Dividend Chokehold? AT&T's Yield May Hide Costly Risks

I've followed AT&T for years, and it's honestly been a tough stock to hold. Back in 2016, shares were trading above $43. By mid?2023, they'd dropped all the way down to $14. That's nearly a 68% drop, and even the big dividend didn't make up for it. For a long time, I saw a company weighed down by too much debt and no clear direction. A bunch of acquisitions didn't move the needle in the right way, and investors basically lived through a lost decade. But more recently, things have shifted. AT&T stock has come roaring back. Since bottoming at $14, it's nearly doubled, and it's up over 52% in the past year. Total returns over the last twelve months are around 75%, which actually beats T-Mobile and leaves Verizon far behind. That's not something I expected, but it's what caught my attention again.

T Data by GuruFocus

Still, I think it's important to keep perspective. Even with this rally, AT&T's share price is basically flat compared to where it was five or more years ago. To me, that says the long?term story hasn't fully changed yet. But I do think there are some new catalysts. Tariff fears seem to have cooled for now, especially with the U.S. easing trade tensions with key partners. And AT&T just reported its 1Q earnings with a few meaningful updates. To put it all into context, I'll also be comparing their performance with T-Mobile since they operate in the same space

AT&T's Lumen Deal Feels Like More of the Same

AT&T recently agreed to spend $5.75 billion to buy Lumen Technologies' fiber business that serves mass market customers. While this isn't a huge deal in terms of size, it feels pretty similar to past movesit's being done in cash, will take a long time to get regulatory approval, and looks like it'll be complicated to integrate. In my view, the underlying assets don't look that exciting either, especially considering Lumen's recent financial performance. Their operating cash flow dropped from $4.74 billion in 2022 to $2.16 billion in 2023, even though it did bounce back to $4.33 billion last year. The same trend shows up when we strip out working capital and look at adjusted operating cash flow. But EBITDA is where things really don't look greatit's been falling steadily from $6.86 billion to $3.94 billion.

Lumen's revenue and profits have mostly been shrinking too, and even looking ahead, things don't seem much better. Management says they expect 2025 EBITDA to land between $3.2 billion and $3.4 billion, with operating cash flow somewhere between $4.8 billion and $5.2 billion. Sure, that cash flow forecast is a bit higher than last year's, but I don't like that EBITDA is still trending down. That makes it hard to feel confident about what this business will really contribute in the future.

What makes this even trickier is that AT&T doesn't think the deal will do much for them in the short term. They expect it won't really move the needle on adjusted EBITDA, EPS, or free cash flow for at least the first 12 to 24 months. And since the deal isn't expected to close until the first half of 2026, that means they're basically committing 2 to 3 years of work with little to no real business impact in the meantime. On the bright side, since the deal is under $6 billion, it doesn't totally wreck the balance sheet. AT&T is also planning to bring in an equity partner, which could help limit the hit to their debt load. But even that just adds another layer of complexity to an already messy process.

Focused on the Wrong Things?

AT&T brings in nearly $125 billion in revenue, and this deal adds just $6 billion to a company already carrying $119 billion in debt. It still feels like they're focusing too much on building out dumb pipes like high-speed internet, instead of going after more valuable things like AI-powered or software-driven services. When I look at companies like CoreWeave, which recently went public and offers AI infrastructure from data centers, the contrast is clear. CoreWeave is already generating $4 billion in annual sales and could hit $10+ billion next year. Meanwhile, AT&T's deal feels like it has limited upside.

Another issue that bugs me is the Communications segment, especially the Business Wireline unit. This part of AT&T saw revenue fall 9.1%, from $4.91 billion to $4.47 billion. I've looked into this part of the business before, and honestly, I think it's just dead weight at this point. As more customers shift to mobile, this segment is going to keep shrinking until it's basically gone.

