OPEN-SOURCE SCRIPT

Grothendieck-Teichmüller Geometric Synthesis

Dskyz's Grothendieck-Teichmüller Geometric Synthesis (GTGS)

THEORETICAL FOUNDATION: A SYMPHONY OF GEOMETRIES

The 🎓 GTGS is built upon a revolutionary premise: that market dynamics can be modeled as geometric and topological structures. While not a literal academic implementation—such a task would demand computational power far beyond current trading platforms—it leverages core ideas from advanced mathematical theories as powerful analogies and frameworks for its algorithms. Each component translates an abstract concept into a practical market calculation, distinguishing GTGS by identifying deeper structural patterns rather than relying on standard statistical measures.

1. Grothendieck-Teichmüller Theory: Deforming Market Structure

The Theory: Studies symmetries and deformations of geometric objects, focusing on the "absolute" structure of mathematical spaces.

Indicator Analogy: The calculate_grothendieck_field function models price action as a "deformation" from its immediate state. Using the nth root of price ratios (math.pow(price_ratio, 1.0/prime)), it measures market "shape" stretching or compression, revealing underlying tensions and potential shifts.

2. Topos Theory & Sheaf Cohomology: From Local to Global Patterns

The Theory: A framework for assembling local properties into a global picture, with cohomology measuring "obstructions" to consistency.

Indicator Analogy: The calculate_topos_coherence function uses sine waves (math.sin) to represent local price "sections." Summing these yields a "cohomology" value, quantifying price action consistency. High values indicate coherent trends; low values signal conflict and uncertainty.

3. Tropical Geometry: Simplifying Complexity

The Theory: Transforms complex multiplicative problems into simpler, additive, piecewise-linear ones using min(a, b) for addition and a + b for multiplication.

Indicator Analogy: The calculate_tropical_metric function applies tropical_add(a, b) => math.min(a, b) to identify the "lowest energy" state among recent price points, pinpointing critical support levels non-linearly.

4. Motivic Cohomology & Non-Commutative Geometry

The Theory: Studies deep arithmetic and quantum-like properties of geometric spaces.

Indicator Analogy: The motivic_rank and spectral_triple functions compute weighted sums of historical prices to capture market "arithmetic complexity" and "spectral signature." Higher values reflect structured, harmonic price movements.

5. Perfectoid Spaces & Homotopy Type Theory

The Theory: Abstract fields dealing with p-adic numbers and logical foundations of mathematics.

Indicator Analogy: The perfectoid_conv and type_coherence functions analyze price convergence and path identity, assessing the "fractal dust" of price differences and price path cohesion, adding fractal and logical analysis.

The Combination is Key: No single theory dominates. GTGS’s Unified Field synthesizes all seven perspectives into a comprehensive score, ensuring signals reflect deep structural alignment across mathematical domains.

🎛️ INPUTS: CONFIGURING THE GEOMETRIC ENGINE

The GTGS offers a suite of customizable inputs, allowing traders to tailor its behavior to specific timeframes, market sectors, and trading styles. Below is a detailed breakdown of key input groups, their functionality, and optimization strategies, leveraging provided tooltips for precision.

Grothendieck-Teichmüller Theory Inputs

🧬 Deformation Depth (Absolute Galois):

What It Is: Controls the depth of Galois group deformations analyzed in market structure.

How It Works: Measures price action deformations under automorphisms of the absolute Galois group, capturing market symmetries.

Optimization:

Higher Values (15-20): Captures deeper symmetries, ideal for major trends in swing trading (4H-1D).

Lower Values (3-8): Responsive to local deformations, suited for scalping (1-5min).

Timeframes:

Scalping (1-5min): 3-6 for quick local shifts.

Day Trading (15min-1H): 8-12 for balanced analysis.

Swing Trading (4H-1D): 12-20 for deep structural trends.

Sectors:

Stocks: Use 8-12 for stable trends.

Crypto: 3-8 for volatile, short-term moves.

Forex: 12-15 for smooth, cyclical patterns.

Pro Tip: Increase in trending markets to filter noise; decrease in choppy markets for sensitivity.

🗼 Teichmüller Tower Height:

What It Is: Determines the height of the Teichmüller modular tower for hierarchical pattern detection.

How It Works: Builds modular levels to identify nested market patterns.

