Itron at Crossroads: Momentum or Margin Mirage?

Introduction

The main reason why investors have faith in the company is that it leads the smart grid market with the best technology. With a 34% share of North American smart electricity meters, the company has built a complete technology platform that incorporates advanced metering infrastructure, edge computing capabilities, and integrated software solutions. Itron's OpenWay Riva platform shows distributed intelligence and multi-communication technology support, which makes it possible to capture utility infrastructure modernization value that is ongoing.

The company's security technology differentiation is not limited to hardware but also includes cybersecurity leadership, data analytics capabilities, and comprehensive software platforms. This system creates a barrier for utility clients to switch to other providers besides it allowing the company to earn additional income through these services instead of just selling hardware.

Recurring Revenue Valuation

The recurring revenue valuation indicates that Itron is effectively moving away from a cyclical hardware business to a more predictable software-driven model, which should be priced higher as this transformation goes on.

Per Meter Valuation

The higher Itron's per-installed-meter valuation is, the more investors relate to the value of their existing meter relationships, which can be influenced by the data monetization capabilities or the vendor companies get involved in higher-value service contracts. On the other hand, the same per-annual-shipment valuations mean that the companies have the same opportunities to grow through new meter deployments.

Key Growth Drivers

AMI Technology

Itron's comprehensive Advanced Metering Infrastructure platform, which is the most significant technological growth driver for the company, is a huge development. The Advanced Metering Infrastructure platform is a clear example of a paradigm shift from traditional mechanical meters to smart, connected devices. The combination of the smart meter, communication network, and data management to provide access to information on resource consumption and grid performance in real-time is the AMI platform's main feature.

The two-way communication feature of the platform not only enables automated meter reading and billing but also facilitates proactive service management which in turn reduces operational expenses and enhances customer service quality. Moreover, the smart meters embedded with sophisticated sensors play a vital role in outage detection, illegal connections identification, and power quality parameters measurement that helps utilities to pursue their grid optimization and maintenance reduction goals.

Itron's AMI technology is universal communication protocols compatible such as mesh networks, cellular connectivity, and power line carrier systems, therefore, utilities can deploy them easily in different environments and weather conditions. This multi-protocol-based utilities' watershed conclusion made them decide that the best communication way will be based on terrain, infrastructure density, and cost considerations while at the same time confirming the ability of the various network segments to work together.

Scalability

The platform's scalability architecture is built with the ability to be deployed on various scales from a municipal utility to a large investor-owned utility serving millions of people. The modular system design provides phased implementations capabilities which align with utility budgeting cycles and operational requirements while allowing future technology benefits and upgrade compatibility.

Internet of Things (IoT) Connectivity Solutions

The Itron IoT connectivity platform has outgrown its initial use as mere metering applications to help with the deployment of the entire smart infrastructure including street lighting, environmental monitoring, and asset tracking systems. The Riva program of the company is an edge computing platform which provides the features for real-time data processing and autonomous decision making at the network edge that culminate in the optimization of bandwidth and improve response times.

Integrating low-power wide-area network (LPWAN) technologies into the Itron IoT solutions are the key that makes it possible to use battery-powered devices for a period of three years through a single cost-effective deployment of sensors and monitoring devices across large areas. Such technologies are of great importance in the case of water utilities managing distributed infrastructure assets and municipalities developing smart city initiatives.

In addition, a unified hub for device management which is part of the IoT platform makes possible central configuration, monitoring, and maintenance functions that ultimately lead to operational complexity reduction and an increase in system reliability. Furthermore, remote diagnostics and over-the-air firmware updates that point to their parts being obsolete will take the burden off field service workers, will decrease the number of tech refresh cycles.',

The Itron IoT edge intelligence abilities make it possible for local data processing and analytics to take place which in turn will support the real-time operational decisions without the necessity of constant connectivity to central systems. This distributed intelligence philosophy is what improves system resilience and also brings down operational costs related to data transmission and cloud computing resources.

Competition

The smart metering sector is very much led by a few major technical companies, with Itron being the rule setter of the market together with its leading competitors. Landis+Gyr is the major competitor to Itron, which has a 30% market share in the North American smart electricity meter market forming a near-duopoly backdrop where these two companies manage the sale of 65% of the regional market between them. The result is high-tech duopoly where both contenders continually push the limits of technology to secure their market positions.

