OPEN-SOURCE SCRIPT

Güncellendi [blackcat] L3 Volatility Ehlers Stochastic CGO

OVERVIEW

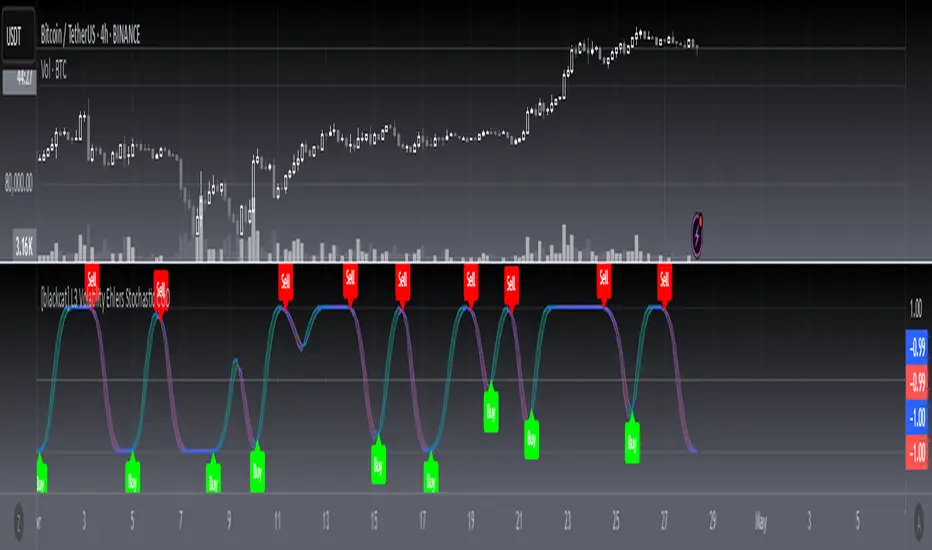

This advanced indicator integrates the Center of Gravity Oscillator (CGO) with an Ehlers-Stochastic framework and an Adaptive Local Minimum-Maximum Average (ALMA) smoothing algorithm. Designed for non-overlaid charts, it identifies market momentum shifts by analyzing price action through multi-layer volatility analysis.

FEATURES

• Dual-line system:

✓ Stochastic CGO: Core oscillating line derived from weighted OHLC price calculations

✓ ALMA Lagging Line: Smoothing component using customizable offset/sigma parameters

• Dynamic color scheme:

✓ Green/red trend differentiation via crossover comparison

✓ Optional fill areas between lines (toggleable)

• Clear trade signals:

✓ Buy/Sell labels triggered by mathematically defined crossovers

✓ Zero-reference baseline marker (#0ebb23)

• Customizable parameters:

Fast Length (9 default) controls CGO sensitivity

Slow Length (5 default) governs ALMA responsiveness

ALMA Offset/Sigma allow adaptive curve optimization

HOW TO USE

Configure core parameters:

• Adjust Fast Length (CGO timeframe window)

• Set Slow Length, ALMA Offset, and Sigma for smoother/laggier response

Interpret visuals:

• Bullish trend = green shaded zone (when primary line above lagging line)

• Bearish trend = red shaded zone (primary line below lagging line)

Analyze signals:

• Buy triggers occur when rising CGO crosses above ALMA while below zero

• Sell triggers activate when falling CGO breaks below ALMA after exceeding zero base

Optimize display:

✓ Enable/disable fill area via Fill Between Lines

LIMITATIONS

• Relies heavily on lookback periods - rapid market changes may reduce predictive accuracy

• Signal frequency increases during high-volatility environments

• Requires additional confirmation methods due to occasional premature crossovers

• Default parameter settings may lack universality across asset classes

NOTES

• Best paired with volume-based confirmations for stronger signals

• Reducing ALMA Sigma sharpens line responsiveness at cost of noise susceptibility

• Increasing Fast Length extends calculation horizon while reducing peak sensitivity

• Weighted OHLC source formula prioritizes closing prices for swing direction assessment

This advanced indicator integrates the Center of Gravity Oscillator (CGO) with an Ehlers-Stochastic framework and an Adaptive Local Minimum-Maximum Average (ALMA) smoothing algorithm. Designed for non-overlaid charts, it identifies market momentum shifts by analyzing price action through multi-layer volatility analysis.

