Trump TACO trade contains seeds of own unravelling

Tacos can be tasty and satisfying, but tend to come apart if eaten too eagerly. Something similar may be happening in global stock markets, where hopes that Donald Trump will always chicken out from imposing high tariffs – the so-called TACO trade – have propelled stocks to record highs. It’s an unstable equilibrium.

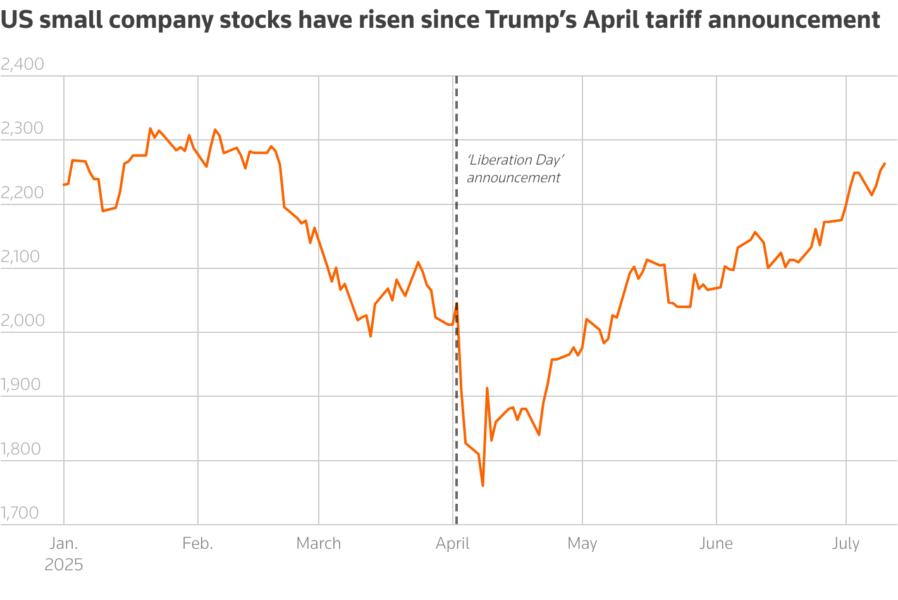

Trump’s 35% threatened tariff on Canada capped off a week of more-aggressive-than-expected announcements: a mooted 50% levy on copper imports, and a potential 200% charge on drugs. Markets have drawn the same conclusion as before: that Trump will bark loudly, but his tariffs will not bite enough to derail the economy. The S&P 500 is now at a record level. The Russell 2000 Index, which contains smaller companies more directly exposed to the U.S. economy, is above where it was on April 2 when the president announced country-specific reciprocal levies.

The TACO trade is more than a bet on Trump psychology. There are good reasons why chickening out could be the most likely outcome. The United States is not in a position to quicky fire up copper mines, or smartphone manufacturing plants, and so may settle for lower tariffs. If its key trading partners end up somewhere close to the April 2 10% “baseline” level, the economic impact may be modest.

Yet the TACO trade implies a seductive predictability, and Trump is anything but. His previous actions during his first presidency, which include hyping dubious remedies for Covid-19, show that policy errors are a feature of his government. His most recent announcements, including a 25% levy for Japan, suggest tariffs will end up higher than the baseline 10%. And the confidence created by the TACO trade may now be creating a risky logic. On Thursday Trump told NBC that buoyant stock markets proved his tariffs had been “well received”, rather than damaging the economy, implicitly giving him a green light to proceed with more damaging levies.

Yet markets are far from pricing in the true impact of a trade war. So far, the U.S. has barely concluded any trade deals, meaning more extreme negotiation and threats may be coming. Moreover, the impact of tariffs announced to date on U.S. consumer prices will only start to be felt this month.

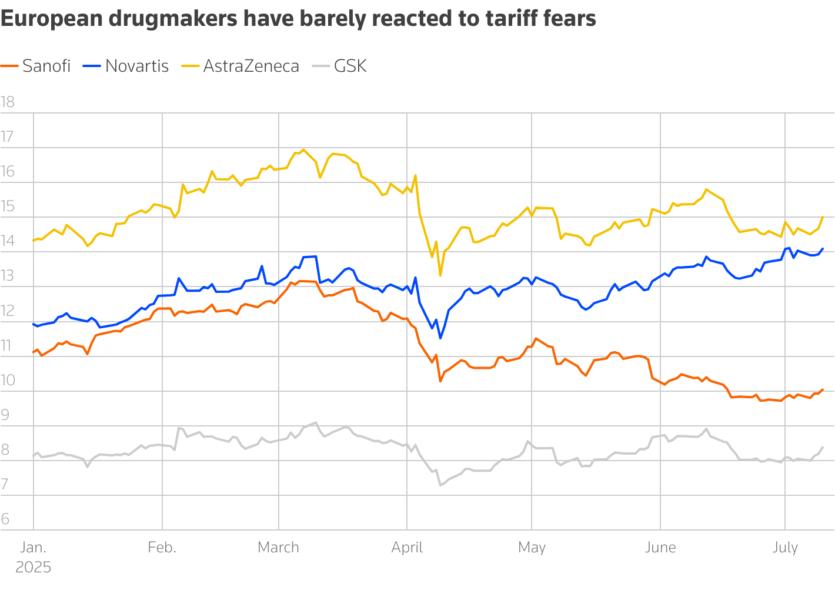

Stock prices in some of the most affected sectors look complacent. In Europe, drugmakers Novartis NOVN, AstraZeneca

AZN, Sanofi

SAN and GSK

GSK are on average trading at 11.8 times forward earnings, above their 11.3 times level at the start of the year, as per LSEG data. Carmakers Volkswagen

VOW, Stellantis

STLAM, Porsche

P911, BMW

BMW and Mercedes-Benz

MBG are now on average trading at 8 times, also above their level at the start of the year. Buoyant markets will require capitulation from Trump to avoid a reckoning, yet they make that same capitulation less likely.

Follow @Unmack1 on X

CONTEXT NEWS

U.S. President Donald Trump on July 10 announced a new wave of tariffs on Canada, whilst at the same time highlighting buoyant stock markets as a validation of his trade war.

Trump said that a 35% tariff rate would apply to Canada as of August 1. Earlier in the week he proposed a 50% tariff on copper imports, and a 200% tariff on pharmaceuticals. The U.S. is currently negotiating with key trading partners including the European Union over his proposed “reciprocal” tariffs, which were announced on April 2.

“I think the tariffs have been very well received,” he said in an interview with NBC. “The stock market hit a new high today.”