India’s food delivery duo is ripe for disruption

India’s food delivery duopoly is brushing off the imminent entry of a low-fee champion. Shares of $28 billion Eternal ETERNAL, formerly known as Zomato, and Swiggy

SWIGGY, have recovered since early June when Rapido’s intention to slash food delivery charges was reported by local media. But the industry is ripe for disruption.

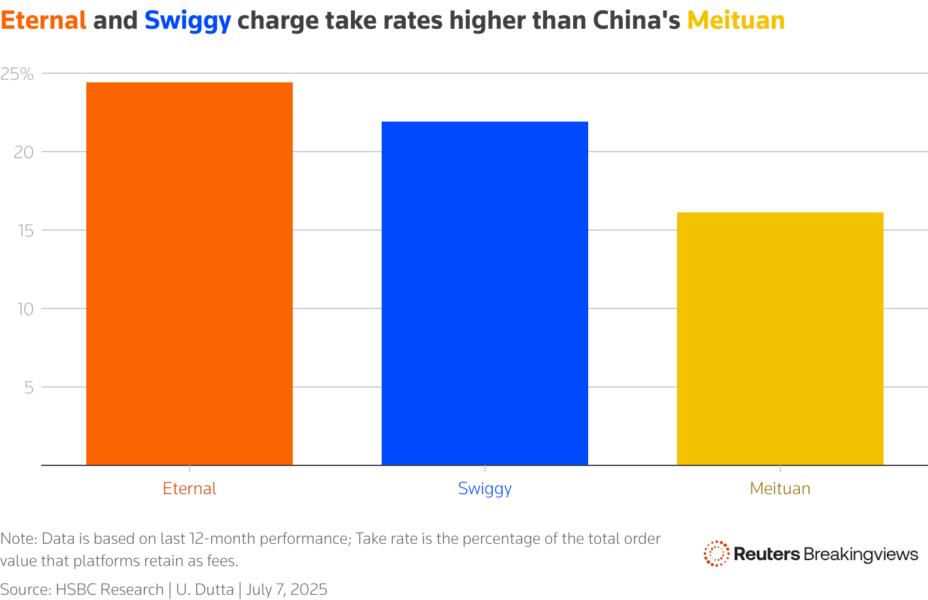

Rapido, which began life as a bike taxi firm a decade ago, aims to nearly halve the duo's “take rates” - the percentage of the total transaction value the companies keep as revenue for facilitating orders and deliveries, usually commissions paid by restaurants or delivery charges by customers. Zomato and Swiggy's at 24.4% and 21.9% respectively are much higher than global peers, per HSBC, easily besting China’s Meituan's 3690 16.1%.

To be sure, other mobility providers have tried and failed to muscle into food delivery. Rapido, though, has chipped away at Ola and Uber’s grip on ride-hailing by focusing on affordability. It has captured a majority share of the bike taxi market, 33% of three-wheelers, and near-20% of four-wheelers, according to Motilal Oswal, a brokerage. The company's latest fundraising round valued it at $1.1 billion and it is profitable on an EBITDA basis. Now it wants to utilise its 4 million rider network to deliver meals outside of peak travel hours.

Besides inviting new competition, India’s high take rates may explain why industry growth is slowing. Take Eternal. Food delivery is its biggest business, accounting for 38% of its top line. But the segment's gross order value grew just 16% year-on-year in the quarter ended March and 17% in the December quarter - missing the company's own guidance of 20%.

The company led by Deepinder Goyal charges an average take rate of about 24%, per Visible Alpha, enough to generate a profit per order. If Eternal adopts a similar rate as Meituan, its adjusted food delivery revenue would drop by about one-third, according to Breakingviews' calculations. That would make it harder for Eternal to support its other loss-making businesses, including quick commerce.

Swiggy may ultimately share in any success of Rapido if the upstart defies expectations. It owns about 13% of its wannabe rival and both share Dutch investor Prosus PRX as a backer. For now, Rapido's entry was the subject of the first question Swiggy CEO Sriharsha Majety faced at Prosus’ Capital Markets Day late last month. A high-fee business model in a price-sensitive country will keep the market on edge.

Follow Ujjaini Dutta on LinkedIn and X.

CONTEXT NEWS

Ride-hailing startup Rapido is set to roll out a pilot of its food delivery service, Ownly, in Bengaluru this week, The Economic Times reported on July 2, citing people directly aware of the developments.

The firm is planning to charge restaurant commissions in the 8-15% range, the report added.