Evening Wrap: ASX 200 stumbles on rising benchmark yields, RBA minutes hint readiness to hike if necessary

The S&P/ASX 200 closed 32.5 points lower, down 0.42%.

There's a very simple rule in financial markets: Stocks hate rising yields.

And since the middle of last week, both local and overseas benchmark yields have been on the rise. The result is lower prices for Aussie stocks today – particularly those in the Consumer Discretionary, Property, and Financials sectors.

The only sector to show any strength of note was the Energy sector. It's enjoying the potential spoils of rising coal and crude oil prices.

It also likely didn't help matters that minutes from the RBA's June meeting released today demonstrated an all too eager readiness to hike again if required...

Let's dive in!

Today in Review

Tue 02 Jul 24, 4:31pm (AEST)

| Name | Value | % Chg |

|---|---|---|

| Major Indices | ||

| ASX 200 | 7,718.2 | -0.42% |

| All Ords | 7,959.7 | -0.41% |

| Small Ords | 2,949.4 | -0.19% |

| All Tech | 3,066.8 | -0.39% |

| Emerging Companies | 2,118.8 | +0.08% |

| Currency | ||

| AUD/USD | 0.6643 | -0.25% |

| US Futures | ||

| S&P 500 | 5,524.25 | -0.17% |

| Dow Jones | 39,449.0 | -0.16% |

| Nasdaq | 20,001.0 | -0.25% |

| Name | Value | % Chg |

|---|---|---|

| Sector | ||

| Energy | 10,268.1 | +2.00% |

| Utilities | 9,288.8 | -0.01% |

| Information Technology | 2,283.9 | -0.26% |

| Communication Services | 1,482.2 | -0.30% |

| Health Care | 43,411.3 | -0.33% |

| Industrials | 6,762.6 | -0.35% |

| Consumer Staples | 12,231.7 | -0.39% |

| Financials | 7,583.8 | -0.44% |

| Materials | 16,949.0 | -0.60% |

| Consumer Discretionary | 3,470.5 | -0.92% |

| Real Estate | 3,543.6 | -1.42% |

Markets

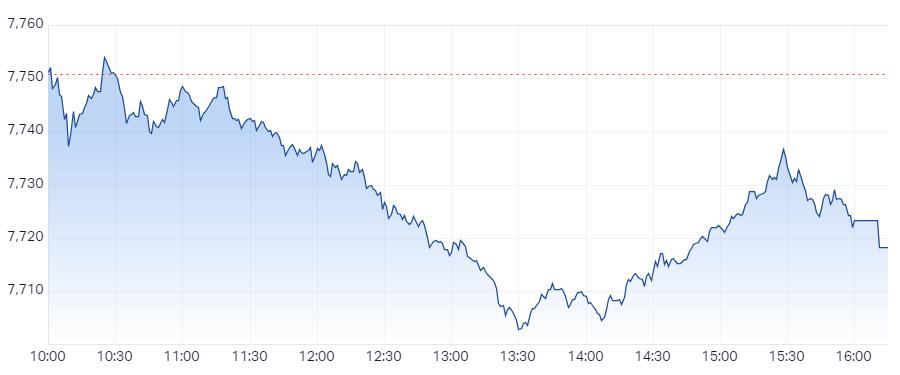

ASX 200 Session Chart

The S&P/ASX 200 (XJO) finished 32.5 points lower at 7,718.2, 0.47% from its session high and just 0.2% from its low. In the broader-based S&P/ASX 300 (XKO), advancers lagged decliners by a dismal 99 to 163.

The Energy (XEJ) (+2.0%) sector was the best performing sector today, likely in response to rising coal and crude oil prices over the last 24-hours (note, I have analysis of the two major coal contracts in ChartWatch below).

Company | Last Price | Change $ | Change % | 1mo % | 1yr % |

|---|---|---|---|---|---|

Whitehaven Coal (WHC) | $8.59 | +$0.46 | +5.7% | +6.6% | +26.3% |

Coronado Global Resources (CRN) | $1.340 | +$0.05 | +3.9% | +20.2% | -12.1% |

Woodside Energy Group (WDS) | $29.13 | +$0.88 | +3.1% | +5.2% | -15.0% |

Yancoal Australia (YAL) | $7.02 | +$0.1 | +1.4% | +8.7% | +56.0% |

New Hope Corporation (NHC) | $5.17 | +$0.07 | +1.4% | +4.0% | +8.1% |

Santos (STO) | $7.69 | +$0.06 | +0.8% | +0.8% | +3.1% |

Beach Energy (BPT) | $1.490 | +$0.01 | +0.7% | -11.0% | +10.4% |

The best of the energy sector today

The XEJ’s rally is entering its second week, and based upon today’s move, appears to be gathering steam. However, from a technical perspective, there’s clearly still plenty of work to be done. The long term downtrend ribbon is the next key point of supply (dynamic). I’d like to see the XEJ’s price close above this zone to grow more confident of the current rally’s sustainability.

