How Long Can Sterling Rely on E-Infrastructure Visibility?

Sterling Infrastructure, Inc. STRL continues to benefit from a strong backlog and expanding pipeline in its E-Infrastructure Solutions segment, but sustaining this visibility over the long term is becoming a key focus. As of March 31, 2025, the segment’s backlog was $1.2 billion, reflecting a 27% year-over-year increase. In addition, the company reached the high end of its $750 million target for future-phase opportunities, bringing total visibility close to $2 billion. With a book-to-burn ratio above 2x, current demand signals remain robust.

Driven by Artificial intelligence (AI), data-center construction accounted for more than 65% of the E-Infrastructure backlog at quarter-end. Revenues tied to these projects increased approximately 60% from the prior-year period, driven by accelerated customer timelines and Sterling’s role in complex, multi-phase builds. The company is also seeing renewed activity in e-commerce infrastructure and smaller industrial developments, which make up the remaining 35% of the backlog, adding balance to its project mix and reducing dependency on any single trend.

As Sterling’s visibility stretches into future phases, it acknowledges that customer timelines and funding schedules can shift. The company’s positioning in multi-phase programs is expected to help offset these variables, but sustaining high conversion rates from identified opportunities into booked backlog will be key to preserving visibility beyond the near term.

Looking ahead, Sterling expects mid-to-high teens revenue growth for the segment in 2025, supported by operating margins in the mid-20% range. While structural tailwinds in AI, e-commerce and digital infrastructure continue to drive demand, management is focused on extending visibility into 2026 and beyond.

Other Players Strengthening Their E-Infrastructure Pipeline

Comfort Systems USA FIX and EMCOR Group, Inc. EME are among the companies steadily expanding presence in digital infrastructure, positioning themselves to benefit from long-term trends in AI-driven and mission-critical construction.

Comfort Systems is benefiting from strong demand for data center and semiconductor projects, driving record first-quarter 2025 results with earnings up more than 75% and revenues rising 19% year over year. Its backlog reached an all-time high of $6.9 billion, supported by robust bookings across mechanical and electrical work. While tariff pressures and hyperscaler spending shifts pose risks, record operating margins and heavy investment in modular capacity position Comfort Systems well to maintain momentum and capture growth in technology-driven markets.

EMCOR is benefiting significantly from rising infrastructure demand, particularly within the network and communications sector, driven by data center growth. As of March 31, 2025, EMCOR’s total Remaining Performance Obligations were $11.75 billion, indicating 28.1% year-over-year growth. Strong public infrastructure spending in the United States further supports EMCOR’s growth prospects. Backed by sustained demand, the company has provided a positive 2025 outlook, expecting year-over-year growth across both revenues and earnings.

STRL’s Price Performance, Valuation and Estimates

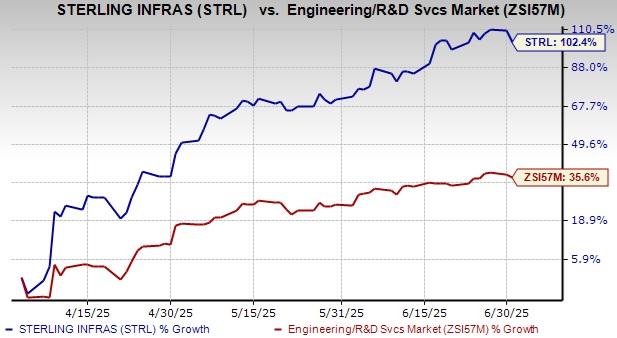

Sterling stock has surged 102.4% in the past three months, outpacing the Zacks Engineering - R and D Services industry’s rise of 35.6%.

From a valuation standpoint, Sterling is currently trading at a premium with a price-to-earnings ratio of 24.61X compared with the industry’s average of 21.01X.

The Zacks Consensus Estimate for Sterling’s 2025 and 2026 EPS has remained unchanged over the past 30 days. The estimated figure indicates 41.2% and 10.1% year-over-year growth, respectively.

STRL currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research