Aclara Technologies LLC currently ranks third with a 22% share and is an important technology challenger of the Itron's chip. Aclara's emphasis on advanced metering infrastructure and data analysis capabilities builds obstacle to the Itron's technologies in which utilities look for comprehensive solutions. Honeywell,Sensus (which is now part of Xylem after acquiring it for $1.7 billion), and other specialized technology companies are among those which share the rest of the market.

Technological Competition Vectors

The competition in smart metering technology is pursued in multifaceted technological dimensions that directly affect utility operations and customer value propositions. Communication technologies embody a criticism battleground, where competitors prevail in diverse ways through such strategies as cellular, mesh networking, and proprietary radio frequency solutions. Each technology has unique benefits of varying degrees of coverage, reliability, and data transmission capabilities, forcing businesses to come up with an extensive communication portfolio.

Edge computing and distributed intelligence capabilities became the new major differentiator of the competition in this market. Nowadays smart meters are required to process data in their local system, to make their own decisions, and to present real-time analytics at the grid edge prior to the data being sent. Because of this paradigmic shift, the competition has been inflating as not only the manufacturers but also the utilities demand for greater complexity in computations to be built into their metering infrastructures.

Cybersecurity technology has been and still is an important competitive factor, and utilities are favoring those vendors who provide them with strong and robust security systems. The very idea has become a differentiator that proves of great importance because, during the period when cyber threats are on the increase, utilities can simply not afford to spend on a vulnerable infrastructure.

Data analytics and artificial intelligence integration capabilities construct extra competitive pressure. The utilities are looking for metering solutions that give them actionable insight, predictive maintenance capabilities, and advanced grid optimization features. This technology requirement has been the one that has driven heckler to come up with the complexities that are entailed in software systems beside their tangible ones.

Itron's Technological Strategic Response

Advanced Metering Infrastructure Innovation

The company has positively dealt with competitive pressure through the strategic placement of advanced metering infrastructure technology. The company's OpenWay Riva platform is noteworthy as it is virtually the definitive response to the market's demands and it is a combination of several distinct technologies such as communication, edge computing, and advanced security, packed in a single solution. With this platform41 project, utilities can install scaling infrastructure that is adapted to new technological demands.

The company builds on the distributed intelligence technology, which, in turn, is one of its key best practices. Distributed intelligence tech apart from reducing the communication bandwidth has increased the subsystem responsiveness by enabling the grid-edge computing capabilities. This approach takes care of the utilities' concerns regarding congestion and real-time management of the grid, therefore Itron presents its solutions as being favorable for utilities with complex distribution management.

Communication Technology Diversification

Realizing that communication requirements in different utility environments vary, Itron created a wide array of communication technologies instead of akitting to a single route. This technological strategy permits the company to provide the best communication solutions adaptable to different deployment scenarios that may arise from setting up environments with a remove cellular connectivity to a rural area where a better coverage of a mesh networking is available.

The company's founding in the utility sector communication standard protocols will facilitate the entry of other existing systems into the loop and leave the door open for future technical changes without the risk of vendor lock-in. This measure provides an answer to utilities' concerns over vendor lock-in, as well as demonstrating Itron's commitment to building open, scalable technology architectures.

Software Platform Development

The strategic reaction of Itron in the face of competition includes a strong focus on software platform development which stretches beyond simple metering properties. The company's meter data management systems, analytics platforms, and grid management software join-up in a technology ecosystem that provides a much higher cost implication for clientele when they want to switch and also increase the value proposition.

The systems of software not only enlist AI and machine learning capabilities but also the functionalities of predictive analytics, automated fault detection, and optimization algorithms that are embedded within their stack technology. By the integration of advanced analytics and embedded intelligence, directly into their product stacks, Itron so distinguishes its offerings that, its competitors, if they use the more complicated solutions or software, are often suboptimal suppliers.

Key Risks

Demand Volatility and Customer Concentration

Itron's business model, by its nature, exposes the company to demand volatility risks due to utility infrastructure investments' cyclical characteristics. The rate and timing of customer demand for products along with factors such as customer rescheduling orders and cancellations of current customer orders and commitments, represent the main risk factor that has the potential of changing drastically the company's revenue predictability and operational planning.

