COMMENT-SEK and credibility, top priorities for the Riksbank

The Riksbank meets today and a larger than expected 50-basis point rate hike is needed to bolster the weak krona and maintain the central bank's credibility.

Currency stability has been at the forefront of the bank's efforts to bring down inflation but imported price pressures continue to drive the inflation rate.

Hawkish rhetoric from the European Central Bank, Bank of England and Norges Bank has also increased pressure on the SEK and the Riksbank will have to follow suit if currency stability is to be achieved. Furthermore, the Riksbank's rate path will need to be raised if krona appreciation is the goal.

The Riksbank is expected to raise its key interest rate by 25 basis points to 3.75% today. A further 25-basis point hike in September is likely, with the SEK weakening again and inflation still a problem. There is a possibility the Riksbank might have to take its benchmark rate above 4.0% before embarking on an easing bias.

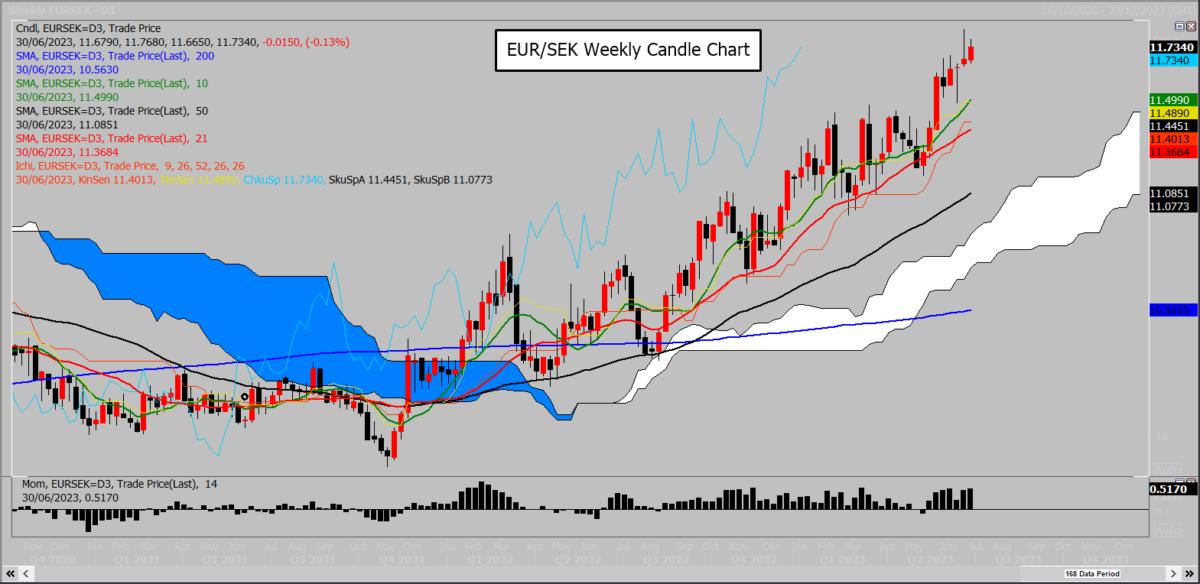

Sweden's crown is trying to fight back versus the euro but remains over 12% weaker since August 2022. The bigger EUR/SEK levels to watch are at 11.4850 and 11.8150, the June range.

For more click on