OPEN-SOURCE SCRIPT

Stochastic + Bollinger Bands Multi-Timeframe Strategy

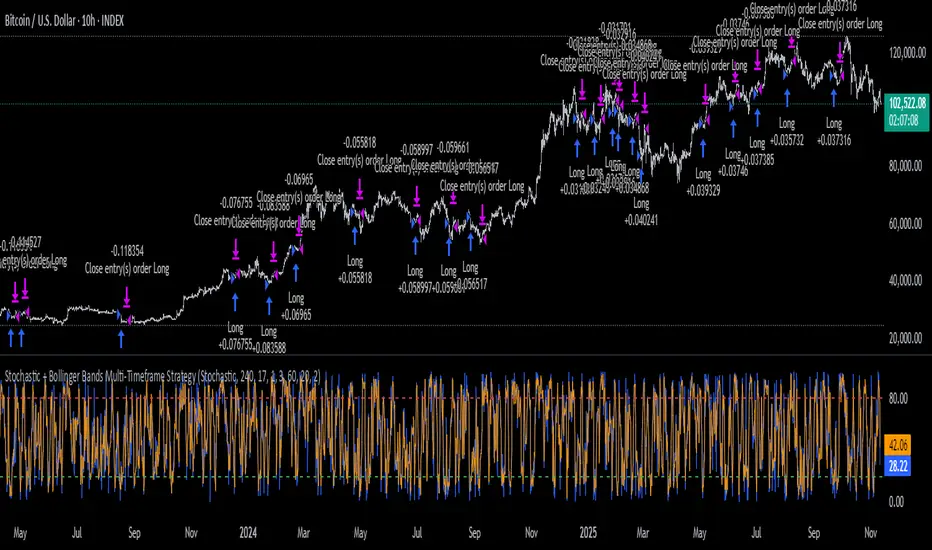

This strategy fuses the Stochastic Oscillator from the 4-hour timeframe with Bollinger Bands from the 1-hour timeframe, operating on a 10-hour chart to capture a unique volatility rhythm and temporal alignment discovered through observational alpha.

By blending momentum confirmation from the higher timeframe with short-term volatility extremes, the strategy leverages what some traders refer to as “rotating volatility” — a phenomenon where multi-timeframe oscillations sync to reveal hidden trade opportunities.

🧠 Strategy Logic

✅ Long Entry Condition:

Stochastic on the 4H timeframe:

%K crosses above %D

Both %K and %D are below 20 (oversold zone)

Bollinger Bands on the 1H timeframe:

Price crosses above the lower Bollinger Band, indicating a potential reversal

→ A long trade is opened when both momentum recovery and volatility reversion align.

✅ Long Exit Condition:

Stochastic on the 4H:

%K crosses below %D

Both %K and %D are above 80 (overbought zone)

Bollinger Bands on the 1H:

Price reaches or exceeds the upper Bollinger Band, suggesting exhaustion

→ The long trade is closed when either signal suggests a potential reversal or overextension.

🧬 Temporal Structure & Alpha

This strategy is deployed on a 10-hour chart — a non-standard timeframe that may align more effectively with multi-timeframe mean reversion dynamics.

This subtle adjustment exploits what some traders identify as “temporal drift” — the desynchronization of volatility across timeframes that creates hidden rhythm in price action.

→ For example, Stochastic on 4H (lookback 17) and Bollinger Bands on 1H (lookback 20) may periodically sync around 10H intervals, offering unique alpha windows.

📊 Indicator Components

🔹 Stochastic Oscillator (4H, Length 17)

Detects momentum reversals using %K and %D crossovers

Helps define overbought/oversold zones from a mid-term view

🔹 Bollinger Bands (1H, Length 20, ±2 StdDev)

Measures price volatility using standard deviation around a moving average

Entry occurs near lower band (support), exits near upper band (resistance)

🔹 Multi-Timeframe Logic

Uses request.security() to safely reference 4H and 1H indicators from a 10H chart

Avoids repainting by using closed higher-timeframe candles only

📈 Visualization

A plot selector input allows toggling between:

Stochastic Plot (%K & %D, with overbought/oversold levels)

Bollinger Bands Plot (Upper, Basis, Lower from 1H data)

This helps users visually confirm entry/exit triggers in real time.

