PROTECTED SOURCE SCRIPT

RSI Bands With RSI - ATR Trend Line

RSI Bands With RSI - ATR Trend Line (Smoothed Baseline)

Overview

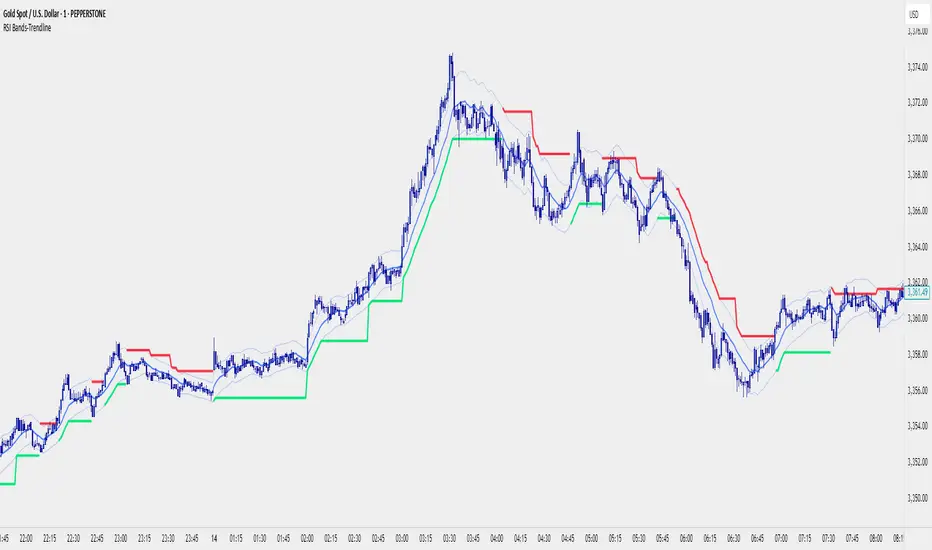

A trend-following tool that fuses RSI-based regime detection with a smoothed baseline and ATR bands. Trend line aims to stay with the RSI move, cut random noise, and flip cleanly. The line draws green in bulls and red in bears; signals fire only on candle close confirmed flips.

Key Features

✅ Dynamic Trend Detection

RSI (>50 / <50) sets bullish/bearish regime

Smoothed baseline adapts to price while damping whipsaw

ATR-based bands expand/contract with volatility

✅ Precise Signal Generation

Buy when trend flips to bullish (close confirms above the upper band)

Sell when trend flips to bearish (close confirms below the lower band)

Flips require a real band break → fewer false transitions

✅ Visual Clarity

Green line = bullish trend, Red line = bearish trend

✅ Customizable Settings

RSI Length (default 14)

Baseline Smoothing (default 26)

ATR Length (default 14)

ATR Multiplier (default 1.4)

Toggles for Signals and Labels

✅ TradingView Alerts

Built-in Buy & Sell alerts (recommend Once per bar close)

How It Works

Algorithm Logic

RSI Regime: RSI above/below 50 sets bull/bear. At exactly 50, the prior target is carried forward.

Target & Smoothing: A per-bar target is built from the bar’s range and RSI, then smoothed with an EMA-style filter (Baseline Smoothing) to form the baseline.

ATR Bands: Upper/Lower = baseline ± (ATR × Multiplier).

Flip Rule (Supertrend-like):

Close above upper band → bullish flip; trend line tracks the lower band (green).

Close below lower band → bearish flip; trend line tracks the upper band (red).

Between bands → prior trend line persists.

Signals/Alerts: A flip event generates a Buy/Sell signal and alert.

Best Use Cases

Trending Markets – Built to ride sustained moves in either direction.

Multiple Timeframes – Works from intraday to higher TFs; higher TFs usually produce cleaner flips.

Various Asset Classes – Forex, Indices, Stocks, Crypto, Commodities; ATR adapts to volatility.

Recommended Settings

Conservative (Lower Frequency)

RSI 14–20 • Baseline 34 • ATR 14–21 • Multiplier 1.8–2.2

Use for swing/position trading; calmer signal stream.

Balanced (Default)

RSI 14 • Baseline 26 • ATR 14 • Multiplier 1.4

Good general-purpose setup for swing or active intraday.

Aggressive (Higher Frequency)

RSI 10–14 • Baseline 13–21 • ATR 10–14 • Multiplier 1.1–1.3

For scalping/day trading; earlier but noisier flips.

