Couche-Tard should have gone hostile on Seven & i

Be bold and go hostile, or don't bother at all. That's the message Canada's Alimentation Couche-Tard ATD is sending to foreigners eyeing acquisitions of Japanese companies. The company's withdrawal on Wednesday of its $46 billion non-binding proposal to purchase convenience store operator Seven & i

3382, along with a roughly 1,500-word rebuke of the process, suggests it's time for buyers to stop being friendly – and for Tokyo to firm up how it wants Japan Inc to behave.

Couche-Tard's bid for the 7-Eleven owner was compelling at a 47% premium to the undisturbed share price nearly a year ago, but the soft approach allowed its reluctant target to drag its feet. In Tokyo, it was no secret that the company did not want to be bought; its founding family even tried its own white knight buyout before abandoning it. So it is unsurprising that Alain Bouchard, Couche-Tard's founder and executive chair concluded "there has been no sincere or constructive engagement" after the suitor raised its offer and signed a non-disclosure agreement.

Seven & i calls these barbs "mischaracterizations", but the saga evokes Japan's past bad M&A, like Toshiba's long-drawn-out sale, which activists effectively kicked off in 2017. It also confirms that subsequently introduced guidelines for fair M&A and corporate takeovers aren't worth much. These were designed to revive the $4 trillion economy after decades of deflation. Companies are not on board, however.

They make a show of acting in good faith but clutch to poison pill defences. Even Japan's largest publicly traded firm, Toyota Motor 7203, in June emerged as a leader of a highly controversial $33 billion deal that, as the Asian Corporate Governance Association puts it, "exposes the persistent frailties of Japan’s corporate governance regime and the enduring power of entrenched interests".

Couche-Tard's decision not to go hostile no doubt stemmed from worrying doing otherwise would scare off the Japanese management team. It also faced antitrust hurdles in the United States and clamouring about the national interest in Japan. Yet there is a growing contingent of bankers and lawyers in the Asian country who view cultural issues as outdated hurdles to transformative inbound deals; they are advising their clients to take a firmer and, if necessary, hostile approach from the beginning.

True, Couche-Tard succeeded in forcing Seven & i to replace its CEO with a foreigner, Stephen Dacus, and revise its standalone value creation plan. But without a suitor applying pressure, some commitments could fade over time. One of these is a 2 trillion yen ($13.5 billion) buyback over the next five years funded in part by the agreed 815 billion yen sale of the group’s supermarket business to Bain Capital; another is a future stock market listing of its North American convenience store unit that targets an equity value of at least 1 trillion yen.

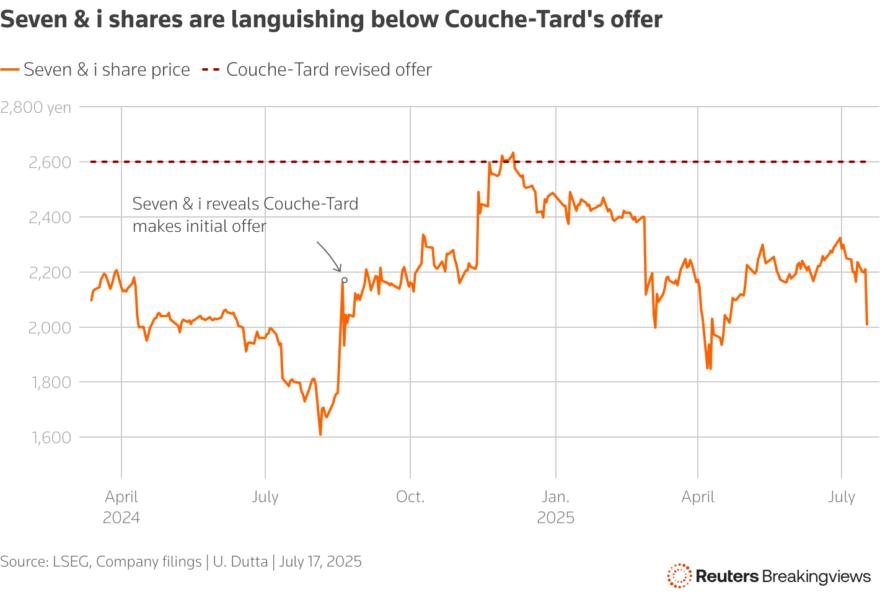

Shareholders have concluded that Seven & i was better off with a buyer too. The stock only fell 6% on Thursday, putting it 18% above its pre-deal level. But it is languishing one-fifth below Couche-Tard's offer. The Canadians did not get what they wanted, and arguably nor did Tokyo. Neither tried hard enough.

Follow Una Galani on Linkedin and X.

CONTEXT NEWS

Alimentation Couche-Tard on July 16 withdrew its non-binding proposal to acquire Seven & i. The Canadian convenience store owner said it had submitted a proposal of 2,600 yen per share in cash, representing a 47.6% premium price to the target's unaffected stock price. That values the Japanese company's equity at $45.6 billion.

Since signing a non-disclosure agreement in April, "there has been no sincere or constructive engagement from 7&i that would facilitate the advancement of any proposal, contrary to comments made publicly by 7&i representatives", Couche-Tard said. "The quantity and substance of the permitted due diligence, including at two tightly constrained management meetings, have been negligible", it added.

Seven & i said it disagrees with Couche-Tard's "mischaracterizations", said it acted in "good faith", and reiterated its commitment to its standalone value creation plan, including to return 2 trillion yen to shareholders through share buybacks by the end of 2030.