OPEN-SOURCE SCRIPT

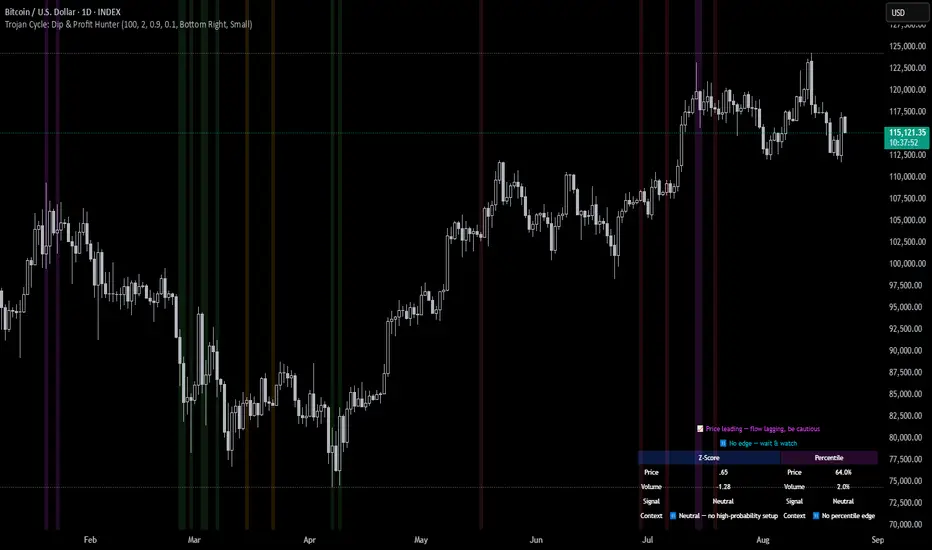

Trojan Cycle: Dip & Profit Hunter

📉 Crypto is changing. Your signals should too.

This script doesn’t try to outguess price — it helps you track capital rotation and flow behavior in alignment with the evolving macro structure of the digital asset market.

Trojan Cycle: Dip & Profit Hunter is a signal engine built to support and validate the capital rotation models outlined in the Trojan Cycle and Synthetic Rotation theses — available via RWCS_LTD’s published charts

It is not a classic “buy low, sell high” tool. It is a structural filter that uses price/volume statistics to surface accumulation zones, synthetic traps, and macro context shifts — all aligned with the institutionalization of crypto post-2024.

🧠 Purpose & Value

Crypto no longer follows the retail-led, halving-driven pattern of 2017 or 2021.

Instead, institutional infrastructure, regulatory filters, and equity-market Trojan horses define the new path of capital.

This tool helps you visualize that path by interpreting behavior through statistical imbalances and real-time momentum signals.

Use it to:

Track where capital is accumulating or exiting

Identify signals consistent with true cycle rotation (vs. synthetic traps)

Validate your macro view with real-time statistical context

🔍 How It Works

The engine combines four signal layers:

1. Z-Score Logic

- Measures how far price and volume have deviated from their mean

- Detects dips, blowoffs, and exhaustion zones

2. Percentile Logic

- Compares current price and volume to historical rank distribution

- Flags statistically rare conditions (e.g. bottom 10% price, top 90% volume)

3. Combined Context Engine

- Integrates both models to generate one of 36 unique output states

- Each state provides a labeled market context (e.g., 🟢 Confluent Buy, 🔴 Confluent Sell, 🧨 Synthetic Trap)

4. Momentum Spread & Divergence

- Measures whether price is leading volume (trap risk) or volume is leading price (accumulation)

- Outputs intuitive momentum context with emoji-coded alerts

📋 What You See

🧠 Contextual Table UI with key Z-Scores, percentiles, signals, and market commentary

🎯 Emoji-coded signals to quickly grasp high-probability setups or risk zones

🌊 Optional overlays: price/volume divergence, momentum spread

🎨 Visual table customization (size, position) and chart highlights for signal clarity

🔔 Alert System

✅ Single dynamic alert using alert() that only fires when signal context changes

Prevents alert fatigue and allows clean webhook/automation integration

🧭 Use Cases

For macro cycle traders: Track where we are in the Trojan Cycle using statistical context

For thesis explorers: Use the 36-output signal map to match against your rotation thesis

For capital rotation watchers: Identify structural setups consistent with ETF-driven or compliance-filtered flow

For narrative skeptics: Avoid synthetic altseason traps where volume lags or flow dries up

🧪 Suggested Pairing for Thesis Validation

To use this tool as part of a thesis-confirmation framework, pair it with:

BTC.D — Bitcoin Dominance

ETH/BTC — Ethereum strength vs. Bitcoin

TOTALE100/ETH — Altcoin strength relative to ETH

RWCS_LTD’s published charts and macro cycle models

🏁 Final Note

Crypto has matured. So should your signals.

This tool doesn’t try to game the next 2 candles. It helps you understand the current phase in a compliance-filtered, institutionalized rotation model.

