- Adaptive Intelligence — Market volatility detection adjusts parameters in real-time

- Confidence Scoring — Every level is ranked and displayed with a numerical confidence score

- Individual Alerts — Separate alert controls for each detection method

DETECTION ENGINES

1 — Pivot Points Engine

Calculates daily pivot levels including PP, R1-R3, and S1-S3 using previous day's high, low, and close.

2 — Swing Detector

Identifies significant swing highs and lows using prominence filtering to eliminate noise.

3 — Psychological Matrix

Detects round number levels at three configurable increments (default: 10, 25, 50).

4 — Fibonacci Engine

Calculates retracement levels (23.6%, 38.2%, 50%, 61.8%, 78.6%) from major swings.

5 — VWAP System

Generates volume-weighted average price levels at three different periods.

6 — Confluence Analyzer

Awards bonus confidence points when multiple engines identify the same level.

HOW TO USE

Reading the Levels

- Levels above current price = Resistance (red by default)

- Levels below current price = Support (green by default)

- Numbers in brackets show confidence score [0.0-3.0+]

- Higher confidence = stronger level

- Levels with score > 2.0 indicate extreme confluences

Trading Strategies

- Bounce Trading — Enter positions when price approaches high-confidence levels expecting reversal

- Breakout Trading — Trade breakouts through levels, using broken level as stop-loss

- Confluence Zones — Focus on areas where multiple engines agree

SETTINGS GUIDE

Oracle Settings

- Validation Mode — Conservative parameters for more reliable signals

- Max Levels — Number of levels to display (10-50)

- Level Extension — Line extension direction (None/Left/Right/Both)

Individual Engine Controls

Each engine can be toggled on/off with separate alert controls:

- Pivot Engine (daily pivots)

- Swing Detector (historical swings)

- Psychological Matrix (round numbers)

- Fibonacci Engine (retracements)

- VWAP System (volume-weighted levels)

Visual Settings

- Individual color selection for each level type

- Label display toggle with size options

- Line style preferences (Solid/Dashed/Dotted)

Alert Configuration

- Alert Distance % — Proximity threshold (default: 0.5%)

- Alert Cooldown — Minimum bars between alerts (default: 60)

- Individual alert toggles for each engine

ADAPTIVE PARAMETERS

The indicator automatically adjusts to market conditions:

- High Volatility Mode — Wider swing detection, stricter prominence filters

- Normal Mode — Balanced parameters for typical market conditions

- Validation Mode — Most conservative settings for reliable signals

Market regime is detected using 100-period volatility measurement with automatic threshold adjustment.

ALERTS

Five alert types plus special confluence alerts:

- 🎯 Pivot Alerts — Daily pivot level approaches

- 🌊 Swing Alerts — Historical swing level tests

- 🧠 Psychological Alerts — Round number approaches

- 🌀 Fibonacci Alerts — Retracement level tests

- 📉 VWAP Alerts — Volume-weighted level approaches

- ⚡ Critical Alerts — Ultra-high confidence levels (score ≥ 2.0)

Alerts include price level, confidence score, and source information.

BEST PRACTICES

Timeframe Selection

- Works on all timeframes (optimized for 5min to Daily)

- Higher timeframes = more reliable levels

- Use multi-timeframe analysis for confirmation

Optimization by Instrument

Forex:

Psychological increments: 0.0010, 0.0050, 0.0100

Stocks (Low-priced):

Psychological increments: 1, 5, 10

Stocks (High-priced):

Psychological increments: 10, 25, 50

Crypto:

Adjust based on price range and volatility

LIMITATIONS

- Calculation intensive on last bar (may cause slight delays)

- Maximum 50 levels can be displayed simultaneously

- Swing detection requires minimum 25 bars of history

- VWAP calculations use price range as volume proxy when volume unavailable

NOTES

- Levels are recalculated on each bar close

- Confidence scores update dynamically with market conditions

- Colors automatically adjust based on price position

- All settings are saved with chart layout

═════════════════════════════════════════════════════════════════════════

Version: 3.0 | Build 2025.10

License: GNU GPL v3.0

© 2025 TwistedHWAY

═════════════════════════════════════════════════════════════════════════

Açık kaynak kodlu komut dosyası

Gerçek TradingView ruhuyla, bu komut dosyasının mimarı, yatırımcıların işlevselliğini inceleyip doğrulayabilmesi için onu açık kaynaklı hale getirdi. Yazarı tebrik ederiz! Ücretsiz olarak kullanabilseniz de, kodu yeniden yayınlamanın Topluluk Kurallarımıza tabi olduğunu unutmayın.

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, alım satım veya diğer türden tavsiye veya öneriler anlamına gelmez ve teşkil etmez. Kullanım Koşulları bölümünde daha fazlasını okuyun.

Açık kaynak kodlu komut dosyası

Gerçek TradingView ruhuyla, bu komut dosyasının mimarı, yatırımcıların işlevselliğini inceleyip doğrulayabilmesi için onu açık kaynaklı hale getirdi. Yazarı tebrik ederiz! Ücretsiz olarak kullanabilseniz de, kodu yeniden yayınlamanın Topluluk Kurallarımıza tabi olduğunu unutmayın.

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, alım satım veya diğer türden tavsiye veya öneriler anlamına gelmez ve teşkil etmez. Kullanım Koşulları bölümünde daha fazlasını okuyun.