The XEJ’s rally is gathering steam, but substantial challenges remain

Doing it tough today were the 'interest rate sensitives' of Real Estate Investment Trusts (XPJ) (-1.5%), Consumer Discretionary (XDJ) (-0.92%), and Financials (XFJ) (-0.44%). These sectors hate it when market yields rise, as has generally been the case for both Australian and global benchmark yields since the start of the week.

Sandwiched between those interest rate sensitives somewhere was the ASX’s enduring worst performer, Resources (XJR)(-1.42%) (well it was June’s worst performer, it just feels like it's been forever!).

Company | Last Price | Change $ | Change % | 1mo % | 1yr % |

|---|---|---|---|---|---|

Core Lithium (CXO) | $0.086 | -$0.005 | -5.5% | -33.8% | -90.6% |

Jupiter Mines (JMS) | $0.285 | -$0.015 | -5.0% | -14.9% | +39.0% |

Syrah Resources (SYR) | $0.335 | -$0.015 | -4.3% | -26.4% | -57.6% |

Chalice Mining (CHN) | $1.515 | -$0.06 | -3.8% | -8.5% | -75.7% |

IGO (IGO) | $5.63 | -$0.22 | -3.8% | -19.5% | -62.1% |

Pilbara Minerals (PLS) | $2.97 | -$0.11 | -3.6% | -21.6% | -38.5% |

Mineral Resources (MIN) | $53.66 | -$1.28 | -2.3% | -25.1% | -24.6% |

Capricorn Metals (CMM) | $4.79 | -$0.09 | -1.8% | +0.2% | +17.7% |

Alumina (AWC) | $1.670 | -$0.03 | -1.8% | -11.9% | +21.5% |

Lotus Resources (LOT) | $0.325 | -$0.005 | -1.5% | -30.1% | +85.7% |

WA1 Resources (WA1) | $19.22 | -$0.25 | -1.3% | -9.3% | +236.0% |

Iluka Resources (ILU) | $6.60 | -$0.07 | -1.0% | -7.7% | -40.5% |

Sandfire Resources (SFR) | $8.59 | -$0.09 | -1.0% | -7.1% | +44.9% |

Fortescue (FMG) | $21.57 | -$0.19 | -0.9% | -12.8% | -2.4% |

Rio Tinto (RIO) | $119.63 | -$1.04 | -0.9% | -7.2% | +4.5% |

Nickel Industries (NIC) | $0.800 | -$0.005 | -0.6% | -16.7% | -8.6% |

Northern Star Resources (NST) | $12.83 | -$0.07 | -0.5% | -10.6% | +5.9% |

Lynas Rare Earths (LYC) | $6.13 | -$0.03 | -0.5% | -8.0% | -10.1% |

BHP Group (BHP) | $43.16 | -$0.14 | -0.3% | -3.0% | -4.0% |

Another bruising day for ASX Resources stocks

ChartWatch

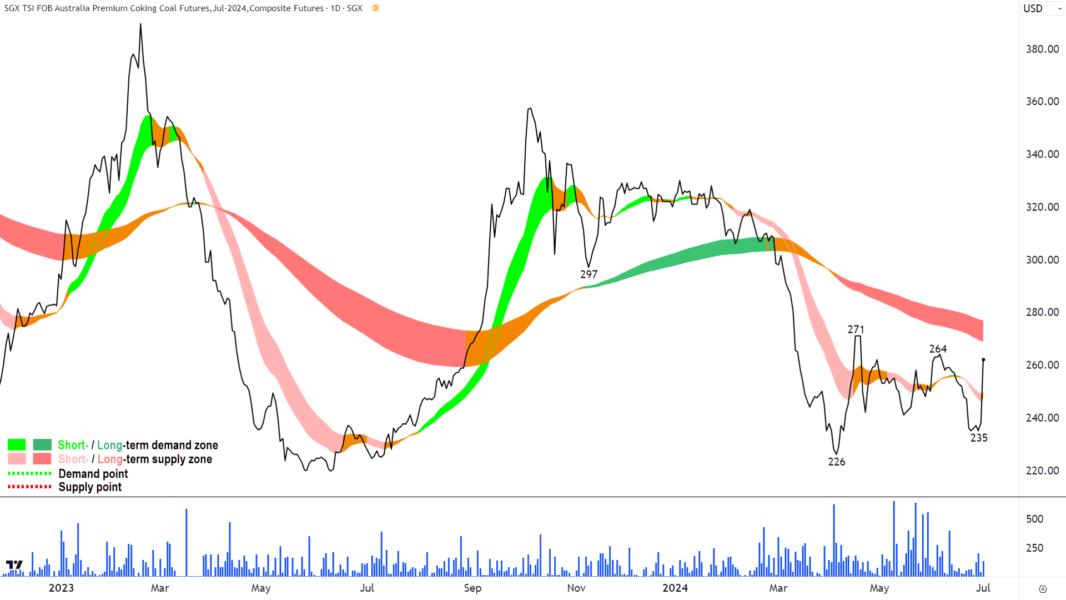

Australian Premium Coking Coal Futures (Front month, back-adjusted) SGX

Anglo-American's loss is ASX coal's gain