It’s not built for hype — it’s built for conviction.

Explore the thesis → Validate the structure → Trade with clarity.

🚨 Disclaimer

This script is not financial advice. It is an analytical tool designed to support market structure research and rotation thesis validation. Use this as part of a broader framework including technical structure, dominance charts, and macro data.

This script doesn’t try to outguess price — it helps you track capital rotation and flow behavior in alignment with the evolving macro structure of the digital asset market.

Trojan Cycle: Dip & Profit Hunter is a signal engine built to support and validate the capital rotation models outlined in the Trojan Cycle and Synthetic Rotation theses — available via RWCS_LTD’s published charts

It is not a classic “buy low, sell high” tool. It is a structural filter that uses price/volume statistics to surface accumulation zones, synthetic traps, and macro context shifts — all aligned with the institutionalization of crypto post-2024.

🧠 Purpose & Value

Crypto no longer follows the retail-led, halving-driven pattern of 2017 or 2021.

Instead, institutional infrastructure, regulatory filters, and equity-market Trojan horses define the new path of capital.

This tool helps you visualize that path by interpreting behavior through statistical imbalances and real-time momentum signals.

Use it to:

Track where capital is accumulating or exiting

Identify signals consistent with true cycle rotation (vs. synthetic traps)

Validate your macro view with real-time statistical context

🔍 How It Works

The engine combines four signal layers:

1. Z-Score Logic

- Measures how far price and volume have deviated from their mean

- Detects dips, blowoffs, and exhaustion zones

2. Percentile Logic

- Compares current price and volume to historical rank distribution

- Flags statistically rare conditions (e.g. bottom 10% price, top 90% volume)

3. Combined Context Engine

- Integrates both models to generate one of 36 unique output states

- Each state provides a labeled market context (e.g., 🟢 Confluent Buy, 🔴 Confluent Sell, 🧨 Synthetic Trap)

4. Momentum Spread & Divergence

- Measures whether price is leading volume (trap risk) or volume is leading price (accumulation)

- Outputs intuitive momentum context with emoji-coded alerts

📋 What You See

🧠 Contextual Table UI with key Z-Scores, percentiles, signals, and market commentary

🎯 Emoji-coded signals to quickly grasp high-probability setups or risk zones

🌊 Optional overlays: price/volume divergence, momentum spread

🎨 Visual table customization (size, position) and chart highlights for signal clarity

🔔 Alert System

✅ Single dynamic alert using alert() that only fires when signal context changes

Prevents alert fatigue and allows clean webhook/automation integration

🧭 Use Cases

For macro cycle traders: Track where we are in the Trojan Cycle using statistical context

For thesis explorers: Use the 36-output signal map to match against your rotation thesis

For capital rotation watchers: Identify structural setups consistent with ETF-driven or compliance-filtered flow

For narrative skeptics: Avoid synthetic altseason traps where volume lags or flow dries up

🧪 Suggested Pairing for Thesis Validation

To use this tool as part of a thesis-confirmation framework, pair it with:

BTC.D — Bitcoin Dominance

ETH/BTC — Ethereum strength vs. Bitcoin

TOTALE100/ETH — Altcoin strength relative to ETH

RWCS_LTD’s published charts and macro cycle models

🏁 Final Note

Crypto has matured. So should your signals.

This tool doesn’t try to game the next 2 candles. It helps you understand the current phase in a compliance-filtered, institutionalized rotation model.

It’s not built for hype — it’s built for conviction.

Explore the thesis → Validate the structure → Trade with clarity.

🚨 Disclaimer

This script is not financial advice. It is an analytical tool designed to support market structure research and rotation thesis validation. Use this as part of a broader framework including technical structure, dominance charts, and macro data.

Açık kaynak kodlu komut dosyası

Gerçek TradingView ruhuyla, bu komut dosyasının mimarı, yatırımcıların işlevselliğini inceleyip doğrulayabilmesi için onu açık kaynaklı hale getirdi. Yazarı tebrik ederiz! Ücretsiz olarak kullanabilseniz de, kodu yeniden yayınlamanın Topluluk Kurallarımıza tabi olduğunu unutmayın.

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, alım satım veya diğer türden tavsiye veya öneriler anlamına gelmez ve teşkil etmez. Kullanım Koşulları bölümünde daha fazlasını okuyun.

Açık kaynak kodlu komut dosyası

Gerçek TradingView ruhuyla, bu komut dosyasının mimarı, yatırımcıların işlevselliğini inceleyip doğrulayabilmesi için onu açık kaynaklı hale getirdi. Yazarı tebrik ederiz! Ücretsiz olarak kullanabilseniz de, kodu yeniden yayınlamanın Topluluk Kurallarımıza tabi olduğunu unutmayın.

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, alım satım veya diğer türden tavsiye veya öneriler anlamına gelmez ve teşkil etmez. Kullanım Koşulları bölümünde daha fazlasını okuyun.