🛠 Customization

Fully configurable Stochastic and BB settings

Timeframes are independently adjustable

Strategy settings like position sizing, slippage, and commission are editable

⚠️ Disclaimer

This strategy is intended for educational and informational purposes only.

It does not constitute financial advice or a recommendation to buy or sell any asset.

Market conditions vary, and past performance does not guarantee future results.

Always test any trading strategy in a simulated environment and consult a licensed financial advisor before making real-world investment decisions.

By blending momentum confirmation from the higher timeframe with short-term volatility extremes, the strategy leverages what some traders refer to as “rotating volatility” — a phenomenon where multi-timeframe oscillations sync to reveal hidden trade opportunities.

🧠 Strategy Logic

✅ Long Entry Condition:

Stochastic on the 4H timeframe:

%K crosses above %D

Both %K and %D are below 20 (oversold zone)

Bollinger Bands on the 1H timeframe:

Price crosses above the lower Bollinger Band, indicating a potential reversal

→ A long trade is opened when both momentum recovery and volatility reversion align.

✅ Long Exit Condition:

Stochastic on the 4H:

%K crosses below %D

Both %K and %D are above 80 (overbought zone)

Bollinger Bands on the 1H:

Price reaches or exceeds the upper Bollinger Band, suggesting exhaustion

→ The long trade is closed when either signal suggests a potential reversal or overextension.

🧬 Temporal Structure & Alpha

This strategy is deployed on a 10-hour chart — a non-standard timeframe that may align more effectively with multi-timeframe mean reversion dynamics.

This subtle adjustment exploits what some traders identify as “temporal drift” — the desynchronization of volatility across timeframes that creates hidden rhythm in price action.

→ For example, Stochastic on 4H (lookback 17) and Bollinger Bands on 1H (lookback 20) may periodically sync around 10H intervals, offering unique alpha windows.

📊 Indicator Components

🔹 Stochastic Oscillator (4H, Length 17)

Detects momentum reversals using %K and %D crossovers

Helps define overbought/oversold zones from a mid-term view

🔹 Bollinger Bands (1H, Length 20, ±2 StdDev)

Measures price volatility using standard deviation around a moving average

Entry occurs near lower band (support), exits near upper band (resistance)

🔹 Multi-Timeframe Logic

Uses request.security() to safely reference 4H and 1H indicators from a 10H chart

Avoids repainting by using closed higher-timeframe candles only

📈 Visualization

A plot selector input allows toggling between:

Stochastic Plot (%K & %D, with overbought/oversold levels)

Bollinger Bands Plot (Upper, Basis, Lower from 1H data)

This helps users visually confirm entry/exit triggers in real time.

🛠 Customization

Fully configurable Stochastic and BB settings

Timeframes are independently adjustable

Strategy settings like position sizing, slippage, and commission are editable

⚠️ Disclaimer

This strategy is intended for educational and informational purposes only.

It does not constitute financial advice or a recommendation to buy or sell any asset.

Market conditions vary, and past performance does not guarantee future results.

Always test any trading strategy in a simulated environment and consult a licensed financial advisor before making real-world investment decisions.

Açık kaynak kodlu komut dosyası

Gerçek TradingView ruhuyla, bu komut dosyasının mimarı, yatırımcıların işlevselliğini inceleyip doğrulayabilmesi için onu açık kaynaklı hale getirdi. Yazarı tebrik ederiz! Ücretsiz olarak kullanabilseniz de, kodu yeniden yayınlamanın Topluluk Kurallarımıza tabi olduğunu unutmayın.

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, alım satım veya diğer türden tavsiye veya öneriler anlamına gelmez ve teşkil etmez. Kullanım Koşulları bölümünde daha fazlasını okuyun.

Açık kaynak kodlu komut dosyası

Gerçek TradingView ruhuyla, bu komut dosyasının mimarı, yatırımcıların işlevselliğini inceleyip doğrulayabilmesi için onu açık kaynaklı hale getirdi. Yazarı tebrik ederiz! Ücretsiz olarak kullanabilseniz de, kodu yeniden yayınlamanın Topluluk Kurallarımıza tabi olduğunu unutmayın.

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, alım satım veya diğer türden tavsiye veya öneriler anlamına gelmez ve teşkil etmez. Kullanım Koşulları bölümünde daha fazlasını okuyun.