You may have noticed in the Winners table of the Interesting Moves section from yesterday’s Evening wrap a sudden influx of coal stocks – 5 to be exact: Coronado Global Resources CRN, New Hope Corporation

NHC, Stanmore Resources

SMR, Whitehaven Coal

WHC, and Yancoal Australia

YAL.

The reason for the strong performance in ASX coal was news that major producer Anglo-American had been forced to stop production at one of its Queensland mines due to a fire.

As can be seen from the above chart, the result of the news – which implies lesser supply to the market – saw the price of the key Australian coking coal futures contract spike over 10% to US$262/t on Singapore’s SGX futures exchange.

Coking or metallurgical (“met”) coal as it is also known, is the other key ingredient to iron ore in the steel making process. It should not be confused with thermal coal which is used for electrical power generation.

While we’re on the topic of charts, it’s also worth noting that the charts of SMR, NHC, and YAL are also constituents of my Uptrends Scan List in my regular ChartWatch Daily Scans, and I suspect that based upon today’s performance WHC will be joining them tomorrow.

So, given all the above, I figure it’s a good time to look at the charts of the two major Australian coal futures contracts, Met Coal above, and Newcastle thermal coal below.

Clearly, despite the excitement of the last 24-hours, met coal remains in a long term downtrend. The short term downtrend was neutralised by yesterday’s spike.

That spike closed the met coal price above the dynamic supply of the short term trend ribbon, but just short of the 264 point of supply.

The price action has compressed within a range between 226 and 271, the top of which coincides with likely dynamic supply from the long term downtrend ribbon.

A close above 271 is a prerequisite for neutralising the long term downtrend, and it would be beneficial to see a return to rising peaks and rising troughs prior to then (i.e., supply removal and demand reinforcement respectively).

Alternatively, a close back below the short term trend ribbon would indicate the supply side is very much still in control, and a close below 235 would set met coal up to probe even lower points of demand.

