The shutdown that began on October 1 in the United States could disrupt the release of key economic data. The highly anticipated jobs report (NFP), scheduled for October 3, may be suspended or delayed if the federal government remains closed. This uncertainty could weigh on financial markets already seeking clarity.

The fourth trading quarter began this week, and investors are projecting October’s trend as the S&P 500 delivered a solid bullish performance in Q3. First-tier fundamentals are driving the major market moves, particularly those affecting the Federal Reserve’s monetary policy outlook.

As every first Friday of the month, the US labor market report (NFP) is scheduled for this week, Friday, October 3. This macroeconomic figure is the dominant fundamental driver of the week. Let’s recall that the Fed cut the federal funds rate in September as the US economy created almost no jobs in the past five months.

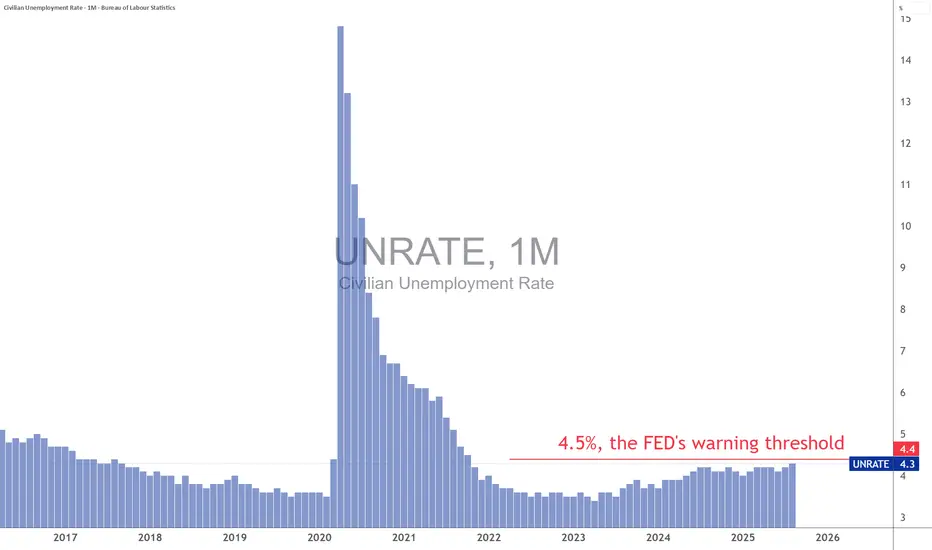

1. The US labor market has been slowing significantly since the beginning of the year, with the Fed’s alert threshold set at 4.5% unemployment

The main chart (top of page) shows the US unemployment rate, which is trending higher. In its latest macroeconomic projections, the Fed indicated that its unemployment “alert level” is 4.5% of the labor force.

Friday’s NFP (October 3) will update this unemployment rate, currently at 4.3%. Any uptick would significantly increase the probability of a jumbo Fed cut at the October 29 monetary policy meeting.

The charts below (source: Bloomberg) illustrate the gradual deterioration of the US labor market:

2. At this stage and before the NFP, the probability of a jumbo Fed cut on Wednesday, October 29 is minimal

A jumbo Fed cut means lowering the federal funds rate by 50 basis points (0.50%). Only further deterioration in the labor market revealed in the October 3 NFP report could raise the probability of such a scenario.

The table below, from the CME Fed Watch Tool, shows the implied probability of Fed action at its upcoming policy meetings:

DISCLAIMER:

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only. The presented idea (including market commentary, market data and observations) is not a work product of any research department of Swissquote or its affiliates. This material is intended to highlight market action and does not constitute investment, legal or tax advice. If you are a retail investor or lack experience in trading complex financial products, it is advisable to seek professional advice from licensed advisor before making any financial decisions.

This content is not intended to manipulate the market or encourage any specific financial behavior.

Swissquote makes no representation or warranty as to the quality, completeness, accuracy, comprehensiveness or non-infringement of such content. The views expressed are those of the consultant and are provided for educational purposes only. Any information provided relating to a product or market should not be construed as recommending an investment strategy or transaction. Past performance is not a guarantee of future results.

Swissquote and its employees and representatives shall in no event be held liable for any damages or losses arising directly or indirectly from decisions made on the basis of this content.

The use of any third-party brands or trademarks is for information only and does not imply endorsement by Swissquote, or that the trademark owner has authorised Swissquote to promote its products or services.

Swissquote is the marketing brand for the activities of Swissquote Bank Ltd (Switzerland) regulated by FINMA, Swissquote Capital Markets Limited regulated by CySEC (Cyprus), Swissquote Bank Europe SA (Luxembourg) regulated by the CSSF, Swissquote Ltd (UK) regulated by the FCA, Swissquote Financial Services (Malta) Ltd regulated by the Malta Financial Services Authority, Swissquote MEA Ltd. (UAE) regulated by the Dubai Financial Services Authority, Swissquote Pte Ltd (Singapore) regulated by the Monetary Authority of Singapore, Swissquote Asia Limited (Hong Kong) licensed by the Hong Kong Securities and Futures Commission (SFC) and Swissquote South Africa (Pty) Ltd supervised by the FSCA.

Products and services of Swissquote are only intended for those permitted to receive them under local law.

All investments carry a degree of risk. The risk of loss in trading or holding financial instruments can be substantial. The value of financial instruments, including but not limited to stocks, bonds, cryptocurrencies, and other assets, can fluctuate both upwards and downwards. There is a significant risk of financial loss when buying, selling, holding, staking, or investing in these instruments. SQBE makes no recommendations regarding any specific investment, transaction, or the use of any particular investment strategy.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The vast majority of retail client accounts suffer capital losses when trading in CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Digital Assets are unregulated in most countries and consumer protection rules may not apply. As highly volatile speculative investments, Digital Assets are not suitable for investors without a high-risk tolerance. Make sure you understand each Digital Asset before you trade.

