Is HMY Stock a Screaming Buy After the 75% YTD Price Rally?

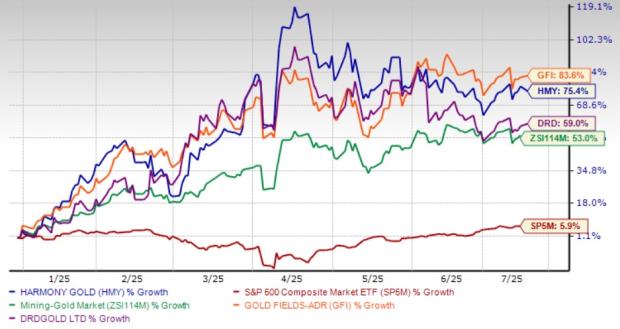

Harmony Gold Mining Company Limited’s HMY shares have popped 75.4% this year, outperforming the Zacks Mining – Gold industry’s growth of 53% and the S&P 500’s rise of 5.9%. The rally has been driven by an upswing in gold prices and HMY’s strong operating performance. Its peers, Gold Fields Limited GFI and DRDGOLD Limited DRD, have racked up gains of 83.6% and 59%, respectively, over the same period.

HMY’s YTD Price Performance

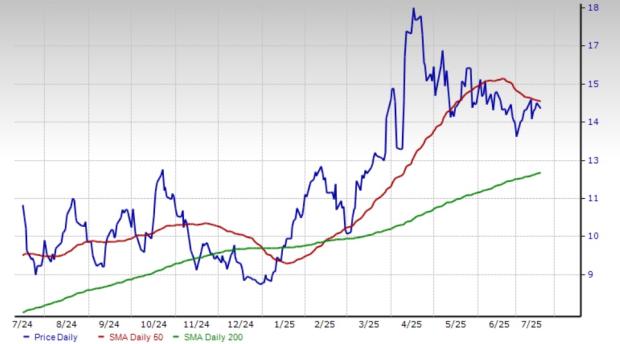

Technical indicators show that HMY stock eclipsed its 200-day simple moving average (SMA) on Jan. 17, 2025. The stock, for the most part, has traded above its 200-day SMA so far this year. However, Harmony is currently trading below the 50-day SMA. Nevertheless, the 50-day SMA continues to read higher than the 200-day SMA following a golden crossover on Feb. 13, 2025, indicating a bullish trend.

HMY Trades Below 50-Day SMA

Let’s take a look at HMY’s fundamentals to better analyze how to play the stock.

Wafi-Golpu & Eva Copper Projects Underpin HMY’s Growth

Harmony is South Africa's biggest gold producer by volume, with production of roughly 1.56 million ounces in fiscal 2024. It has a diverse portfolio of gold development projects spread across South Africa and Papua New Guinea (PNG). The company’s development projects currently in progress include the development of the Wafi-Golpu copper-gold project in PNG and the Eva Copper project in Australia.

The Wafi-Golpu project is believed to be a game-changer for the company, with an estimated gold reserve of 13 million ounces. HMY is currently in negotiations with its joint venture partner, Newmont Corporation NEM and the PNG Government regarding the terms of a Mining Development Contract, which is required for a Special Mining Lease.

The low-risk Eva Copper project in Australia offers additional upside, giving HMY a significant global copper-gold footprint. HMY acquired Eva Copper in 2022, adding a tier-one mining jurisdiction to its portfolio. The acquisition is in line with HMY’s objective of transitioning into a low-cost gold and copper mining company. The feasibility study update for the project is currently underway. HMY has received a conditional grant funding from the Queensland government, which will help accelerate the development of this project. It is subject to several conditions, including HMY reaching a positive final investment decision by January 2026. Eva Copper is expected to produce 55,000-60,000 tons of copper per annum.

Higher Gold Prices to Drive HMY’s Profitability

Gold prices are up roughly 28% this year, largely attributable to aggressive trade policies, including sweeping new import tariffs announced by President Donald Trump that have intensified global trade tensions and heightened investor anxiety. Also, central banks worldwide have been accumulating gold reserves, led by risks arising from Trump’s policies. Gold prices shot up to a record high of $3,500 per ounce on April 22. While gold prices have fallen from their April 2025 high, they remain favorable, aided by geopolitical tensions, and are currently hovering above the $3,300 per ounce level. Increased purchases by central banks and geopolitical tensions are factors expected to help the yellow metal sustain the rally.

For the nine months ended March 31, 2025, HMY recorded a roughly 30% increase in average gold prices received to $2,497 per ounce. Higher gold prices are expected to boost HMY’s profitability and drive cash flow generation.

Harmony Gold’s Solid Financial Health Bodes Well

Harmony boasts a strong balance sheet and generates substantial cash flows, which allows it to finance its development projects and drive shareholder value. Its net cash climbed roughly 53% to $592 million at the end of the third quarter of fiscal 2025 (ended March 31, 2025), from $386 million at the end of first-half fiscal 2025 (ended Dec. 31, 2024). HMY also has a dividend policy to pay 20% of the net free cash generated to its shareholders at its board’s discretion. HMY offers a dividend yield of 1.3% at the current stock price. It has a five-year annualized dividend growth rate of about 19.4%.

A Look at Harmony Gold Stock’s Valuation

The HMY stock looks attractive from a valuation perspective. Harmony Gold is currently trading at a forward price/earnings of 5.05X, a roughly 60% discount when stacked up with the industry’s average of 12.61X. HMY is also trading at a discount to Gold Fields and DRDGOLD. Harmony Gold has a Value Score of B, while both Gold Fields and DRDGOLD have a Value Score of C.

HMY’s P/E F12M Vs. Industry, GFI and DRD

What HMY’s Earnings Estimates Indicate

Earnings estimates for HMY for fiscal 2025 have been going up over the past 60 days. The Zacks Consensus Estimate for fiscal 2025 has been revised upward over the same time frame.

(Find the latest EPS estimates and surprises on Zacks Earnings Calendar.)

How Should Investors Play the HMY Stock?

Harmony is advancing several key development projects, including Wafi-Golpu and Eva Copper, which are expected to enhance production and expand its international footprint. The acquisition of Eva Copper aligns with the company’s goal of transitioning into a low-cost gold and copper producer. The favorable gold price environment is also expected to aid HMY’s performance. Solid balance sheet and efforts to drive cash flow also augur well. Harmony’s cheap valuation should also lure investors seeking value. We advise investors to bet on this Zacks Rank #1 (Strong Buy) stock now, as it has solid growth prospects.

You can see the complete list of today’s Zacks #1 Rank stocks here.

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research