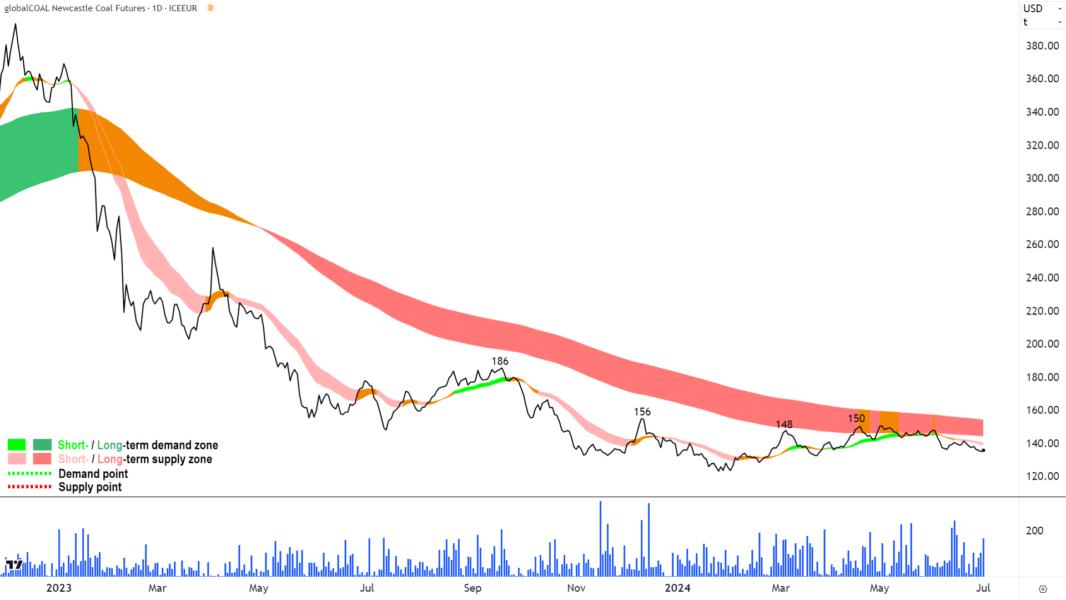

Newcastle Coal Futures (Front month, back-adjusted) ICE

No redeeming features...

You might find it a little confusing to see such pronounced downtrends in thermal coal, the met coal chart not looking too crash hot either, while at the same time finding the charts of so many ASX coal stocks in strong uptrends.

I just follow trends, so this potential discrepancy is meaningless to me!

The short and long term downtrends here are well established. The price action is falling peaks and falling troughs (i.e., supply reinforcement and demand removal respectively).

There is a total absence of demand-side control evidenced in this chart.

In the absence of a return to rising peaks and rising troughs and or a close above the short and long term downtrend ribbons, I suggest a close above 150 is the minimum requirement to signal that the demand-side is indeed back in control.

Economy

Today

AUS RBA June Meeting Minutes

Key takeaways from the minutes:

"households were not being as cautious in their spending as previously thought"

"The labour market was still assessed as tight relative to full employment"

"Inflation remained above the target range and had been a little higher than expected in prior months"

“longer term inflation expectations in Australia were still anchored...Members acknowledged that if inflation expectations were to rise materially from current levels, it could require significantly higher interest rates to bring inflation back to target, with adverse implications for growth in output and employment”

"while monetary policy was restrictive, an important judgement was whether policy settings were sufficiently restrictive to return inflation to target within the timeframe implicit in the Board’s strategy"

Later this week

Tuesday

19:00 EUR Core CPI Flash Estimate y/y to June (+2.8% forecast vs +2.9% in May)

23:30 USA Federal Reserve Chairman Jerome Powell Speaks

Wednesday

00:00 USA JOLTS Job Openings June (7.86M forecast vs 8.06 in May)

11:30 AUS Retail Sales June (+0.3% forecast vs +0.1% in May)

11:45 CHN Caixin Services PMI June (53.4 forecast vs 54.0 in May)

17:15 EUR Services PMIs Various June

Thursday

00:00 USA Services PMI June (52.5 forecast vs 53.8 in May)

04:00 USA FOMC June Meeting Minutes

All Day USA July 4 Public Holiday - non trading day

Friday

22:30 Non-Farm Employment Change, Average Hourly Earnings m/m, Unemployment Rate June

+189K forecast vs +272K in May; +0.3% forecast vs +0.4% in May; 4.0% forecast vs 4.0% in May

Latest News

Lithium pls min

Latest views on lithium from three major brokers

Tue 02 Jul 24, 1:49pm (AEST)

Director Transactions kar xro

Insider Trades: Directors bought and sold shares in these 7 ASX 200 stocks last week

Tue 02 Jul 24, 11:57am (AEST)

Short Selling pls iel

The 10 most shorted ASX stocks plus the biggest risers and fallers – Week 26

Tue 02 Jul 24, 10:57am (AEST)

Technical Analysis

Strap in investors! ASX is primed for a July-August blast off!