Optimization:

Higher Values (6-8): Detects complex fractals, ideal for swing trading.

Lower Values (2-4): Focuses on primary patterns, faster for scalping.

Timeframes:

Scalping: 2-3 for speed.

Day Trading: 4-5 for balanced patterns.

Swing Trading: 5-8 for deep fractals.

Sectors:

Indices: 5-8 for robust, long-term patterns.

Crypto: 2-4 for rapid shifts.

Commodities: 4-6 for cyclical trends.

Pro Tip: Higher towers reveal hidden fractals but may slow computation; adjust based on hardware.

🔢 Galois Prime Base:

What It Is: Sets the prime base for Galois field computations.

How It Works: Defines the field extension characteristic for market analysis.

Optimization:

Prime Characteristics:

2: Binary markets (up/down).

3: Ternary states (bull/bear/neutral).

5: Pentagonal symmetry (Elliott waves).

7: Heptagonal cycles (weekly patterns).

11,13,17,19: Higher-order patterns.

Timeframes:

Scalping/Day Trading: 2 or 3 for simplicity.

Swing Trading: 5 or 7 for wave or cycle detection.

Sectors:

Forex: 5 for Elliott wave alignment.

Stocks: 7 for weekly cycle consistency.

Crypto: 3 for volatile state shifts.

Pro Tip: Use 7 for most markets; 5 for Elliott wave traders.

Topos Theory & Sheaf Cohomology Inputs

🏛️ Temporal Site Size:

What It Is: Defines the number of time points in the topological site.

How It Works: Sets the local neighborhood for sheaf computations, affecting cohomology smoothness.

Optimization:

Higher Values (30-50): Smoother cohomology, better for trends in swing trading.

Lower Values (5-15): Responsive, ideal for reversals in scalping.

Timeframes:

Scalping: 5-10 for quick responses.

Day Trading: 15-25 for balanced analysis.

Swing Trading: 25-50 for smooth trends.

Sectors:

Stocks: 25-35 for stable trends.

Crypto: 5-15 for volatility.

Forex: 20-30 for smooth cycles.

Pro Tip: Match site size to your average holding period in bars for optimal coherence.

📐 Sheaf Cohomology Degree:

What It Is: Sets the maximum degree of cohomology groups computed.

How It Works: Higher degrees capture complex topological obstructions.

Optimization:

Degree Meanings:

1: Simple obstructions (basic support/resistance).

2: Cohomological pairs (double tops/bottoms).

3: Triple intersections (complex patterns).

4-5: Higher-order structures (rare events).

Timeframes:

Scalping/Day Trading: 1-2 for simplicity.

Swing Trading: 3 for complex patterns.

Sectors:

Indices: 2-3 for robust patterns.

Crypto: 1-2 for rapid shifts.

Commodities: 3-4 for cyclical events.

Pro Tip: Degree 3 is optimal for most trading; higher degrees for research or rare event detection.

🌐 Grothendieck Topology:

What It Is: Chooses the Grothendieck topology for the site.

How It Works: Affects how local data integrates into global patterns.

Optimization:

Topology Characteristics:

Étale: Finest topology, captures local-global principles.

Nisnevich: A1-invariant, good for trends.

Zariski: Coarse but robust, filters noise.

Fpqc: Faithfully flat, highly sensitive.

Sectors:

Stocks: Zariski for stability.

Crypto: Étale for sensitivity.

Forex: Nisnevich for smooth trends.

Indices: Zariski for robustness.

Timeframes:

Scalping: Étale for precision.

Swing Trading: Nisnevich or Zariski for reliability.

Pro Tip: Start with Étale for precision; switch to Zariski in noisy markets.

Unified Field Configuration Inputs

⚛️ Field Coupling Constant:

What It Is: Sets the interaction strength between geometric components.

How It Works: Controls signal amplification in the unified field equation.

Optimization:

Higher Values (0.5-1.0): Strong coupling, amplified signals for ranging markets.

Lower Values (0.001-0.1): Subtle signals for trending markets.

Timeframes:

Scalping: 0.5-0.8 for quick, strong signals.

Swing Trading: 0.1-0.3 for trend confirmation.

Sectors:

Crypto: 0.5-1.0 for volatility.

Stocks: 0.1-0.3 for stability.