The capital expenditure patterns of the utility sector are affected by aspects that are based on the regulatory cycle, the ongoing economic conditions and the policies that are changes that create uncertainties. A major part of Itron's revenue is generated from large utility customers which in a way creates a risk in concentration as their loss or delay of major contracts can cause a significant impact on the company's financial performance. Furthermore, this customer concentration risk is exacerbated by the lengthy sales cycles that are characteristic of the utility sector, where purchasing decisions can stretch from two years and above and have complicated regulatory approval processes.

Disruption of Technology and Pressure of Innovation

The smart metering business is under constant development of technology that poses threats of both opportunity and survival for the incumbents. The entry of new technologies such as 5G communication, artificial intelligence, edge computing and Internet of Things which is reshaping of customer expectation as well as competitive dynamics. For Itron to keep its technological leadership, it has to constantly invest in R&D but through this innovation process, the company might be faced with the risk of making some of its product lines obsolete or would drop their market value significantly.

The increased digital transformation in the utility sector puts the company under pressure to produce software that is smart and compliments the hardware they provide to utility customers. Therefore, such a transition will require investment in new competencies which in turn will affect the old models of income being generated from the traditional metering products.

Cybersecurity and Infrastructure Risks

Vulnerability in Critical Infrastructure

Because Itron provides utility infrastructure, it faces a lot of cybersecurity risks compared to companies that do not provide it. Organizing for cyber-resilience has become a common concern faced by many organizations, which have been of late striving to deal with the issue and reaping the benefits, though many smaller organizations have so far continued to be on the darker side, with 35% citing lack of sufficient resiliency. With its products being critical components of the national infrastructure, they are tempting targets of state-sponsored cyber-attacks, ransomware campaigns, and other sophisticated threats.

A successful cyber attack by Itron products or system could not only create utility service disruptions but would also lead to regulatory sanctions, legal liability, and a bad reputation. The interconnectedness in the smart grid is also the reason why any vulnerability in Itron's systems could, in turn, affect other utility networks thus increasing the impact of security breaches.

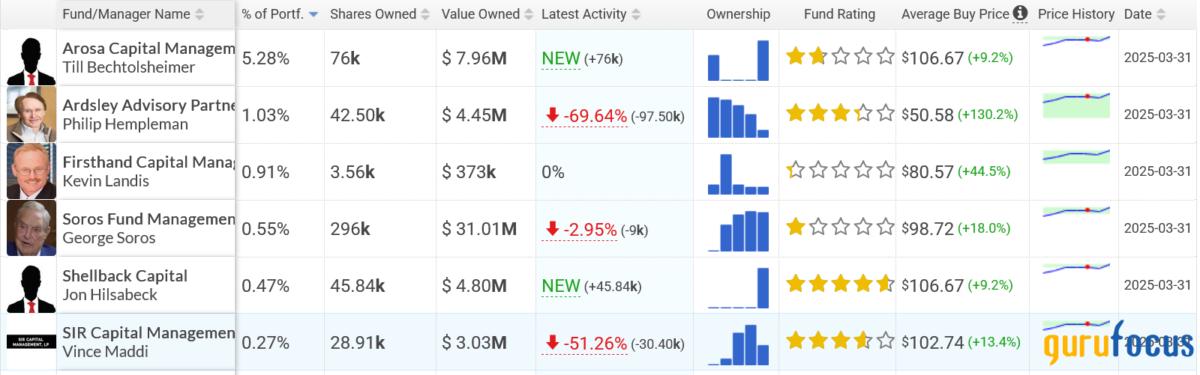

Guru

The activity of institutional investors brings a mixed yet intriguing perspective about Itron. The recent position addition of 5.28% worth $7.96 million by Till Bechtolsheimer is a strong signal of bullish conviction from a disciplined value investor. His entry at an average cost of $106.67, which is lower compared to the recent gains, shows that he perceives Itron's smart grid technology leadership and market position as having significant upside potential.