Tue 02 Jul 24, 9:35am (AEST)

Technical Analysis bio cba

ChartWatch ASX Scans: Metro Mining, Origin Energy, Stanmore Resources, Audinate, Charter Hall, Ebos

Tue 02 Jul 24, 9:00am (AEST)

Market Wraps

Morning Wrap: ASX 200 to fall, S&P 500 ticks higher, Energy and Coal stocks in focus

Tue 02 Jul 24, 8:41am (AEST)

More News

Interesting Movers

Trading higher

+8.0% Droneshield (DRO) - No news, rise is consistent with the most wonderful short and long term uptrends! 🔎📈

+7.3% Liontown Resources (LTR) - Joint Statement with LG Energy Solution and Presentation - Strategic Partnership and Long Term Funding and Strategic partnership to deliver long-term funding, note however, LTR closed with long upward pointing shadow terminating at short term downtrend ribbon, long term trend remains down

+6.4% Electro Optic Systems (EOS) - No news, rise is consistent with short and long term uptrends 🔎📈

+5.8% Resolute Mining (RSG) - No news, rise is consistent with short and long term uptrends 🔎📈

+5.7% Whitehaven Coal (WHC) - Continued positive response to yesterday's news of supply disruptions at a competitor's QLD mine, rise is consistent with prevailing short and long term uptrends 🔎📈

+5.2% Acrow (ACF) -Acrow Achieves Record Secured Hire Contracts and Pipeline, rise is consistent with prevailing long term uptrend, bounced off long term uptrend ribbon 🔎📈

+4.3% Vulcan Energy Resources (VUL) - No news, perfectly bouncing off long term uptrend ribbon! 🔎📈

+4.0% IPD Group (IPG) - No news, rise is consistent with short and long term uptrends 🔎📈

+3.9% Coronado Global Resources (CRN) - Continued positive response to yesterday's news of supply disruptions at a competitor's QLD mine, rise is consistent with prevailing short and long term uptrends 🔎📈

+3.2% Botanix Pharmaceuticals (BOT) - No news, retained at buy at Euroz Hartleys, price target increased $0.47 from $0.33

+3.1% Woodside Energy Group (WDS) - No news, generally strong ASX energy sector on rising energy commodities prices

Trading lower

-12.6% Rpmglobal (RUL) - Update on Software sales & expected FY2024 Result

-7.3% Imugene (IMU) - No news, fall is consistent with short and long term downtrends 🔎📈

-6.5% Immutep (IMM) - No news, continued negative response to last week's Positive topline results from ph2b in head & neck cancer

-6.5% Lindian Resources (LIN) - Investor Webinar

-6.0% Mesoblast (MSB) - Mesoblast to File BLA for Ryoncil FDA Approval Next Week, fall is consistent with prevailing short term downtrend and falling peaks and falling troughs 🔎📉

-5.5% Core Lithium (CXO) - No news, continued negative response to last week's NEWS

-5.0% Jupiter Mines (JMS) - No news, fall is consistent with prevailing short term downtrend and falling peaks and falling troughs 🔎📉

-5.0% Mayne Pharma Group (MYX) - Class action settlement, fall is consistent with short and long term downtrends 🔎📈

-4.3% Bannerman Energy (BMN) - No news, continued negative response to last week's NEWS

-4.3% Syrah Resources (SYR) - No news, fall is consistent with short and long term downtrends 🔎📈

-4.2% EML Payments (EML) - No news today, but possibly delayed negative response to yesterday's NEWS, fall is consistent with prevailing short term downtrend, long term trend is transitioning from up to down 🔎📉

Broker Notes

Adacel Technologies (ADA)

Retained at buy at Bell Potter; Price Target: $0.75 from $0.80

Atlas Arteria (ALX)

Retained at buy at Jefferies; Price Target: $6.41 from $6.33

Retained at neutral at Macquarie; Price Target: $5.20 from $5.39

Retained at equal-weight at Morgan Stanley; Price Target: $5.66

Retained at sector perform at RBC Capital Markets; Price Target: $5.50

Austin Engineering (ANG)

Retained at buy at Shaw and Partners; Price Target: $0.60

Botanix Pharmaceuticals (BOT)

Retained at buy at Euroz Hartleys; Price Target: $0.47 from $0.33

Cobram Estate Olives (CBO)

Retained at hold at Bell Potter; Price Target: $1.95 from $2.10

Retained at buy at Shaw and Partners; Price Target: $2.05

Computershare (CPU)

Retained at outperform at Macquarie; Price Target: $30.00 from $29.00

DGL Group (DGL)

Downgraded to hold from buy at Bell Potter; Price Target: $0.65 from $0.75

Delta Lithium (DLI)

Retained at buy at Bell Potter; Price Target: $0.75

Hansen Technologies (HSN)

Retained at buy at Shaw and Partners; Price Target: $6.90

Hub24 (HUB)