Forex: 0.3-0.5 for balance.

Pro Tip: Default 0.137 (fine structure constant) is a balanced starting point; adjust up in choppy markets.

📐 Geometric Weighting Scheme:

What It Is: Determines the framework for combining geometric components.

How It Works: Adjusts emphasis on different mathematical structures.

Optimization:

Scheme Characteristics:

Canonical: Equal weighting, balanced.

Derived: Emphasizes higher-order structures.

Motivic: Prioritizes arithmetic properties.

Spectral: Focuses on frequency domain.

Sectors:

Stocks: Canonical for balance.

Crypto: Spectral for volatility.

Forex: Derived for structured moves.

Indices: Motivic for arithmetic cycles.

Timeframes:

Day Trading: Canonical or Derived for flexibility.

Swing Trading: Motivic for long-term cycles.

Pro Tip: Start with Canonical; experiment with Spectral in volatile markets.

Dashboard and Visual Configuration Inputs

📋 Show Enhanced Dashboard, 📏 Size, 📍 Position:

What They Are: Control dashboard visibility, size, and placement.

How They Work: Display key metrics like Unified Field, Resonance, and Signal Quality.

Optimization:

Scalping: Small size, Bottom Right for minimal chart obstruction.

Swing Trading: Large size, Top Right for detailed analysis.

Sectors: Universal across markets; adjust size based on screen setup.

Pro Tip: Use Large for analysis, Small for live trading.

📐 Show Motivic Cohomology Bands, 🌊 Morphism Flow, 🔮 Future Projection, 🔷 Holographic Mesh, ⚛️ Spectral Flow:

What They Are: Toggle visual elements representing mathematical calculations.

How They Work: Provide intuitive representations of market dynamics.

Optimization:

Timeframes:

Scalping: Enable Morphism Flow and Spectral Flow for momentum.

Swing Trading: Enable all for comprehensive analysis.

Sectors:

Crypto: Emphasize Morphism Flow and Future Projection for volatility.

Stocks: Focus on Cohomology Bands for stable trends.

Pro Tip: Disable non-essential visuals in fast markets to reduce clutter.

🌫️ Field Transparency, 🔄 Web Recursion Depth, 🎨 Mesh Color Scheme:

What They Are: Adjust visual clarity, complexity, and color.

How They Work: Enhance interpretability of visual elements.

Optimization:

Transparency: 30-50 for balanced visibility; lower for analysis.

Recursion Depth: 6-8 for balanced detail; lower for older hardware.

Color Scheme:

Purple/Blue: Analytical focus.

Green/Orange: Trading momentum.

Pro Tip: Use Neon Purple for deep analysis; Neon Green for active trading.

⏱️ Minimum Bars Between Signals:

What It Is: Minimum number of bars required between consecutive signals.

How It Works: Prevents signal clustering by enforcing a cooldown period.

Optimization:

Higher Values (10-20): Fewer signals, avoids whipsaws, suited for swing trading.

Lower Values (0-5): More responsive, allows quick reversals, ideal for scalping.

Timeframes:

Scalping: 0-2 bars for rapid signals.

Day Trading: 3-5 bars for balance.

Swing Trading: 5-10 bars for stability.

Sectors:

Crypto: 0-3 for volatility.

Stocks: 5-10 for trend clarity.

Forex: 3-7 for cyclical moves.

Pro Tip: Increase in choppy markets to filter noise.

Hardcoded Parameters

Tropical, Motivic, Spectral, Perfectoid, Homotopy Inputs: Fixed to optimize performance but influence calculations (e.g., tropical_degree=4 for support levels, perfectoid_prime=5 for convergence).

Optimization: Experiment with codebase modifications if advanced customization is needed, but defaults are robust across markets.

🎨 ADVANCED VISUAL SYSTEM: TRADING IN A GEOMETRIC UNIVERSE

The GTTMTSF’s visuals are direct representations of its mathematics, designed for intuitive and precise trading decisions.

Motivic Cohomology Bands:

What They Are: Dynamic bands (H⁰, H¹, H²) representing cohomological support/resistance.

Color & Meaning: Colors reflect energy levels (H⁰ tightest, H² widest). Breaks into H¹ signal momentum; H² touches suggest reversals.

How to Trade: Use for stop-loss/profit-taking. Band bounces with Dashboard confirmation are high-probability setups.

