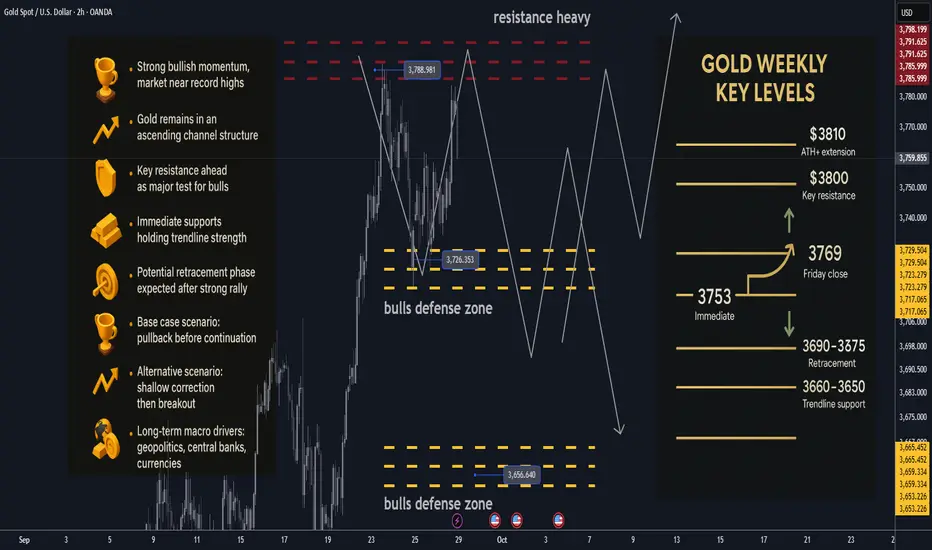

🏆 Friday’s Close & Recent ATH: Gold closed the week near $3,769, not far from its latest all-time high ($3,734) as bullish momentum continues to dominate. Every dip is being met with strong buying interest, reinforcing the uptrend.

📈 Trend Structure: The market remains firmly inside an ascending channel on both 1H and 4H charts. The broader structure is bullish, with corrections appearing as healthy consolidations rather than reversals.

🔑 Key Resistance Levels: The most critical resistance sits at $3,800, a psychological and technical barrier. Beyond that, $3,810–3,820 represents potential breakout extension targets if bulls push through.

🛡️ Support Zones: Immediate support rests at $3,753–3,755, aligned with a rising trendline. Deeper supports lie at $3,690–3,675, with stronger downside protection at $3,660–3,650. A sustained break below $3,650 would signal deeper correction risk.

⚖️ Likely Scenarios:

o Scenario 1 (Base Case) – A short-term pullback toward support before continuation higher.

o Scenario 2 – A shallow correction, followed by a direct breakout above $3,800.

Probabilities currently favor Scenario 1 due to overbought conditions.

📊 Short-Term Targets: On continuation, upside levels to monitor are $3,740 → $3,780 → $3,800, with a possible push toward $3,810 ATH+ extension.

💡 Market Sentiment Drivers: Geopolitical tensions, central bank accumulation, and persistent currency debasement concerns remain key macro tailwinds. These factors underpin the long-term bullish bias, despite near-term choppiness.

🔄 Retracement Outlook: Analysts suggest a retracement is due after the strong run-up. A controlled dip into the $3,660–3,640 zone could offer buying opportunities for swing traders targeting another leg higher.

🧭 Risk Levels to Watch: Holding above the ascending trendline (around $3,630–3,640) keeps the bullish structure intact. A decisive break below this area could trigger a deeper correction toward channel midpoints.

🚀 Overall Weekly Outlook: Gold remains in a strong bullish trajectory with $3,800 as the major battleground. Expect short-term pullbacks, but the path of least resistance is still higher, with long-term prospects pointing toward $4,000.

📈 Trend Structure: The market remains firmly inside an ascending channel on both 1H and 4H charts. The broader structure is bullish, with corrections appearing as healthy consolidations rather than reversals.

