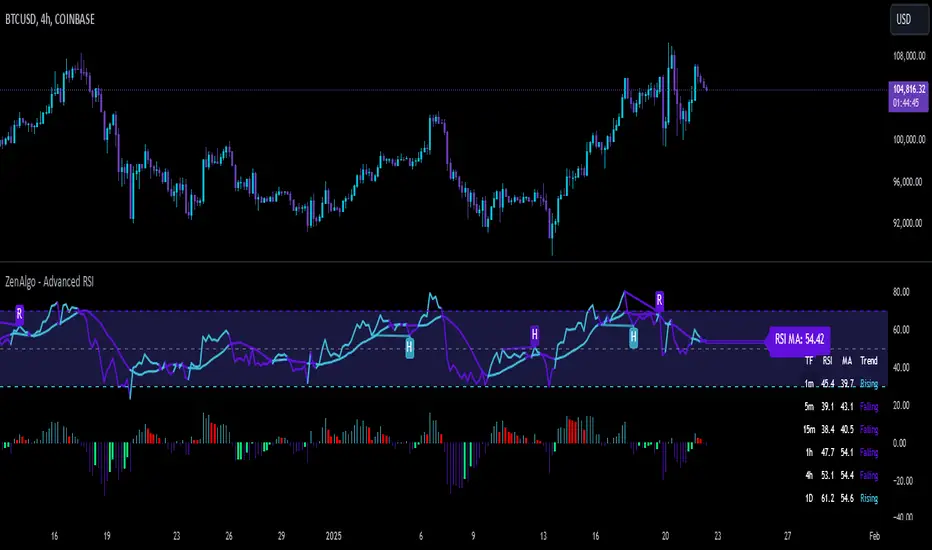

ZenAlgo - Advanced RSI

Additionally, it includes a Multi TimeFrame table, allowing traders to monitor RSI values and trends across six different timeframes in one view. This enhancement provides a broader perspective on market dynamics and helps traders identify consistent or diverging trends across multiple timeframes, enabling more precise decision-making.

Features

RSI with Moving Averages:

- Offers five types of moving averages (SMA, EMA, WMA, SMMA, VWMA) to suit various trading styles and market conditions.

- Moving averages are overlaid on RSI, allowing traders to detect support/resistance levels and momentum shifts directly on the RSI panel.

RSI Histogram:

- Displays the difference between RSI and its moving average.

- Positive histogram values indicate rising momentum, while negative values show declining momentum.

- Automatically detects and highlights divergences with color-coded bars (red for bearish, green for bullish).

Bollinger Bands for RSI:

- Adds upper and lower bands to RSI, visualizing volatility and overbought/oversold conditions.

Divergence Detection:

- Identifies and visualizes both regular and hidden divergences, marking key reversal or trend continuation points.

- Labels divergences with R (regular) or H (hidden) to provide clarity on their implications.

Bollinger Bands for RSI:

- Adds upper and lower bands to RSI, visualizing volatility and overbought/oversold conditions.

Diamond Signals:

- Marks crossovers of RSI and its moving average in overbought (RSI > 70) or oversold (RSI < 30) zones with diamond symbols, highlighting potential reversals.

Multi TimeFrame Table:

- Displays RSI values for six different timeframes in a clear and intuitive table.

- Calculates the trend on each timeframe based on the average direction of the last three candles. Trends are categorized as "rising" (increasing), "falling" (decreasing), or "neutral" (stable).

- Provides easily interpretable insights across timeframes, allowing traders to focus on the current chart without switching timeframes manually.

Added Value: Why Is This Indicator Original/Why Shall You Pay for This Indicator?

ZenAlgo - Advanced RSI is a cohesive system where each component enhances the others. The originality and added value of the indicator come from:

1. Synergy Between Components:

Unlike standalone indicators, which can provide isolated or incomplete insights, ZenAlgo - Advanced RSI combines RSI, moving averages, and divergence detection into a unified system. For instance:

- The RSI histogram integrates momentum and trend strength in a single visualization, eliminating the need for multiple separate tools.

- Divergences are calculated using both price action and histogram trends, providing more reliable signals compared to divergence detection using only RSI.

2. Customization for Traders:

- The ability to select from various moving averages (e.g., EMA for fast responses, SMA for smoother trends) allows users to tailor the indicator to different trading environments and strategies.

3. Actionable Visual Cues:

- Diamond signals, histogram bars, and divergence markings make complex market patterns easier to interpret, reducing the cognitive load for traders.

4. Enhanced Divergence Analysis:

- Built-in detection of regular and hidden divergences offers clarity and saves traders the effort of manually analyzing charts.

5. Bollinger Bands Integration:

- Adding Bollinger Bands to RSI provides insights into volatility and momentum that go beyond what traditional Bollinger Bands or RSI can deliver individually.

6. Multi TimeFrame Table:

- The Multi Time Frame table adds a new layer of analytical depth by consolidating RSI values and trends from multiple timeframes into a single tool. This helps traders identify consistent or diverging trends across timeframes, which is crucial for adjusting trading strategies to suit specific market conditions.