Morphism Flow (Webbing):

What It Is: White particle streams visualizing market momentum.

Interpretation: Dense flows indicate strong trends; sparse flows signal consolidation.

How to Trade: Follow dominant flow direction; new flows post-consolidation signal trend starts.

Future Projection Web (Fractal Grid):

What It Is: Fibonacci-period fractal projections of support/resistance.

Color & Meaning: Three-layer lines (white shadow, glow, colored quantum) with labels showing price, topological class, anomaly strength (φ), resonance (ρ), and obstruction (H¹). ⚡ marks extreme anomalies.

How to Trade: Target ⚡/● levels for entries/exits. High-anomaly levels with weakening Unified Field are reversal setups.

Holographic Mesh & Spectral Flow:

What They Are: Visuals of harmonic interference and spectral energy.

How to Trade: Bright mesh nodes or strong Spectral Flow warn of building pressure before price movement.

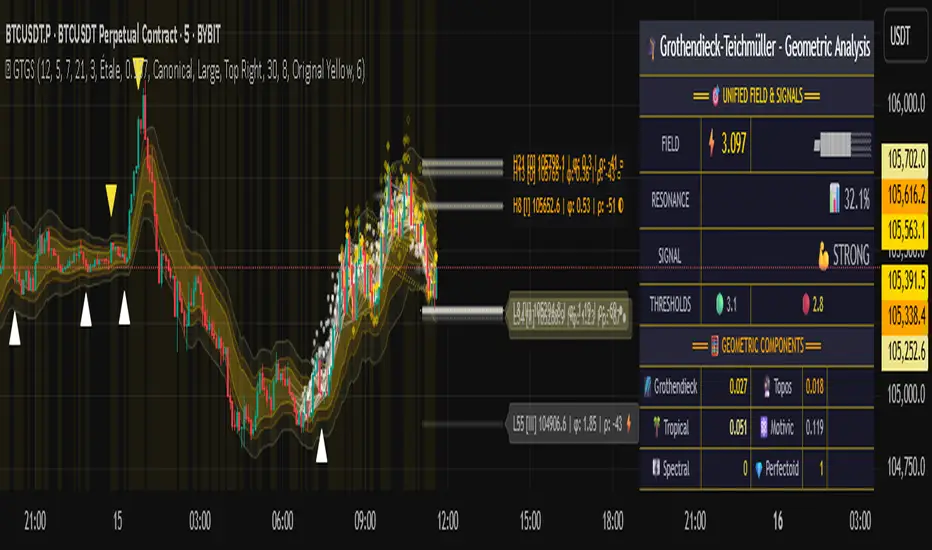

📊 THE GEOMETRIC DASHBOARD: YOUR MISSION CONTROL

The Dashboard translates complex mathematics into actionable intelligence.

Unified Field & Signals:

FIELD: Master value (-10 to +10), synthesizing all geometric components. Extreme readings (>5 or <-5) signal structural limits, often preceding reversals or continuations.

RESONANCE: Measures harmony between geometric field and price-volume momentum. Positive amplifies bullish moves; negative amplifies bearish moves.

SIGNAL QUALITY: Confidence meter rating alignment. Trade only STRONG or EXCEPTIONAL signals for high-probability setups.

Geometric Components:

What They Are: Breakdown of seven mathematical engines.

How to Use: Watch for convergence. A strong Unified Field is reliable when components (e.g., Grothendieck, Topos, Motivic) align. Divergence warns of trend weakening.

Signal Performance:

What It Is: Tracks indicator signal performance.

How to Use: Assesses real-time performance to build confidence and understand system behavior.

🚀 DEVELOPMENT & UNIQUENESS: BEYOND CONVENTIONAL ANALYSIS

The GTTMTSF was developed to analyze markets as evolving geometric objects, not statistical time-series.

Why This Is Unlike Anything Else:

Theoretical Depth: Uses geometry and topology, identifying patterns invisible to statistical tools.

Holistic Synthesis: Integrates seven deep mathematical frameworks into a cohesive Unified Field.

Creative Implementation: Translates PhD-level mathematics into functional Pine Script, blending theory and practice.

Immersive Visualization: Transforms charts into dynamic geometric landscapes for intuitive market understanding.