On the other hand, the recent decision taken by Philip Hempleman to reduce his position massively by 69.64% is selling off 97,500 shares which is somewhat worrying. Nevertheless, his average buying price is $50.58 which is way much lower compared to the current levels; thus, instead of losing, he's making substantial profits. This shows that disciplined profit-making is the rationale behind profit-taking moves rather than the company's performance deteriorating.

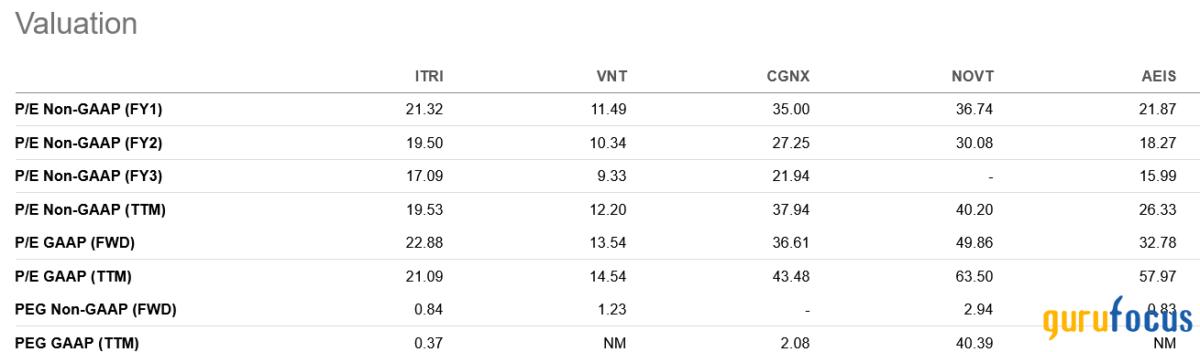

Valuation

Itron's P/E valuation metrics highlight that Itron's market is an investment that can be concluded as both viable and less risky than others in the market. The non-GAAP price-to-earnings (P/E) of Itron is now at 21.32 for FY1 going down to 17.09 for FY3 making them an attractive choice when compared to lab infrastructure tech companies. In addition, the company's price also remains significantly lower than that of Cognex (35.00 P/E) and Novanta (36.74 P/E) while it is more expensive than Vontier (11.49 P/E) where the company's strong market position and growth perspective are reflected.

The forward P/E of Itron continues to point at a visible earnings growth trajectory with the multiple dropping from 21.32 to 17.09 over the three years, which confirms the strong earnings momentum. The two assets have a different relationship, where the latter has a current P/E of 21.87, which is 0.45 points higher than what is currently offered at Itron, which indicates that Itron has not only sustainable value but also superior potential in the smart grid market. The GAAP (Generally Accepted Accounting Principles) P/E metrics are still acceptable (22.88 forward, 21.09 TTM) as a technology leader, especially when considering Itron's successful market holding and the long-term utility infrastructure modernization cycle offering a continued demand of clarity.

The PEG ratios for Itron present the most compelling reason for valuation. The non-GAAP PEG coming at 0.84 and GAAP PEG is 0.37 sugest that the stock is undervalued. Generally, PEG measures equity below or above 1.0 as overvalued or undervalued, respectively, hence Itron looks particularly good against Novanta's 2.94 PEG or Cognex's 2.08 PEG. These numbers give Itron a chance to assert itself as the best value platform for the growth-oriented investor looking to invest in the trends of modern critical infrastructure.

Recommendation

The smart grid technology sector is an outstanding growth sector with projected sales of $66.1 billion for 2024 which will go up to a between $77.79 billion and $269.5 billion by 2030-2033 representing suitably compounded annual growth rates of 10.6% to 19.7%. Government investment campaigns are among the largest demand catalysts that are available. Such money is for taxpayer's Grid Resilience and Innovation Partnerships, like $3.9 billion, and China's $50 billion grid project which are major players in their respective domains. The good financial management of Itron has a substantial role in supporting the aforementioned thesis, with the revenue for the year 2024 expected to be $2.44 billion (an increase of 12% from the previous year) and free cash flow hitting a record $208 million. In addition, the company's guidance for 2025 hints at a projection of $2.4-$2.5 billion revenue with non-GAAP EPS of $5.20-$5.60, which means that the company will continue to have momentum.