India stock exchange derivative activity slips by a third since Jane Street trading ban

Trading in India's weekly equity index options has slumped by a third since the country's market regulator banned U.S. high-frequency trading giant Jane Street in the local market earlier this month, exchange data showed on Thursday.

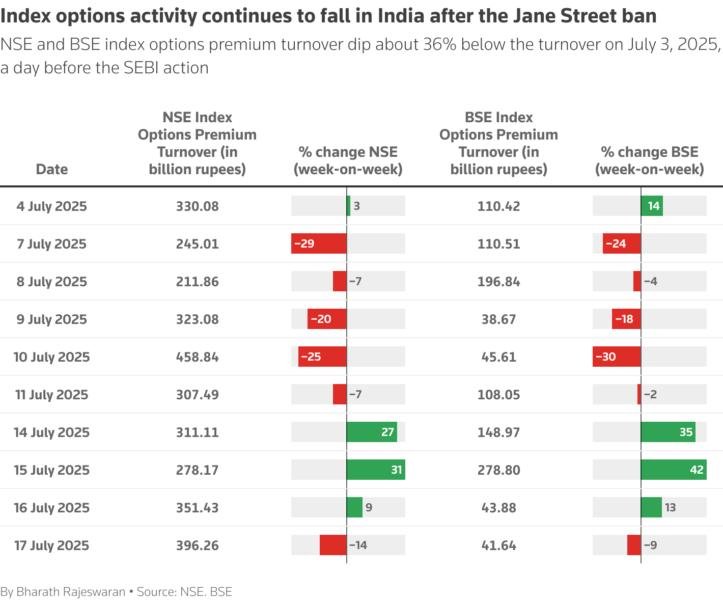

National Stock Exchange of India - the world's largest derivatives exchange by number of contracts traded - saw a nearly 36% drop over two weeks in index options premium turnover, a key measure of real capital deployed and risk appetite.

The options premium turnover stood at 396.26 billion rupees ($4.6 billion) on Thursday, which is the day of weekly options expiry on NSE.

The Securities and Exchange Board of India barred Jane Street on July 4, saying an investigation found it manipulated stock indexes through positions taken in derivatives.

NSE's rival exchange BSE BSE also saw its options premium turnover drop 36.4% below the July 3 levels. BSE index options expire on Tuesdays.

Emails to NSE and BSE were not immediately answered.

Out of the 10 sessions since the ban, turnover has declined in six on a week-on-week basis across both the exchanges.

"The notable decline in options premium turnover can be attributed to the abrupt withdrawal or reduction of activity by Jane Street, which serves as a primary liquidity provider within the options market," said Osho Krishan, senior analyst of technical and derivatives research at brokerage Angel One.

Unless new market-makers step in or volatility rises materially, turnover is unlikely to bounce back soon, Krishan said.

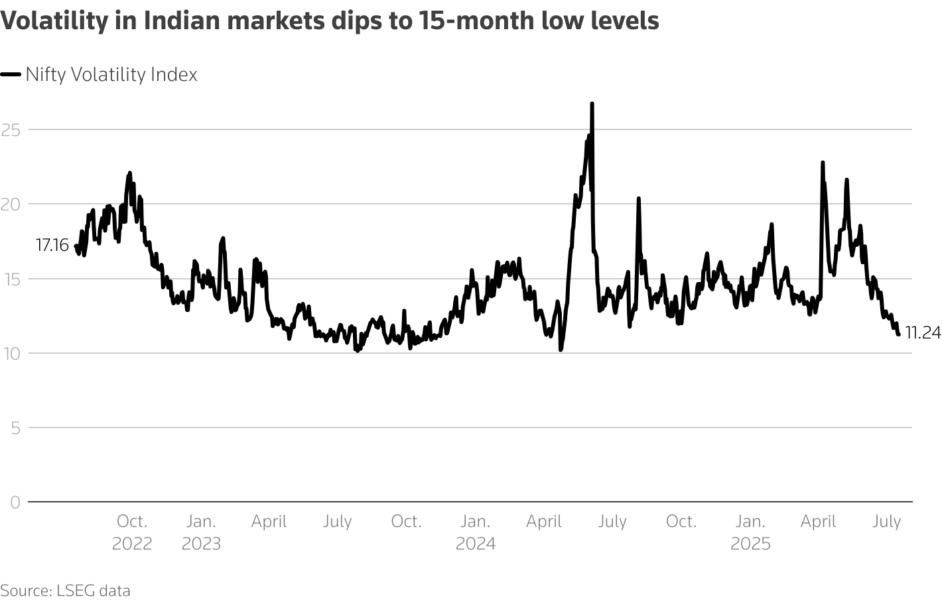

Traders also point to a broader lull in volatility dragging volumes.

"This isn't just a Jane Street story," said Mayank Bansal, a portfolio manager in India's options market. "It's mostly about volatility — once that comes back, so will the volumes."

The Nifty volatility index INDIAVIX has fallen in nine of the 13 sessions in July so far, and was hovering near a more than one-year low.

($1 = 86.0410 Indian rupees)