ASML Earnings "Miss": What the Market Got Wrong

ASML Earnings Miss: The Market is Wrong

Today, ASML, the monopoly semiconductor equipment giant, reported its highly anticipated earnings results. By any financial metric, the earnings were phenomenal, 8.92 billion USD in revenue compared to ~7 billion in Q2 2024, 2.656 billion in net income and nearly a 200% increase in bookings quarter over quarter. In the quarter the company reported an astonishing 54% gross margin as ASML displays its near unlimited pricing power, the company can effectively set the price on its advanced lithography and its primary customers (Samsung, TSMC, Micron, SMIC) have no choice but to accept the cost, there is quite literally no other alternative available on the planet. With such impressive results, major headlines initially were surrounding an earnings blowout due to bookings coming in above expectation, yet, what followed was a dramatic 11% drop in the stock price. Why you might ask?

The key catalyst was a comment from CEO Christophe Fouquet in the earnings press statement:

At the same time, we continue to see increasing uncertaintydriven by macro economic and geopolitical developments. Therefore, while westill prepare for growth in 2026, we cannot confirm it at this stage.

Any understanding or deeper look at the semiconductor manufacturing process and the reporting of its key customers would show this comment is incredibly conservative and downplaying the reality of operations. On the downstream supply chain, Nvidia, AMD, Micron and Taiwan Semiconductor and nearly any company related continue to explode both in growth, share price, and capital expenditures. Unprecedented levels of capital are flooding into development at a staggering pace, particularly from megacap tech companies. The idea that ASML could experience a flat year, despite earnings that reflect strong booking growth and clear momentum, ignores the sheer scale and velocity of AI-driven investment, a view not supported by capital markets.

The CEO's comment was simply a display of conservatism rather than a genuine warning. In reality, no company can ever guarantee future growth with absolute certainty, a reality and truth that the market seems to not understand. In the same breath, he explicitly stated that ASML is preparing for growth, a crucial nuance the market has chosen to ignore entirely. As a side note, semiconductor markets shot up on Monday of this week saw export restrictions on China semiconductor sales and shipments being lifted by US regulators, as 27% of ASML revenue is directly tied to Chinese exposure, this would strengthen the sales and continuing operations to the region moving forward.

While it is absolutely possible that tariffs and significant trade barriers hit the semiconductor/tech market hard enough to instill zero 2026 growth, from a financial standpoint it would seem this pessimism is exaggerated. It's important to break down the market context, the comment itself, and ASML's longer-term position in the semiconductor ecosystem beyond just 2026 regardless of one somewhat negative comment.

Conservative CEO Commentary, Not a Warning

When CEOs discuss uncertainty, they are almost always speaking from a place of necessary conservatism. It is prudent for leadership to acknowledge macroeconomic headwinds and geopolitical risks, it shows they are realistic and prepared for a range of scenarios. In ASML's case, the comment wasn't a signal of deteriorating demand or internal weakness. Instead, it reflected a responsible approach to guidance amid a complicated global environment.

Investors, however, seized on the ambiguity and treated it as a dire warning, despite there being no fundamental change in the company's demand trajectory. The reality is that semiconductor demand downstream remains strong and is likely to remain so for the foreseeable future.

ASML Stock is Exceptionally Cheap for AI Industry Exposure

From a valuation perspective, a discounted cash flow calculation using short term growth estimate of 14% (in line with other semiconductor manufacturing participants with much less critical infrastructure), a long term growth rate of 3% and a current year EPS of 26.33, would result in a 928.39 intrinsic value per share. Once you account for cash, receivables summarized in net tangible assets of 13 billion, a strong backlog and a strong 14 billion dollar buyback authorization, the true fair value per share is be at or above 1,000

DCF Model ASML Equity:

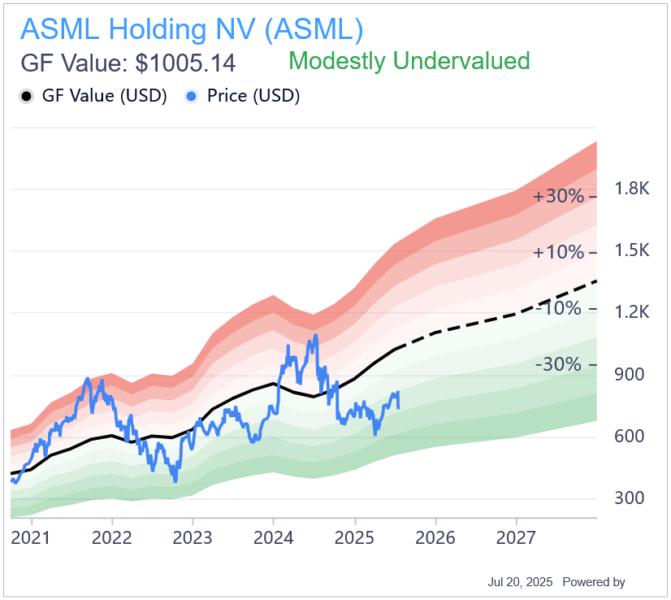

The Gurufocus fair value estimate would place the fair value of the stock at 1,005.14, implying a ~30% upside, and also a favorable risk return setup, the sheer profitability and execution of ASML legitimately warrant prices such as this, along with a fair margin of safety currently baked in to the current price.