🎨 Visual Elements

RSI Smooth baseline (soft blue)

Upper/Lower ATR Bands (faint blue)

Trend Line (Bull/Bear) drawn only in the active regime (green/red)

Optional Buy/Sell arrows and labels

⚠️ Important Notes

Signals on Close

Flips confirm on bar close. Intrabar crosses can revert; wait for confirmation.

Risk Management

Size positions appropriately; many traders trail beyond the opposite band/line.

Factor in spread, slippage, sessions, and news.

Confirmation & Testing

Combine with structure/volume/HTF bias if desired.

Backtest and forward-test per instrument and timeframe.

For research/education only; not financial advice.

Overview

A trend-following tool that fuses RSI-based regime detection with a smoothed baseline and ATR bands. Trend line aims to stay with the RSI move, cut random noise, and flip cleanly. The line draws green in bulls and red in bears; signals fire only on candle close confirmed flips.

Key Features

✅ Dynamic Trend Detection

RSI (>50 / <50) sets bullish/bearish regime

Smoothed baseline adapts to price while damping whipsaw

ATR-based bands expand/contract with volatility

✅ Precise Signal Generation

Buy when trend flips to bullish (close confirms above the upper band)

Sell when trend flips to bearish (close confirms below the lower band)

Flips require a real band break → fewer false transitions

✅ Visual Clarity

Green line = bullish trend, Red line = bearish trend

✅ Customizable Settings

RSI Length (default 14)

Baseline Smoothing (default 26)

ATR Length (default 14)

ATR Multiplier (default 1.4)

Toggles for Signals and Labels

✅ TradingView Alerts

Built-in Buy & Sell alerts (recommend Once per bar close)

How It Works

Algorithm Logic

RSI Regime: RSI above/below 50 sets bull/bear. At exactly 50, the prior target is carried forward.

Target & Smoothing: A per-bar target is built from the bar’s range and RSI, then smoothed with an EMA-style filter (Baseline Smoothing) to form the baseline.

ATR Bands: Upper/Lower = baseline ± (ATR × Multiplier).

Flip Rule (Supertrend-like):

Close above upper band → bullish flip; trend line tracks the lower band (green).

Close below lower band → bearish flip; trend line tracks the upper band (red).

Between bands → prior trend line persists.

Signals/Alerts: A flip event generates a Buy/Sell signal and alert.

Best Use Cases

Trending Markets – Built to ride sustained moves in either direction.

Multiple Timeframes – Works from intraday to higher TFs; higher TFs usually produce cleaner flips.

Various Asset Classes – Forex, Indices, Stocks, Crypto, Commodities; ATR adapts to volatility.

Recommended Settings

Conservative (Lower Frequency)

RSI 14–20 • Baseline 34 • ATR 14–21 • Multiplier 1.8–2.2

Use for swing/position trading; calmer signal stream.

Balanced (Default)

RSI 14 • Baseline 26 • ATR 14 • Multiplier 1.4

Good general-purpose setup for swing or active intraday.

Aggressive (Higher Frequency)

RSI 10–14 • Baseline 13–21 • ATR 10–14 • Multiplier 1.1–1.3

For scalping/day trading; earlier but noisier flips.

🎨 Visual Elements

RSI Smooth baseline (soft blue)

Upper/Lower ATR Bands (faint blue)

Trend Line (Bull/Bear) drawn only in the active regime (green/red)

Optional Buy/Sell arrows and labels

⚠️ Important Notes

Signals on Close

Flips confirm on bar close. Intrabar crosses can revert; wait for confirmation.

Risk Management

Size positions appropriately; many traders trail beyond the opposite band/line.

Factor in spread, slippage, sessions, and news.

Confirmation & Testing

Combine with structure/volume/HTF bias if desired.

Backtest and forward-test per instrument and timeframe.

For research/education only; not financial advice.

Korumalı komut dosyası

Bu komut dosyası kapalı kaynak olarak yayınlanmaktadır. Ancak, ücretsiz ve herhangi bir sınırlama olmaksızın kullanabilirsiniz – daha fazla bilgiyi buradan edinebilirsiniz.

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, alım satım veya diğer türden tavsiye veya öneriler anlamına gelmez ve teşkil etmez. Kullanım Koşulları bölümünde daha fazlasını okuyun.

Korumalı komut dosyası

Bu komut dosyası kapalı kaynak olarak yayınlanmaktadır. Ancak, ücretsiz ve herhangi bir sınırlama olmaksızın kullanabilirsiniz – daha fazla bilgiyi buradan edinebilirsiniz.

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, alım satım veya diğer türden tavsiye veya öneriler anlamına gelmez ve teşkil etmez. Kullanım Koşulları bölümünde daha fazlasını okuyun.