FEATURES

• Dual-line system:

✓ Stochastic CGO: Core oscillating line derived from weighted OHLC price calculations

✓ ALMA Lagging Line: Smoothing component using customizable offset/sigma parameters

• Dynamic color scheme:

✓ Green/red trend differentiation via crossover comparison

✓ Optional fill areas between lines (toggleable)

• Clear trade signals:

✓ Buy/Sell labels triggered by mathematically defined crossovers

✓ Zero-reference baseline marker (#0ebb23)

• Customizable parameters:

Fast Length (9 default) controls CGO sensitivity

Slow Length (5 default) governs ALMA responsiveness

ALMA Offset/Sigma allow adaptive curve optimization

HOW TO USE

Configure core parameters:

• Adjust Fast Length (CGO timeframe window)

• Set Slow Length, ALMA Offset, and Sigma for smoother/laggier response

Interpret visuals:

• Bullish trend = green shaded zone (when primary line above lagging line)

• Bearish trend = red shaded zone (primary line below lagging line)

Analyze signals:

• Buy triggers occur when rising CGO crosses above ALMA while below zero

• Sell triggers activate when falling CGO breaks below ALMA after exceeding zero base

Optimize display:

✓ Enable/disable fill area via Fill Between Lines

LIMITATIONS

• Relies heavily on lookback periods - rapid market changes may reduce predictive accuracy

• Signal frequency increases during high-volatility environments

• Requires additional confirmation methods due to occasional premature crossovers

• Default parameter settings may lack universality across asset classes

NOTES

• Best paired with volume-based confirmations for stronger signals

• Reducing ALMA Sigma sharpens line responsiveness at cost of noise susceptibility

• Increasing Fast Length extends calculation horizon while reducing peak sensitivity

• Weighted OHLC source formula prioritizes closing prices for swing direction assessment

Sürüm Notları

OVERVIEW📈 [blackcat] L3 Volatility Ehlers Stochastic CGO is a sophisticated TradingView indicator that combines elements of volatility analysis, Ehlers' stochastic techniques, and adaptive moving averages. This script aims to provide traders with a comprehensive view of market momentum and potential reversal points.

FEATURES

Custom source price calculation using OHLC data

User-adjustable parameters for CGO and ALMA calculations

Center of Gravity Oscillator (CGO) implementation

Adaptive Moving Average (ALMA) smoothing technique

Dynamic trend detection and signal generation

Optional filling between indicator lines

Clear visual representation of buy/sell signals

Alert functionality for signal detection

HOW TO USE

Add the script to your TradingView chart.

Adjust input variables in the settings panel:

Fast Length (CGO)

Slow Length (ALMA)

ALMA Offset

ALMA Sigma

Fill Between Lines

Observe the generated plots and signals on your chart:

Blue or green line representing Stochastic CGO

Red or green lagging line showing ALMA-smoothed values

"Buy" and "Sell" labels indicating trading opportunities

Filled area between lines if enabled

LIMITATIONS

Complexity may be challenging for novice traders

Performance can vary across different markets and timeframes

Requires careful tuning of input parameters for optimal results

NOTES

The script calculates momentum based on the Center of Gravity concept

ALMA is used to smooth the lagging line, reducing noise

Signals are generated based on crossovers between the main oscillator and lagging line

Trend color changes dynamically based on current market conditions

THANKS

Special thanks to the TradingView community for their valuable feedback and contributions to this indicator's development.

Açık kaynak kodlu komut dosyası

Gerçek TradingView ruhuyla, bu komut dosyasının yaratıcısı, yatırımcıların işlevselliğini inceleyip doğrulayabilmesi için onu açık kaynaklı hale getirdi. Yazarı tebrik ederiz! Ücretsiz olarak kullanabilseniz de, kodu yeniden yayınlamanın Topluluk Kurallarımıza tabi olduğunu unutmayın.

Avoid losing contact!Don't miss out! The first and most important thing to do is to join my Discord chat now! Click here to start your adventure: discord.com/invite/ZTGpQJq 防止失联,请立即行动,加入本猫聊天群: discord.com/invite/ZTGpQJq

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, alım satım veya diğer türden tavsiye veya öneriler anlamına gelmez ve teşkil etmez. Kullanım Koşulları bölümünde daha fazlasını okuyun.

Açık kaynak kodlu komut dosyası

Gerçek TradingView ruhuyla, bu komut dosyasının yaratıcısı, yatırımcıların işlevselliğini inceleyip doğrulayabilmesi için onu açık kaynaklı hale getirdi. Yazarı tebrik ederiz! Ücretsiz olarak kullanabilseniz de, kodu yeniden yayınlamanın Topluluk Kurallarımıza tabi olduğunu unutmayın.

Avoid losing contact!Don't miss out! The first and most important thing to do is to join my Discord chat now! Click here to start your adventure: discord.com/invite/ZTGpQJq 防止失联,请立即行动,加入本猫聊天群: discord.com/invite/ZTGpQJq

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, alım satım veya diğer türden tavsiye veya öneriler anlamına gelmez ve teşkil etmez. Kullanım Koşulları bölümünde daha fazlasını okuyun.