ASML Gurufocus Fair Value Estimate:

As a quick note on the financials, taking a look at the profitability metrics/ratios, its plainly obvious that ASML delivers unmatched profitability metrics which are seen in only a handful of public companies in existence. An incredible 53% Return on equity, 40.51% return on capital employed, and a net profit margin of nearly 30% and an outright 10/10 profitability rank shows the company is more than capable of printing cash flows with consistency and it reflects in the financials.

ASML Profitability Metrics:

*Gurufocus ASML Summary

Semiconductor Demand is Rapidly Increasing:

The modern economy is increasingly reliant on advanced semiconductors, which are essential in everything from smartphones and data centers to autonomous vehicles and, most notably, artificial intelligence (AI). AI alone is creating an insatiable appetite for high-performance chips, which in turn drives demand for cutting-edge lithography machines, ASML's specialty.

Unlike many cyclical tech sectors, semiconductor manufacturing equipment benefits from structural growth drivers. Every leap in chip performance requires more sophisticated manufacturing processes. ASML's extreme ultraviolet (EUV) lithography machines are the critical enablers of these advanced chips. In fact, no other company in the world can produce EUV machines at the scale and precision ASML can, putting it in a virtual monopoly position.

ASML: The Cheapest Real AI Play

Investors searching for genuine AI exposure often flock to high-profile names like Nvidia. While Nvidia garners headlines and excitement, ASML represents a purer, more foundational play on AI growth yet trades at far more reasonable valuations on a forward basis and facing virtually zero competition. Even in a no growth scenario for 2026, the company still would only be trading at a 28x forward earnings multiple, which is incredibly cheap compared to companies with similar profitability such as NVDA at a ~40, ARM at a 81 PE and AMD at a 37 forward PE albeit with less exceptional profitability metrics.

ASML's machines are necessary for creating the chips that power AI workloads. Without ASML's EUV systems, manufacturers cannot economically produce the high-density, high-efficiency chips that AI

applications demand. This makes ASML indispensable not just to AI chip makers but to the broader technological advancement of the entire semiconductor industry.

Despite this strategic importance, ASML's valuation remains relatively undemanding, especially when compared to the sky-high multiples seen in other AI-linked stocks. Investors currently have an opportunity to buy into a company that not only dominates a crucial chokepoint in the semiconductor supply chain but also benefits directly from AI's exponential growth.

A Monopolist State: Safety in Dominance

ASML's competitive position is perhaps its most compelling attribute. It effectively holds a monopoly in advanced lithography technology, particularly EUV systems. Developing these machines requires years of research, billions in capital expenditures, and an intricate network of highly

specialized suppliers. Any new entrant would face monumental hurdles in catching up. Typically monopolistic operations are subject to regulatory scrutiny although the beauty of ASML is, this really is not the case, there is no anti competitive/antitrust actions as the monopoly is simply due to the extreme technological feats of its engineering and IP. The company is also shielded and supported by strategic initiatives via policy and, not only is there no other alternative, the positioning is supported via the agencies that would typically regulate its operations.

This monopolistic status confers significant pricing power, stability in margins, and a defensible moat against competitors. It also provides resilience against geopolitical shocks. For example, recent concerns

over tariffs and trade restrictions are overblown when it comes to ASML. The company's primary customers include Taiwan's TSMC, South Korea's Samsung, and leading European chipmakers not U.S. fabs. The U.S. currently lacks meaningful capacity in advanced lithography-dependent chip manufacturing, so even if tariffs were implemented, they would have a negligible impact on ASML's business and would likely be exempted from tariffs in any matter.

Why the Selloff is Overdone

The fact that the stock did not react immediately to the financial report but plunged only after the earnings call suggests that the market's reaction was driven by a knee-jerk interpretation of CEO comments rather than fundamentals. Investors often overreact to management's cautious language without considering the company's actual financial health and market position.

It's critical to look beyond headline soundbites, ASML's backlog remains robust, and its technology leadership is unchallenged. The company continues to invest in next-generation lithography, including High-NA EUV, which will further cement its dominance in the years ahead.

Looking Ahead: Growth, Not Gloom

While ASML's leadership has expressed caution about confirming 2026 growth, this does not imply that growth will not materialize. Rather, it signals responsible management in an environment where macro and geopolitical shifts can change rapidly. The underlying drivers of semiconductor growth AI, cloud computing, data center, and the proliferation of related supply chains remain firmly intact.

Moreover, as chip complexity increases, ASML stands to benefit disproportionately. Every step forward in node shrinkage or chip design intricacy translates into greater reliance on ASML's truly dominant machines.

Conclusion: A Buying Opportunity Hidden in Fear

"Be greedy when others are fearful"

In summary, the post-earnings decline in ASML stock represents a classic market overreaction to conservative management commentary rather than a fundamental deterioration in the company's prospects. The CEO's cautious tone was an exercise in responsible disclosure, not a harbinger of decline.

ASML remains the linchpin of the semiconductor industry and a foundational enabler of the AI revolution. Its monopoly-like market position, strong technological moat, and strategic importance make it not only a safer semiconductor investment but arguably the most attractive long-term AI infrastructure play available today.

For investors who can look past the immediate noise and focus on structural trends, this selloff could prove to be an exceptional entry point into a company that is literally in a league of its own.