The GTTMTSF is more than an indicator; it’s a new lens for viewing markets, for traders seeking deeper insight into hidden order within chaos.

"Where there is matter, there is geometry." - Johannes Kepler

— Dskyz, Trade with insight. Trade with anticipation.

THEORETICAL FOUNDATION: A SYMPHONY OF GEOMETRIES

The 🎓 GTGS is built upon a revolutionary premise: that market dynamics can be modeled as geometric and topological structures. While not a literal academic implementation—such a task would demand computational power far beyond current trading platforms—it leverages core ideas from advanced mathematical theories as powerful analogies and frameworks for its algorithms. Each component translates an abstract concept into a practical market calculation, distinguishing GTGS by identifying deeper structural patterns rather than relying on standard statistical measures.

1. Grothendieck-Teichmüller Theory: Deforming Market Structure

The Theory: Studies symmetries and deformations of geometric objects, focusing on the "absolute" structure of mathematical spaces.

Indicator Analogy: The calculate_grothendieck_field function models price action as a "deformation" from its immediate state. Using the nth root of price ratios (math.pow(price_ratio, 1.0/prime)), it measures market "shape" stretching or compression, revealing underlying tensions and potential shifts.

2. Topos Theory & Sheaf Cohomology: From Local to Global Patterns

The Theory: A framework for assembling local properties into a global picture, with cohomology measuring "obstructions" to consistency.

Indicator Analogy: The calculate_topos_coherence function uses sine waves (math.sin) to represent local price "sections." Summing these yields a "cohomology" value, quantifying price action consistency. High values indicate coherent trends; low values signal conflict and uncertainty.

3. Tropical Geometry: Simplifying Complexity

The Theory: Transforms complex multiplicative problems into simpler, additive, piecewise-linear ones using min(a, b) for addition and a + b for multiplication.

Indicator Analogy: The calculate_tropical_metric function applies tropical_add(a, b) => math.min(a, b) to identify the "lowest energy" state among recent price points, pinpointing critical support levels non-linearly.

4. Motivic Cohomology & Non-Commutative Geometry

The Theory: Studies deep arithmetic and quantum-like properties of geometric spaces.

Indicator Analogy: The motivic_rank and spectral_triple functions compute weighted sums of historical prices to capture market "arithmetic complexity" and "spectral signature." Higher values reflect structured, harmonic price movements.

5. Perfectoid Spaces & Homotopy Type Theory

The Theory: Abstract fields dealing with p-adic numbers and logical foundations of mathematics.

Indicator Analogy: The perfectoid_conv and type_coherence functions analyze price convergence and path identity, assessing the "fractal dust" of price differences and price path cohesion, adding fractal and logical analysis.

The Combination is Key: No single theory dominates. GTGS’s Unified Field synthesizes all seven perspectives into a comprehensive score, ensuring signals reflect deep structural alignment across mathematical domains.

🎛️ INPUTS: CONFIGURING THE GEOMETRIC ENGINE

The GTGS offers a suite of customizable inputs, allowing traders to tailor its behavior to specific timeframes, market sectors, and trading styles. Below is a detailed breakdown of key input groups, their functionality, and optimization strategies, leveraging provided tooltips for precision.

Grothendieck-Teichmüller Theory Inputs

🧬 Deformation Depth (Absolute Galois):

What It Is: Controls the depth of Galois group deformations analyzed in market structure.

How It Works: Measures price action deformations under automorphisms of the absolute Galois group, capturing market symmetries.

Optimization:

Higher Values (15-20): Captures deeper symmetries, ideal for major trends in swing trading (4H-1D).

Lower Values (3-8): Responsive to local deformations, suited for scalping (1-5min).

Timeframes:

Scalping (1-5min): 3-6 for quick local shifts.

Day Trading (15min-1H): 8-12 for balanced analysis.

Swing Trading (4H-1D): 12-20 for deep structural trends.

Sectors:

Stocks: Use 8-12 for stable trends.

Crypto: 3-8 for volatile, short-term moves.

Forex: 12-15 for smooth, cyclical patterns.

Pro Tip: Increase in trending markets to filter noise; decrease in choppy markets for sensitivity.

🗼 Teichmüller Tower Height:

What It Is: Determines the height of the Teichmüller modular tower for hierarchical pattern detection.