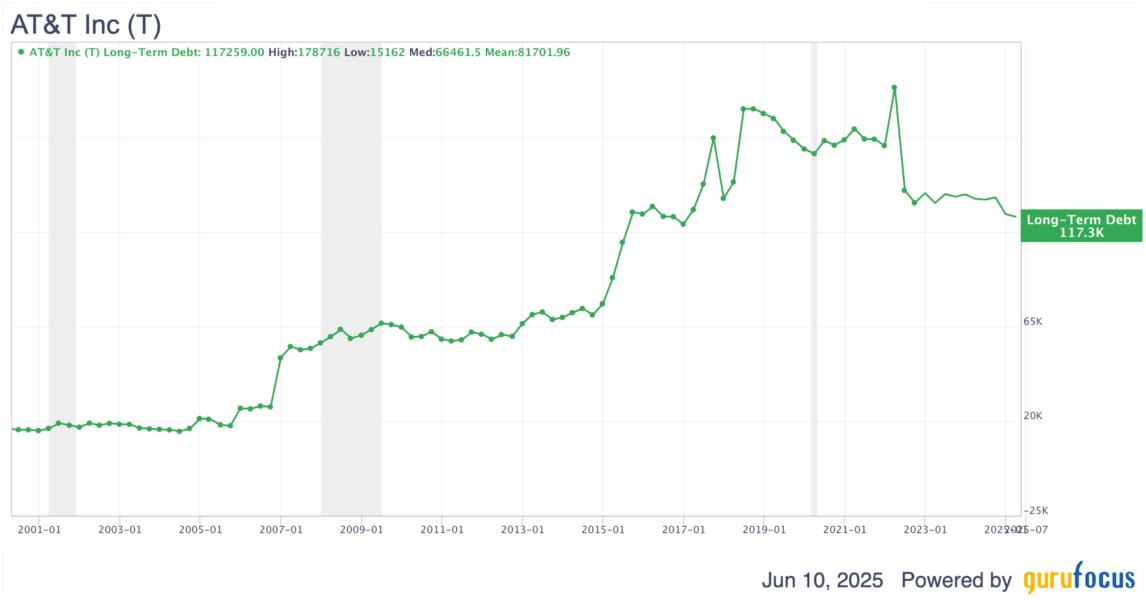

Debt Keeps Holding Them Back

Honestly, I think management still doesn't get what investors wantthey want the company to seriously cut debt and start investing in the future. But AT&T seems almost allergic to paying down debt in a meaningful way. Right now, they have $46.19 billion of debt at 46% interest and another $8.61 billion at even higher rates of 68.75%. Just servicing this debt is costing them $2.7 billion a year. That's a huge drag, and I think investors are right to discount the stock because of it.

T Data by GuruFocus

Their interest coverage ratio is around 4which is decent on the surface, but it was as low as 0.5 just two years ago, so there's not a lot of room for error if earnings soften again. Even more concerning is the maturity schedule: about $8 to $10 billion comes due each year through 2026, and while it's manageable now, they're already refinancing at rates north of 5.4%, which just piles on more long-term cost. In June, they had to issue $3.5 billion in new long-term debt with maturities out to 2056, just to push the problem down the road.

With 7.2 billion shares outstanding, if AT&T just focused on getting their debt down to their target ratio of 2.5 EBITDA (they're currently at 2.9), the earnings per share could rise significantly. That would help a lot more than all these buybacks in my opinion. Management is aiming to hit that 2.5 ratio by the end of Q2 and start more aggressive share repurchases afterward, but I'll believe it when I see it.

T-Mobile vs. AT&T: A Sector Struggling to Grow

Now let's talk about how AT&T stacks up against its peers. To me, this comparison helps make two things clear. First, it shows how much pressure the whole telecom sector is under, with stiff competition from both Verizon and T-Mobile. Second, it backs up my main argument: that AT&T is still a better choice for income-focused investors, even with all its issues.

One thing that stands out is how T-Mobile continues to grow its user base. In Q1, they added 495,000 postpaid phone subscribers, while AT&T added 324,000. But keep in mind, a lot of these gains came from Verizon losing 289,000 subscribers. So the battle for users is just a game of stealing from each other at this point.

When I look at the dividend, AT&T still stands out to me. Yes, they cut their payout recently, but that was due to the WarnerMedia spinoff. Outside of that, the dividend has been consistent for decades. T-Mobile only started paying a dividend in 2024, so there's no long track record there. AT&T's payout ratio is 50%, compared to TMUS's 32.23%, so they're giving more of their earnings back to shareholders. But the yield itself is down to 4%, which is the lowest it's been in years. At that level, it's not much better than a high-yield savings account or Treasuries, which does hurt the appeal a bit.

Profitability is another area I've been watching closely. T-Mobile has better margin numbers than AT&T across the board. Their gross margin is 63.8%, while AT&T is at 59.9%. And when you go down the income statement, T-Mobile's lead just gets wider. Their net margin is 14.4%, compared to AT&T's 9.64%. That kind of buffer can really help in uncertain times and could also support stronger dividend growth in the future.

That said, I do think AT&T made some real progress on margins last quarter. If they can keep that up, it might help close the gap over time. But even then, there are big risks ahead. Companies like Starlink could come in and undercut AT&T with cheaper satellite internet. And once 6G becomes a thing, AT&T is probably going to have to spend big on bandwidth. If T-Mobile or Verizon outspends them, it could lead to more customer losses. To me, AT&T is starting to look more like a utilityreliable, but not exciting. But if new tech comes along that changes how people use smartphones, AT&T's free cash flow could take a big hit.

