OPEN-SOURCE SCRIPT

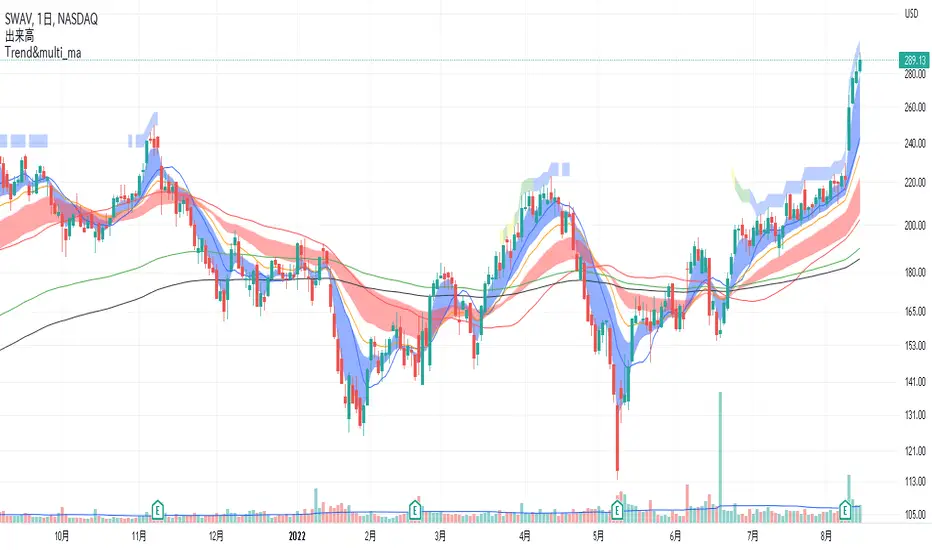

Güncellendi trend judgment & multi ma

1 The background is filled with the number of matches to the trend template.

For the following conditions, 7 matches are yellow, 8 matches are green, and 9 matches are blue.

1. the stock price is above the 150-day MA and 200-day MA

2. the 50-day MA is above the 200-day MA

3. 200-day MA is in an uptrend for at least one month

4. 50-day MA is above 150-day MA and 200-day MA

5. stock price is 25% or more above 52-week low

6. stock price is 0 - 25% below 52-week high

7. IBD RS is above 70, preferably in the 90s → I don't know the exact formula, so I'm approximating with a formula that gives similar values.

8. when the stock is breaking above the base, the stock price is above the 50MA → It is difficult to judge the base itself, so it is not included in the conditions.

9. volume is high during an upward and low during a downward → volume during an upward > volume during a downward in the past 20 periods.

ex1. the 5-day MA is above the 20-day MA.

2 multi moving averages are shown.

For the following conditions, 7 matches are yellow, 8 matches are green, and 9 matches are blue.

1. the stock price is above the 150-day MA and 200-day MA

2. the 50-day MA is above the 200-day MA

3. 200-day MA is in an uptrend for at least one month

4. 50-day MA is above 150-day MA and 200-day MA

5. stock price is 25% or more above 52-week low

6. stock price is 0 - 25% below 52-week high

7. IBD RS is above 70, preferably in the 90s → I don't know the exact formula, so I'm approximating with a formula that gives similar values.

8. when the stock is breaking above the base, the stock price is above the 50MA → It is difficult to judge the base itself, so it is not included in the conditions.

9. volume is high during an upward and low during a downward → volume during an upward > volume during a downward in the past 20 periods.

ex1. the 5-day MA is above the 20-day MA.

2 multi moving averages are shown.

Sürüm Notları

1 The background is filled with the number of matches to the trend template.For the following conditions, 7 matches are yellow, 8 matches are green, and 9 matches are blue.

1. the stock price is above the 150-day MA and 200-day MA

2. the 150-day MA is above the 200-day MA

3. 200-day MA is in an uptrend for at least one month

4. 50-day MA is above 150-day MA and 200-day MA

5. stock price is 25% or more above 52-week low

6. stock price is 0 - 25% below 52-week high

7. IBD RS is above 70, preferably in the 90s → I don't know the exact formula, so I'm approximating with a formula that gives similar values.

8. when the stock is breaking above the base, the stock price is above the 50MA → It is difficult to judge the base itself, so it is not included in the conditions.

9. volume is high during an upward and low during a downward → volume during an upward > volume during a downward in the past 20 periods.

ex1 . the 5-day MA is above the 20-day MA.

2 multi moving averages are shown.

Açık kaynak kodlu komut dosyası

Gerçek TradingView ruhuyla, bu komut dosyasının mimarı, yatırımcıların işlevselliğini inceleyip doğrulayabilmesi için onu açık kaynaklı hale getirdi. Yazarı tebrik ederiz! Ücretsiz olarak kullanabilseniz de, kodu yeniden yayınlamanın Topluluk Kurallarımıza tabi olduğunu unutmayın.

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, alım satım veya diğer türden tavsiye veya öneriler anlamına gelmez ve teşkil etmez. Kullanım Koşulları bölümünde daha fazlasını okuyun.

Açık kaynak kodlu komut dosyası

Gerçek TradingView ruhuyla, bu komut dosyasının mimarı, yatırımcıların işlevselliğini inceleyip doğrulayabilmesi için onu açık kaynaklı hale getirdi. Yazarı tebrik ederiz! Ücretsiz olarak kullanabilseniz de, kodu yeniden yayınlamanın Topluluk Kurallarımıza tabi olduğunu unutmayın.

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, alım satım veya diğer türden tavsiye veya öneriler anlamına gelmez ve teşkil etmez. Kullanım Koşulları bölümünde daha fazlasını okuyun.