Bitcoin Mining Revenue Jumped 24% in November as Price Approached $100K

Bitcoin miners reported significant profits inNovember due to the rally in prices and increased transaction fees. While still below pre-halving levels, the cryptocurrency mining sector experienced a notable uptick, with publicly listed miners' market caps jumping substantially, according to JPMorgan.

Bitcoin’s Recent Gains

This boost came as Bitcoin reached new heights, withtransaction fees spiking around the US presidential election on November 5.This surge offered miners much-needed hashprice relief, a key measure of miningprofitability, Coindesk reported. Analysts noted that Bitcoin miners earned$52,000 daily per exahash (EH/s) in November, reflecting a 24% increase fromOctober.

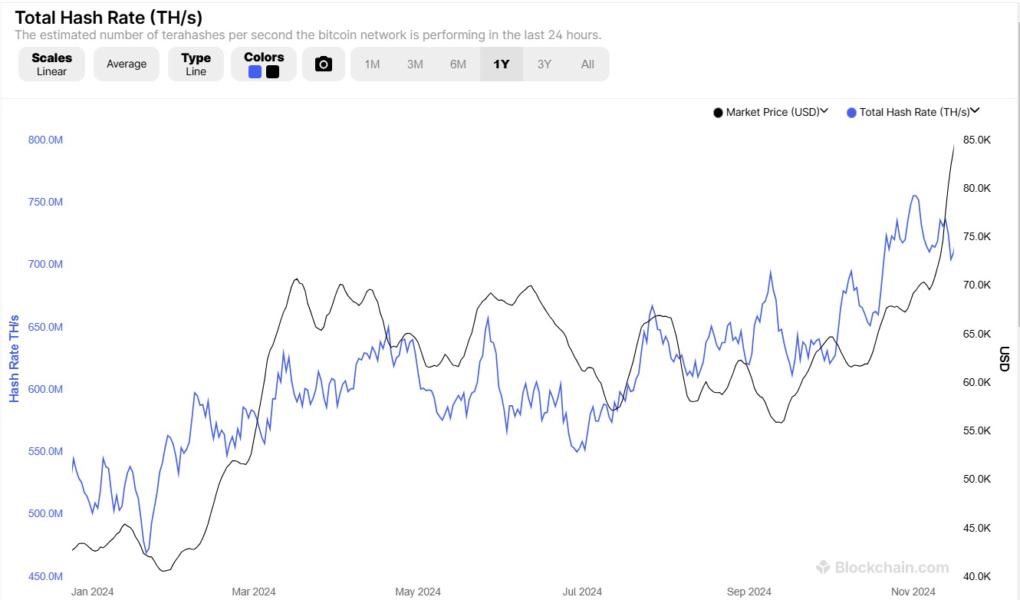

The overall network hashrate, which indicates thetotal computational power dedicated to mining, grew 4% month-on-month to 731EH/s. However, the growth in mining difficulty outpaced this increase, risingby 7% from October.

Publicly traded Bitcoin miners also benefited from November’s rally. The combined market capitalization of 14 minerstracked by JPMorgan reportedly jumped to $36.2 billion, a 52% increase from the previousmonth.

These gains highlighted the growing investorconfidence in the sector amid renewed optimism about Bitcoin's performance. At the time of publication, the top cryptocurrency was trading at $95,654. The figure represents a 1.56% drop and less than 1% increase in the past day and week, respectively. Last month, BTC rose to an all-time price high of $99k.

Bitcoin Price Chart, Source: CoinMarketCap

Annualized Volatility

Bitcoin’s annualized volatility rose to 62% inNovember, compared to 42% in October amid heightened market activity. Analystsattribute this increase to the cryptocurrency's strong price movement during themonth.

The report highlights an optimistic picture of Bitcoinmining's near-term future, though challenges remain. While miners benefitedfrom a revenue boost in November, profitability is reportedly about 50% belowpre-halving levels.

As Bitcoin continues to evolve, the interplay betweenhashrate growth, transaction fees, and market dynamics will remain critical forminers navigating this volatile landscape.

Source: Blockchain.com

Most recently, Bitcoin miner MARA Holdings warned thatthe United States must stay ahead in Bitcoin holdings and mining operations.The company mentioned that this is a critical national security imperative due togrowing global competition.

The country reportedly holds an estimated 200,000Bitcoin ahead of China's 190,000 BTC holdings. Compared to gold, the US has8,133 metric tonnes versus China's 2,264 tonnes. Elsewhere, HIVE Digital Technologies posted asignificant expansion of its BTC mining capabilities, reportedly ordering 5,000new miners.