Initiated at buy at Bell Potter; Price Target: $53.20

IGO (IGO)

Retained at underweight at Morgan Stanley; Price Target: $5.05

IPH (IPH)

Retained at outperform at Macquarie; Price Target: $7.35

James Hardie Industries (JHX)

Retained at outperform at Macquarie; Price Target: $66.60 from $55.00

Lendlease Group (LLC)

Upgraded to buy from neutral at Citi; Price Target: $6.30

Medibank Private (MPL)

Retained at neutral at Macquarie; Price Target: $3.70 from $3.60

National Australia Bank (NAB)

Retained at neutral at Goldman Sachs; Price Target: $34.04

NIB (NHF)

Retained at neutral at Macquarie; Price Target: $7.50 from $7.30

Peninsula Energy (PEN)

Retained at buy at Shaw and Partners; Price Target: $0.26

Pioneer Credit (PNC)

Retained at buy at Shaw and Partners; Price Target: $0.80

QBE Insurance Group (QBE)

Retained at neutral at Macquarie; Price Target: $18.40 from $18.00

Saturn Metals (STN)

Retained at buy at Shaw and Partners; Price Target: $0.37 from $0.44

Santos (STO)

Retained at outperform at Macquarie; Price Target: $9.00

Woodside Energy Group (WDS)

Retained at outperform at Macquarie; Price Target: $32.00

Xero (XRO)

Retained at buy at Goldman Sachs; Price Target: $180.00 from $164.00

Scans

Top Gainers

| Code | Company | Last | % Chg |

|---|---|---|---|

| REC | Recharge Metals Ltd | $0.036 | +38.46% |

| NNL | Nordic Nickel Ltd | $0.078 | +36.84% |

| AHK | Ark Mines Ltd | $0.205 | +36.67% |

| MMM | Marley Spoon Se | $0.02 | +33.33% |

| NPM | Newpeak Metals Ltd | $0.024 | +33.33% |

View all top gainers

Top Fallers

| Code | Company | Last | % Chg |

|---|---|---|---|

| SUM | Summit Minerals Ltd | $0.27 | -21.74% |

| WMG | Western Mines Gro... | $0.28 | -18.84% |

| RCE | Recce Pharmaceuti... | $0.49 | -18.33% |

| RC1 | Redcastle Resourc... | $0.018 | -18.18% |

| ASQ | Australian Silica... | $0.023 | -17.86% |

View all top fallers

52 Week Highs

| Code | Company | Last | % Chg |

|---|---|---|---|

| AZ9 | Asian Battery Met... | $0.04 | +14.29% |

| CYM | Cyprium Metals Ltd | $0.052 | +10.64% |

| SLS | Solstice Minerals... | $0.19 | +8.57% |

| DRO | Droneshield Ltd | $1.81 | +7.74% |

| MAU | Magnetic Resource... | $1.25 | +5.93% |

View all 52 week highs

52 Week Lows

| Code | Company | Last | % Chg |

|---|---|---|---|

| MAY | Melbana Energy Ltd | $0.028 | -20.00% |

| NVA | Nova Minerals Ltd | $0.175 | -12.50% |

| ODY | Odyssey Gold Ltd | $0.015 | -11.77% |

| JNO | Juno Minerals Ltd | $0.031 | -11.43% |

| DTZ | DOTZ Nano Ltd | $0.12 | -11.11% |

View all 52 week lows

Near Highs

| Code | Company | Last | % Chg |

|---|---|---|---|

| DVDY | Vaneck Morningsta... | $20.83 | -0.62% |

| DJW | Djerriwarrh Inves... | $2.99 | +0.67% |

| UMAX | Betashares S&P 50... | $23.58 | +0.26% |

| VEU | Vanguard All-Worl... | $88.53 | -0.32% |

| KED | Keypath Education... | $0.835 | 0.00% |

View all near highs

Relative Strength Index (RSI) Oversold

| Code | Company | Last | % Chg |

|---|---|---|---|

| VLUE | Vaneck MSCI Inter... | $25.01 | -0.04% |

| CNEW | Vaneck China New ... | $5.755 | -0.95% |

| TANN | Betashares Solar ETF | $7.23 | -1.50% |

| CCX | City Chic Collect... | $0.123 | -2.00% |

| ACQ | Acorn Capital Inv... | $0.76 | -1.94% |

View all RSI oversold