Subscriber Growth Isn't Enough To Change the Story

Some investors have gotten excited about AT&T again lately because a few of their metrics have improved. Postpaid phone additions stayed strong in Q1 2025, and even though churn was still high, AT&T says it's just normalizing. Gross additions were up 13%, which was enough to balance out the churn. But I think that spike in churn caught some people off guard, and it was higher than expected.

Even though the growth in gross additions is a good sign, I still think the overall story hasn't changed much. Since AT&T sold off DirecTV and WarnerMedia, they've gone back to focusing on core connectivity, but top-line growth has stayed pretty flat. Revenue growth is still positive, but just barely. And when I look at average revenue per user (ARPU), I see more red flags. Fiber ARPU has improved, which supports their big investment in that area. But postpaid phone ARPU has gone nowhere, which makes me question whether the expected margin gains are really sustainable.

AT&T's Valuation Feels Out of Sync

Back in 2021, I pointed out that AT&T's stock was getting dragged down by a lot of overly negative sentiment. At the time, I felt that investors were being too harsh, and the stock seemed undervalued compared to peers like Verizon. But a lot has changed since then and not necessarily for the better.

Now, AT&T is trading at a noticeable premium compared to Verizon, not just on a P/E basis but also on sales and cash flow multiples. For example, AT&T's price-to-operating cash flow ratio (P/OCF) has surged from about 2.8 in late 2023 to 4.72 today. That's a pretty big move in a short time. Meanwhile, I don't think the fundamentals have improved enough to justify this kind of jump. The business hasn't shown significant revenue growth or any major improvements that could explain this kind of re-rating.

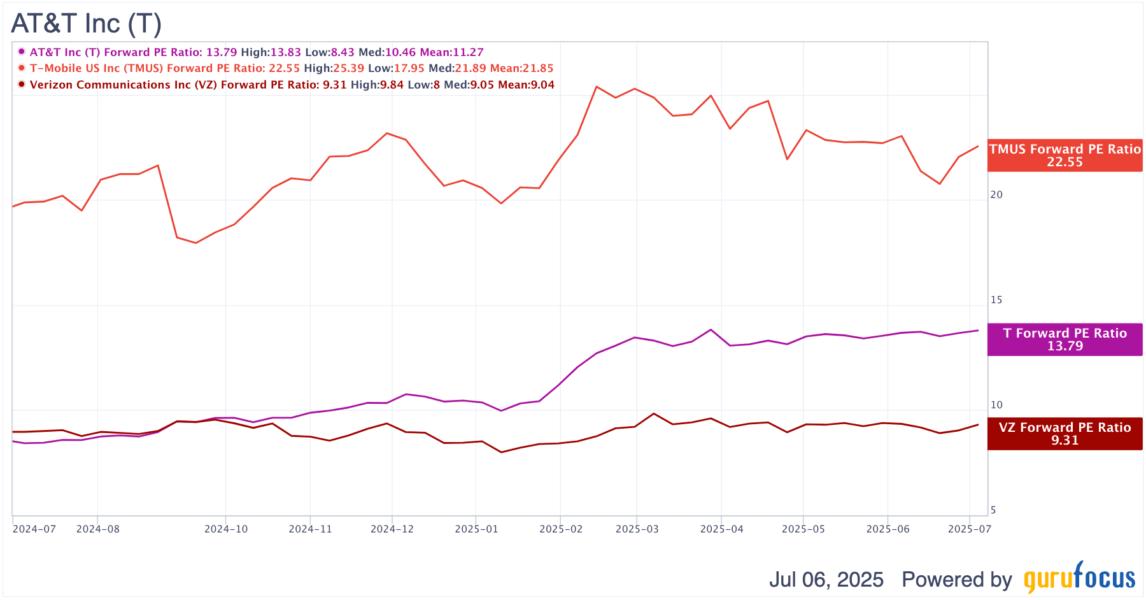

T Data by GuruFocus

Back in October last year, I already flagged that AT&T's valuation was starting to pull away from Verizon's, even though many of the same risks were still hanging over the company. Now, that gap has gotten even wider. When we compare the forward P/E ratios for both stocks based on their FY 2025 earnings guidance, Verizon still trades just a bit above 9x, while AT&T is pushing toward 14x. And if we bring T-Mobile into the mix, it's trading at an even higher multiple despite, in my view, having weaker fundamentals than AT&T.

