Apollo yield machine finds new fuel in UK pensions

There’s an all-consuming logic to what CEO Marc Rowan is building at Apollo Global Management APO. The firm manages $785 billion of assets and has a private-capital operation that spans everything from buyout loans to boat finance. The trick is finding the right liabilities to fund this blizzard of investment possibilities. UK pensions are the next move, judging by a $7.8 billion acquisition announced by Apollo partner Athora late on Thursday. It’s likely to be the first of many.

Admittedly, Athora isn’t directly part of Rowan’s empire. Apollo merely has a stake in the Europe-focused retirement insurer, equivalent to 25% in December, and a “strategic relationship” that involves advising on investment management. It’s nonetheless easy to slot the new deal into Rowan’s broader strategy.

Athora is buying Pension Insurance Corporation from a consortium of private investors. The target looks after about $70 billion of assets, which back the retirement savings of 400,000 Brits. Some of that money could in theory be routed towards Apollo’s varied investment opportunities like private credit, real estate, infrastructure and niche asset-backed finance.

At first glance, the price of 1.05 times shareholders’ equity, according to a person familiar with the matter, looks relatively full. Buying a bunch of financial assets at book value is not generally a good way to make money. And the historic cash returns that Pension Insurance Corporation has produced for its equity owners are hardly enough to get pulses racing. Strip out a special dividend from last year, and the normal payout was just under 300 million pounds, which according to Breakingviews calculations implies a 5% return on the purchase price. That's not much higher than the 4.5% currently paid by 10-year UK government bonds.

Yet that comparison misses the real point of the deal. It’s more likely to be all about scale and the ability to grow faster. Size helps in the so-called pension risk transfer market, which involves big insurers taking over responsibility for managing another company’s retirement scheme. Larger managers can afford to develop their own internal risk models for calculating equity requirements, and get them signed off by regulators, which can mean that the business runs on less capital.

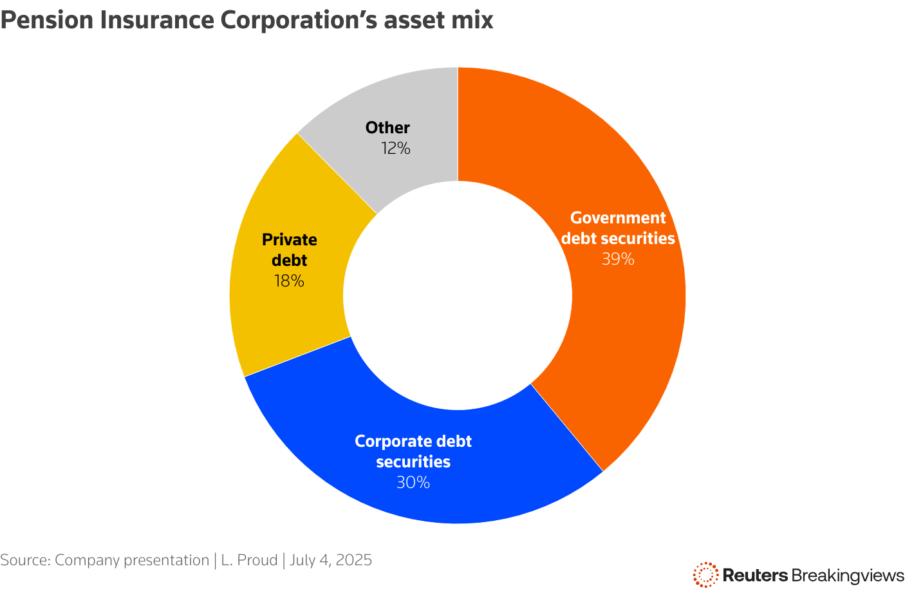

More pertinently for Athora, having access to a giant investment machine like Apollo's gives the business a licence to grow. One increasingly popular way to boost returns in the pension insurance business is to put money into relatively high-yielding, unique assets that match the time horizon of the liabilities, like new housing or infrastructure projects including data centres. Private debt investments were about a fifth of Pension Insurance Corporation's total assets last year. That proportion could rise under the guidance of private-market specialist Apollo, in turn enabling the business to buy out more retirement schemes as the market grows. Apollo recently committed to provide $6 billion of financing for Britain's long-delayed Hinkley Point nuclear project. In short, Rowan has created a giant machine for sourcing yield. UK pensions can turbocharge it.

Follow Liam Proud on Bluesky and LinkedIn.

CONTEXT NEWS

Specialised life insurance group Athora has agreed to buy Britain’s Pension Insurance Corporation for 5.7 billion pounds ($7.8 billion), both companies said on July 3.

Athora, which has 76 billion euros ($89.7 billion) of assets under administration before the deal, is backed by U.S. private-markets giant Apollo Global Management.