Cryptocurrencies are not considered legal tender in some jurisdictions and are subject to regulatory uncertainties.

The use of Internet-based systems can involve high risks, including, but not limited to, fraud, cyber-attacks, network and communication failures, as well as identity theft and phishing attacks related to crypto-assets.

The fourth trading quarter began this week, and investors are projecting October’s trend as the S&P 500 delivered a solid bullish performance in Q3. First-tier fundamentals are driving the major market moves, particularly those affecting the Federal Reserve’s monetary policy outlook.

As every first Friday of the month, the US labor market report (NFP) is scheduled for this week, Friday, October 3. This macroeconomic figure is the dominant fundamental driver of the week. Let’s recall that the Fed cut the federal funds rate in September as the US economy created almost no jobs in the past five months.

1. The US labor market has been slowing significantly since the beginning of the year, with the Fed’s alert threshold set at 4.5% unemployment

The main chart (top of page) shows the US unemployment rate, which is trending higher. In its latest macroeconomic projections, the Fed indicated that its unemployment “alert level” is 4.5% of the labor force.

Friday’s NFP (October 3) will update this unemployment rate, currently at 4.3%. Any uptick would significantly increase the probability of a jumbo Fed cut at the October 29 monetary policy meeting.

The charts below (source: Bloomberg) illustrate the gradual deterioration of the US labor market:

2. At this stage and before the NFP, the probability of a jumbo Fed cut on Wednesday, October 29 is minimal

A jumbo Fed cut means lowering the federal funds rate by 50 basis points (0.50%). Only further deterioration in the labor market revealed in the October 3 NFP report could raise the probability of such a scenario.

The table below, from the CME Fed Watch Tool, shows the implied probability of Fed action at its upcoming policy meetings:

DISCLAIMER:

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only. The presented idea (including market commentary, market data and observations) is not a work product of any research department of Swissquote or its affiliates. This material is intended to highlight market action and does not constitute investment, legal or tax advice. If you are a retail investor or lack experience in trading complex financial products, it is advisable to seek professional advice from licensed advisor before making any financial decisions.

This content is not intended to manipulate the market or encourage any specific financial behavior.

Swissquote makes no representation or warranty as to the quality, completeness, accuracy, comprehensiveness or non-infringement of such content. The views expressed are those of the consultant and are provided for educational purposes only. Any information provided relating to a product or market should not be construed as recommending an investment strategy or transaction. Past performance is not a guarantee of future results.

Swissquote and its employees and representatives shall in no event be held liable for any damages or losses arising directly or indirectly from decisions made on the basis of this content.

The use of any third-party brands or trademarks is for information only and does not imply endorsement by Swissquote, or that the trademark owner has authorised Swissquote to promote its products or services.

Swissquote is the marketing brand for the activities of Swissquote Bank Ltd (Switzerland) regulated by FINMA, Swissquote Capital Markets Limited regulated by CySEC (Cyprus), Swissquote Bank Europe SA (Luxembourg) regulated by the CSSF, Swissquote Ltd (UK) regulated by the FCA, Swissquote Financial Services (Malta) Ltd regulated by the Malta Financial Services Authority, Swissquote MEA Ltd. (UAE) regulated by the Dubai Financial Services Authority, Swissquote Pte Ltd (Singapore) regulated by the Monetary Authority of Singapore, Swissquote Asia Limited (Hong Kong) licensed by the Hong Kong Securities and Futures Commission (SFC) and Swissquote South Africa (Pty) Ltd supervised by the FSCA.

Products and services of Swissquote are only intended for those permitted to receive them under local law.

All investments carry a degree of risk. The risk of loss in trading or holding financial instruments can be substantial. The value of financial instruments, including but not limited to stocks, bonds, cryptocurrencies, and other assets, can fluctuate both upwards and downwards. There is a significant risk of financial loss when buying, selling, holding, staking, or investing in these instruments. SQBE makes no recommendations regarding any specific investment, transaction, or the use of any particular investment strategy.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The vast majority of retail client accounts suffer capital losses when trading in CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Digital Assets are unregulated in most countries and consumer protection rules may not apply. As highly volatile speculative investments, Digital Assets are not suitable for investors without a high-risk tolerance. Make sure you understand each Digital Asset before you trade.

Cryptocurrencies are not considered legal tender in some jurisdictions and are subject to regulatory uncertainties.

The use of Internet-based systems can involve high risks, including, but not limited to, fraud, cyber-attacks, network and communication failures, as well as identity theft and phishing attacks related to crypto-assets.

This content is written by Vincent Ganne for Swissquote.

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only and does not constitute investment, legal or tax advice.

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only and does not constitute investment, legal or tax advice.

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, işlem veya diğer türden tavsiye veya tavsiyeler anlamına gelmez ve teşkil etmez. Kullanım Şartları'nda daha fazlasını okuyun.

This content is written by Vincent Ganne for Swissquote.

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only and does not constitute investment, legal or tax advice.

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only and does not constitute investment, legal or tax advice.

Feragatname

Bilgiler ve yayınlar, TradingView tarafından sağlanan veya onaylanan finansal, yatırım, işlem veya diğer türden tavsiye veya tavsiyeler anlamına gelmez ve teşkil etmez. Kullanım Şartları'nda daha fazlasını okuyun.