How It Works: Builds modular levels to identify nested market patterns.

Optimization:

Higher Values (6-8): Detects complex fractals, ideal for swing trading.

Lower Values (2-4): Focuses on primary patterns, faster for scalping.

Timeframes:

Scalping: 2-3 for speed.

Day Trading: 4-5 for balanced patterns.

Swing Trading: 5-8 for deep fractals.

Sectors:

Indices: 5-8 for robust, long-term patterns.

Crypto: 2-4 for rapid shifts.

Commodities: 4-6 for cyclical trends.

Pro Tip: Higher towers reveal hidden fractals but may slow computation; adjust based on hardware.

🔢 Galois Prime Base:

What It Is: Sets the prime base for Galois field computations.

How It Works: Defines the field extension characteristic for market analysis.

Optimization:

Prime Characteristics:

2: Binary markets (up/down).

3: Ternary states (bull/bear/neutral).

5: Pentagonal symmetry (Elliott waves).

7: Heptagonal cycles (weekly patterns).

11,13,17,19: Higher-order patterns.

Timeframes:

Scalping/Day Trading: 2 or 3 for simplicity.

Swing Trading: 5 or 7 for wave or cycle detection.

Sectors:

Forex: 5 for Elliott wave alignment.

Stocks: 7 for weekly cycle consistency.

Crypto: 3 for volatile state shifts.

Pro Tip: Use 7 for most markets; 5 for Elliott wave traders.

Topos Theory & Sheaf Cohomology Inputs

🏛️ Temporal Site Size:

What It Is: Defines the number of time points in the topological site.

How It Works: Sets the local neighborhood for sheaf computations, affecting cohomology smoothness.

Optimization:

Higher Values (30-50): Smoother cohomology, better for trends in swing trading.

Lower Values (5-15): Responsive, ideal for reversals in scalping.

Timeframes:

Scalping: 5-10 for quick responses.

Day Trading: 15-25 for balanced analysis.

Swing Trading: 25-50 for smooth trends.

Sectors:

Stocks: 25-35 for stable trends.

Crypto: 5-15 for volatility.

Forex: 20-30 for smooth cycles.

Pro Tip: Match site size to your average holding period in bars for optimal coherence.

📐 Sheaf Cohomology Degree:

What It Is: Sets the maximum degree of cohomology groups computed.

How It Works: Higher degrees capture complex topological obstructions.

Optimization:

Degree Meanings:

1: Simple obstructions (basic support/resistance).

2: Cohomological pairs (double tops/bottoms).

3: Triple intersections (complex patterns).

4-5: Higher-order structures (rare events).

Timeframes:

Scalping/Day Trading: 1-2 for simplicity.

Swing Trading: 3 for complex patterns.

Sectors:

Indices: 2-3 for robust patterns.

Crypto: 1-2 for rapid shifts.

Commodities: 3-4 for cyclical events.

Pro Tip: Degree 3 is optimal for most trading; higher degrees for research or rare event detection.

🌐 Grothendieck Topology:

What It Is: Chooses the Grothendieck topology for the site.

How It Works: Affects how local data integrates into global patterns.

Optimization:

Topology Characteristics:

Étale: Finest topology, captures local-global principles.

Nisnevich: A1-invariant, good for trends.

Zariski: Coarse but robust, filters noise.

Fpqc: Faithfully flat, highly sensitive.

Sectors:

Stocks: Zariski for stability.

Crypto: Étale for sensitivity.

Forex: Nisnevich for smooth trends.

Indices: Zariski for robustness.

Timeframes:

Scalping: Étale for precision.

Swing Trading: Nisnevich or Zariski for reliability.

Pro Tip: Start with Étale for precision; switch to Zariski in noisy markets.

Unified Field Configuration Inputs

⚛️ Field Coupling Constant:

What It Is: Sets the interaction strength between geometric components.

How It Works: Controls signal amplification in the unified field equation.

Optimization:

Higher Values (0.5-1.0): Strong coupling, amplified signals for ranging markets.

Lower Values (0.001-0.1): Subtle signals for trending markets.

Timeframes:

Scalping: 0.5-0.8 for quick, strong signals.

Swing Trading: 0.1-0.3 for trend confirmation.

Sectors:

Crypto: 0.5-1.0 for volatility.