7. All-in-One Efficiency:

- Instead of juggling multiple indicators, traders gain a streamlined tool that consolidates trend, momentum, and volatility analysis into a single, easy-to-read panel.

How It Works

1. RSI Calculation:

- RSI is calculated using the standard formula to determine the relative strength of upward and downward price movements over a specified period.

2. Moving Averages:

- Users choose from SMA, EMA, WMA, SMMA, or VWMA. The selected moving average is computed using RSI values, not price data, to better align with the indicator's momentum focus.

3. Histogram:

- The histogram shows the difference between RSI and its moving average. Positive values indicate RSI is above its moving average, signaling increasing momentum; negative values indicate the opposite.

4. Divergence Detection:

- Regular divergences are identified when price forms higher highs or lower lows, while RSI trends in the opposite direction.

- Hidden divergences are marked when price forms higher lows or lower highs, but RSI trends differently.

- Divergence is validated using both histogram and price trends for enhanced reliability.

5. Bollinger Bands for RSI:

- The upper and lower bands are based on the RSI and a configurable standard deviation, highlighting moments of high volatility and overbought/oversold conditions.

6. Trend Analysis:

- The indicator computes an average RSI value over last few candles to detect trend strength and direction, helping traders identify when trends are gaining or losing momentum.

7. Diamond Signals:

- Signals are triggered when RSI crosses its moving average within overbought or oversold zones. These events are plotted as diamonds for quick visualization.

- Please note that this indicator does not trigger any alerts or direct buy/sell signals.

8. Multi TimeFrame Table:

- RSI values are calculated for six separate time frames chosen by the user (e.g., 1-minute, 5-minute, 1-hour).

- The trend is determined by averaging the direction of the last three candles on each timeframe. Results are displayed as "rising," "falling," or "neutral" in the table.

- The table serves as a quick-reference tool for analyzing trends and RSI values across multiple market perspectives.

Usage Examples

- Tracking Trends: Use the histogram to monitor momentum: positive values indicate strengthening trends, while negative values suggest weakening trends.

- Spotting Divergences: Look for regular divergences (R) to anticipate reversals and hidden divergences (H) to confirm trend continuation.

- Utilizing Diamond Signals: When diamonds appear in overbought or oversold zones, they signal potential market reversals, allowing traders to act quickly.

- Analyzing Volatility: Bollinger Bands on RSI highlight moments of high volatility, providing additional confirmation for potential trend changes.

- Quick Assessment of RSI values: Use the Multi TimeFrame table to quickly assess RSI values and trends on different timeframes. Consistent trends (e.g., "rising" RSI on most timeframes) suggest market alignment, while diverging trends may indicate potential reversals or conflicting market signals. Use this insight to refine entries and exits.

Settings

- RSI Length: Number of candles used for RSI calculation.

- RSI Source: Data source for RSI calculation.

- MA Type: Type of moving average (SMA, EMA, RMA, WMA, VWMA).

- MA Length: Number of RSI values used for moving average calculation.

- BB StdDev: Standard deviation length for Bollinger Bands calculation.

- Disable / enable display of: Bullish, Bearish, Hidden Bullish and Hidden Bearish divergences.

- Show table RSI & MA: display or hide Multi TimeFrame RSI table.

- Table position / size: set MultiTimeFrame table position to suit your needs and keep it from obstructing other indicator views

Important Notes

- This indicator is a technical analysis tool and does not guarantee trading success.

- Use it in conjunction with other indicators and fundamental analysis for a more comprehensive trading strategy.

- In strong trends, divergences may become less reliable as price action overrides momentum indicators.

Yalnızca davetli komut dosyası

Bu komut dosyasına yalnızca yazar tarafından onaylanan kullanıcılar erişebilir. Kullanmak için izin istemeniz ve almanız gerekir. Bu genellikle ödeme yapıldıktan sonra verilir. Daha fazla ayrıntı için aşağıdaki yazarın talimatlarını izleyin veya doğrudan ZenAlgo_Official ile iletişime geçin.

TradingView, yazarına tamamen güvenmediğiniz ve nasıl çalıştığını anlamadığınız sürece bir komut dosyası için ödeme yapmanızı veya kullanmanızı TAVSİYE ETMEZ. Ayrıca topluluk komut dosyalarımızda ücretsiz, açık kaynaklı alternatifler bulabilirsiniz.

Yazarın talimatları

zenalgo.com

discord.zenalgo.com

Feragatname

Yalnızca davetli komut dosyası

Bu komut dosyasına yalnızca yazar tarafından onaylanan kullanıcılar erişebilir. Kullanmak için izin istemeniz ve almanız gerekir. Bu genellikle ödeme yapıldıktan sonra verilir. Daha fazla ayrıntı için aşağıdaki yazarın talimatlarını izleyin veya doğrudan ZenAlgo_Official ile iletişime geçin.

TradingView, yazarına tamamen güvenmediğiniz ve nasıl çalıştığını anlamadığınız sürece bir komut dosyası için ödeme yapmanızı veya kullanmanızı TAVSİYE ETMEZ. Ayrıca topluluk komut dosyalarımızda ücretsiz, açık kaynaklı alternatifler bulabilirsiniz.

Yazarın talimatları

zenalgo.com

discord.zenalgo.com