Apartment Investment and Management Company: A Long-Term Bet on NAV Growth

Since the spin-off that separated Apartment Investment and Management Company AIV, also known as Aimco, from Apartment Income REIT (AIRC), the thesis has transformed into a different business.

Apartment Income REIT is more income-oriented, while Aimco's thesis is focused on real estate development, i.e., it is not just about collecting rent, but rather generating some value in the coming years by significantly increasing units via ground-up construction and redevelopment.

My thesis is mainly that although there are important triggers and, consequently, the potential for value creation is undeniable, the path forward is fraught with execution risk. Therefore, I classify Aimco as that classic show me story.

NAV Growth Prospects

The core appeal of this REIT is its clear and focused strategy: create value by developing apartment buildings at a cost significantly below their stabilized market value. This isn't about incremental rent growth or an inflation-linked revenue, it's actually about manufacturing equity through their expertise and the like. The company investor presentation shows this. They have a target net operating income (NOI) yield spreads of 1.5% to 2% on their development projects.

To explain this simply, if they manage to build a property that generates an annual return of 6.5% on the total cost and the market values this completed and rented property at a capitalization rate of 5%, they will have created a premium of ~30% on the capital invested. This could generate a large return for shareholders.

This is also shown in their active projects. Aimco is investing $648 million to construct over a thousand new apartment units. Upon stabilization, these projects are expected to generate $44 million in NOI, in other words, a 6.8% yield on cost. It's also worth keeping in mind that this NOI should grow at a constant pace, as the financials illustrate.

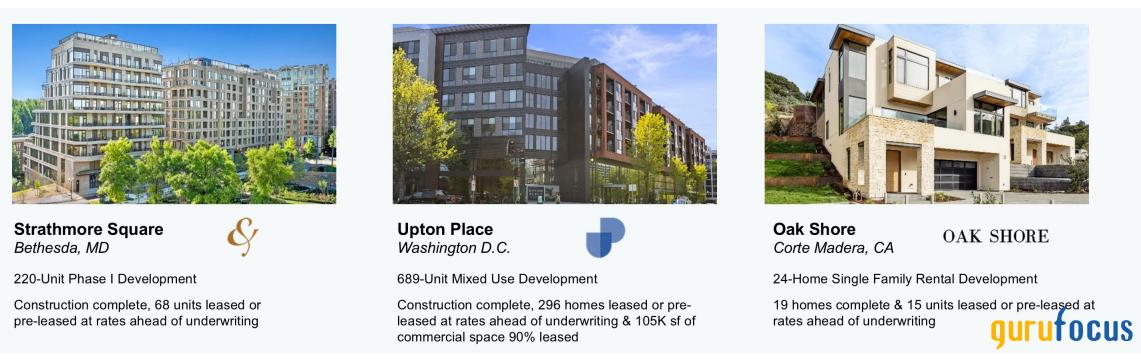

These active developments can be seen in the image below. Most of them are completed and have some appealing characteristics such as the high barrier to entry and/or a high YoY revenue growth.

Those 1,000 should generate a $44 million NOI already, but this isn't all. Beyond this, the company has a pipeline of ~6,000 potential residential units.

This entire strategy is supported by a solid balance sheet, although they don't have a positive net income yet. With 100% of its debt either fixed-rate or hedged at a reasonable weighted average cost, Aimco has the financial runway and stability to see its current projects through to their full potential or at least near it.

Even though it still shows indicators of loss, the debt is bad but not that bad. Net leverage is $1.17 billion, and NOI in Q1 2025 was 25.1 million, i.e., if we calculate net leverage/NOI, we get a ratio of just under 10x, which for a REIT of this type and with so much in the pipeline is justifiable.

Guru Activity

Even with this value creation plan, an analysis of institutional ownership shows a lack of conviction on the part of long-term value investors. Paul Tudor Jones (Trades, Portfolio) has been trading since 2024, which may suggest an opportunistic approach rather than fundamental, long-term action. But much of this is also likely due to the fact that Aimco is a much more niche REIT, with a market capitalization of only $1.3 billion, which ultimately limits the ability of some large investors to analyze and enter the market.