Stocks: 0.1-0.3 for stability.

Forex: 0.3-0.5 for balance.

Pro Tip: Default 0.137 (fine structure constant) is a balanced starting point; adjust up in choppy markets.

📐 Geometric Weighting Scheme:

What It Is: Determines the framework for combining geometric components.

How It Works: Adjusts emphasis on different mathematical structures.

Optimization:

Scheme Characteristics:

Canonical: Equal weighting, balanced.

Derived: Emphasizes higher-order structures.

Motivic: Prioritizes arithmetic properties.

Spectral: Focuses on frequency domain.

Sectors:

Stocks: Canonical for balance.

Crypto: Spectral for volatility.

Forex: Derived for structured moves.

Indices: Motivic for arithmetic cycles.

Timeframes:

Day Trading: Canonical or Derived for flexibility.

Swing Trading: Motivic for long-term cycles.

Pro Tip: Start with Canonical; experiment with Spectral in volatile markets.

Dashboard and Visual Configuration Inputs

📋 Show Enhanced Dashboard, 📏 Size, 📍 Position:

What They Are: Control dashboard visibility, size, and placement.

How They Work: Display key metrics like Unified Field, Resonance, and Signal Quality.

Optimization:

Scalping: Small size, Bottom Right for minimal chart obstruction.

Swing Trading: Large size, Top Right for detailed analysis.

Sectors: Universal across markets; adjust size based on screen setup.

Pro Tip: Use Large for analysis, Small for live trading.

📐 Show Motivic Cohomology Bands, 🌊 Morphism Flow, 🔮 Future Projection, 🔷 Holographic Mesh, ⚛️ Spectral Flow:

What They Are: Toggle visual elements representing mathematical calculations.

How They Work: Provide intuitive representations of market dynamics.

Optimization:

Timeframes:

Scalping: Enable Morphism Flow and Spectral Flow for momentum.

Swing Trading: Enable all for comprehensive analysis.

Sectors:

Crypto: Emphasize Morphism Flow and Future Projection for volatility.

Stocks: Focus on Cohomology Bands for stable trends.

Pro Tip: Disable non-essential visuals in fast markets to reduce clutter.

🌫️ Field Transparency, 🔄 Web Recursion Depth, 🎨 Mesh Color Scheme:

What They Are: Adjust visual clarity, complexity, and color.

How They Work: Enhance interpretability of visual elements.

Optimization:

Transparency: 30-50 for balanced visibility; lower for analysis.

Recursion Depth: 6-8 for balanced detail; lower for older hardware.

Color Scheme:

Purple/Blue: Analytical focus.

Green/Orange: Trading momentum.

Pro Tip: Use Neon Purple for deep analysis; Neon Green for active trading.

⏱️ Minimum Bars Between Signals:

What It Is: Minimum number of bars required between consecutive signals.

How It Works: Prevents signal clustering by enforcing a cooldown period.

Optimization:

Higher Values (10-20): Fewer signals, avoids whipsaws, suited for swing trading.

Lower Values (0-5): More responsive, allows quick reversals, ideal for scalping.

Timeframes:

Scalping: 0-2 bars for rapid signals.

Day Trading: 3-5 bars for balance.

Swing Trading: 5-10 bars for stability.

Sectors:

Crypto: 0-3 for volatility.

Stocks: 5-10 for trend clarity.

Forex: 3-7 for cyclical moves.

Pro Tip: Increase in choppy markets to filter noise.

Hardcoded Parameters

Tropical, Motivic, Spectral, Perfectoid, Homotopy Inputs: Fixed to optimize performance but influence calculations (e.g., tropical_degree=4 for support levels, perfectoid_prime=5 for convergence).

Optimization: Experiment with codebase modifications if advanced customization is needed, but defaults are robust across markets.

🎨 ADVANCED VISUAL SYSTEM: TRADING IN A GEOMETRIC UNIVERSE

The GTTMTSF’s visuals are direct representations of its mathematics, designed for intuitive and precise trading decisions.

Motivic Cohomology Bands:

What They Are: Dynamic bands (H⁰, H¹, H²) representing cohomological support/resistance.

Color & Meaning: Colors reflect energy levels (H⁰ tightest, H² widest). Breaks into H¹ signal momentum; H² touches suggest reversals.