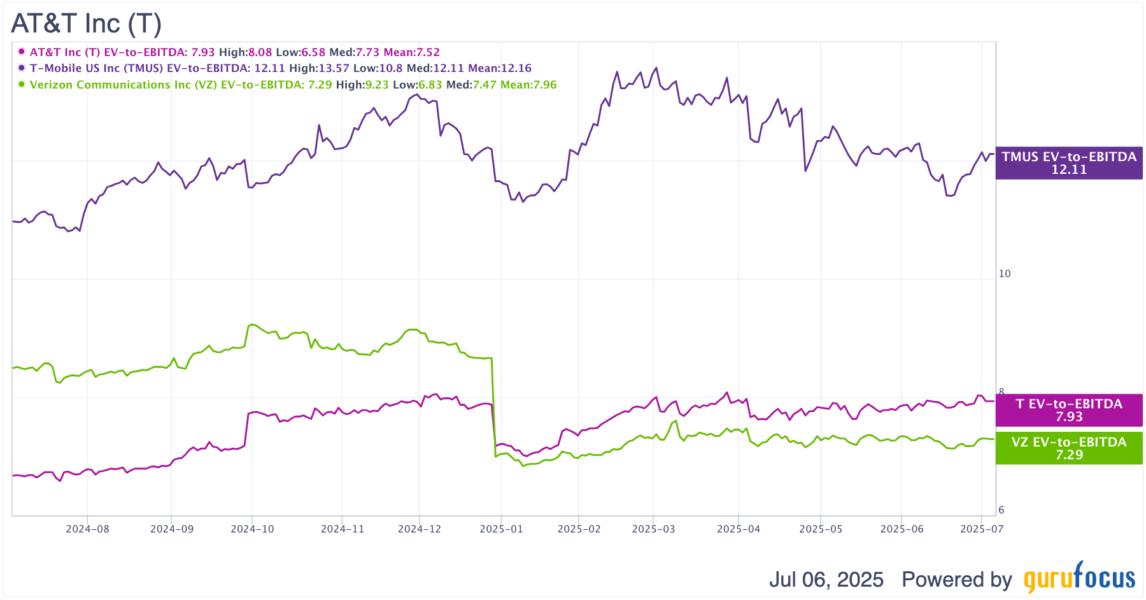

T Data by GuruFocus

Largely the same case shows up when you look at EV/EBITDA multiplesAT&T is trading at a slight premium to Verizon, as shown in the chart above. What's strange is that analysts aren't projecting much more revenue growth for AT&T than they are for Verizon, so it's hard to justify why the market is assigning AT&T this kind of valuation edge. To me, the stock looks stretched at current levels, and I think some investors chasing the recent momentum might be overlooking some key warning signs.

What the Gurus Are Doing

If you're hoping the guru investors are showing strong confidence in AT&T, the latest guru moves don't exactly back that up. Yes, some well-known names like Daniel Loeb (Trades, Portfolio), Ray Dalio (Trades, Portfolio), Renaissance Technologies (Trades, Portfolio), Joel Greenblatt (Trades, Portfolio), and Paul Tudor Jones (Trades, Portfolio) all have some shares as of Q1 2025. But here's the catch: their stakes are pretty small compared to their total portfolios. Plus, a lot of these big investors have been selling or cutting back. For example, Ray Dalio (Trades, Portfolio) trimmed his position by more than 57%, Mark Hillman (Trades, Portfolio) reduced his by over 41%, and Steven Cohen (Trades, Portfolio) basically sold nearly all his shares, dropping his holding by almost 99%. Even the ones who bought more, like Jeremy Grantham (Trades, Portfolio) who tripled his stake, still hold only tiny pieces of their total assets in AT&T. What really stands out to me is that none of these gurus see AT&T as a key holding. The biggest position, Daniel Loeb (Trades, Portfolio)'s, makes up just 1.62% of his total assets, and most others are far smaller than that. Some investors are either just starting positions or shrinking them, which tells me the smart money isn't jumping in with confidence. It looks more like they are either locking in profits after the recent rally or simply not convinced by AT&T's turnaround story. I believe if the pros aren't willing to put a big bet on it, why should I think there's some hidden value here? To me, this guru activity confirms that AT&T remains a prove it to me stock.

Concluding Thoughts

AT&T's story over the past decade has been full of challenges. The stock plunged from over $43 in 2016 to just $14 by mid-2023, and a lot of the company's moveslike the WarnerMedia and DirecTV dealstested investors' patience. The recent rebound in the share price makes sense to some extent, since the market probably punished the stock too harshly after those big capital allocation mistakes. But now, I think the stock has run up too quickly, and that creates new problems for shareholders. The premium valuation compared to Verizon is tough to justify when you look closely at the business and operational numbers. What concerns me more is that AT&T seems to be doubling down on buying old, slow-growth businesses that will take time and effort to get through regulatory approval and integration. Meanwhile, they're missing out on chasing new growth areas like AI and software-driven services. I believe this focus on legacy assets doesn't position AT&T well for the future.

With fierce competition in the wireless sector and ongoing trade tensions possibly driving up costs, the outlook doesn't look easy. The dividend yield is at its lowest in years, which weakens the stock's appeal for income investors. Given all this, I remain cautious on telecom stocks overall and continue to view AT&T as a hold rather than a buy right now.