Aimco's Real Estate Market Context

To understand Aimco's risk profile, it is essential to analyze its market positioning. The company's development costs provide a clear indicator: the current pipeline of more than 1,000 units has a cost of $648 million, or approximately $648,000 per unit. This figure is higher than the national average for construction costs in the US and places these assets in the high-end apartment segment. However, as the company itself states, it is a diversified real estate company focused on the U.S. multifamily sector.

As the images below show, the developments are diversified. In California, there is a high-end development with 24 homes, but there is also a development in Washington, D.C., with less luxurious apartments than those in California.

Overall, it ends up being a high-risk, high-reward and well-diversified strategy. Apartments geared towards this high standard are well positioned in the sector because they have higher barriers to entry, like those in Miami and Boston, as well as having higher rents and appreciation potential.

Risk/Reward Analysis For Aimco

While the blueprint for success is a little bit appealing, a blueprint is not a finished building. The path from a piece of dirt to a cash-flowing asset is lined with potential pitfalls, and this is where the Aimco thesis gets more risky than consolidated REITs.

The primary downside risk is pure execution. Real estate development is notoriously difficult. Projects can face some construction delays, unexpected material cost inflation (which is kind of cyclical), labor shortages and several other problems. A project that pencils out with a healthy 200-basis-point spread can quickly see that margin evaporate if concrete prices spike, a key contractor fails or anything like that. Aimco's future value is heavily dependent on its ability to manage these complex, multi-year projects on time and on budget. Any stumble could be punished severely by the market.

There is significant geographic concentration risk. According to its own figures, more than 45% of its stabilized portfolio's NOI comes from Boston and another 26% from Chicago. While these are strong markets, having nearly three-quarters of your current income tied to just two cities is a concentrated bet. A negative regulatory change should be monitored as a potential issue.

Finally, the lack of a dividend is a major structural negative for income investors, but is okay for the ones who know this fact and are okay with not collecting a strong yield as dividend yield but only with upside and/or buybacks for now.

Valuation: A Speculative Wager on NAV Growth

Valuing a company like Aimco with traditional metrics is challenging. Price-to-earnings is irrelevant due to negative GAAP income. Price-to-FFO is also misleading because the current FFO from its small stabilized portfolio pales in comparison to the potential FFO from its massive development pipeline.

The most appropriate way to look at AIV's valuation is as a bet on Net Asset Value (NAV) per share growth. The investment thesis is that management will take the company's existing assets and, through its development prowess, convert them into a much larger pool of higher-value assets over time.

The question for investors is: What are you paying for today? At a ~$1.22 billion market cap, you are buying the existing portfolio of 5,600 units, plus a call option on the success of the development pipeline. The ~$44 million in NOI from projects currently under construction, once stabilized, could be worth between $730 million (at a 6% cap rate) and $880 million (at a 5% cap rate). Given the $648 million cost, that's a clear value creation of $80M to $230M. And this we are not considering the 6,000 potential residential units.

Let's do a little more projection, but conservatively. If this pipeline materializes in mid-2029, we could see something close to 12,500 units. If the average NOI per unit in 2029 is close to $20.1k (which would be close to inflation growth), we have a total NOI of $251 million.

This NOI volume could generate an FFO of around $140 million, with a margin of just over 55%. The price-to-FFO ratio would then be just over 8x, which would already allow for a very attractive shareholder yield and even a re-rating of the multiple to capture an appreciation in the stock.

The Bottom Line

Taking all this into account, Aimco still seems like an interesting REIT, but with many caveats. The potential is there, and it may eventually become a company with higher yields or create a lot of value and consequently have upside. But the problem is that there is still a lot of uncertainty, and this makes the thesis less compelling for those who want a higher level of cash flow right now.

In any case, this REIT can be characterized as a security with a higher risk content but also with a slightly higher reward than the market average.