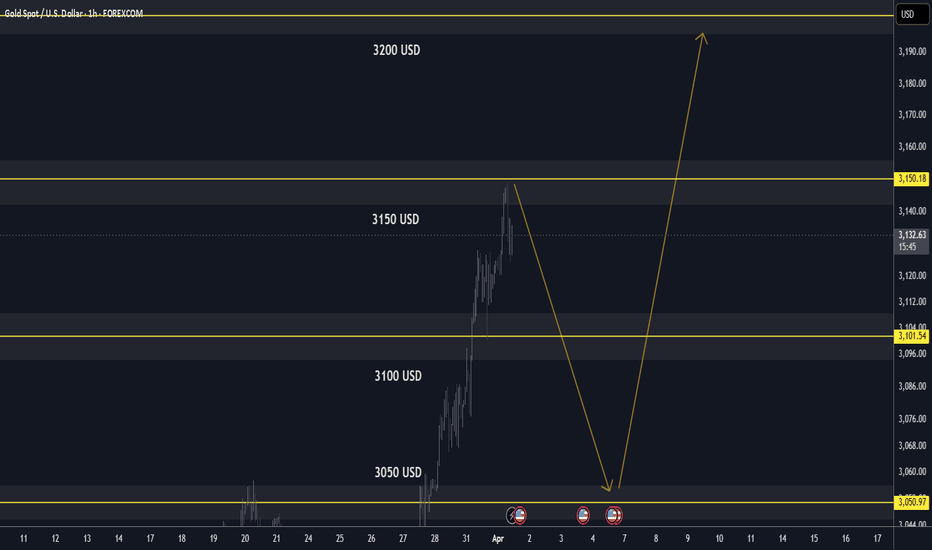

📊 Technical Outlook update

🔸Bullish OUTLOOK

🔸3050 USD Resistance Heavy

🔸3000/3040 Trading Range

🔸2990 potential Bear Trap

🔸Price Target BULLS: 3100 USD - 3150 USD

🔸Recommended Strategy: BUY DIPS 2990

📊Gold Market Summary – This Week

💰Gold Price Surge: Gold prices soared above $3,000, prompting Bank of America to raise its price target.

💸Profit-Taking Pressure: After the surge, mild profit-taking caused a slight price correction.

🛡️Safe-Haven Demand: Gold continues to show strength, supported by safe-haven flows amid economic uncertainty.

📅 Economic Data Impact: U.S. economic data (e.g., 0.9% rise in durable goods orders) is influencing gold prices, pushing them to session highs.

🔄Consolidation with Bullish Outlook: Gold is consolidating but remains bullish due to favorable U.S. dollar performance and Federal Reserve policies.

🌍Geopolitical Tensions: Ongoing Russia-Ukraine conflict and U.S.-Russia tensions continue to support gold’s status as a safe-haven asset.

💎 Summary:

Gold remains resilient with strong demand, positive economic indicators, and geopolitical tensions supporting its value, despite minor price corrections.

🔸Bullish OUTLOOK

🔸3050 USD Resistance Heavy

🔸3000/3040 Trading Range

🔸2990 potential Bear Trap

🔸Price Target BULLS: 3100 USD - 3150 USD

🔸Recommended Strategy: BUY DIPS 2990

📊Gold Market Summary – This Week

💰Gold Price Surge: Gold prices soared above $3,000, prompting Bank of America to raise its price target.

💸Profit-Taking Pressure: After the surge, mild profit-taking caused a slight price correction.

🛡️Safe-Haven Demand: Gold continues to show strength, supported by safe-haven flows amid economic uncertainty.

📅 Economic Data Impact: U.S. economic data (e.g., 0.9% rise in durable goods orders) is influencing gold prices, pushing them to session highs.

🔄Consolidation with Bullish Outlook: Gold is consolidating but remains bullish due to favorable U.S. dollar performance and Federal Reserve policies.

🌍Geopolitical Tensions: Ongoing Russia-Ukraine conflict and U.S.-Russia tensions continue to support gold’s status as a safe-haven asset.

💎 Summary:

Gold remains resilient with strong demand, positive economic indicators, and geopolitical tensions supporting its value, despite minor price corrections.

Not

Bulls are taking out 3050 USD and areclose to breaking the recent resistance

at this rate we will hit 3100/3150 this Friday

Not

🆘Goldman Sachs lifts gold forecast. Could get above US$4200 by end 2025 in extreme case.Not

expecting pullback from here. rejected on high volumeafter retesting ATH. temp setback for the bulls.

expecting retrace into Friday session.

taplink.cc/black001

💎Syndicate Black

⚡️Gold/Forex auto-trading bot

📕MyFXBOOK verified 500%+ gains

💎GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate free gold signals

t.me/syndicategold001

💎Syndicate Black

⚡️Gold/Forex auto-trading bot

📕MyFXBOOK verified 500%+ gains

💎GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate free gold signals

t.me/syndicategold001

İlgili yayınlar

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, işlem veya diğer türden tavsiye veya tavsiyeler anlamına gelmez ve teşkil etmez. Kullanım Şartları'nda daha fazlasını okuyun.

taplink.cc/black001

💎Syndicate Black

⚡️Gold/Forex auto-trading bot

📕MyFXBOOK verified 500%+ gains

💎GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate free gold signals

t.me/syndicategold001

💎Syndicate Black

⚡️Gold/Forex auto-trading bot

📕MyFXBOOK verified 500%+ gains

💎GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate free gold signals

t.me/syndicategold001

İlgili yayınlar

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, işlem veya diğer türden tavsiye veya tavsiyeler anlamına gelmez ve teşkil etmez. Kullanım Şartları'nda daha fazlasını okuyun.