How to Trade: Use for stop-loss/profit-taking. Band bounces with Dashboard confirmation are high-probability setups.

Morphism Flow (Webbing):

What It Is: White particle streams visualizing market momentum.

Interpretation: Dense flows indicate strong trends; sparse flows signal consolidation.

How to Trade: Follow dominant flow direction; new flows post-consolidation signal trend starts.

Future Projection Web (Fractal Grid):

What It Is: Fibonacci-period fractal projections of support/resistance.

Color & Meaning: Three-layer lines (white shadow, glow, colored quantum) with labels showing price, topological class, anomaly strength (φ), resonance (ρ), and obstruction (H¹). ⚡ marks extreme anomalies.

How to Trade: Target ⚡/● levels for entries/exits. High-anomaly levels with weakening Unified Field are reversal setups.

Holographic Mesh & Spectral Flow:

What They Are: Visuals of harmonic interference and spectral energy.

How to Trade: Bright mesh nodes or strong Spectral Flow warn of building pressure before price movement.

📊 THE GEOMETRIC DASHBOARD: YOUR MISSION CONTROL

The Dashboard translates complex mathematics into actionable intelligence.

Unified Field & Signals:

FIELD: Master value (-10 to +10), synthesizing all geometric components. Extreme readings (>5 or <-5) signal structural limits, often preceding reversals or continuations.

RESONANCE: Measures harmony between geometric field and price-volume momentum. Positive amplifies bullish moves; negative amplifies bearish moves.

SIGNAL QUALITY: Confidence meter rating alignment. Trade only STRONG or EXCEPTIONAL signals for high-probability setups.

Geometric Components:

What They Are: Breakdown of seven mathematical engines.

How to Use: Watch for convergence. A strong Unified Field is reliable when components (e.g., Grothendieck, Topos, Motivic) align. Divergence warns of trend weakening.

Signal Performance:

What It Is: Tracks indicator signal performance.

How to Use: Assesses real-time performance to build confidence and understand system behavior.

🚀 DEVELOPMENT & UNIQUENESS: BEYOND CONVENTIONAL ANALYSIS

The GTTMTSF was developed to analyze markets as evolving geometric objects, not statistical time-series.

Why This Is Unlike Anything Else:

Theoretical Depth: Uses geometry and topology, identifying patterns invisible to statistical tools.

Holistic Synthesis: Integrates seven deep mathematical frameworks into a cohesive Unified Field.

Creative Implementation: Translates PhD-level mathematics into functional Pine Script, blending theory and practice.

Immersive Visualization: Transforms charts into dynamic geometric landscapes for intuitive market understanding.

The GTTMTSF is more than an indicator; it’s a new lens for viewing markets, for traders seeking deeper insight into hidden order within chaos.

"Where there is matter, there is geometry." - Johannes Kepler

— Dskyz, Trade with insight. Trade with anticipation.

Açık kaynak kodlu komut dosyası

Gerçek TradingView ruhuyla, bu komut dosyasının mimarı, yatırımcıların işlevselliğini inceleyip doğrulayabilmesi için onu açık kaynaklı hale getirdi. Yazarı tebrik ederiz! Ücretsiz olarak kullanabilseniz de, kodu yeniden yayınlamanın Topluluk Kurallarımıza tabi olduğunu unutmayın.

Empowering everyday traders and DAFE Trading Systems

DAFETradingSystems.com

DAFETradingSystems.com

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, alım satım veya diğer türden tavsiye veya öneriler anlamına gelmez ve teşkil etmez. Kullanım Koşulları bölümünde daha fazlasını okuyun.

Açık kaynak kodlu komut dosyası

Gerçek TradingView ruhuyla, bu komut dosyasının mimarı, yatırımcıların işlevselliğini inceleyip doğrulayabilmesi için onu açık kaynaklı hale getirdi. Yazarı tebrik ederiz! Ücretsiz olarak kullanabilseniz de, kodu yeniden yayınlamanın Topluluk Kurallarımıza tabi olduğunu unutmayın.

Empowering everyday traders and DAFE Trading Systems

DAFETradingSystems.com

DAFETradingSystems.com

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, alım satım veya diğer türden tavsiye veya öneriler anlamına gelmez ve teşkil etmez. Kullanım Koşulları bölümünde daha fazlasını okuyun.