🔑 Key Resistance Levels: The most critical resistance sits at $3,800, a psychological and technical barrier. Beyond that, $3,810–3,820 represents potential breakout extension targets if bulls push through.

🛡️ Support Zones: Immediate support rests at $3,753–3,755, aligned with a rising trendline. Deeper supports lie at $3,690–3,675, with stronger downside protection at $3,660–3,650. A sustained break below $3,650 would signal deeper correction risk.

⚖️ Likely Scenarios:

o Scenario 1 (Base Case) – A short-term pullback toward support before continuation higher.

o Scenario 2 – A shallow correction, followed by a direct breakout above $3,800.

Probabilities currently favor Scenario 1 due to overbought conditions.

📊 Short-Term Targets: On continuation, upside levels to monitor are $3,740 → $3,780 → $3,800, with a possible push toward $3,810 ATH+ extension.

💡 Market Sentiment Drivers: Geopolitical tensions, central bank accumulation, and persistent currency debasement concerns remain key macro tailwinds. These factors underpin the long-term bullish bias, despite near-term choppiness.

🔄 Retracement Outlook: Analysts suggest a retracement is due after the strong run-up. A controlled dip into the $3,660–3,640 zone could offer buying opportunities for swing traders targeting another leg higher.

🧭 Risk Levels to Watch: Holding above the ascending trendline (around $3,630–3,640) keeps the bullish structure intact. A decisive break below this area could trigger a deeper correction toward channel midpoints.

🚀 Overall Weekly Outlook: Gold remains in a strong bullish trajectory with $3,800 as the major battleground. Expect short-term pullbacks, but the path of least resistance is still higher, with long-term prospects pointing toward $4,000.

Not

🎁Please hit the like button and🎁Leave a comment to support our team!

Not

broke 3800/3810 USD resistance and set a new ATHon Sunday Asian market open. 3900/3950 USD up next.

Not

gold broke ATH and now trading at 3865 USD.silver also getting ready for the ATH breakout.

Not

odds of US govt shutdown increased to 75% overnightNot

ProjectSyndicate Market Summary | Weekly update📊 WTD performance

🟡 GOLD (XAUUSD): ~3,882.00 | +148.00 (+3.97 %)

💶 EURUSD: ~1.1742 | +42 pips (+0.36 %)

💷 GBPUSD: ~1.3449 | +50 pips (+0.37 %)

💴 USDJPY: ~147.47 | −138 pips (−0.93 %)

📈 SPX: ~6,715.79 | +77.84 (+1.17 %)

📈 NDX: ~24,800.73 | +297.60 (+1.21 %)

🗞 Highlights This Week (Gold & FX)

🇺🇸 Dovish Fed expectations re-ignited on weak private payrolls, fueling gold and pressuring USD

🟡 Gold pierced $3,890 intraday and held above $3,850 amid safe-haven demand

💶 EUR/USD rallied on USD softness; GBP/USD held gains amid mixed UK data

💴 JPY strengthened as USD weakness and risk aversion boosted Yen demand

📈 U.S. equities gained modestly as rate cut hopes kept sentiment supported

🟡 Gold Market Note – This Week

Gold extended its rally, reclaiming fresh highs near $3,890/oz as expectations for multiple Fed cuts gained traction.

Support zones now cluster near $3,800, while resistance lies above $3,900. The metal remains on track for a strong weekly close.

taplink.cc/black001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1800%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1800%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

İlgili yayınlar

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, alım satım veya diğer türden tavsiye veya öneriler anlamına gelmez ve teşkil etmez. Kullanım Koşulları bölümünde daha fazlasını okuyun.

taplink.cc/black001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1800%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1800%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

İlgili yayınlar

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, alım satım veya diğer türden tavsiye veya öneriler anlamına gelmez ve teşkil etmez. Kullanım Koşulları bölümünde daha fazlasını okuyun.